Author: Ryan Grace

January 17, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend. The days go by fast here in the cave and we find ourselves in the clouds again.

I’m feeling much better today than Monday when we traded 89k, thank you for asking.

What were you doing Monday? Were you buying the low end of the range? What are you doing today, are you taking anything off the table? $100,000 is a beautiful number, but it’s just a number.

This week we’ve got the good stuff as usual and are focused on what to expect as Trump makes his return. What’s priced in, what isn’t? The market is bulled up on executive actions that could immediately impact crypto, but it’s important to first sort the probable from the possible.

We also launched a second email on Wednesday, which we aim to evolve into a quantitative market research product, something we hope becomes a valuable tool in the kit and helps increase your crypto market awareness.

We explained how to use this data during the tastycrypto show Wednesday, which you can watch on our YouTube channel.

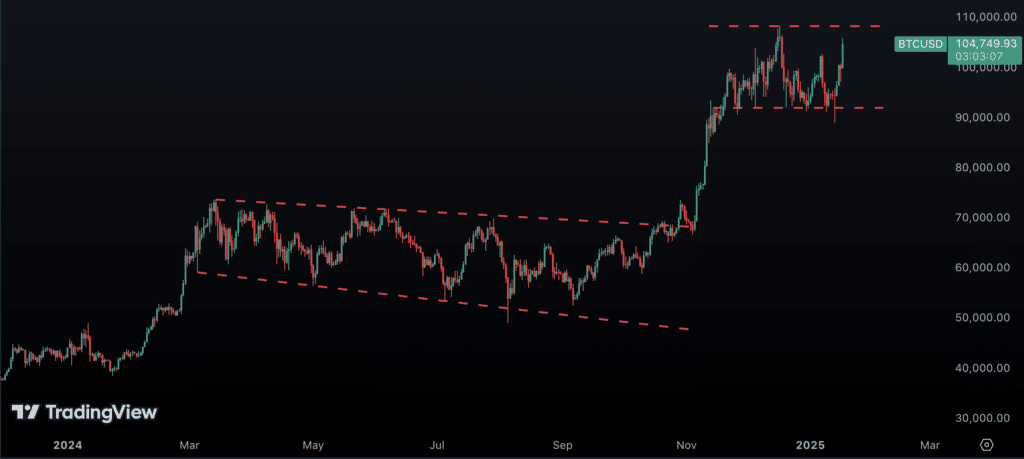

There are short-term bullish signals all around while we remain range bound.

We have engaged blast off mode, but we must reach escape velocity to leave this place. We require constant catalysts.

The people look like ants, but we can still see them.

Trump on Deck

The crypto world is getting buzzed on speculation of immediate policy shifts as Trump enters office. His administration’s stated commitment to making crypto a national priority has led some to believe the inauguration will be one of the defining moments in crypto history. We will see… I’m slightly skeptical. My weed stocks are down like 90% since the last time politics influenced my investment decisions.

Watch what they do, not what they say, and first we’re going to need to see some action.

Day 1. What to Expect Right Away?

According to reports (Bloomberg), Trump plans to sign an executive order on his first day in office, making crypto a national priority. This could set the stage for major changes, including:

A Crypto Advisory Council. In addition to David Sacks and his new role as Crypto/AI Czar, the creation of a crypto focused advisory council is expected to be announced.

This council could help to bridge the gap between policymakers and industry leaders, providing guidance and clarity on issues like token classification, stablecoin regulations, and DeFi.

More regulatory relief. The industry anticipates a favorable regulatory environment going forward and it’s possible there’s an abrupt end to existing crypto-related litigation, like the Ripple and Coinbase cases, though my sources tell me this is quite a rosy view with little historical precedent.

More likely, we could see the immediate reversal of restrictive policies like SAB 121 which could open the door for more financial institutions to embrace digital assets, bringing more liquidity to the market. Either way, we’ll no longer be dealing with an anti-crypto regime.

Big Dreamz. There’s been chatter of a strategic bitcoin reserve since the summer when Trump and others latched on to the idea. I assign a low probability to this, at least immediately.

A first step could be to ensure the US doesn’t sell the bitcoin it currently holds from seizures related to criminal activities. There’s nuance here too, as some of this crypto might ultimately belong to victims in these cases, such as exchange hacks where customer funds were stolen.

So, the feasibility of this remains uncertain, but it signals a potential integration of Bitcoin into broader economic strategies, such as its role as a hedge and a reserve asset.

Web3 Word of the Week (W3WOW)

How Likely Is This to Happen?

Crypto’s future is not entirely dependent on Trump’s promises, but we think there’s a good chance he gets most of this done. An administration moving towards actively working with the industry is a massive change from the prior anti-crypto stance. This requires minimal legislative intervention and aligns with Trump’s deregulatory stance.

I don’t assign a high probability to a BTC reserve or any sweeping policy overhauls, as these will take time and probably require significant bipartisan support. Long-term maybe, but short-term I’m like 5 delta here.

That said, I think there’s a 50% chance we get a pause or reversal in enforcement actions by the SEC, including ongoing lawsuits. No more Wells Notices. It’d be odd to me for the SEC to continue going after the companies whose leaders form the President’s Crypto Advisory Council.

How I think about the market impact.

This is all clearly getting priced into the market and is collectively the big driver behind trading +100 post election. Post inauguration and some of these likely announcements… Buy the rumor, sell the news? I don’t necessarily think so…

Don't hate the player, follow the money.

There’s a fascinating relationship between the crypto industry and the incoming administration. Donations and sponsorships have come from major industry players, providing a glimpse into the future of the industry and potential investment opportunities.

Stablecoins

Beyond a bitcoin reserve and reports of Michael Saylor meeting with Trump at Mar-A-Lago and whispering in his ear, stablecoins are likely in the spotlight.

Circle, the company behind the USDC stablecoin, has donated $1 million of the stablecoin to Trump’s inauguration and should underscore the rising prominence of stablecoins in regulatory discussions.

Ripple's Moves

Ripple is also looking for a seat at the table following a $5 million XRP donation. With legal clarity potentially on the horizon under a Trump-appointed SEC chair, Ripple’s high-profile support for the administration could translate into broader adoption of XRP, which could be a big value unlock for XRP and its ecosystem.

DeFi, DAOs, and Real-World Assets

Companies like Ondo and Kraken are also throwing coins in the hat, contributing to Trump’s inauguration and signaling their belief in the administration’s potential to provide much-needed clarity for DeFi platforms.

Ondo is focused on RWAs and this is another area I’m watching as I think you’re going to see the continuation of financial assets represented on blockchain networks in tokenized form. If regulation accelerates stablecoin adoption, this is inevitable.

Post-Innauguration

The interplay between the crypto industry and the Trump administration reveals a roadmap of priorities that could shape the market with bitcoin, stablecoins, XRP, DeFi and Web3 infrastructure all poised to benefit from a friendlier regulatory stance.

However, we should balance our optimism with realism—while the advisory council and regulatory adjustments seem imminent, ideas like a Bitcoin reserve or sweeping legislative changes will take time.

For now, keep an eye on immediate policy moves and monitor the advisory council’s composition for clues about which sectors and projects could benefit from being close to the president.

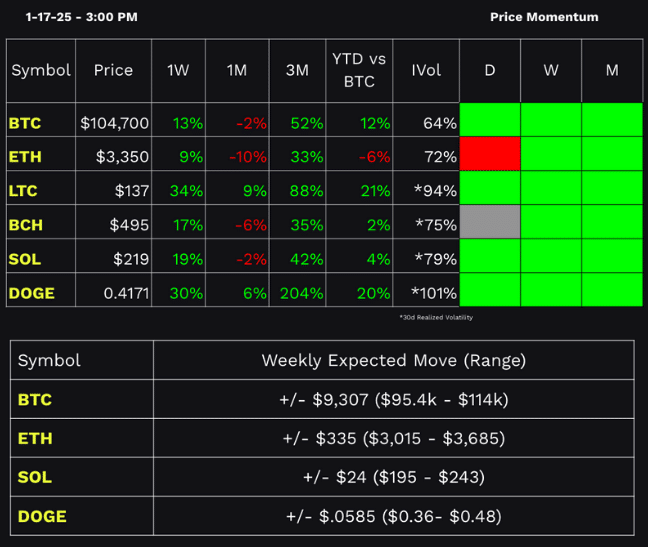

At the time of writing, we’re seeing a slight rise in implied volatility coupled with higher prices. This gives us larger expected trading ranges when we run the numbers each week.

I’m sticking with my approach to trading the bull market by buying dips near the low end of the weekly implied ranges and selling a little at the highs. This helps me manage some risk, while staying in the position and on the right side of the trend.

Performance Dashboard

Show Highlights

- Katie is ready to dive in… to liquidity pools

- Ryan casually spills some tasty alpha

- Shelley is weird

- Ya’ll are getting more emails from Ryan

Free Virtual Event + Digital Collectible

More crypto things! Free session + digital collectible!

The digital collectible for this free event is yours to own but you must sign up prior to the minting date: 10:00 AM CT, January 25th. Watch the presentation live or view the collectible anytime when you register in advance. Sign up today to secure your digital collectible.