Author: Ryan Grace

March 22, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Let’s be honest, last week was a fluff piece. Yes, we released the best update to the tastycrypto app yet, and I’m proud of all the hard work the team has been putting in. The app has some great new features and we’re going to continue to iterate. Just wait until the next release. As you know, we’re cooking with flame throwers in the tastycrypto cave.

But I know the truth… Platform updates… That’s not why you’re really here.

Next to Orange, this digital pill we pop open each Saturday morning, it’s about the market, the macro. We’re here for the money.

Let’s run it back.

Crypto has always been a macro asset class, and now the macro is more relevant than ever. We’re also faced with a challenging environment at the moment. Tariffs, fiscal spending cuts, growth slowing, uncertainty. It ain’t easy.

There are periods where it’s easy though. The times when tech stocks just go up and everybody wins. Then of course, there are also periods where it’s hard and nothing seems to work. Maybe treasuries and gold, or fixed income proxies do ok, but stocks and high beta stuff like crypto usually gets hit pretty hard.

We’ve been in one of these hard periods for the past couple of months. So, for today’s email, we’re taking a closer look at what the market is telling us and the signals we’re seeing.

Timing is difficult, but timing is everything. The trick is getting ahead of the shift from one market to the next. If we can recognize when/if we’re headed towards an environment that’s more conducive to “number go up” we might just be alright.

Top Down

Growth slowing:

There are signs we may be experiencing a quarterly GDP slowdown.

The Atlanta Fed’s model is forecasting a sharp drop in growth expectations from where we were previously.

For what it’s worth, CNBC periodically surveys fund managers and these people are also anticipating a slowing economy.

That said, GDP is a lagging indicator, and by the time the data confirms what we suspect, markets may have already moved on and begun pricing in an improving economic outlook. Most of this data is not real-time. Markets are though, and when looking at performance/positioning (see below), it’s pretty clear the market is presently pricing in a slowdown.

Economic growth appears to be slowing down. This explains some of the price acton we’re seeing.

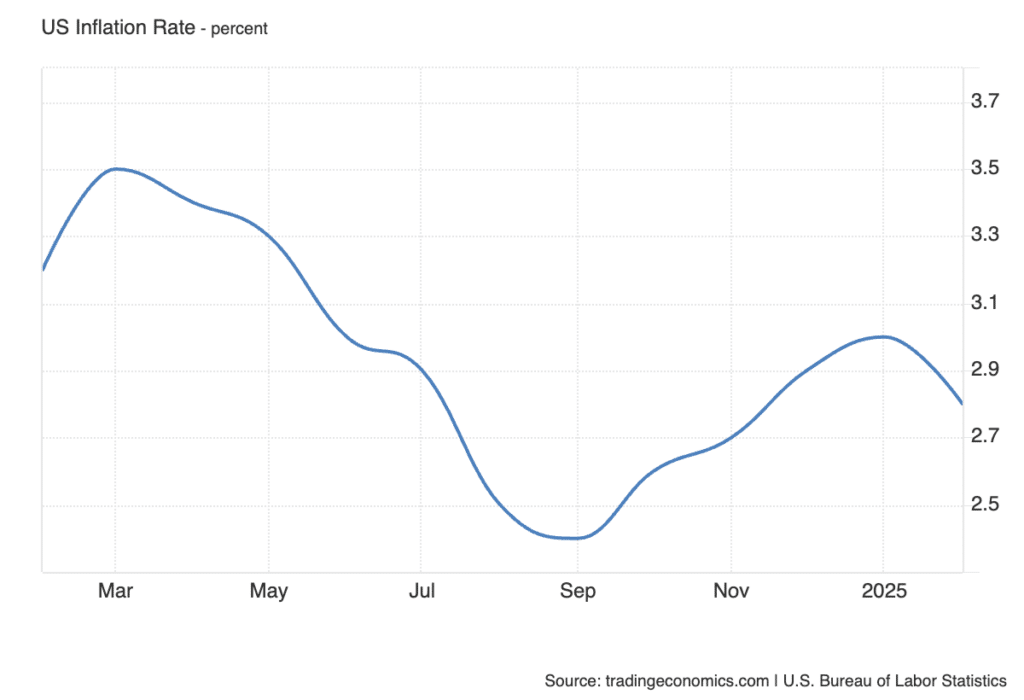

Inflation slowing:

The y/y rate of change of consumer prices (CPI) is another indicator of economic conditions. Yes, it’s also reported on a lag, but CPI has been falling alongside growth expectations recently. Forecasts are for another decrease in March too (won’t be reported until April), and we’re seeing the market price this in now.

Look at how oil and agricultural commodities have performed over the past month. In addition to CPI, producer prices (PPI) also fell hard in February, dropping from 3.7% to 3.2%. Expectations are for a further slowdown in March. More signs economic inflation is decelerating. Not exactly what you want to see if you’re bullish crypto.

When growth and inflation slow at the same time. Stocks sell-off, volatility expands, and interest rates fall as capital moves out of risk assets and into less volatile investments. As a non-yielding asset, gold does well when rates fall, more specifically falling real-rates (inflation adjusted). So, no surprise gold is at all time highs. But what about crypto, why is it down?

Isn’t BTC called digital gold?

“Digital gold” is an easy analogy to explain bitcoin and the value of the asset and its underlying technology. Arguably BTC and gold have similar characteristics, but bitcoin doesn’t play the same role, or have the same place across broader financial markets. Maybe it will someday. But today, there’s no real reason to expect a high correlation between the two assets short-term, especially during a macro induced volatility breakout.

Gold is a currency/commodity and bitcoin is a commodity/high beta tech stock. I believe both will act as a currency debasement hedge over the long run, but they are not the same.

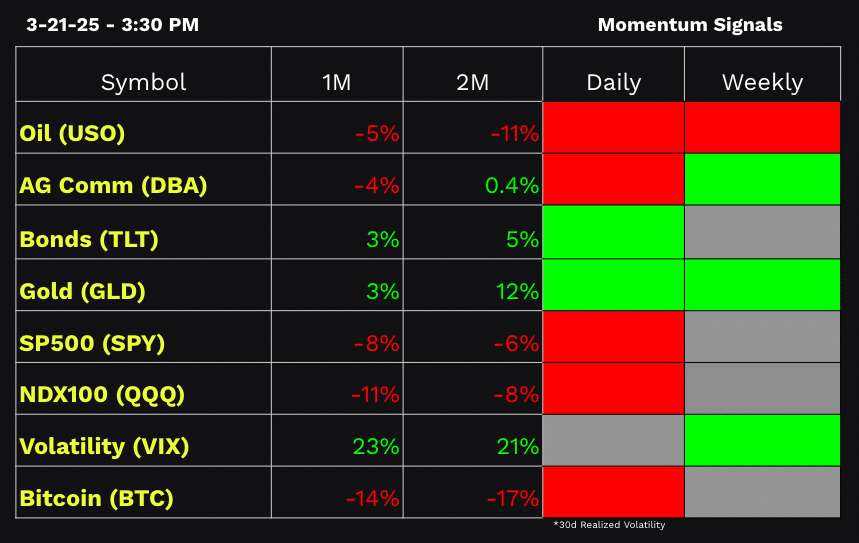

I digress. You can see evidence of the market pricing in the current environment I’m describing. In the same way we use momentum signals to understand the BTC/crypto market trends, we can apply this process to traditional assets. This helps us understand the current setup. This is also useful for recognizing when there’s a shift underway. Our macro trading gauge, if you will.

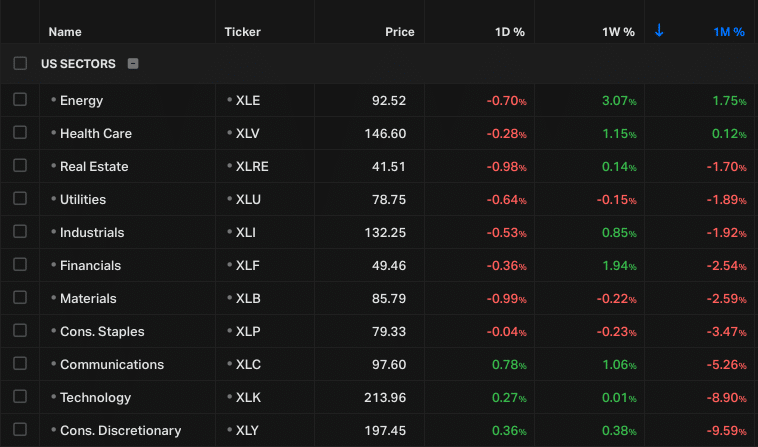

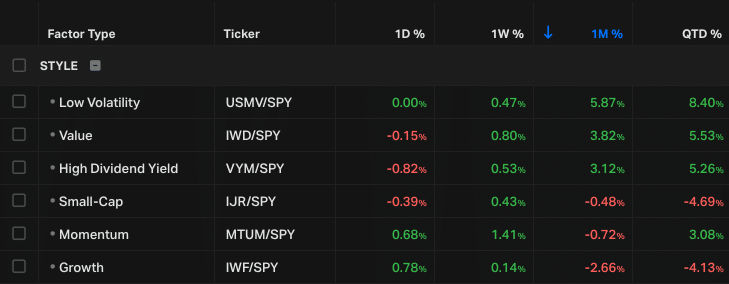

To view this at a more granular level, we can also look at equity market sector performance and even factor exposures.

Look at what’s working over the past month and look at what isn’t. It’s all the same thing.

So, how do we use this?

Remember last week? Nothing changes, if nothing changes. Sure, we’d love to be in the easy macro environment, BTC to the moon. That’s one in which both growth and inflation aren’t falling at the same time.

Instead, maybe they’re both going up! – That’d be nice. Or, maybe it’s a bit more stagflationary. Well, you’re going to need to hedge that inflation dynamic in the face of low growth – Hello BTC. We can wait until the data tells us more, but by then it’s likely too late. We’ve missed the move.

Price is the truth.

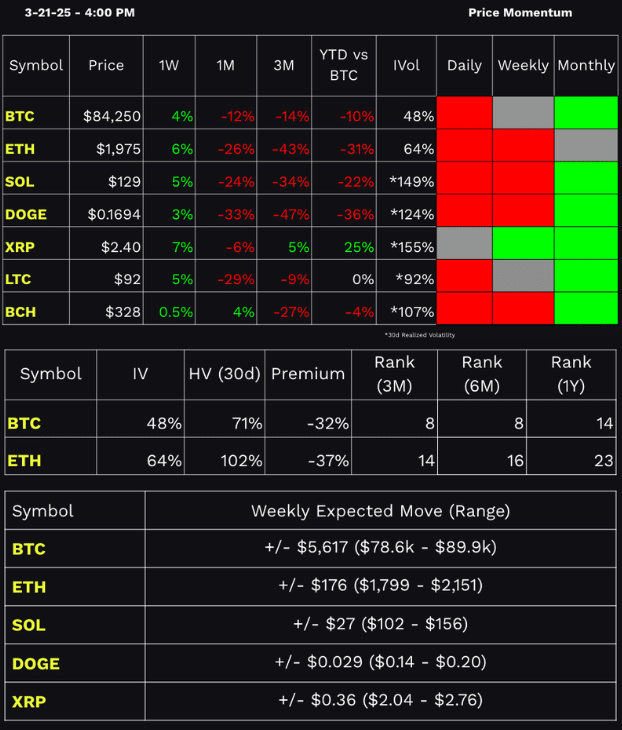

I propose we keep a close eye on cross-asset class performance and more closely the momentum signals we overlay on top. Given the relatively correlated returns we’ve observed between bitcoin and these other areas of the market… This can provide an indication of when things are starting to change, when there’s a shift underway. Helping us possibly get in front of a bigger move as we shift from short-term bearish back to short-term bullish again (future state) within the broader structural trend (per monthly momentum signals).

In the meantime, we wait for the signal.

Nothing is binary, there are only probabilistic outcomes. But if we see all signs pointing towards the same outcome, we can assign a higher probability.

As I’ve discussed previously, we want to see clear signs of a volatility breakdown in equities, bullish signals across the SPY/QQQ, m/m commodity reflation, and more specifically a shift in relative performance away from defensive sectors and factor exposures such as Health Care/Real-Estate and Low Vol / High Dividend. Until then, there’s little reason to believe we’re actually transitioning to a more favorable environment.

For now, the larger BTC range is 75k-90k and given what we’re seeing across our market signals, I’m assigning a higher probability to continued short-term weakness until something changes.

Web3 Word of the Week (W3WOW)

Show Highlights

- The future of social media…

- BEANS homework: Assignment Understood

- Professor Ryan in the house… or DAOse?? 🤓

- Coming Up:

- BTC Options Trading Insights!

- MOAR BEANS Giveaways