Author: Ryan Grace

November 9, 2024

Good morning my tasty friends. I hope you’re all having a wonderful start to the weekend.

What a week.

Post-election there’s definitely a sense across the industry that a weight has been lifted. Trump is not crypto’s savior, nor should crypto be political. It’s a decentralized technology. But, I think it’s fair to say the prospect of regulatory progress is seemingly greater now than ever. And sooner than later.

We don’t yet know what President-elect Trump will actually try to implement, but we do know what he’s said. We also know that the current administration under President Biden hasn’t exactly embraced the crypto industry either, and with Gary Gensler in charge, the SEC has brought over 100 enforcement actions against crypto firms, collecting $7.5 billion in fines in the process.

If you’ve been building in crypto in the United States, it hasn’t been the friendliest operating environment. This all likely changes going forward.

The uncertainty and the fear of the SEC is likely to lessen, it’s probable congress moves to pass some form of crypto regulation in the near term, and once there are known crypto rules and regulations, this will invite more participation by institutions and individuals waiting for the regulatory greenlight.

The weight of uncertainty has put pressure on prices and now the market breathes a sigh of relief.

Performance Dashboard

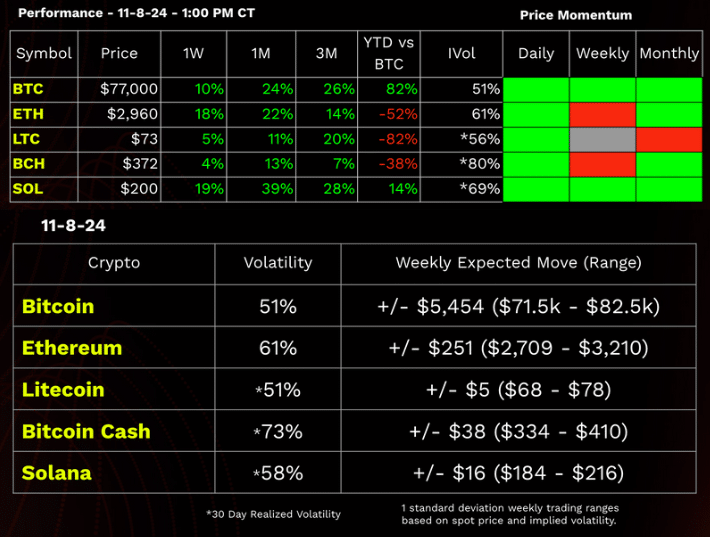

The election is over and objectively speaking bitcoin is up about 10% on the week, hitting a new all time high as I write this.

Does it stay here? Who knows, I hope it goes higher.

As always, please find our updated performance dashboard and estimated trading ranges below. Ranges are calculated as 1 standard deviation of the spot price and current volatility.

Crypto in Politics

For the first time in history crypto played a role in the election, an estimated 50 million US citizens own crypto, and digital assets are quickly becoming a legitimate asset class among both retail and institutional investors. Crypto is more relevant than ever.

With crypto and more so bitcoin front and center, on The tastycrypto Show, Glen (my quant) and I discussed a few of the reasons why we think it makes sense as an investment, given its unique characteristics.

Why Invest in Bitcoin

In the crypto community, “orange pilled” is used in reference to the Matrix movie where the character Neo faces the choice of taking the red pill and witnessing the reality outside the simulation (seeing the light so to speak), and taking the blue pill which returns him to the matrix. Spoiler alert: He takes the red pill.

The bitcoin logo is orange and that’s obviously the color of bitcoin, so, if you own crypto, to some extent you’ve been orange pilled. You’ve seen the light.

This past brutal crypto winter, I found myself in a boardroom in London where a former executive at our parent company once remarked to me. “You’ve really drunk the Kool-Aid” – What he doesn’t know is that I don’t even drink. Well, not any more. Not after the orange pills.

Should you have it in your portfolio? – I don’t know your situation, but here’s why I own it.

I took the orange pill.

Bitcoins's Appealing Characteristics

Scarcity

A decent analogy people like to use around bitcoin is that it’s digital gold.

Sure one is a physical metal mined from planet earth and the other is a magical token mined on the internet, but both assets have similar financial properties.

They’re both scarce assets, divisible, and have the same monetary characteristics, but it’s the scarcity component which makes them both very compelling, especially as a hedge against financial manipulation and fiat currency debasement.

According to the U.S. Geological Survey, it’s estimated there are around 244,000 metric tons of gold in existence.

The supply of bitcoin that can be mined is mathematically capped at 21 million. And, supply growth slows down every four years following a halving event, as the bitcoin reward miners receive for adding blocks to the network gets reduced by 50% post-halving.

Maybe we start mining gold from asteroids, but today, these assets are finite in nature, and this is a unique characteristic. Unlike fiat currency, you can’t print more bitcoin. This is why we often see bitcoin prices go up during periods of monetary stimulus, low interest rates, and increased liquidity in the financial system.

Digitally Native

Is bitcoin money? Maybe. If people use it as money, then sure. Regardless, it has money traits.

For something to be used as money it typically has to be portable. If it can’t be easily moved from one place to another, or between individuals, it’s not very useful for transacting.

Bitcoin is digitally portable. Bitcoin can be transferred across a globally connected, cryptographically secured network that’s largely accessible on a permission-less basis at almost no cost.

It’s useful in that it’s both a decentralized value transfer mechanism on the internet, and given its element of scarcity, it’s a hedge to monetary inflation and resulting currency debasement.

As a decentralized global asset, it’s untethered from, and in turn benefits from, widening fiscal deficits and expanding central bank balance sheets.

This is a unique characteristic.

When governments and central banks expand the money supply, asset prices tend to inflate, and as a scarce, digital asset, bitcoin tends to inflate a lot.

At least it has historically.

Asymmetric Returns

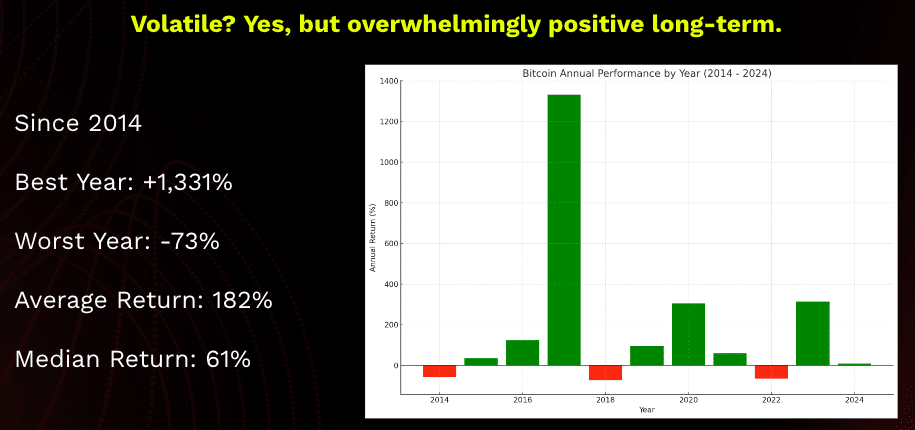

I think there’s a decent probability the price of bitcoin goes up over time, driven by many of the same forces pushing prices to all-time highs today. This has made bitcoin a pretty decent investment.

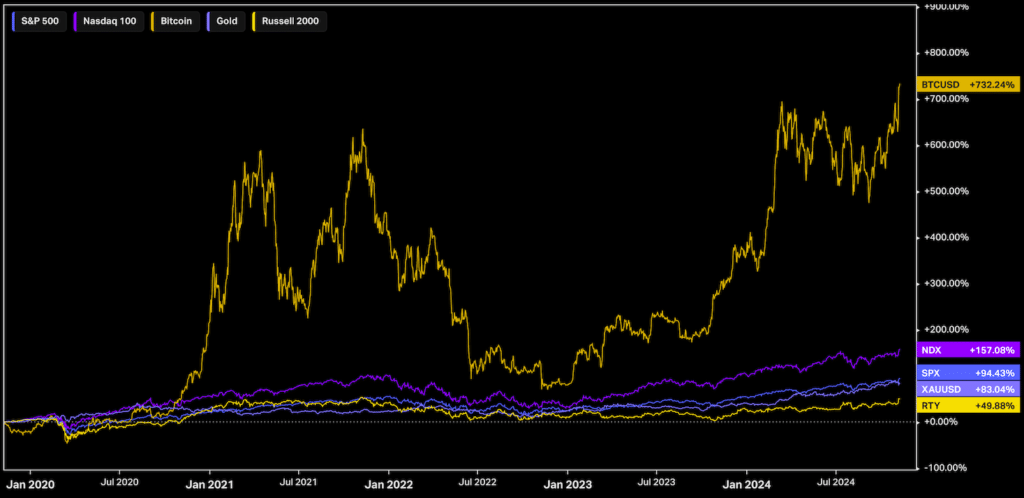

It doesn’t mean it always will be, but it certainly has outperformed just about anything else you could have put your money in over the past few years. Not without some volatility though!

Uncorrelated

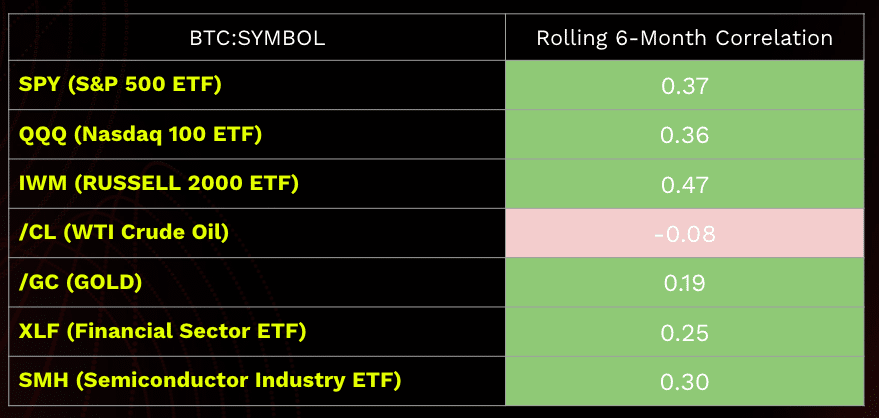

Another characteristic somewhat unique to bitcoin as an investment is its uncorrelated behavior with traditional asset classes.

Unlike stocks or bonds, which are often influenced by broader economic factors, Bitcoin is usually out there dancing on its own.

Historically, it’s shown low correlation to assets like equities and gold, which given how much potential upside it’s offered investors in the past, makes it worthy as a portfolio diversifier.

During periods of volatility, this low correlation might offer some benefits as a small allocation of Bitcoin could potentially reduce portfolio risk.

I also think with both the launch of spot ETFs and the further legitimization of crypto through regulation, larger institutional investors will be looking at bitcoin more seriously and will come to a similar conclusion.

This could lead to some serious capital flow into BTC over time.

If massive pension funds and endowments decide they need a small allocation to bitcoin, the ETFs act as a conduit for capital flows and given how relatively small bitcoin is as an asset class, this capital flow could have an outsized impact on upside prices, especially when considering the scarcity element.

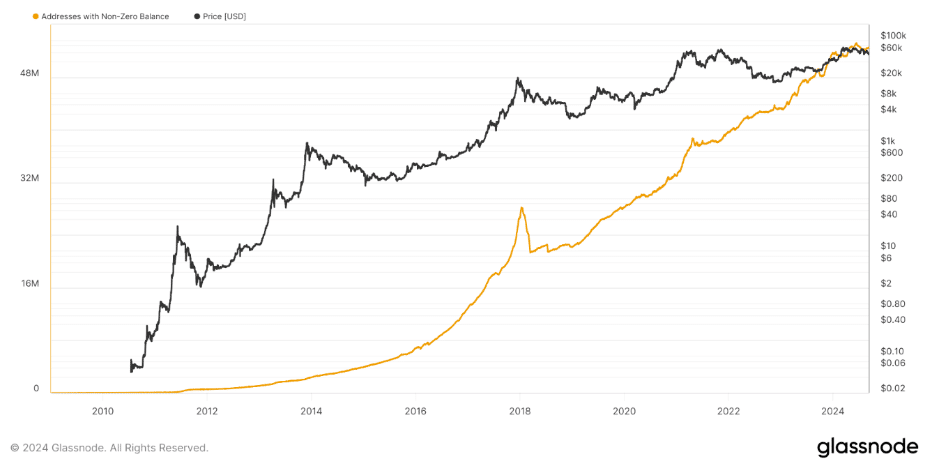

Adoption is growing but it’s still in the early stages. As a store of value, its relative market cap is small.

Finally, I think there’s still upside potential. Adoption is seriously growing, but it’s still early. Yes, bitcoin has been around for a while, but the broader crypto market really hasn’t. The technology is still nascent.

Today there are over 50 million Bitcoin wallet addresses holding a non-zero balance, yet the market cap of bitcoin is still very low compared to traditional assets.

For example, while the narrative of Bitcoin as a “digital gold” store of value has gained traction, bitcoin’s $1.4 trillion market cap is a fraction of gold’s $12 trillion value.

I’m not saying Bitcoin is gold or will reach its valuation, but with ETFs, regulation, and real institutional participation… There’s reason to believe we could see a multi-trillion dollar market cap and a six-figure price in the future.

Not overnight, but over time.

tastycrypto Show Highlights

- Glen slays the sushi buffet

- 50 Million Wallets took the full Orange Pill

- What will become of Gary Gensler?

- Pro-crypto USA

Next: Where Do I Start With Crypto with Katie McGarrigle!

Join in the fun and hop in the live chat during the show!