Author: Ryan Grace

December 14, 2024

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend. We have single digit temperatures here in Chicago, so I’ll likely be spending the weekend inside trading meme coins of course. (More on this later.)

As bitcoin chops around here and everyone questions where we are in the cycle (early), I wanna shine a light on a theme gaining traction in the market. Like picking the right coins, getting the narrative right is part of the crypto game.

Pick Your Pony

Investors are starting to position for opportunities beyond bitcoin and depending on how you measure it, alt coin market cap growth is ripping higher.

The CoinMarketCap Altcoin Season Index has increased in market cap from $917 billion to $1.6 trillion in the past 90 days, while crypto total market cap (excluding the top 10 tokens) has doubled from $200 to $400 billion since November. For context, the total market cap index high was $500 billion in November 2021.

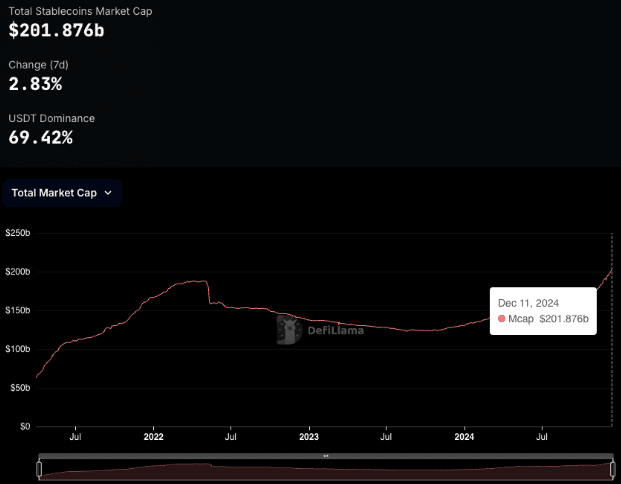

We’re approaching levels from last cycle, but does that mean we’re close to the top? I don’t think so. Let’s look at flows. For the tokens to rip, dollars need to come on chain, and they come in the form of stablecoins. The two biggest stable coins by market cap are USDT (US Dollar Tether) and USDC (US Dollar Coin).

Using stablecoin market cap as a proxy for flows, USDT market cap was $75 billion in November 2021, it’s $140 billion today. USDC cap is basically unchanged, but it’s still recovering from the temporary de-peg it experienced during the regional banking crisis in March 2023. – That said, USDC’s market cap has doubled since the start of the year, now at $42 billion.

Total stablecoin market cap is now at a record high of $202 billion. There’s some liquidity… It’s not a perfect measure, but generally speaking, there’s more money coming on-chain.

Web3 Word of the Week (W3WOW)

Where will it go?

Let’s look at one of the prominent themes emerging this cycle, crypto AI agents. These are high level observations, but if you get the narrative right, sometimes you win a prize.

Characteristic of many crypto market narratives, my friend just told me about crypto AI agents last week. – Of course I instantly bought in because that’s what I like to do.

Personally, my approach to learning about crypto has always been to have some skin in the game, so I’ll buy a small amount to keep me engaged.

For this, I used my capital from Bag Battles to buy Ai16Z, one of the larger projects popping up recently. We’ll get to this shortly, but first, a little more on crypto AI agents.

Crypto Agents

What is a Crypto AI Agent?

A crypto AI agent is a program using artificial intelligence to perform tasks and make decisions on a blockchain network like Ethereum or Solana. For example, a crypto AI agent can act as trading bot managing DeFi strategies, or even vote on proposals in DAOs.

They operate independently, analyzing data to predict trends, and can connect seamlessly with crypto tools like wallets or decentralized exchanges to make quick, intelligent decisions on-chain.

Why is the market excited about the crypto AI agent theme?

The belief is AI agents will essentially make it easier to do things on blockchain networks, by automating tasks and removing complexity.

A lot of the initial use cases are centered around trading bots (agents that analyze data and make automated trading decisions), but imagine a world where an AI agent can take it a step further and deploy a smart contract or automate the process of setting up and managing a liquidity pool.

It’s not just financial services either. As blockchain applications evolve, it’s possible AI agents will facilitate processes from decentralized identity credentialing, to supply chain logistics. – There are a lot of potential use cases.

What tokens represent the AI Agent theme?

If you’re interested in learning more or even getting started in the market, here are a couple of tokens that provide exposure to the theme.

ai16z (AI16Z - Solana)

This is where I started.

The easiest way to think of ai16z is that it’s an AI managed hedge fund or VC fund on Solana. More specifically, it’s a DAO (decentralized autonomous organization) run by an AI agent, and the AI agent acts as a trading bot, autonomously making investment decisions with the DAO’s capital.

To come up with investment ideas, the AI agent uses inputs from dedicated discussion channels, called “alpha chats” on platforms like Telegram and Discord. After scanning these chats for recommendations, such as “Buy X token at this price” it then evaluates the conviction and sentiment of contributors mentioning the asset and filters for noise to distinguish between credible advice and irrelevant chatter. Contributors are added to a trust leaderboard based on the accuracy of their recommendations and resulting profits the AI is able to generate from their suggestions.

From a fundamental perspective, it’s largely an experiment, at least for the time being, but it unlocks a world of possibility. The backbone to this whole thing is ELIZA, which is an open source framework for developers to build and deploy AI agents. Since it’s easy to build agents using this framework, it’s plausible we’ll see entire ecosystems of interconnected AI agents begin to emerge on-chain.

As always, do your own research, but if you’re buying this token, you’re basically making a bet that the AI agent will trade profitably, which will in turn increase confidence in the DAO and accrue value to the token and more broadly the whole crypto AI Agent theme over time.

Virtuals Protocol (VIRTUAL - Base)

After I discovered the Ai16Z token, I came across Virtuals and threw some USDC at it too.

The Virtuals Protocol also merges artificial intelligence with blockchain to revolutionize interactions across gaming, metaverses, and online platforms.

At its core, Virtuals enables users to create, co-own, and monetize AI agents. These AI agents are in the form of intelligent virtual personas like NPCs (non-player characters in games) or virtual companions that can generate real-world revenue.

Virtuals is unique in that it lets users share profits from AI agents that are deployed across various platforms. Each AI agent is tokenized as an ERC-20 asset and revenue comes from services these agents provide.

For instance, if an agent facilitates transactions or interactions in a metaverse, it could generate tokenized rewards which are then distributed among token holders.

Again, it’s all very early stage, but some of these agents such as VADER and AIXBIT are already seeing pretty sizable valuations.

If you look at the AI Agent Category on CoinMarketCap, you’ll see the space is currently valued around $9 billion. Given the proliferation of AI, I suspect this grows overtime, but that’s not to say the current leaders will all survive.

The rise of crypto AI agents feels like a natural next step in the evolution of blockchain technology, blending the automation and intelligence of AI with decentralized networks.

While I continue to harp on how early-stage it all is, the potential use cases, from automated DeFi strategies to gaming and virtual interactions are compelling. It could be that AI agents emerge as a key adoption driver this cycle, similar to how NFTs played a huge role in crypto adoption the last time.

Performance Dashboard

tastycrypto Show Highlights

Next:

- Episode 8 – Where Do I Start With Crypto with Katie McGarrigle!

- BAG BATTLES – ROUND 3 Memecoin Showdown – Monday at 11am CT on the OTC LIVE Show!

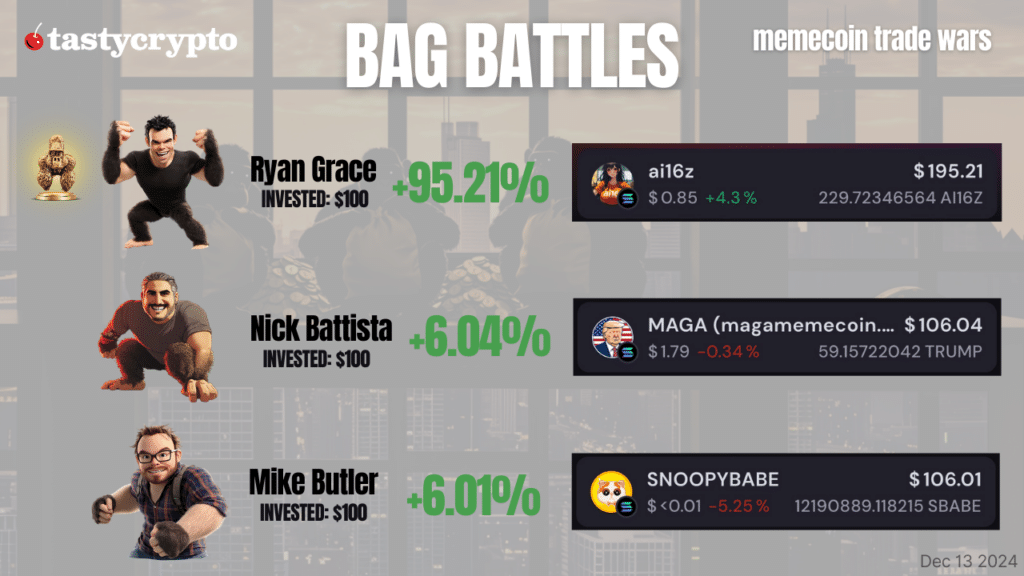

BAG BATTLES UPDATE

In this week’s BAG BATTLES update, my bag rockets ahead with $AI16Z, up an impressive +95.21%, as AI-focused tokens continue to capture investor attention. Nick Battista and Mike Butler are locked in a close race, with Nick’s $MAGA coin (+6.04%)—a politically themed memecoin—and Mike’s $SBABE token (+6.01%), inspired by the popular SnoopyBabe meme cat, which has garnered a devoted fanbase thanks to its blend of humor and virality. As these tokens compete in the unpredictable world of memecoins, the stakes are high. Will $AI16Z maintain its dominance, or will another token rise to claim the top spot? Catch all the action and insights every Monday at 11am CT on OTC LIVE!

Not financial advice. Always do your own research, and remember: memecoins are high risk—be prepared to lose it all!

More updates to the tastycrypto wallet app are coming soon.

Stay tasty,

Ryan