Author: Ryan Grace

November 6, 2024

Good morning my tasty friends. I hope you’re all having a wonderful start to your weekend and are enjoying this bull market we again find ourselves in.

Finally, we hit the magic number.

Does it matter?

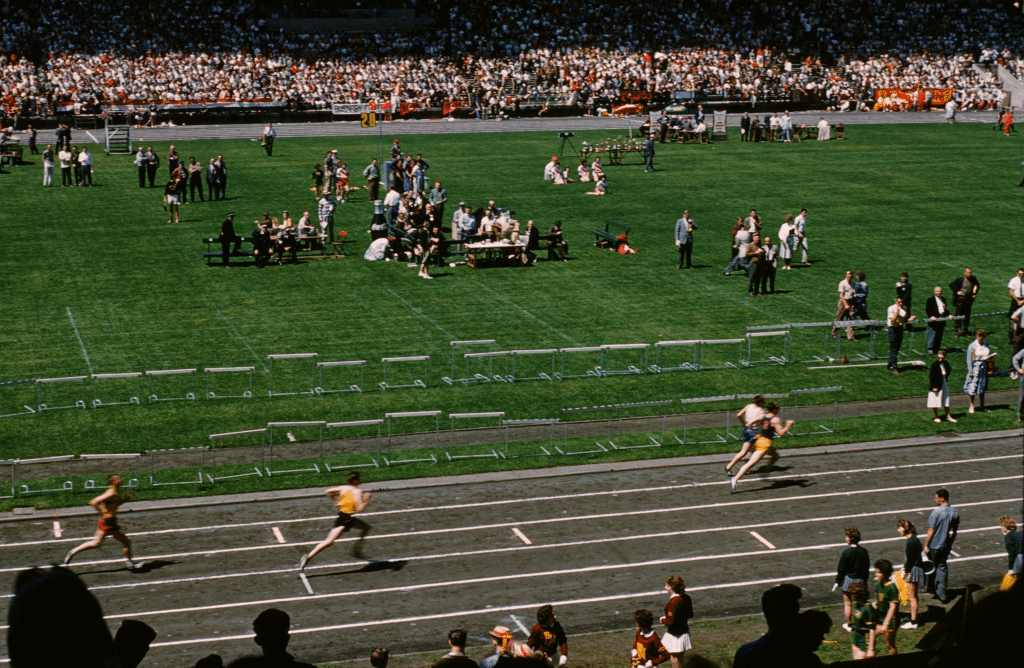

On May 6, 1954, British athlete Roger Bannister became the first known person to run a sub four-minute mile at Oxford University’s Iffy Road Track. A month later John Landy became the second. Two months later they both did it again, racing against each other in August of ’54.

3:59.4

Does it matter?

Roger Bannister broke the plane of reality in 1954, and the perception of what was humanely possible was forever changed, creating a new reality.

As of June 2022, 1,755 people have broken the four-minute mile barrier according to Wikipedia.

Hicham El Guerrouj holds the record at a blistering 3:43 in 1999.

On December 5, 2024 the price of the world’s first cryptocurrency, Bitcoin, achieved a market value of $100,000.

Does it matter?

After running into a high of $104,000, we pulled back into the high-90s, and are now trading around $101,000 at the time of writing.

On one hand we have a new reality of what’s possible, on the other… A 7 dollar stock just went to 10 in a month.

$100,000 is a value that elicits emotions. It feels different. There will be corrections, there will be new highs, and I believe a six-figure bitcoin price will be commonplace. At the end of the day, it’s just a number. Try not to get too emotional.

While the financial media and all of your other crypto email newsletters will fixate on bitcoin’s six-figure price, I want to shift attention towards everything else that happened in crypto this week and acknowledge the fact that, no ETHEREUM IS NOT DEAD.

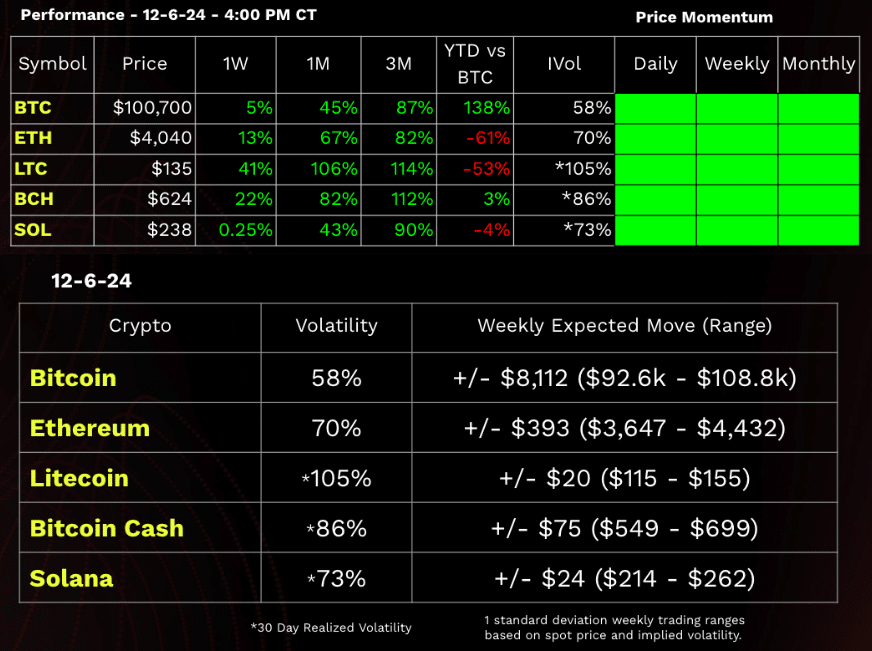

But first… Performance Dashboard and Expected Moves are below.

Performance Dashboard

Explosions in the sky. This week witnessed a continued deluge of related political headlines and big ass flows.

Let’s start with the former.

White Smoke. A new SEC Chairman has been chosen.

Trump has tapped former SEC Commissioner and digital asset advocate, Paul Atkins, as the agency’s new Chair.

While I’ve previously said the future of crypto isn’t reliant on who’s president, it’s certainly not contingent on the SEC chair, but man, after the hell of uncertainty we’ve been through, this is big.

Atkins is set to replace Gary Gensler on January 20, 2025, signaling a dramatic shift in regulatory priorities and an extremely welcomed reprieve from the heavy-fisted regulation by enforcement approach taken by the SEC under Gensler’s leadership. I don’t think I can overstate how important this development is for crypto in the US, and we’re certainly seeing prices reflect this across numerous sectors in crypto markets.

Hi Paul, nice to meet you.

I’d heard the name, but wasn’t super familiar with Paul Atkins before this. If we dig around a little bit, here’s what we know…

He’s known for being a proponent of deregulation and supportive of innovation. During his previous tenure at the SEC, Atkins championed “common sense regulations” that balanced investor protection with fostering the growth of capital markets.

He’s also a crypto guy. His pro-crypto credentials include co-chairing the Token Alliance at the Digital Chamber of Commerce and consulting for fintech firms through his company, Patomak Global Partners.

We will have pizza for lunch every day and there will be no homework.

In another step towards signaling his seriousness about crypto, President-elect Donald Trump has appointed tech investor and venture capitalist David Sacks as the “White House AI & Crypto “Czar.”

Now, I’m not going to claim this appointment is as impactful as the SEC chair, but Sack’s is also a crypto guy and will be tasked with creating a clear legal framework for digital assets and advancing AI innovation in the US, while chairing a presidential council of science and technology advisors.

Sacks is a billionaire venture capitalist and host of the popular All-In podcast so this appointment will likely come with some criticism from the crowd, but regardless, these appointments and others, show the US is likely to further ensure it remains as the world’s leader in technical innovation and the number one place for crypto going forward. Seems bullish…

Ethereum Is Dead (NOT)

For months my friends on the trade desk have been asking me why Ethereum isn’t going up as bitcoin rips higher. My answer… Crypto is the Wild West of financial markets, and as they say. “In the Wild West, anything can happen.”

Patience my little cowboys.

I can empathize with their frustrations, for many, this is their first cycle, and the ETH/BTC ratio was sucking, bitcoin dominance was dominating, and it seemed as if BTCs outperformance would forever crush their dreams of alt coin riches. Well, patience often pays off, at least it did this week.

Let’s do a little roundup of crypto markets.

Ethereum (ETH)

BAF Alert!!! (Big Ass Flows)

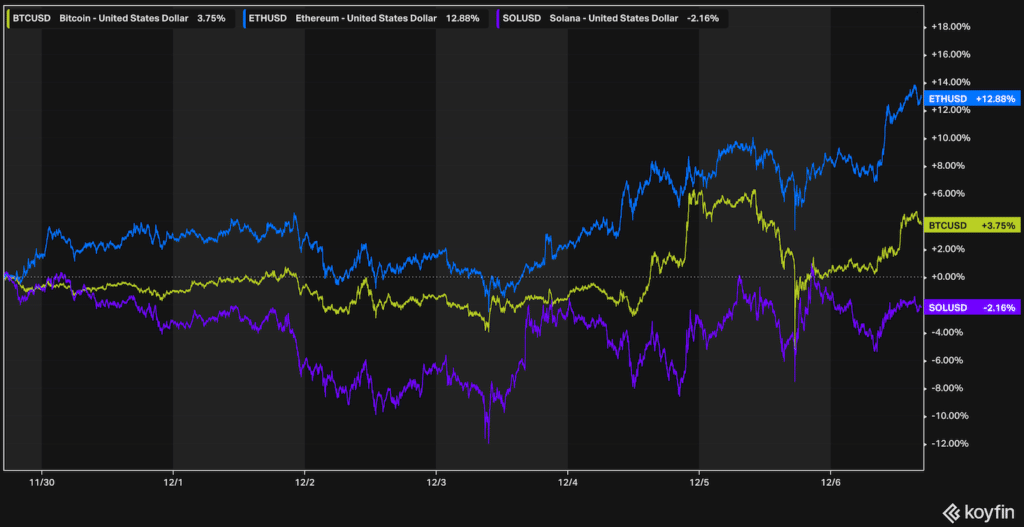

Ethereum clocked a 14% gain on the week versus BTC up 6% and a flat w/w performance for Solana.

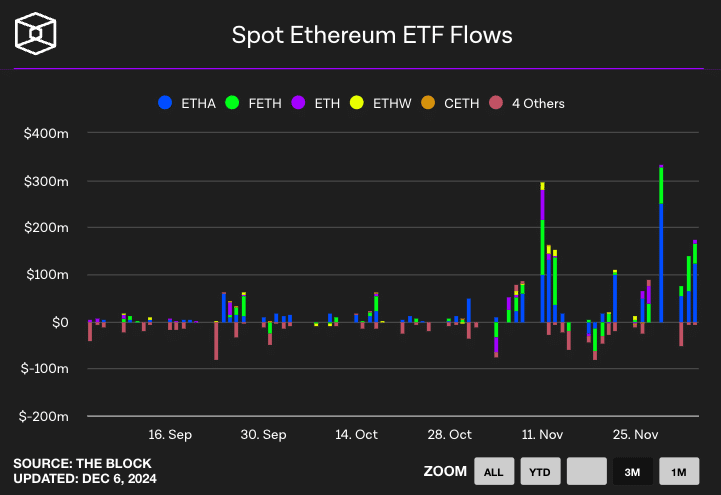

US ETH funds experienced their largest single-day inflows since their July launch, signaling growing investor interest in Ethereum. On Dec. 5, the funds recorded inflows exceeding $1 billion, marking the ninth consecutive day of positive flows and pushing total net inflows to over $1.3 billion in the past two weeks.

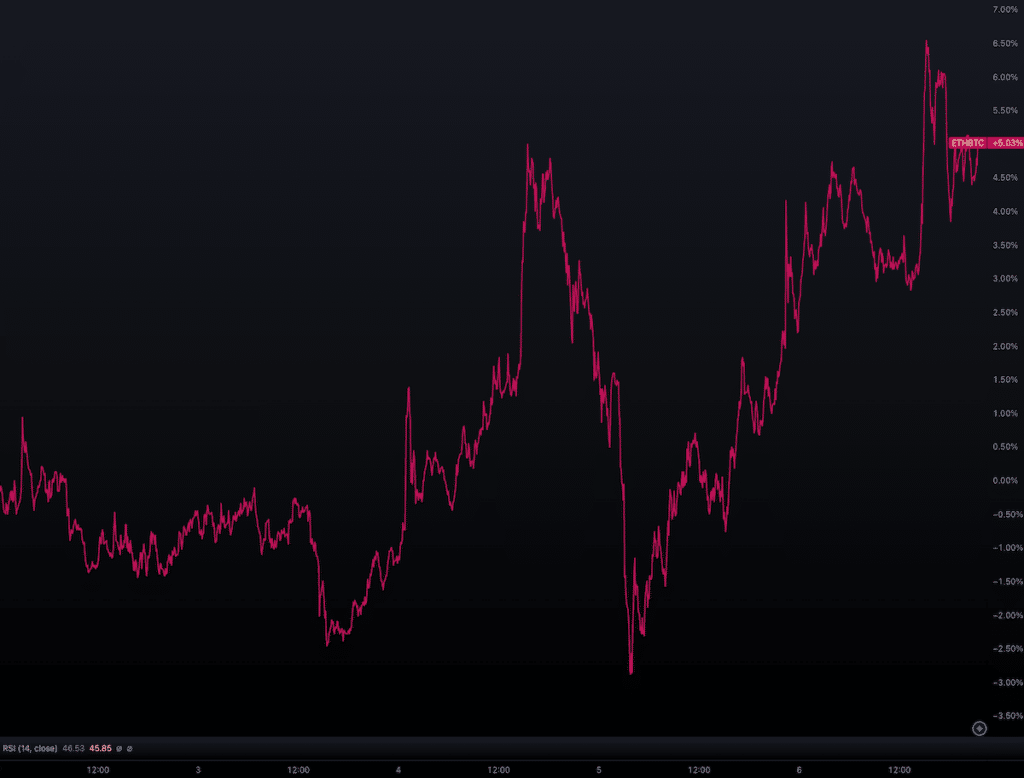

ETH/BTC is popping, finally. With ETH up about 60% over the past month, we’re seeing signs of life in the ETH/BTC ratio if we can get back to the 0.05 level we’ve consistently traded at previously, this implies a 5k ETH price, should BTC hold onto 100k.

Ripple (XRP)

Ripple went straight up, literally. There’s talk of stablecoins coming to Ripple and public companies adding XRP to their treasury, but after an eye watering move, XRP prices have corrected meaningfully. If you owned this before blast-off, congrats.

Solana (SOL)

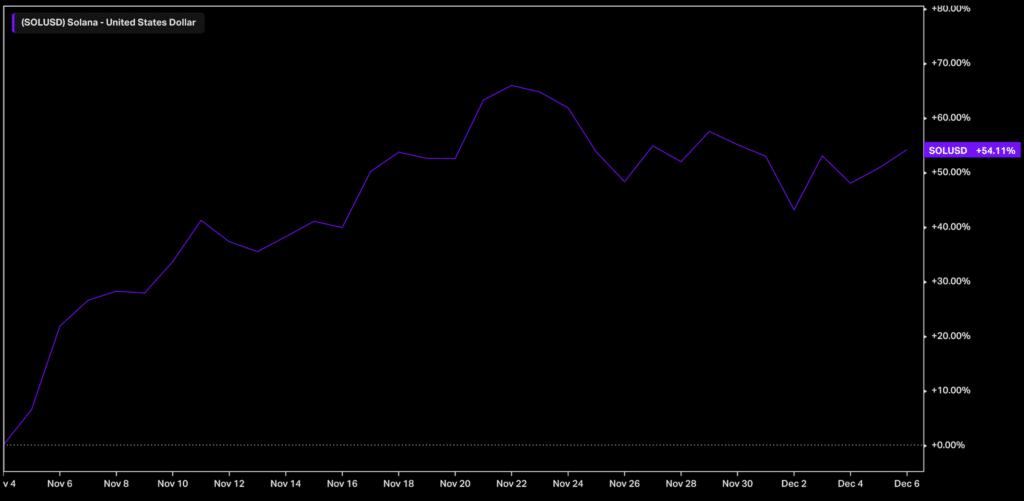

Solana traded sideways but is holding north of $200 after a fantastic +90% return in 3-months. The SEC’s decision to reject Solana Spot ETF filings has poured cold water on SOL’s recent short-term momentum. I think SOL ETFs are still on the table, but it’s a 2025 story now. For context ETH’s market cap is $487 billion against SOL at $113 billion. I think SOL catches up, but for context, I’m a little cowboy.

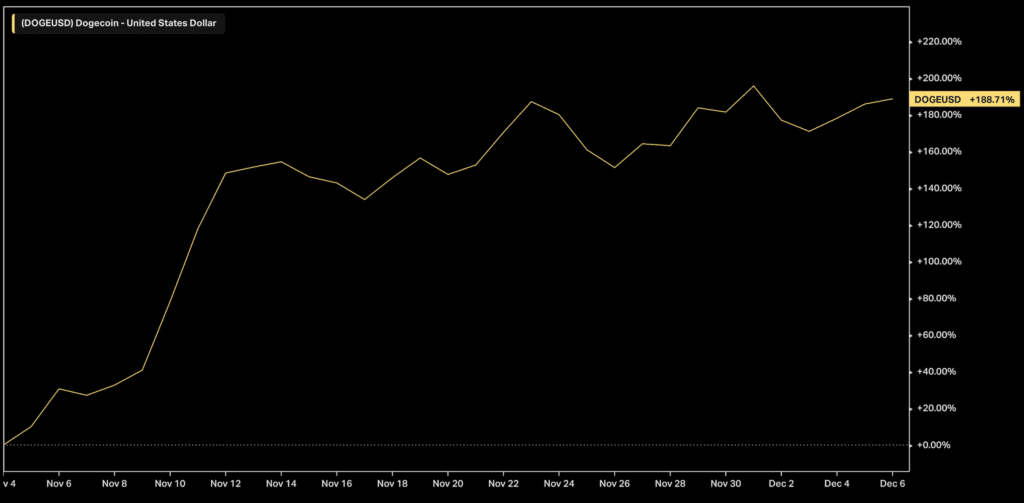

Dogecoin (DOGE)

Our meme proxy DOGE is hanging on to 0.43 and up 150% in the past month. I don’t own this, but I might soon, especially if the rumors of DOGE coming to tastytrade next week are true.

Big moves all around and largely driven by the same thing, this post-election party we’ve been having, but remember, how you feel in the morning largely depends on when you leave the party. I know this. I know how to party.

Stay tasty,

Ryan

tastycrypto Show Highlights

- ETH – IT BUURNNS 🔥

- ETH – IT’S ALIIIIVE 📈

- ETH – IT GROWWWS! 💰

Up Next:

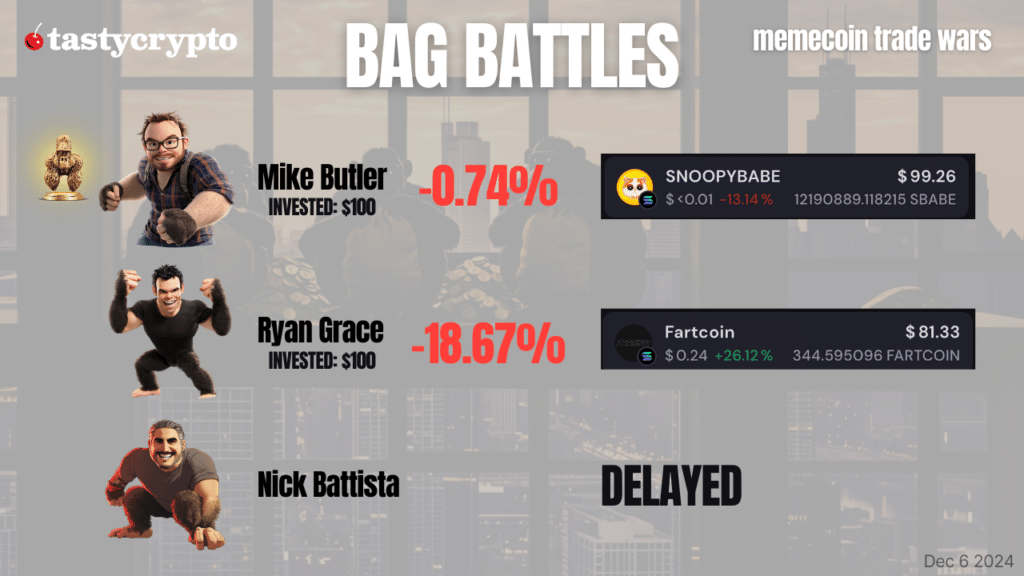

- BAG BATTLES – ROUND 2 Memecoin Showdown (Monday at 11am CT on the OTC LIVE Show)

- Episode 6 – Where Do I Start With Crypto with Katie McGarrigle!

Join in the fun and hop in the live chat during the show!