Author: Ryan Grace

April 5, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

I’m fighting some sort of cold/allergy combo so this note will be a little shorter than usual.

We shall not beat around the proverbial bush. On Wednesday, I opined that once reciprocal tariffs were announced and the unknown became known, there was potential for a relief rally, as markets would face less uncertainty.

Well, that was clearly wrong. Instead, all hell broke loose. We didn’t just get reciprocal tariffs, we got the most extreme case, which has prompted China to retaliate with more tariffs of its own this morning. I even saw a headline where a trader at Goldman proclaimed “it feels like an end of history moment.” – The S&P is down another 6% on the day as I write this.

There will be absolutely no certainty in the short-term.

So, how should we think about crypto markets amid the macro carnage?

It should come as no surprise Bitcoin is trading lower with the S&P getting smoked again on Friday.

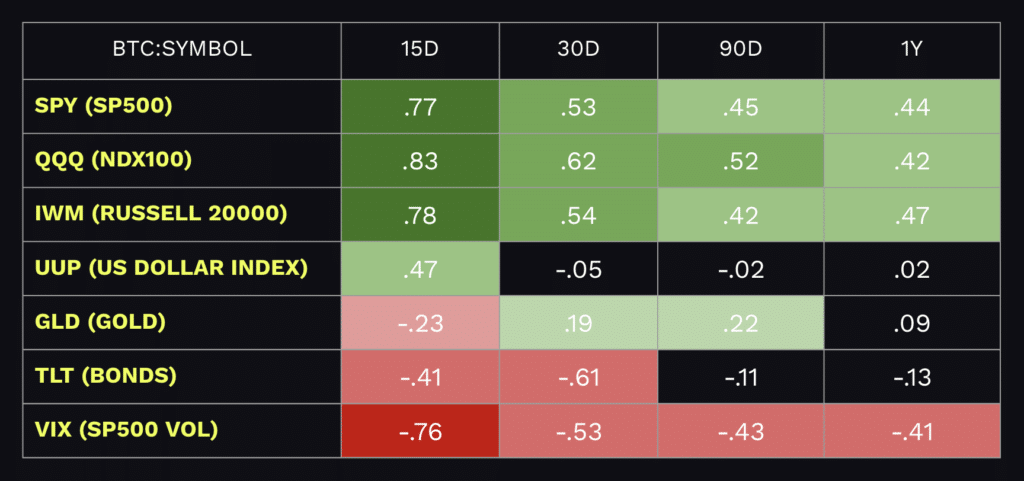

We’ve observed some of the strongest correlations between BTC and traditional assets recently and this is unlikely to change until we see volatility mean revert and a sub-20 VIX. When this happens – anyone’s guess, but it’s a signal we’ll be looking for on an intermediate term basis.

Speaking of the intermediate term (months not weeks), all else equal, a weaker dollar and lower interest rates with a rising probability of more cuts from the Fed should support bitcoin’s price. BTC is not going to be impacted by trade policy in the same way many S&P 500 companies might be. It is a high-beta risk asset though, and it will get punished as long as we remain in this volatility regime.

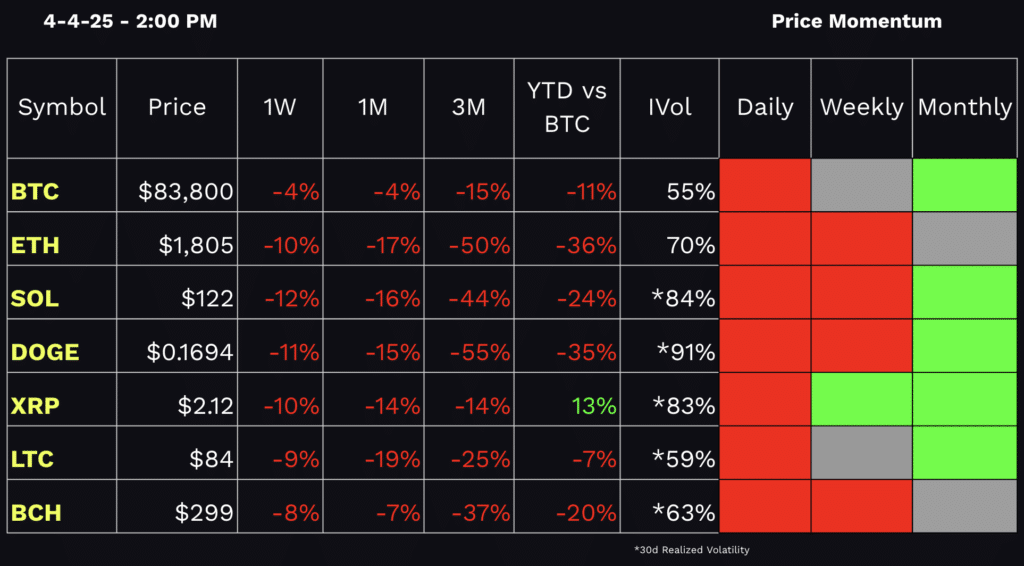

Looking at performance, it’s ugly out there, though BTC has shown some resilience. Trade war aside, BTC put in a local low at the beginning of March, and is not breaking down in similar fashion to equities. That’s not to say that it won’t or that it can’t, but BTC has traded sideways as most other assets wrestle with this tariff induced chaos.

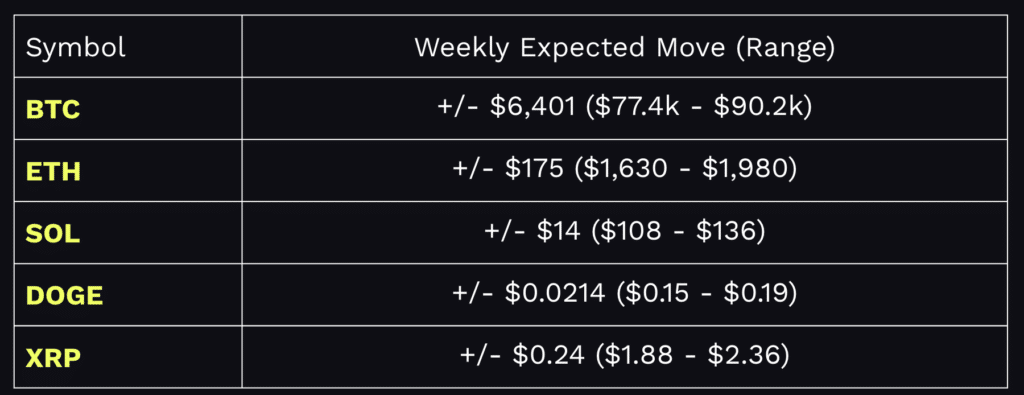

I suspect we’ll continue to experience a massive chop given the events of this past week but it’s important to stay focused and stay patient. Use the volatility-derived expected moves to put perspective around what’s possible with price action. Price momentum remains in a bearish trend, so in my opinion if you’re buying dips, it makes sense to manage risk and take some off into the top of the range.

Web3 Word of the Week (W3WOW)

Show Highlights

- Tom has no idea he’s a token now

- ACE on the Show

- The Walls are dripping

- BEANS gone wild