📕 Definition: Decentralized finance refers to all Web3 applications that are built atop a blockchain network.

Written by: Mike Martin | Updated February 26, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

The tastycrypto wallet allows you to connect to an entire suite of DeFi protocols. DeFi, or ‘decentralized finance’, is an umbrella term that covers all aspects of finance rooted in blockchain technology.

In this guide, we will explain what DeFi is, teach you its utility, and show you how to connect your wallet to popular DeFi protocols.

🍒 tasty takeaways

- DeFi, powered by blockchain, enables staking, lending, borrowing, and trading without intermediaries and middlemen.

- Smart contracts replace traditional clearinghouses, and users participate using an Ethereum-compatible wallet.

- DeFi offers high security, fast settlements, and increased efficiency but comes with coding, counterparty, impermanent loss, and regulatory risks.

- Costs involve protocol and gas fees; choosing audited protocols can mitigate risks.

DeFi Summary

| Details | |

|---|---|

| What Is DeFi? | Decentralized finance, an umbrella term covering finance operations rooted in blockchain technology, eliminating intermediaries. |

| Advantages of DeFi | High security, fast transactions, democratized finance activities like lending, trading, and staking. |

| Bitcoin & Ethereum | Bitcoin is a digital ledger, while Ethereum additionally allows code storage in blocks, leading to smart contracts and DApps. |

| Participation in DeFi | Requires an Ethereum-compatible wallet, ether funding, and connection to a reputable protocol for transactions. |

| DeFi Costs | Include protocol fees and gas fees. |

| Risks of DeFi | Include coding risks, counterparty risks, impermanent loss, and regulatory risks. Audits and widely used protocols can mitigate risks. |

| DeFi Participation Eligibility | Anybody with a crypto wallet can participate, barring restrictions in countries where crypto or DeFi isn't legal. |

What Is DeFi?

DeFi is short for decentralized finance. This is in contrast to traditional finance, or “TradFi“, which relies upon centralized financial services. TradFi and DeFi, however, have a lot in common.

In DeFi, you can stake, lend and borrow crypto, swap NFTs, and trade both options and futures. You can even become your own decentralized market maker. What makes DeFi unique is that no intermediary is required for the technology to work. On DeFi Web3 apps, control is democratized across users and token holders.

In DeFi, traditional intermediaries, such as clearing houses, are replaced by smart contracts. Smart contracts are programs that are stored on a blockchain that are executed when certain conditions are met.

New to crypto? 👉 Check out our Guide: What is Cryptocurrency and How Does it Work?

Advantages of DeFi

When compared to traditional financial institutions, DeFi excels in many areas, including:

Trust is not required for a DeFi application to work

DeFi platforms rooted in blockchain have high security

DeFi transactions are settled in minutes

DeFi is much more efficient than traditional finance

DeFi interest rates are usually more favorable than TradFi

Low financial transaction costs

No bank account required – open to all

No brokerage KYC required

Code is open-source

Another advantage of DeFi is that it democratizes financial activities typically reserved for the elite in traditional finance. Decentralized apps (dApps) in the DeFi space allow any participants to partake in numerous financial activities, including:

Lending or borrowing digital assets (Compound and Aave)

Speculating with derivative financial products (Derive, formerly known as Lyra)

Market making

Staking

Event prediction markets (Polymarket)

📕 Read! 5 Ways to Stake Ethereum

How Does DeFi Work?

In order to best understand how DeFi works, it will help to have a basic understanding of both Bitcoin and Ethereum (ETH).

What Is Bitcoin?

Bitcoin, launched in 2009, was the first successful blockchain to receive widescale interest. This network is essentially a digital ledger. What makes Bitcoin unique is its cryptographic nature – once a transaction enters a block, and that block is added to the chain (ledger), it can never be altered or changed.

What Is Ethereum?

Ethereum, launched in 2017, is similar to bitcoin in its ability to securely store a record of transactions within its blocks. The Ethereum blockchain goes one step further and allows its users to store both transitions and code (smart contract) in its blocks.

These smart contracts can be added together to build entire applications that mirror those of popular ones we know today, such as Twitter and Facebook.

In finance, smart contracts are being utilized to recreate business models that deal in numerous fields, such as:

Borrowing and lending

Market making

Derivatives trading

Not sure how much to invest in crypto? Read our article: Here’s Why To Invest in Crypto and How Much.

How Can I Participate in DeFi?

The tastycrypto wallet allows you to interact with any of the 17,000 Ethereum DeFi protocols currently in existence. In order to get started with DeFi, you will need to follow the following steps:

Sign-up for the tastycrypto wallet. The first step to participating in DeFi is to get a wallet that is compatible with the Ethereum network, as the tastycrypto wallet is.

Fund your wallet with Ethereum. In order to transact within the Ethereum DeFi ecosystem, you will first need to have some ether in your wallet.

Connect your wallet to a reputable protocol. Once you’re ready to transact, you will need to connect your wallet to a DeFi project. You must confirm all transactions in your wallet before they are sent. Most protocols will give you the option to ‘connect a wallet’, at which point you will connect your tastycrypto wallet.

Buy A DeFi ETF Token! You can invest in DeFi protocols through the DeFi Pulse Index (DPI) token.

📕 Read! 3 Ways To Earn Yield in DeFi

How Much Does DeFi Cost?

There are two primary costs associated with transactions in DeFi:

1. The DeFi protocol fee: Most protocols charge a nominal fee to transact. For example, if you wanted to swap tokens in the Uniswap DEX (decentralized exchange) the protocol currently charges a 0.3% fee.

2. The gas fee: After a transaction is sent on a protocol, it ultimately goes to an Ethereum validator to get added to the blockchain. Validators get paid for their work in securing a network in gas fees. These fees vary and are based on: the current demand for validations, the traffic on the network, and how many validators are currently staking.

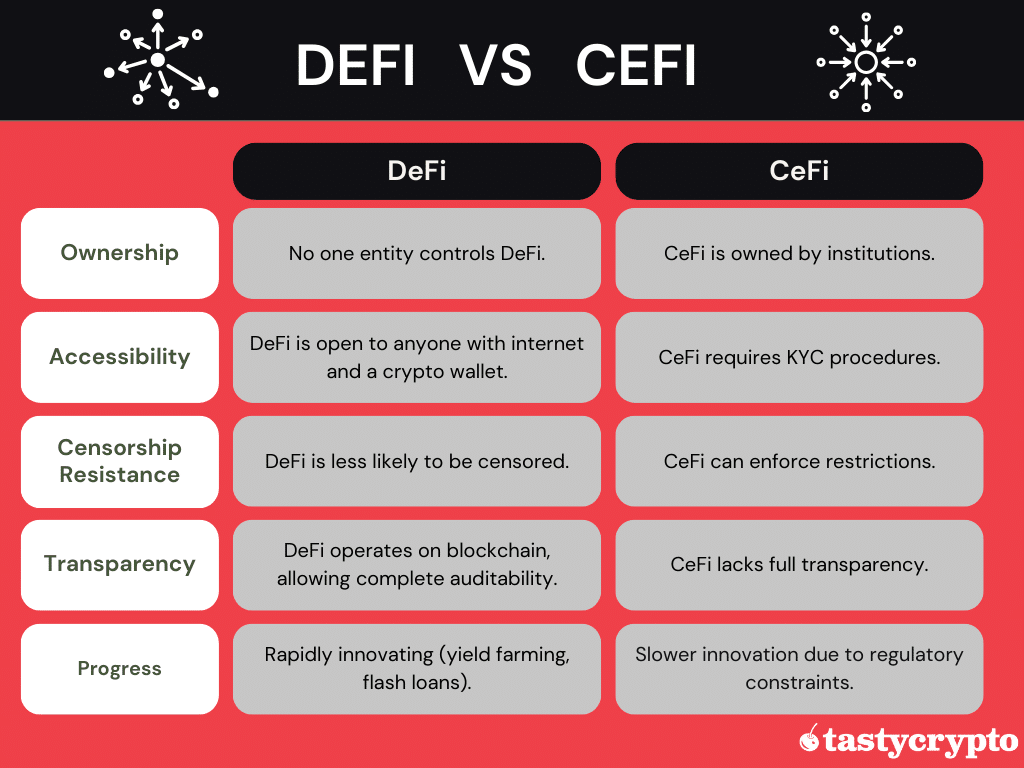

📕 Read! TradFi vs CeFi vs DeFi: Here’s How They Differ

What Are The Risks Of DeFi?

DeFi protocols have very little human interaction. Some protocols called DAOs (decentralized autonomous organizations) are run completely by software programs. All of this code introduces risks to investors. Here are a few of the more predominate risks of DeFI:

Hacker/Coding risks. Poorly written code can allow hackers to gain access to a protocol, which can lead to complete failure. Hacks are the predominant risk in DeFi.

Counterparty Risk. In DeFi, loans are usually overcollateralized. This helps to reduce counterparty risk, but default is still possible in incredibly volatile markets.

Impermanent Loss. Impermanent loss refers to the opportunity cost of placing your crypto in a liquidity pool – could you have made more if you just owned the crypto outright?

Regulatory Risk. At any given time, a government could theoretically outlaw any aspect of crypto. This happened in China, which essentially made crypto illegal. Though future regulation poses a risk to crypto, in the US, government regulation in this space is encouraged.

Volatility. Crypto assets can experience high volatility (not including stablecoins that track U.S. Dollars like MakerDao’s ‘DAI’).

Losing Seed Phrase/Private Key

In order to assure your risks in DeFi are mitigated, it is recommended to make sure at least one independent audit has been done on your chosen protocol. It is best to interact with widely used protocols (Uniswap, Aave, Curve) as the vast majority of these have had at least one audit performed.

Want to learn more DeFi terms? Check out our DeFi glossary!

Can Anyone Participate In DeFi?

DeFi is completely democratized. Anyone with a crypto wallet can participate. The one exception to this is in countries where DeFi (or cryptocurrency) is not legal, such as China.

Governments can also limit what activities can be done by their citizens, such as market marking, staking, and lending cryptocurrency. However, most of these limitations apply to CeFi (centralized finance) crypto organizations, like Coinbase and Gemini.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?

Wrapped Crypto Tokens: A Beginner’s Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.