Author: Ryan Grace

January 11, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

The cave is back to full-strength and we’re cooking with flame throwers. Something like that.

We’ll digest market moves in a moment, but before we do, I need to draw your attention to our new app update, new content, and of course bag battles performance.

A new tastycrypto app just hit the streets.

Laurence and the product team have released a new version of the tastycrypto app, which I must say, I’m pretty happy with. It’s got new chains such as Arbitrum and Optimism, a new token swapping engine, and we’ve upgraded the defi experience. Next up, Laurence has his flame thrower pointed at a great market awareness – watchlist feature, and I hear you’ll be able to buy crypto in your tastytrade account, directly in the tastycrypto app soon. LFG.

I love a good app update and I’ve been using tastycrypto more to swap micro-cap memecoins and AI tokens on Base and Solana. For more on this check out bag battles every Monday at 11:00 AM central on the tastylive network.

Also, if you find some bugs, please let us know. We will squash them.

Shelley Joins The tastycrypto Show

There’s a new face on the network. That’s right, Shelley Van has joined the tastycrypto show and she’ll be making regular appearances going forward. Shelley joins us from the metaverse where she’s led community growth across Decentraland and Hyperfy and she’s got quite the track record building worlds. Yes that’s right, world builder.

Tune into the tastycrypto show on tastylive each week!

Battle of the Bags

Performance Dashboard

Your Faith Will Be Tested

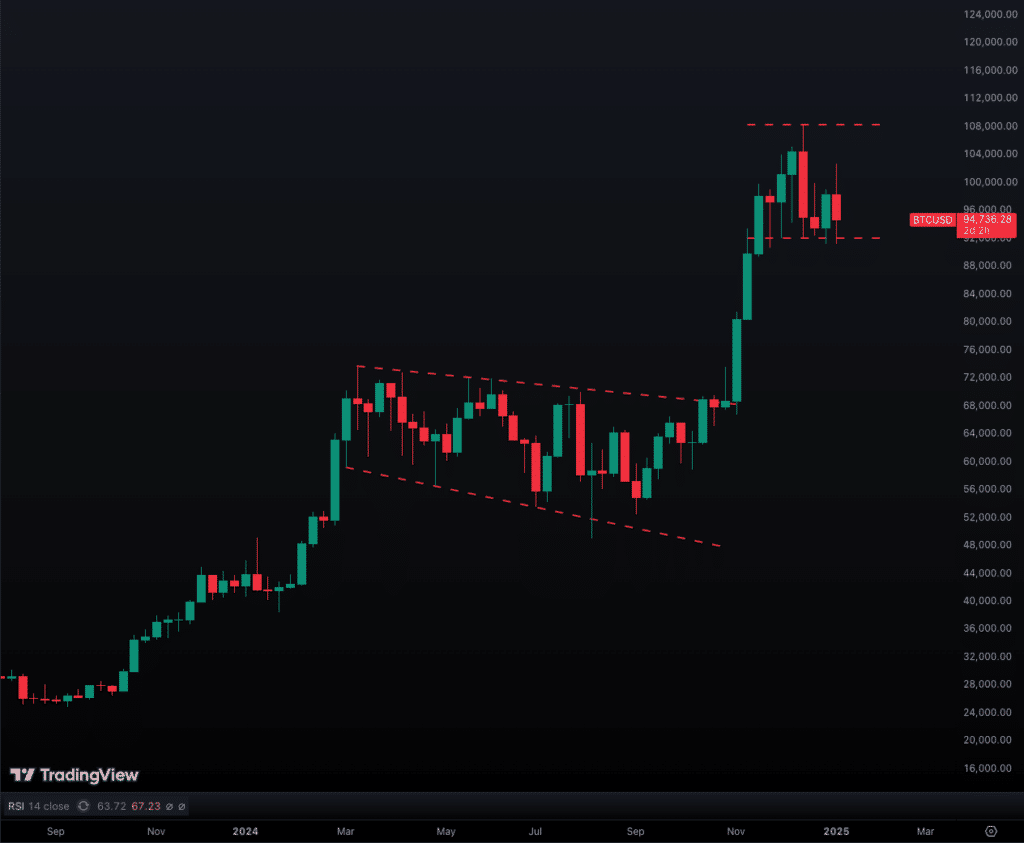

Following a quick rip higher to 102 at the start of the month, we now find ourselves back at the bottom of the big 90-110 trading range we’ve been in since November, post-election.

I’m bullish on crypto in 2025 and certainly over the long-term, but it’s not a straight line. It’s not always going to be up only. Historically, cycles are not without corrections and it’s normal for BTC to pull back 20-30% even during bull markets. Across longer durations, these periods can present entry opportunities, but they require patience.

I’m not trying to scare anyone here, but just be conscious of corrections. That said, where are we as of writing?

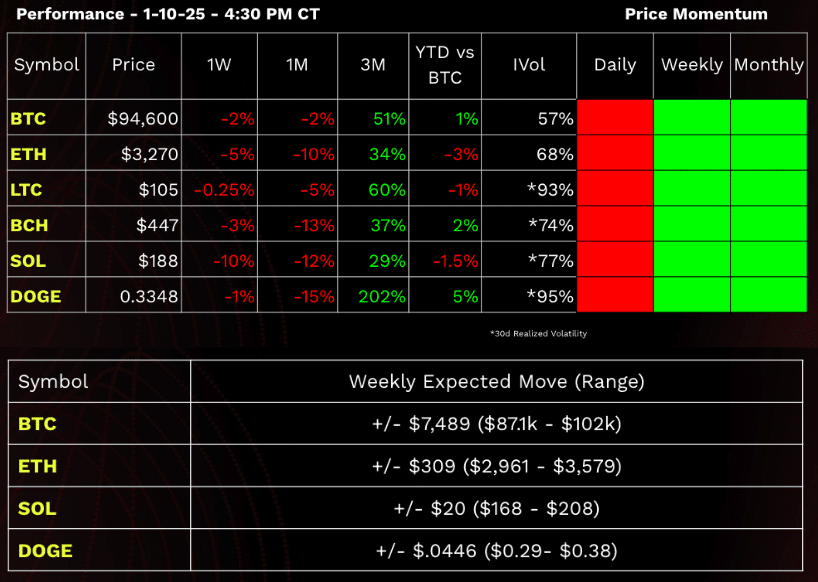

BTC is down about 2% on the week which also puts it down about 2% on a 1-month basis. Looking at the 3-month trend, BTC is running at +52%.

Market Cap Dominance is 58%.

Volatility is 58%. No real change week over week.

Looking at vol and a $95,000 spot price, the expected move is around $7,500 which gives us a weekly 1 standard deviation trading range of about 102 – 87k. This is the mathematical reality currently priced by the options market, but anything can happen.

Bitcoin has been consolidating around the $100k price point with no meaningful change in volatility over the past couple of months.

Macro influences driving short-term weakness?

In a past life I was a more astute macro observer, now I own Fartcoin and LLM, but let’s put the hat back on for a moment.

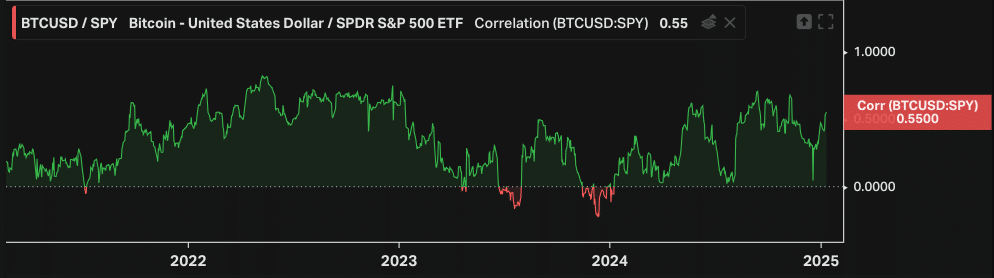

If you want to attempt to explain this week’s price action, BTC is simply responding to what other traditional assets are moving on; the rate of change of economic growth and inflation is accelerating versus earlier exceptions of the pace of interest rate cuts.

Said differently, the market has repriced its expectation of the timing and pace of interest rate cuts, given the relative strength in the economy. The Fed has been singing a more hawkish tune recently, and on the margin, this is a headwind to “number go up.”

The correlation between equities and crypto has strengthened quite a bit, so, short-term, crypto is unlikely to be immune from volatility in traditional markets, especially if this volatility is largely driven by expectations of future Fed policy. Long-term, this doesn’t matter.

What I’ve learned over time is that crypto does pretty well during periods of accelerating rates of change of economic growth and inflation. If this is the reason the Fed is in less of a rush to cut rates, I’m less concerned. When you really need to be worried is when both growth and inflation are falling, and that’s not what’s happening right now.

Big Picture Perspective

This quick move to 90k is causing some to now question their conviction. Here’s how I think about the current situation in no particular order.

- We are about 50k higher than we were at this time last year. Crypto is volatile and crypto is violent. The game has not changed. Take profits along the way, compound returns, and buy big pull-backs. Dips are when we’re down 20-30%, not 5%.

- There will be corrections and short-term bearish momentum within larger structural bullish trends. The trend is bullish. Identify when this has changed. – We monitor 1-3 month price momentum for this signal.

- I am looking to take some BTC profits into 2025 on a break to new all time highs, maybe I’m dreaming, but if we move up into 125 -150 territory, I’ll likely take some off the table.

- My portfolio is 70% BTC but I’m now adding more to ETH and alts on dips as I still think there are big moves to come as the cycle plays out. Again, prior cycles have witnessed large corrections within the trend. I have no idea what will happen but I’m mentally prepared for a 75k BTC print on the road to crypto riches.

- Historically BTC prices have topped out around 500 days post halving, on average. We are 266 in.

- It’s going to be an exciting year, there’s a lot of reasons to be bullish on crypto. Trump will probably look to make a big splash on the policy front, possible ETF catalysts (maybe SOL approval, ETH staking rewards), global liquidity is increasing and the economic environment is generally supportive, but remember the market is not going to trade on these narratives forever.

Stay tasty,

Ryan

Show Highlights

- Wizard Katie apes in & X goes nuts (look at the tweet responses! 😅)

- ShelleyVan joins the arena with $LLM 🚀

- Ryan learns about the metaverse

Join in the fun and hop in the live chat during the show!

Web3 Word of the Week (W3WOW)