Author: Ryan Grace

January 24, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend.

Last week I wrote about the need for constant catalysts, as a lot has been promised and priced in, but to reach new highs, we’d need to see some real action. Trump would need to put his money where his mouth is.

Since we last checked in…

“Crypto capital of the planet”

This executive order establishes a working group on digital asset markets with the purpose of developing a regulatory framework and evaluating the creation of a national digital asset stockpile. The order also focuses on stablecoins, with an explicit ban on central bank digital currencies (CBDCs).

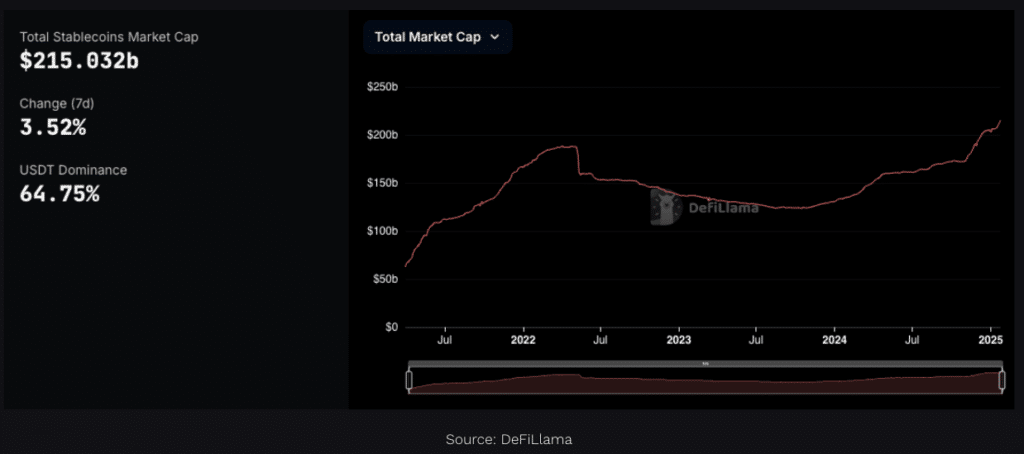

Quick note on the stablecoin front, dollars continue to flow on-chain, with stablecoin total market cap at an all-time high of $215 billion.

Reading into the order a bit, I think one of the more important developments is the move to rescind the Treasury’s framework for international engagement on digital assets.

The prior administration’s approach seemingly treated crypto as a risk to be mitigated instead of an opportunity to be embraced. In turn, this anti-crypto stance arguably restricted US innovation versus more crypto-forward countries like Singapore or the UAE.

Rescinding the previous framework is a paradigm shift in America’s approach to crypto. Inevitably this will support US crypto businesses (think DeFi, exchanges/brokers, also non-financial use cases), but I think it’ll also have some very bullish knock-on effects globally.

These are important, immediate developments on the reg front, but if you’re truly going to be the crypto capital of the plant, you’ve gotta have a bag.

Digital Asset Stockpile

There’s been chatter of establishing a bitcoin strategic reserve, but it looks like we could take a more diversified approach given this concept of a digital asset stockpile.

A stockpile of digital assets would presumably include more than just a big bag of BTC. Will the US government own ETH? Solana? Tokenized real-world assets? Maybe.

Ask me the likelihood of this and I can only shrug. Over the long-term, probably a non-zero probability, but it’d be odd for the US to just start buying crypto before providing regulatory clarity or implementing clear rules.

SAB-121 is Over

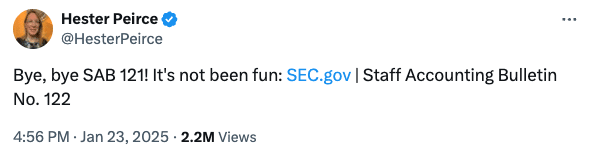

Another development this week that most missed, but absolutely matters, was the announcement by SEC commissioner Hester Pierce on X that SAB-121 is over.

Here’s why it matters: SAB 121 was an SEC staff accounting bulletin requiring companies to treat crypto held on behalf of customers as a liability on their balance sheet, while also forcing them to recognize an equal amount as an asset.

This discouraged banks and more traditional financial institutions from meaningfully participating in the crypto industry, due to the regulatory burden and the serious capital requirements involved.

If you’re forced to hold cash on your balance sheet against a crypto liability, this is basically a non-starter for these institutions. They simply can’t participate due to the capital requirement forced on them through SAB-121.

When we use the term regulation by enforcement, this is one example of it.

The biggest financial institutions in the US were effectively shut out of the industry. Now, should institutions no longer shy away from the crypto industry, the push for a “digital asset stockpile” or broader national adoption of crypto faces less resistance. I don’t see how this doesn’t lead to increased participation and more consumer use cases over time.

The US crypto industry continues to put some big Ws on the board.

Sleeping Giant

A lot is happening fast is an understatement.

There’s been a sea change in the approach to crypto here in the US, yet the narrative is still “Bitcoin this, bitcoin that… Bitcoin, Bitcoin, Bitcoin.”

Yes, the price of bitcoin is at an all-time high, but the main attraction has become a distraction and little attention is being paid to ETH right now. If you’re on crypto twitter (X) at all, the bears are out in full force.

You’d think ETH was dead, which is odd given what we’re seeing.

You can reach your own conclusions, but my conspiracy trade idea is that Ethereum is where the institutions build as real-world assets move on-chain and we see the evolution of DeFi, all propelled by the catalysts laid out earlier.

DYOR, but here’s some dots.

The Bitcoin strategic reserve concept has evolved into a digital asset stockpile (beyond BTC)

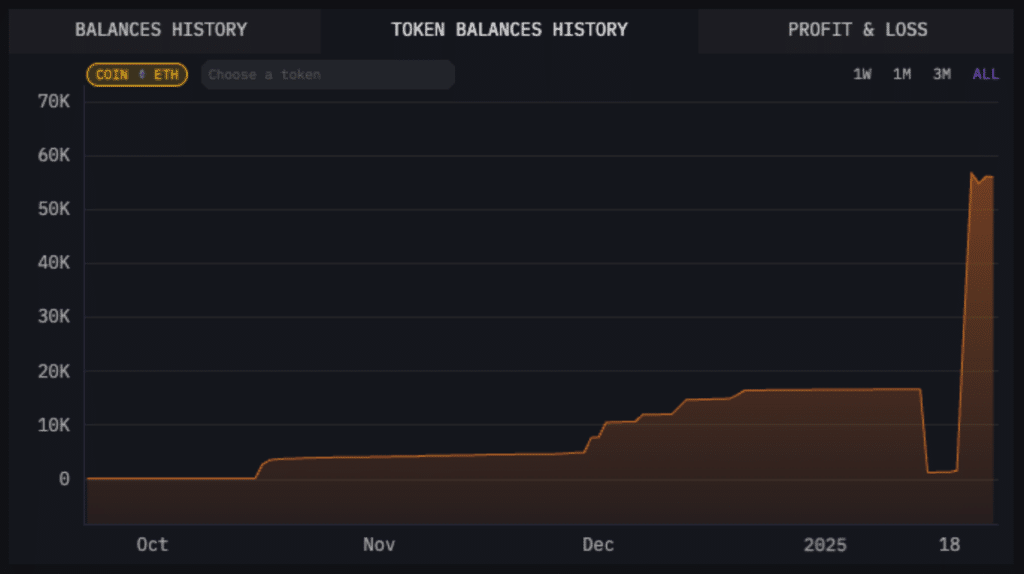

Trump backed DeFi project/company World Liberty Financial is buying and holds a lot ETH

Ethereum ETF inflows quietly picking up

ETH ETF issuers expect staking soon

Additionally, if we believe Ethereum and EVM compatible L2s will be the ecosystem for DeFi 2.0 and home to Wall Street’s tokenized assets, then I think ETH still has quite a bit of room to run with bitcoin market cap dominance at 60% and the ETH/BTC ratio at 3-year low, all while Larry Fink is urging the SEC to rapidly approve the tokenization of stocks and bonds and the president is buying $200 million in ETH.

We’ll do a deep dive here in the coming weeks, but aside from early cycle outperformance in BTC and the AI Agent/Meme hype capturing everyone’s attention…

Why so bearish ETH?

One last thing…

The President seems to be buying a lot of ETH.

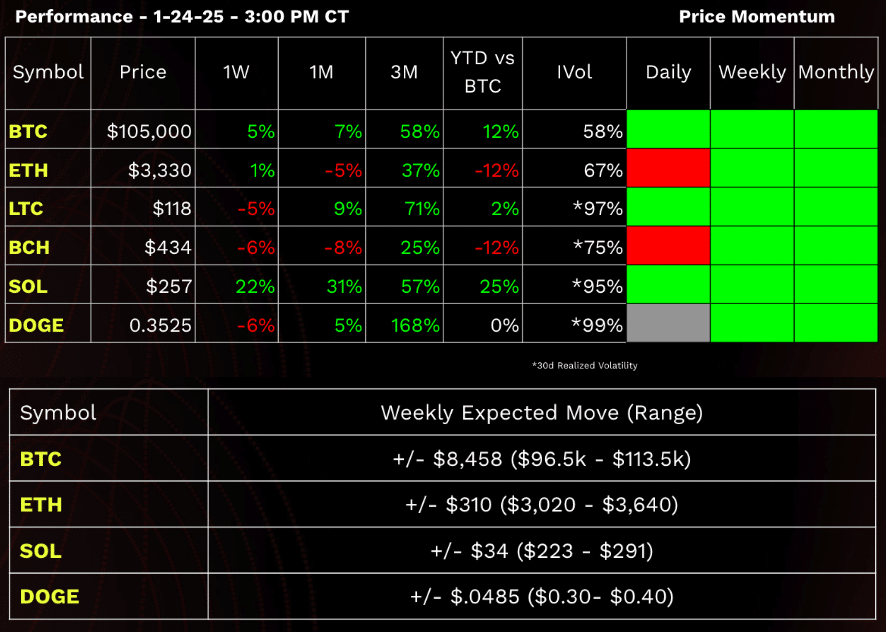

As always, stay on the right side of the trend, trade implied volatility ranges, and keep your head on a swivel.

There are approximately 4.81 “crypto years” in the time it takes for one calendar year of regular stock market trading.

Stay tasty,

Ryan

Web3 Word of the Week (W3WOW)

Show Highlights

- Innovation starts with GOO

- Etch-A-Sketch in the market? (From Shelley’s guest appearance on the OTC Live Show)

- This is big.