Liquidity Mining Definition: The process of earning rewards in return for providing liquidity to a decentralzied exchange.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In cryptocurrency, DeFi liquidity mining is a passive income strategy that involves lending digital assets like Ether (ETH) to decentralized exchanges to earn rewards.

🍒 tasty takeaways

Liquidity mining involves depositing two or more tokens into liquidity pools on decentralized exchanges.

Liquidity providers earn rewards as traders buy and sell from these pools.

Impermanent loss results when the value of the original tokens contributed to a pool fluctuates in price.

- This strategy falls under the yield farming umbrella, enabling crypto holders to seek generous yields.

Liquidity Mining Summary

| Topic | Explanation |

|---|---|

| What Is Liquidity Mining? | A passive income strategy where assets are lent to a DEX for trading fee rewards. |

| How Do DEXs Work? | DEXs use AMM technology via smart contracts for token swaps in liquidity pools. |

| Benefits | Passive income, high yield potential, DEX support, and community development. |

| Risks | Impermanent loss, smart contract vulnerabilities, and potential scams. |

| Liquidity Mining vs. Yield Farming/Staking | Liquidity mining is a subset of yield farming. Staking involves crypto locking for blockchain validation. |

| Usage of LP Tokens | Redeem, stake, trade, or qualify for DEX events. |

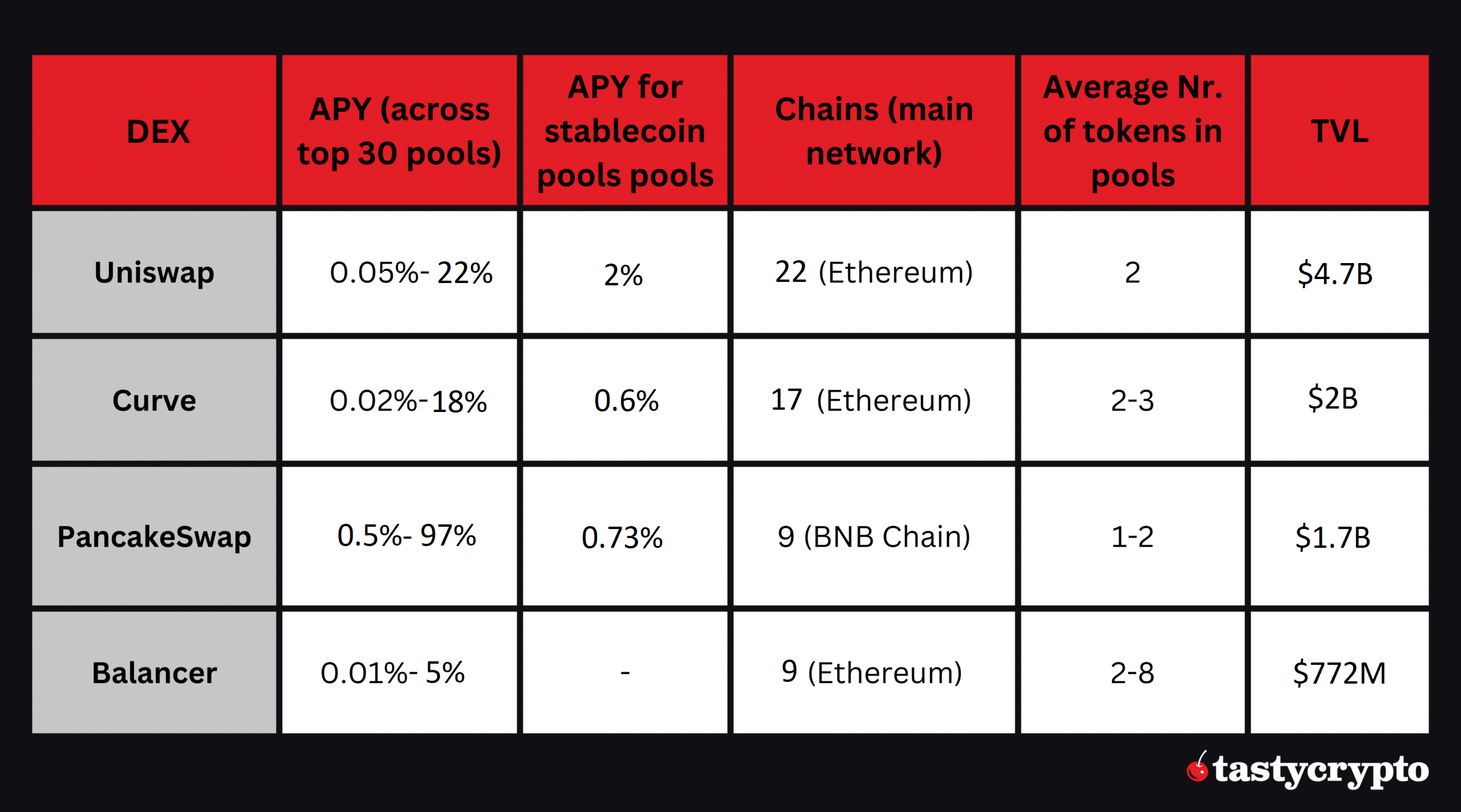

| Top DEXs | Uniswap, Curve, PancakeSwap, Balancer. | Liquidity Mining Steps | Gather tokens, add tokens to a liquidity pool, receive LP token, stake LP token, claim rewards, unstake and withdraw. |

What Is Liquidity Mining?

Liquidity mining is a passive income strategy in which cryptocurrency holders effectively lend their assets to a decentralized exchange (DEX) in return for rewards that come from trading fees.

Decentralized Exchanges operate by using smart contract-based pools. These pools represent either specific trading pairs, like ETH/USDC, or a collection of tokens. In LP pools, funds are gathered from individual contributors called liquidity providers, or LPs, in a decentralized manner.

These LPs are incentivized to temporarily lock up their assets in these pools. In return for their contribution, LPs receive special tokens known as liquidity provider tokens or LP tokens.

These tokens serve to track and represent the LP’s contribution to the pool. For example, if someone were to contribute $1,000 to a pool that’s worth $5,000 in total, they would receive 20% of the pool’s LP tokens. This would also entitle them to a fifth of the total rewards that are distributed to LPs.

What Can I Do with LP Tokens?

LP are versatile digital assets. They can be:

- Redeemed to withdraw your original share (+/- market change) plus the fees received over the duration.

- Staked to receive additional rewards.

- Traded on secondary markets like any other tokens.

- Used to qualify for certain events on DEXs, such as initial DEX offerings (IDOs) which enable investors to get exposure to new tokens.

Liquidity mining builds on the idea of basic liquidity provision. Beyond just supplying assets to a pool and earning fees, liquidity mining offers extra crypto rewards for staking LP tokens throughout the DeFi ecosystem.

Caution! Using LP tokens as collateral can result in increased leverage, which may lead to liquidations!

How Do DEXs Work?

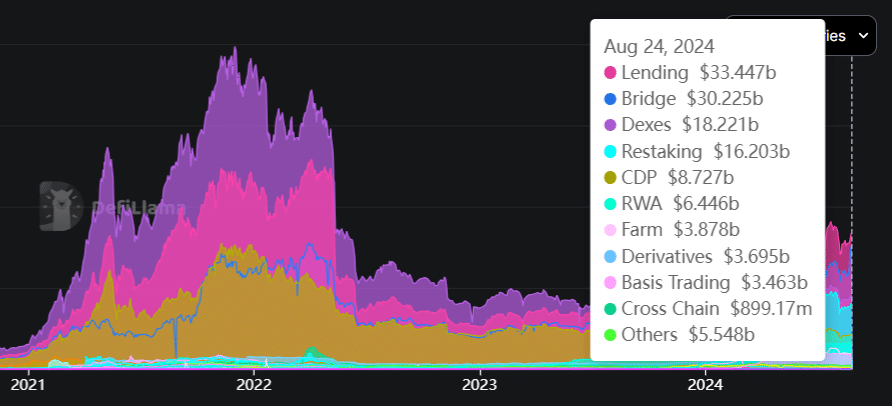

DEXs are one of the main use cases of decentralized finance (DeFi). Currently, there is over $18 billion of total value locked (TVL) in DeFi, being the third-largest sector.

Source: DeFiLlama

DEXs allow anyone to exchange one token for another without the involvement of an intermediary – a revolutionary approach that is made possible thanks to blockchain technology and smart contracts.

🍒 5 Best Crypto Decentralized Exchanges (DEXs) in 2023

Since they’re not operated by centralized entities, as in the case of Binance or Coinbase, DEXs don’t abide by traditional order book/ market maker models.

Instead, they use automated market maker (AMM) technology. This technology leverages smart contracts to run liquidity pools against which users can swap their tokens.

Uniswap and similar DEXs use 50-50 token pools where liquidity providers (LPs) deposit equal values of paired tokens, enabling trades and earning them fees.

However, LPs can face impermanent loss when the prices of their deposited tokens change.

Here are the five largest pools on Uniswap:

Source: UniSwap

How to Become a Liquidity Provider?

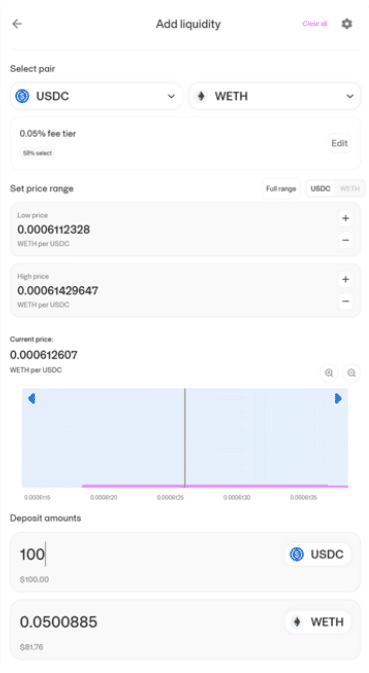

Anyone can become an LP by depositing equal values of two or more tokens into a pool. Uniswap simplifies the process by allowing single-token deposits, which then auto-generates the pair.

All you have to do is connect your non-custodial (self-custody) wallet to a DEX pool and send your tokens.

Source: Uniswap

🍒 Popular token pools with high trading volumes generate smaller rewards, although they involve fewer risks.

Some DEXs, such as Curve, focus on providing liquidity for stablecoins like USDT, DAI, and USDC. The pools of Curve are suitable for investors with low-risk appetites.

Is Liquidity Mining the Same As Yield Farming or Staking?

While liquidity mining allows users to earn rewards by providing liquidity, yield farming and crypto staking are distinct passive income strategies in the crypto space.

Liquidity mining and yield farming are often used interchangeably, although the former can be regarded as a subcategory of yield farming, which is a broader term referring to numerous yield-generating investment strategies in DeFi.

Staking is a bit different. It involves locking a specific cryptocurrency in a dedicated wallet to participate in the block validation process and contribute to blockchain maintenance while seeking a generous annual percentage yield (APY).

Staking is possible with blockchains that use the Proof of Stake (PoS) consensus mechanism. For example, ether (ETH) is the most popular PoS coin to stake. Learn how to stake ETH here.

Benefits of Liquidity Mining

Here are some benefits of liquidity mining:

- Passive income – LPs can generate steady passive income by depositing tokens in DEX pools. They can further multiply rewards with LP tokens.

- High yield potential – Crypto investors can anticipate high returns, with the earnings corresponding to their input and associated risk.

- Low entry barrier – anyone can become an LP and participate in liquidity mining. All you need is a self-custodial crypto wallet.

- Support for DEXs – liquidity provision is the lifeblood of all DEXs. By becoming a liquidity provider, you contribute to a more democratic, decentralized, and transparent DeFi ecosystem, helping DeFi dApps compete with centralized crypto exchanges.

- Community development – liquidity mining enables DEXs to build strong and loyal communities. By distributing governance tokens to LP token holders, DEXs enable equitable distribution of the decision-making process.

DeFi Liquidity Mining Risks

Liquidity mining can be profitable, but there are several risks you should know about:

- Impermanent loss – when participating in liquidity mining, there’s a risk known as impermanent loss. When token prices in a liquidity pool change from your initial deposit—often due to crypto’s volatility, excluding stablecoins—it results in potential discrepancies. If one of the tokens drops in value and you decide to withdraw, you could potentially retrieve less than what you deposited. Some losses can be offset by trading fee gains, but that’s not always the case.

- Smart contract flaws – smart contracts are the foundation of liquidity mining, and if they are poorly coded, they’re vulnerable to hacks. It’s recommended to deal with reputable platforms like Uniswap, Curve, or PancakeSwap, whose code has been audited.

- Potential rug pulls and scams– in DeFi, projects can launch without adequate diligence. This lack of transparency can be a window for bad actors who might suddenly close a protocol and vanish with the funds, reminiscent of incidents like Compounder Finance (do not confuse with Compound Finance!). Again, make sure to operate with tested platforms.

FAQs

Liquidity mining enables crypto holders to earn passive income by lending their digital assets to a DEX. Participants, referred to as liquidity providers, receive rewards derived from trading fees on the DEX.

Liquidity mining is a legitimate and popular passive income strategy in DeFi, although you should deal with reputable platforms only.

DeFi liquidity mining can be profitable, offering crypto holders passive income and potential high yields. This profitability depends on various factors, such as the DEX platform, the pool, and the associated risks of impermanent loss.

No, liquidity mining and Bitcoin mining are completely different concepts. Liquidity mining involves lending digital assets to a DEX pool, while crypto mining refers to the process of validating transactions and creating new blocks using computational power. Bitcoin (BTC) is a popular network that uses mining; Uniswap is a popular dApp that allows for liquidity mining.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?