Bitcoin is considered a store of value because this cryptocurrency is scarce, portable, secure and durable. In this article, we answer the fiercely debated question: is bitcoin a store of value? We say yes. Here’s why.

Written by: Mike Martin | Updated July 23, 2023

Video by: Ryan Grace

Fact checked by: Laurence Willows

🍒 tasty takeaways

Bitcoin’s retention of purchasing power over ten years suggests it can be considered a store of value.

Being decentralized, the Bitcoin network is insulated from monetary manipulation and intervention.

Bitcoin is like digital gold because it is portable, divisible, and relatively scarce.

Bitcoin’s volatility, lack of regulation, security risks, and limited adoption all challenge the belief that bitcoin is a store of value.

First things first – before you make any investment, it would be wise to know what type of asset you’re buying.

So – is bitcoin (BTC) a store of value? Let’s as Ryan, Head of tastycrypto!

“A store of value is essentially an asset that can be saved, retrieved, and exchanged in the future without a significant loss of purchasing power.”

— Ryan Grace

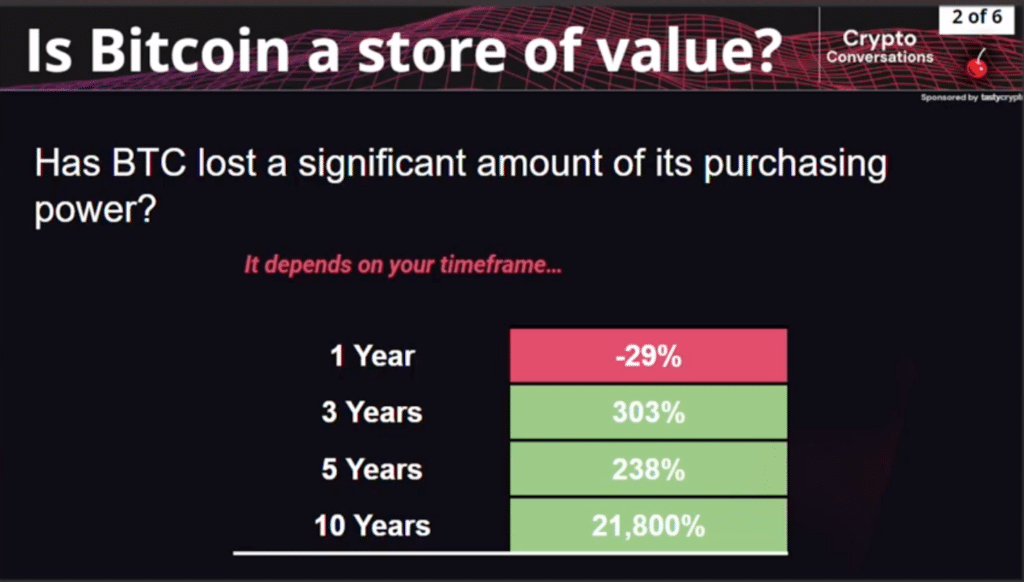

We know the first three parts of this definition are true – but has bitcoin experienced a significant loss of purchasing power?

As we can see from the above data, bitcoin has retained a significant amount of its purchasing power over the duration of ten years. Therefore, bitcoin can be interpreted to be a store of value.

Bitcoin Characteristics

When compared to other stores of value, Bitcoin has several unique characteristics that should appeal to investors.

1. Bitcoin is scarce

There will only ever be 21,000 bitcoins in existence. After all bitcoins are mined, no new bitcoins will come into existence. This means that bitcoin (unlike the US dollar and other fiat currencies) is a deflationary asset class.

Deflationary assets are more attractive to investors than inflationary assets because limited supply creates scarcity.

2. Bitcoin is decentralized

The Bitcoin network is a decentralized blockchain network. Other popular blockchain networks include Ethereum (ETH) and Litecoin (LTC).

Decentralized blockchains are peer-to-peer governed communities insulated from monetary manipulation and intervention.

🍒 Fun fact! bitcoin the cryptocurrency is spelled with a lowercase ‘b’ while Bitcoin the network is spelled with an uppercase ‘B’.

3. Bitcoin is digital gold

Bitcoin has a low correlation to other asset classes. Additionally, bitcoin is portable, divisible, and relatively scarce. Precious metals such as gold also possess these characteristics. Bitcoin, therefore, can be thought of as a digital gold.

4. Bitcoin is divisible

Like fiat currencies issued by central banks, bitcoin too is divisible. You can buy as much or as little bitcoin as you want. Divisibility increases an asset’s utility as a store of value.

📚 Read! Bitcoin vs Gold

Challenges to Bitcoin’s Store of Value Status

Let’s now jump to the other side of the table and look at a few reasons why bitcoin may not be considered a store of value.

Bitcoin is volatile. Bitcoin has greater volatility than most asset classes.

Bitcoin is unregulated. Unforeseen US government regulation could have a detrimental effect on the future price of bitcoin.

Security. Many centralized crypto exchanges (CEXs) have been hacked.

Not widely used. Satoshi Nakamoto’s whitepaper defines Bitcoin as:

“A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

— Bitcoin Whitepaper

In 2023, bitcoin is not used as an online payment system. Why? Low adoption and high network fees. For example, the cost of a bitcoin transaction is far greater than the cost of buying a cup of coffee. Therefore, bitcoin is not widely used on a day-to-day basis.

The Growth of Bitcoin

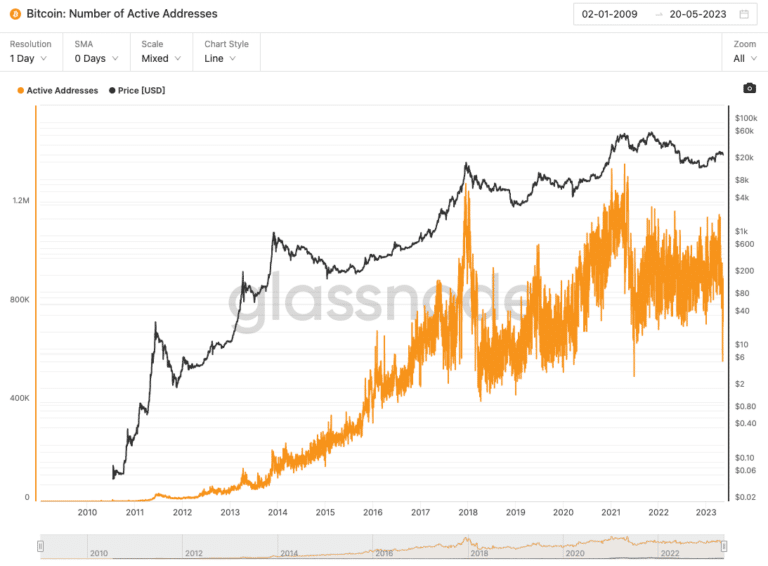

Even throughout the digital currency bear market of 2022/2023, the number of bitcoin addresses with greater than one BTC has been steadily increasing.

The below visual from glassnode shows the steadily increasing number of active crypto wallets that contain more bitcoin (BTC).

-

44 million addresses with positive balances

-

Addressed with a positive balance have increased by 11 million since 2020

-

Addresses with a balance >1 bitcoin have grown by 200k over the same time period

All of these statistics indicate a promising future for bitcoin.

12 Years of Bitcoin

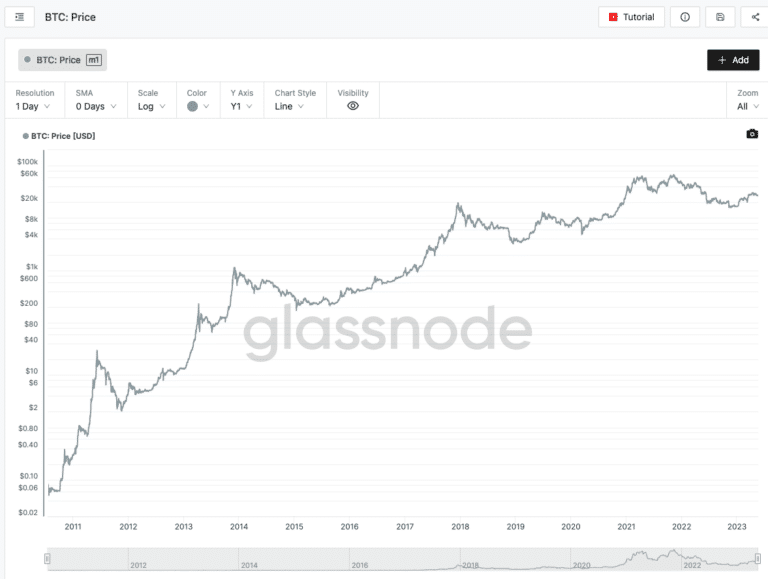

There is no denying that bitcoin has been in a bear market the past year, but this is often taken out of context.

When we look at a 12-year growth chart of bitcoin, it is hard to argue that this store of value is not here to stay.

Bitcoin vs Other Store of Values

It’s hard to gauge the growth potential of bitcoin without comparing this digital asset to that of other asset classes.

As we can see above, the market capitalization of a single company, Apple, is about 5x greater than that of bitcoin.

Additionally, the market cap of bitcoin represents just 0.5% of the global equity market. We can also see from the above visual that bitcoin represents a tiny portion of the global real estate market.

If bitcoin is indeed a real store of value asset class (as this article implies) it may have a very promising future indeed.

“From a diversification and non-correlation standpoint, there is no real portfolio risk by allocating 1-3% of your portfolio to digital assets.”

— Tom Sosnoff

FAQs: Is Bitcoin a Store of Value?

Is Bitcoin really a store of value?

Most people agree that bitcoin is currently a store of value.

What makes Bitcoin a store of value?

Bitcoin is a store of value because this digital asset is both scarce and can be exchanged freely.

What is the argument against Bitcoin store of value?

High volatility and lack of intrinsic value add to the argument that bitcoin is not a store of value.

Will Bitcoin replace gold as a store of value?

Gold will always exist as a store of value, but it is possible that in the future bitcoin may be more popular than gold.

What are the advantages of Bitcoin over gold?

Some benefits of bitcoin over gold are that bitcoin is portable, divisible, and accessible to all.

What is the difference between a Bitcoin and a dollar as a store of value?

Bitcoin operates on a public blockchain network while the US dollar is governed by central banks. Additionally, bitcoin will be a deflationary asset class while the US dollar is inflationary.

Additional Reading

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

What Is a Crypto Whitepaper? 5 Things to Look For

Crypto Fundamentals to Pick Winning Trades

Here’s How to Diversify a Crypto Portfolio