Author: Ryan Grace

February 28, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

Here’s what we did this week.

- BEANS episodes 3 and 4 hit the internet. If you haven’t tuned in yet… WHAT ARE YOU DOING? Shelley and Dan are crushing it and they’re giving away prizes live on-air. Get over to the tastycrypto YouTube or X channels on Monday and Friday at 9:00 AM CT. Spin the wheel, get some alpha, and win some crypto.

- A new version of both the tastycrypto and the tastytrade mobile app with a completely new crypto trading interface have been submitted to the app stores. They should be available for download soon, pending approval. On the tastycrypto side, there’s a new markets tab with a watchlist and awesome news/content feature we think you’re going to enjoy.

- More tokens are coming to the tastytrade brokerage. We’re moving as quickly as we can to add more products to tastytrade’s offering and starting next week you’ll be able to trade ADA, LINK, AAVE, AVAX, and SHIB. If you haven’t done it yet, enable crypto trading on your account to get started.

- We ran a 30 min demo of the tastycrypto app on Wednesday. This is a great watch, especially if you’re new to tastynation and you’re interested in learning more about our crypto wallet and all the beautiful capabilities it offers.

- We bought the dip. Not sure how that’s going to work out just yet. February was ugly. More on markets in a moment.

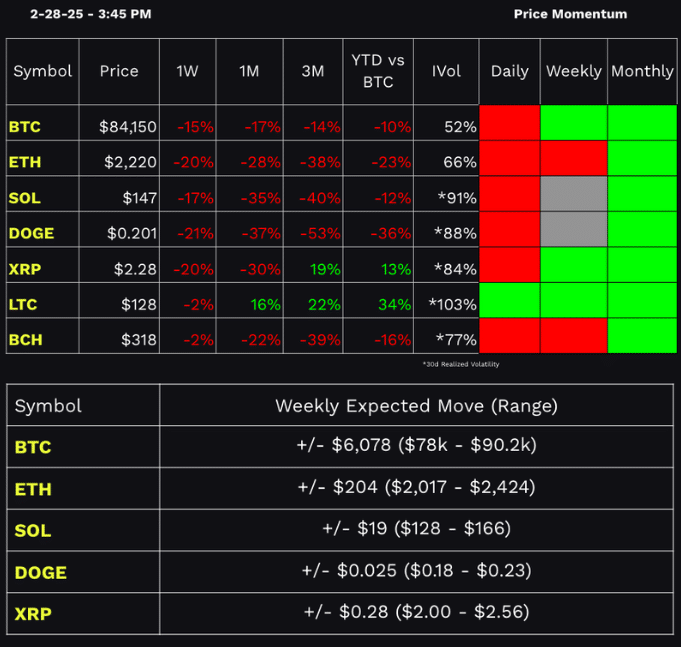

A very bad week to put an end to an even worse month for crypto. After running stops and forcing liquidations under 80k, BTC bounced back to 84k Friday, but it’s too early to call a bottom.

That said, I’m a thrill seeker and I’ve slowly added a little bit back to my BTC position, though keep in mind 70s is in the cards per the weekly expected range.

If you’re in this for the long-term (Saylor Style) then these prices don’t matter and 25 off the highs just means you can buy more cheaper. Short-term, price action is bearish and we really need to see BTC retake 90 and hold on to it, otherwise you might get cut up trying to catch a falling knife.

Like I wrote during the market update on Wednesday, I think this is a correction within a structurally bullish trend which was likely to happen given how ramped up everything was post-election. The catalyst here is the same driver behind equity market weakness, which is a slowdown in the rate of change of economic growth and inflation in Feb.

If this economic environment persists in the months ahead, we trade lower. Again you can see this in sector performance and equity factor exposures. Bitcoin is a high vol asset and when the VIX is flirting with a break of 20, these positions are getting taken down. –See BAO of over $3 billion in BTC ETFs. For those of you that are new here, $3 billion out is a Big Ass Outflow.

The weekly momentum signal for BTC is still bullish but I’ll keep you updated here during Options Trading Concepts on tastylive, Monday at 11:00 AM CT, as well as our next market update email on Wednesday.

Performance Dashboard below…

What's Real?

As the memecoin momentum has faded, and crypto is experiencing a sizable correction, I think it’s likely we see more emphasis placed on fundamentals going forward.

It’s not a knock on memecoins per se, I love trading them, and I enjoy sports betting too, but the reality is many recent token launches have had half-lives of days, or mere hours in some cases.

When we look at where money is likely to flow, especially new money from institutions wandering deeper into the jungle, it’s probably going to be tied to tokens with fundamentals that are more relatable to these traditional investors.

With this in mind, let’s explore some of the ways we might analyze token fundamentals to create an investment framework, how this is similar to traditional stock investing, and some of the tools we can use to perform this analysis.

Categorizing Crypto Assets

For starters, I feel it’s necessary to divide the token we’re looking at into one of four main categories, as not all fundamental metrics are relevant. The approach we take will depend on the underlying asset itself. For example, macro economic factors such as interest rates and monetary policy matter to bitcoin and its digital gold narrative versus Uniswap’s UNI token, where protocol metrics such as fee revenue and total value locked are more relevant.

Below are a handful of categories and the relevant metrics we can use. There are many other categories, similar to the numerous sectors in the stock market, but for now these offer a good starting point.

Monetary Assets

Protocols

Applications

Decentralized Physical Infrastructure (DePin)

Monetary Assets

Bitcoin is the most established and maybe only purely monetary asset in crypto. I suppose there’s an argument for ETH as money, but in my opinion, bitcoin is in a class of its own. Bitcoin’s primary investment thesis is its role as a store of value and a global settlement layer on the internet. I’ve covered this concept at length on the tastycrypto show, and the “digital gold” narrative is fairly straightforward.

With BTC, there are metrics we can use to assess demand, such as on-chain transaction volume and network activity, but beyond tracking global adoption over time, analyzing monetary assets is much different than blockchain protocols and more specifically decentralized applications, which are more like traditional equity investments.

Protocols (Layer 1 & Layer 2 Networks)

Layer 1 and Layer 2 blockchain networks serve as the foundational infrastructure for decentralized applications (dApps), acting as the backbone of the crypto economy. Examples include Ethereum (ETH), Solana (SOL), and Avalanche (AVAX), each offering unique scalability solutions and consensus mechanisms.

Protocols typically derive value from their ecosystems of decentralized applications, which result from their technical ability to support development activity, secure transactions and execute smart contracts. More developers equals more applications, resulting in more use cases, more users, and ultimately more revenue generation through network activity.

When evaluating protocols, I usually first look at total fees generated, which indicates network activity and economic viability, and the price-to-revenue (P/R) multiple, which helps provide an idea of the network’s valuation relative to its earnings.

Additionally, Total Value Locked (TVL) measures how much capital is secured within the ecosystem. Market cap among competing Layer 1s and Layer 2s also plays a crucial role in comparing protocols on a more apples-to-apples basis.

Applications (DeFi, Web3, AI, etc.)

Decentralized applications (dApps) are built on top of blockchain protocols and generate revenue through their various financial services, such as trading fees, lending, and staking.

Leading examples of these apps include Uniswap (UNI), Aave (AAVE), Radium (RAY), and HyperLiquid. These applications are where the majority of user activity occurs, making them critical to the overall success of blockchain ecosystems.

In my opinion, one of the most relevant valuation metrics for dApps is the Price-to-Earnings (P/E) ratio, which helps gauge whether the app’s token might be overvalued or undervalued based on how much money is being generated by the applications.

Additionally, revenue growth rate and user adoption trends provide insight into long-term sustainability. Transaction volume is another essential factor, as high trading activity suggests strong demand and liquidity.

Decentralized Physical Infrastructure (DePIN)

Decentralized Physical Infrastructure Networks (DePIN) leverage token incentives to drive real-world infrastructure expansion at scale. For example, Helium is a decentralized wireless network that incentivizes participation through tokenization. We’ll cover this category in more detail in the future, but if you’re interested in diving in on your own, projects like Helium (HNT), HiveMapper (HONEY), and Grass, are worth a look.

A Traditional Approach

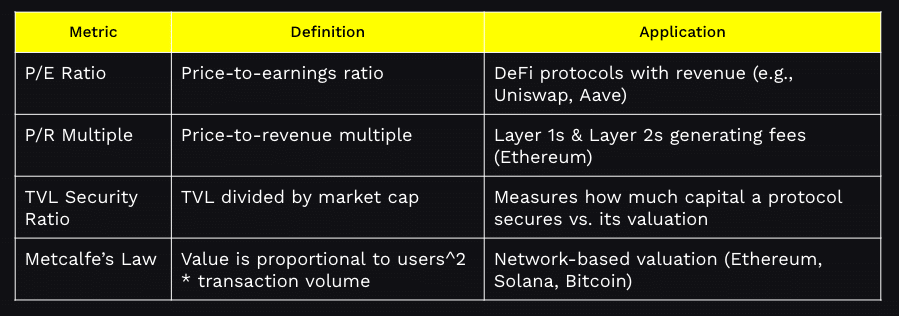

Ok, now that we’ve covered how to think about different types of assets in the crypto space, let’s look closer at a few metrics we can use which are similar to traditional finance.

The P/E ratio is commonly used in traditional finance to assess whether a company’s stock price is overvalued or undervalued relative to how much money the company is earning.. In crypto, this is particularly useful for DeFi applications that generate revenue through trading fees or lending services. – Think of a DEX like Uniswap. If a protocol’s P/E ratio is excessively high compared to similar projects, it may indicate that the token’s valuation is expensive/rich, or vice versa.

On the protocol side, a P/R multiple can help determine whether a Layer 1 or Layer 2 is valued fairly in relation to the fees it generates. For example, Ethereum’s price-to-revenue multiple can indicate whether its valuation is justified based on network activity. If a protocol is trading at an exceptionally high multiple relative to historical levels, it may signal that the market is pricing in overly aggressive growth expectations, while a low P/R multiple could present a value opportunity.

Additionally, the TVL security ratio is an essential measure that’s also relevant to blockchain protocols, particularly those focused on DeFi such as Ethereum and Solana. It compares the total value locked within a network against its market capitalization. This can help investors assess the efficiency of the capital being secured on the chain. A lower ratio may suggest that a protocol is undervalued relative to the amount of capital it protects, while a high ratio could indicate potential overvaluation.

Finally, Metcalfe’s Law provides a framework for valuing blockchain networks based on user adoption and transaction volume. This principle suggests that a blockchain’s value is proportional to the square of the number of active users. This metric is particularly relevant for platforms like Bitcoin and Ethereum, where long-term network effects drive value creation. A sudden drop in user activity or transaction volume could indicate weakening fundamentals, making this an important metric to track.

A Closer Look

We’re barely scratching the surface here, but I feel these metrics offer a starting point for how to think about crypto/token fundamentals. Having some idea of what a token’s value is tied to and whether there’s anything fundamental that supports it is key. There are many tools you can use that offer a detailed, real-time view into this data, from DefiLlama, to Token Terminal and Glassnode to name a few.

For more on this I highly recommend our piece on Crypto Tools For Data, Research, and Analysis

The crypto market is evolving, and as more institutional capital flows in, I think projects with strong fundamentals are likely to outperform over the long-run against assets that are purely speculative in nature. By categorizing crypto assets, applying valuation models, and managing risk effectively, you can build a structured approach to understanding the world of crypto investing.

Web3 Word of the Week (W3WOW)

Show Highlights

- BEANS: left ears only

- We’re giving away crypto & weird NFTs

- Ryan’s doing tasty things