Author: Ryan Grace

April 12, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend. It was another crazy week across markets, but as you know, that doesn’t phase us here in the cave.

We’ve been through the storm. We were there for the FTX collapse. We eat 150 vol for breakfast. We know liquidity is coming.

It’s easy to get distracted by the deafening noise of those freaking out on X or the chorus of commentators claiming this is the end of markets as we know it.

In an attempt to add calm to the chaos, here are a few crypto market observations from the past week, and a trade idea some of you might find interesting.

It was a volatile week, but how volatile was it really?

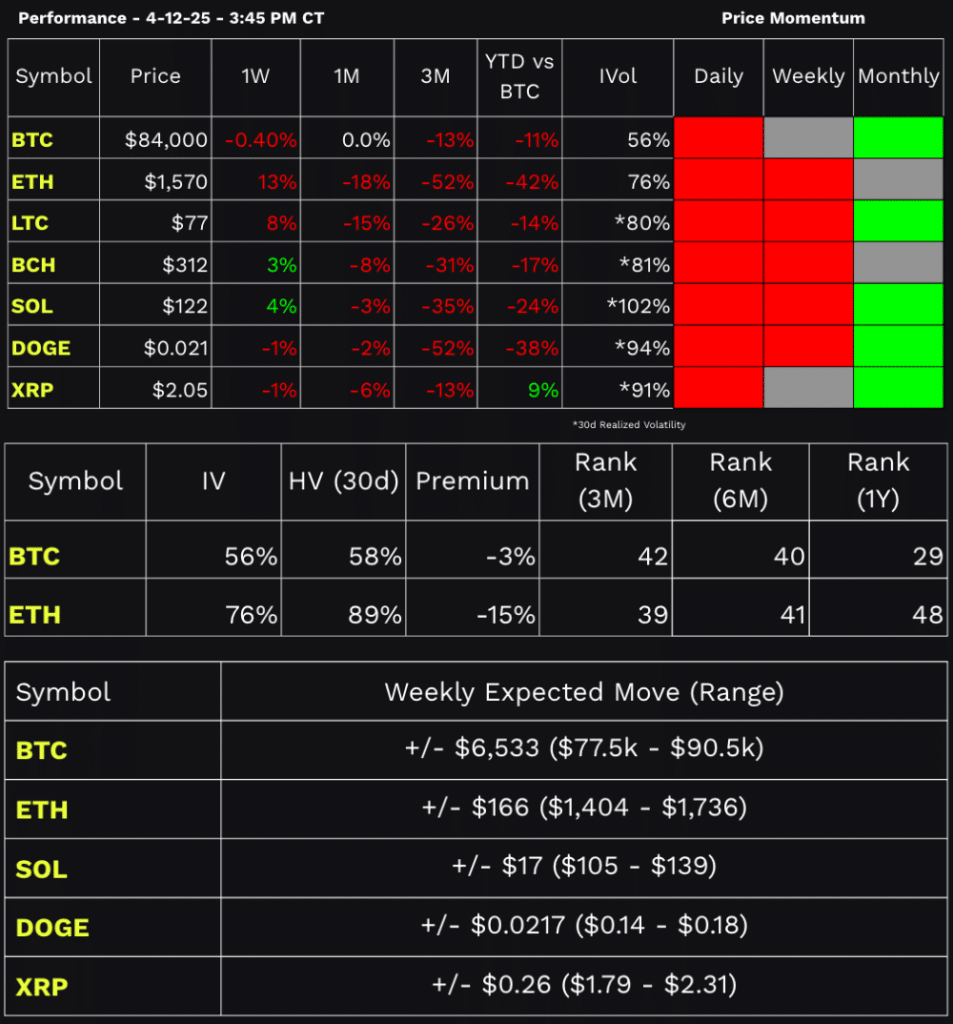

VIX went to 60. A move of 80% at the peak, versus a 15-20% spike in the 30d implied volatilities of BTC and ETH.

On an annual basis, BTC volatility is closer to the middle of its range versus some of the extreme highs we’ve seen across measures of equity market volatility.

BTC has held up relatively well.

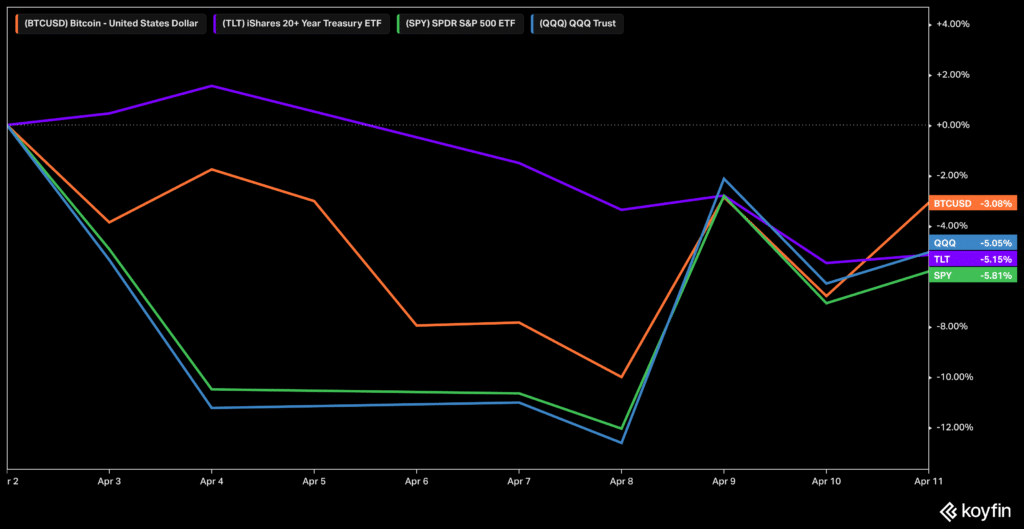

If markets are going to continue whipping around wildly, is crypto a place to ride out the volatility? Since Liberation Day, bitcoin has outperformed equities and even treasury bonds.

Presumably the longer the present conditions persist, the more likely we get a response from the Fed or Trump tweets something.

BTC found buyers around 75 early in the week and we haven’t revisited it since. Over the last month we traded inside of 75-90, for reference.

In no way am I saying the worst is behind us, but generally speaking, BTC has been resilient throughout. Remember, cross asset-correlations will strengthen when there’s a +30 VIX, and sure, vol of vol is ripping to historic highs, but bitcoin is unlikely to be impacted by the same trade tensions weighing on companies like Apple (AAPL) and others.

ETH Options Get the Green Light

In another sign that crypto markers are maturing, specifically in the US, the SEC has approved options trading for spot ETH ETFs, including those offered by BlackRock (ETHA), Fidelity (FETH), Bitwise (ETHW), and Grayscale (ETHE).

A Trade Idea With BTC Options

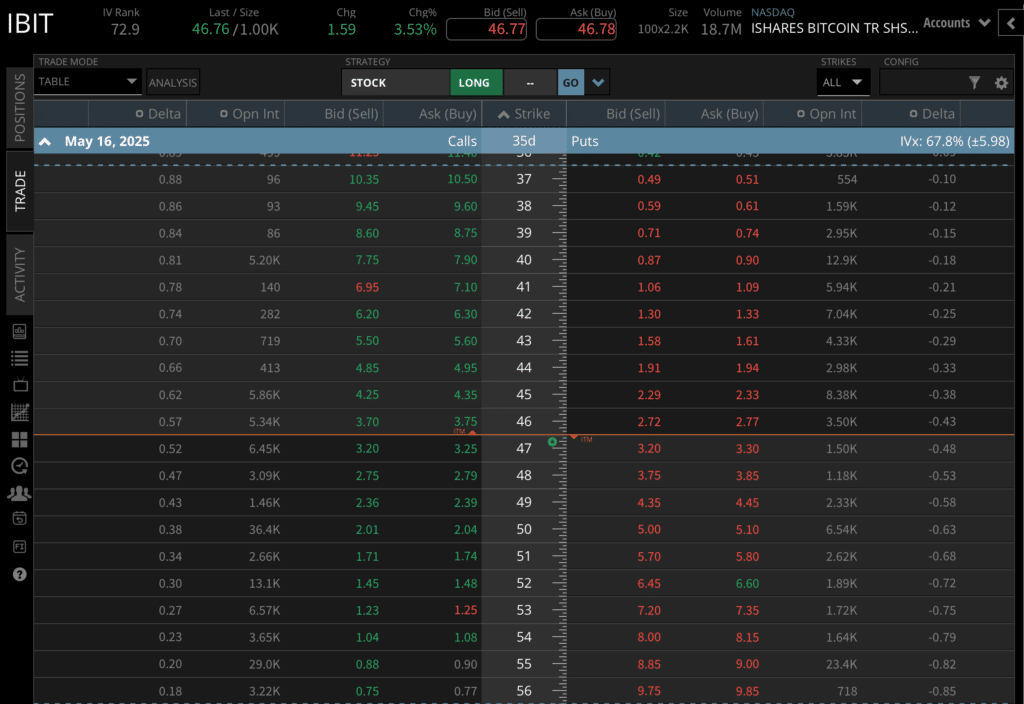

Speaking of options, here’s a way we can potentially profit from high-levels of crypto volatility using options on BTC ETFs. This is simply a trade “example”, but let’s walk though what this might look like using options on IBIT.

I’m choosing IBIT because it’s one of the biggest BTC ETFs with $47 billion in AUM, and the options market in IBIT is considered very liquid. For me, an easy way to measure liquidity is to look at the spread between the bid and ask price of options at various strikes on the chain. IBIT options are a few cents wide. This is typically as tight (liquid) as it gets.

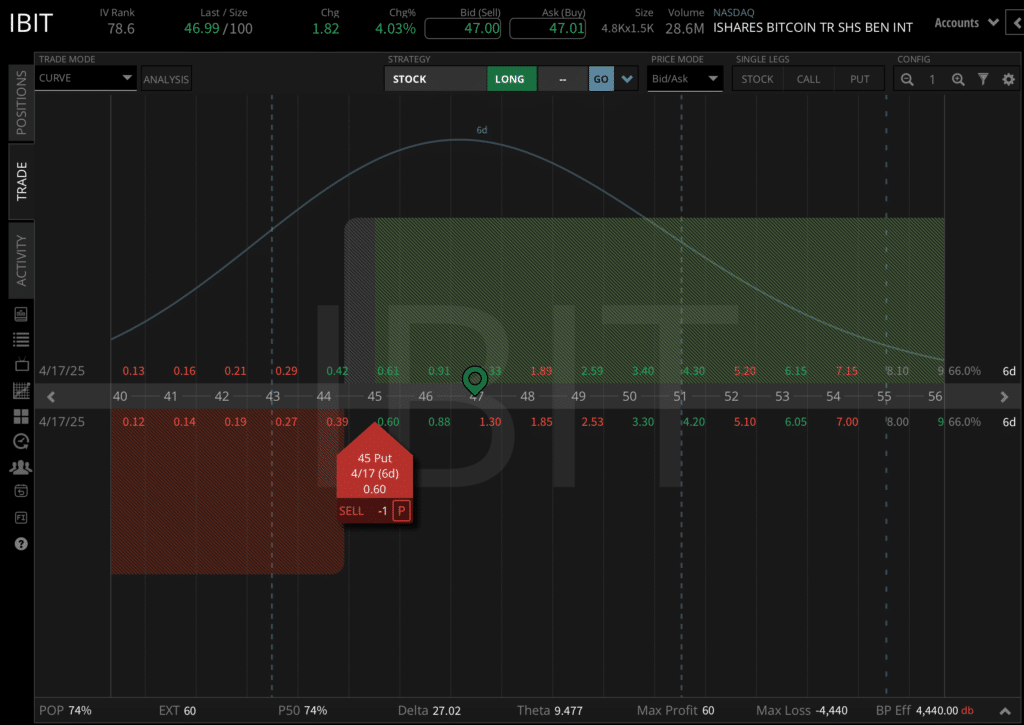

Ok, now onto the trade idea. The strategy here is commonly referred to as “The Wheel” and it’s relatively straightforward, assuming you have a basic understanding of options trading. It simply involves selling a cash secured put as a way to generate income, and then in the event you are assigned on the put option (IBIT price is below the strike at expiration), you then sell a covered call against the resulting 100 shares of IBIT.

In doing so, you’re essentially getting paid to sell the put option, with the intention of buying shares of the ETF at the lower strike price, if the ETF price is below the option strike at expiration and you’re assigned shares.

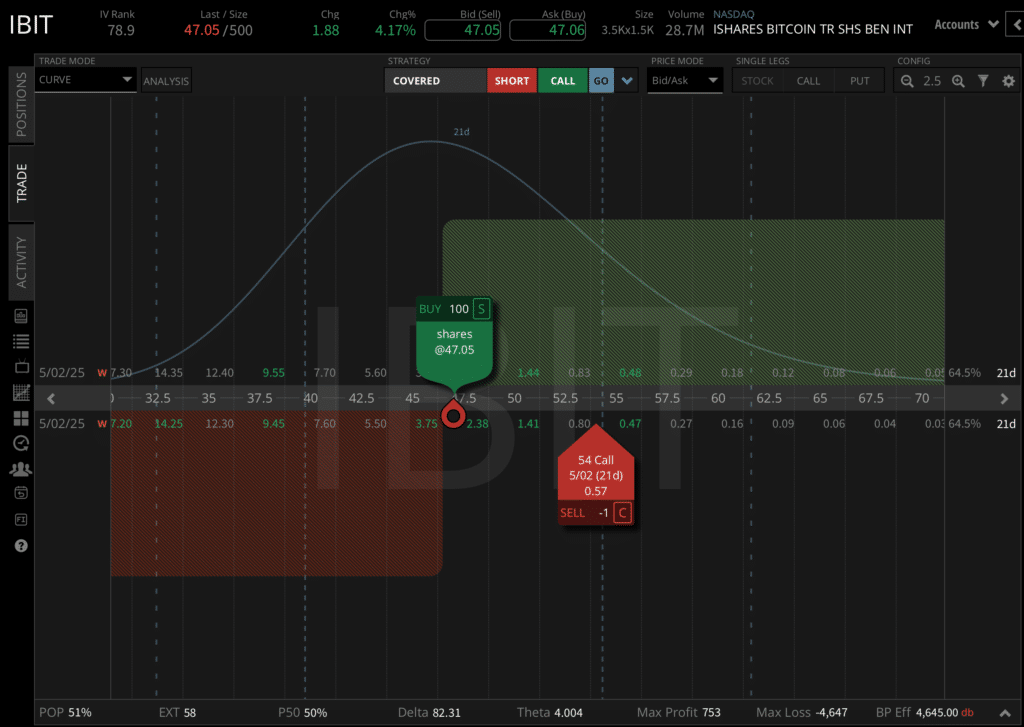

If this happens, you then own shares in the ETF and can sell a call option against the shares, at a higher strike price.

When you sell the call option, you collect additional option premium and further reduce the overall cost basis of the position. If IBIT’s price is above the put strike at expiration and you’re not assigned shares, you just sell a new put option in the next expiration and repeat this process.

Basically you’re getting paid the option premium to buy 100 shares of the ETF at a price lower than it is presently. If the ETF price goes down you’re assigned the shares. If it doesn’t, you just keep the money you received for selling the option.

If you’re assigned and end up with shares of the ETF, you then sell a call against the shares and collect more premium, with the intention of selling the shares at a higher price in the future, if the price of IBIT is above the strike of the call you sell.

Should the price of IBIT remain below the strike price of the call at expiration, you keep the premium you received and just sell a new call against the shares, in the next expiration period.

If option premiums are elevated, this can present an opportunity to generate income while maintaining a bullish directional view on the value of bitcoin, or in this case, the IBIT ETF, which tracks the price of bitcoin.

Web3 Word of the Week (W3WOW)

So, what’s the risk?

Well there are a couple of things to consider with this strategy.

On the downside, there’s a risk the price of the ETF falls below the option’s strike price and it keeps falling. In this case, the maximum risk of this strategy is if IBIT goes to $0, which implies the price of BTC goes to $0.

In the example above we are selling the 45 strike put. If we are assigned at expiration, this results in the purchase of 100 shares of the ETF at $45 per share. So, if the ETF went to $0, we would lose $4,500 in total, minus the $60 we receive for selling the option. A max potential loss of $4,440, in the worst case scenario.

On the upside there’s also a risk to consider, though I see this more as an opportunity cost. Regardless of how you enter the position, a covered call has limited profit potential. – This is defined by the potential appreciation in the price of the shares (up to the strike price), plus the credit received for selling the call option against the shares.

In the image depicting the covered call strategy above, you can see the maximum profit is defined by the difference between the price of the stock (at the time of purchase), the strike price of the call option, plus the credit received for selling the option.

Putting this all together, let’s assume the trade works out perfectly. This is how we can approximate the outcome.

We sell the 45 strike put for $0.60 and receive $60 in our account. The price of IBIT falls to just under $45 per share on the expiration date and we are assigned 100 shares at this price.

Next, we sell a call option against the shares at the 54 strike for 0.57. We receive $57 for selling this option. Then, in the best case scenario, the price of IBIT shoots higher and is above $54 per share at the time the call option expires.

If this happens, our option will be exercised and the 100 shares of IBIT we were assigned (bought) at $45 per share will automatically be sold for a price of $54 per share.

As a result this example has a max potential profit of around $1,000, should it work out perfectly and we end up buying 100 shares at 45, selling them at 54, and collecting over $100 for the options.

Regardless of what happens we get to keep the credits we received for both initially selling the put option ($60) and also selling the call option ($57), roughly $117 in total.

While we are limiting our potential upside here, this strategy is interesting to me because it provides a way to express a bullish directional view on the price of bitcoin, while also generating yield in the form of option premiums, especially during periods of elevated implied volatility.

For more on this strategy make sure to tune into the tastycrypto show next week and as always, keep your head on a swivel.

Good luck out there.

Stay tasty,

Ryan

Show Highlights

- What a month this week has been!

- PUMP HARDER

- tastycrypto Show goes full degen

- Etch it in metal

- We got a visit from over the pond!