TVL in crypto stands refers for the total value of cryptocurrency locked in a project. Market cap refers to the total market value of a platform’s tokens or coins issued.

Written by: Mike Martin | Updated June 26, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In decentralized finance, total value locked (TVL) refers to the total amount of crypto assets that are locked in the ecosystem of a decentralized application. This is in contrast to a coins/tokens market cap, which is simply the total market value of all coins minted. TVL ratio gauges the health of a protocol and is calculated by dividing the market cap by TVL.

🍒 tasty takeaways

TVL (total value locked) refers to the total amount of cryptocurrency being employed by a DeFi project.

Market cap refers to the total outstanding value of a project or blockchain cryptocurrency.

TVL ratio gauges the health of a protocol.

Summary

| Metric | Definition | Example |

|---|---|---|

| TVL | Total value of cryptocurrency employed by a DeFi project. | Lido – 10 billion USD |

| Market Cap | Total market value of a platform’s issued tokens/coins. | Bitcoin – 480 billion USD |

| TVL Ratio | Gauges a protocol's health, calculated as Market Cap / TVL. | Aave: 1.1 billion USD Market Cap / 5.66 billion USD TVL = 0.1964 |

| Top Projects by TVL | DeFi tokens with the highest TVL. | 1. Lido, 2. MakerDao, 3. AAVE, 4. Curve, 5. Uniswap |

| Top Cryptos by Market Cap | Cryptocurrencies with the highest market capitalization. | 1. Bitcoin, 2. Ethereum, 3. Tether, 4. BNB, 5. USD Coin |

What is Total Value Locked?

TVL calculation: Total Number of Coins Staked x Coin Current Price

In decentralized finance (DeFi), total value locked is one of the most important metrics investors look at before interacting or investing in a protocol..

TVL is the net sum of all cryptocurrencies locked in a particular project.

Depending on the project, TVL can be indicative of the total amount of digital assets borrowed/lent, crypto staked, or the net amount of crypto residing in the liquidity pools of a decentralized exchange (DEX).

High TVLs indicate healthy and robust DeFi networks. The greater the TVL, the greater the trust a crypto community has in a given protocol.

Among other things, TVL can help investors to:

Assess risk

Select dApps

Gauge adoption

Measure liquidity

It should be noted that TVL applies only to the value locked in a DeFi protocol’s smart contracts, which are implemented using algorithms. Using TVL to measure blockchain networks, therefore, is not applicable.

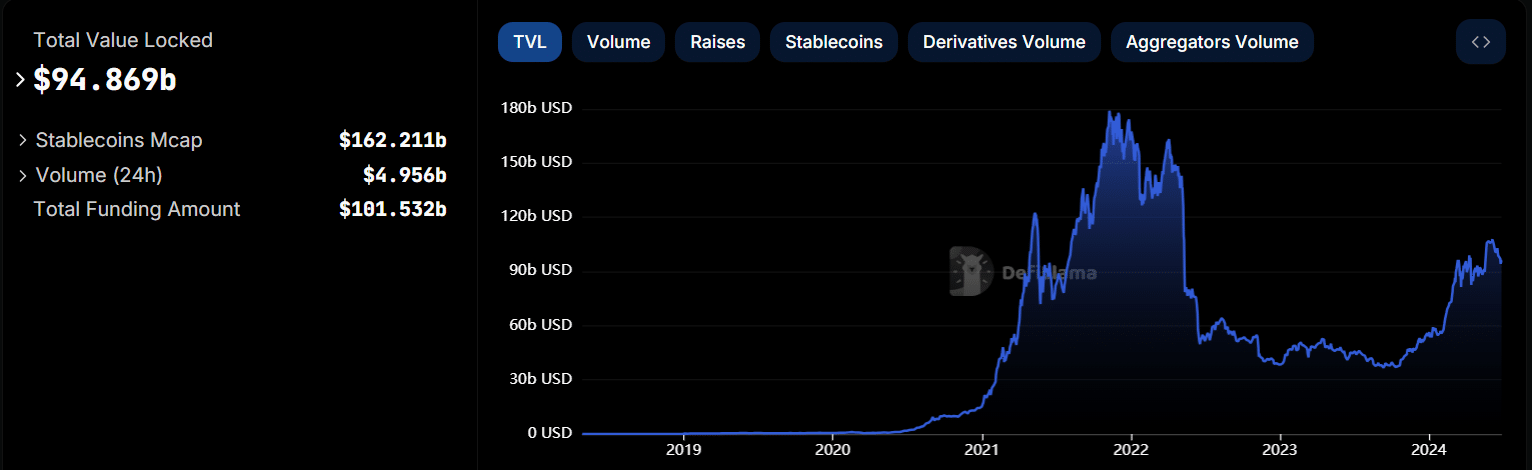

Currently, the TVL of all DeFi protocols combined is 95 billion US Dollars, as seen from the DeFiLlama visual below

What is Crypto Market Cap?

Market Cap Calculation: Number of Outstanding Coins x Coin Price

While TVL looks at the actual health and adoption of a network, a crypto coins market cap (capitalization) simply tells us the total value of all coins outstanding.

For example, about 19 million bitcoin (BTC) have been mined so far. The current price of Bitcoin is $60,700 per coin. The market cap of bitcoin is therefore 19 million x $60,700, which gives us 1,150,000,000,000 US Dollars.

Does Crypto Market Cap Matter?

Though market cap is indeed a vital metric when evaluating the coins of blockchain networks, most investors first look at TVL before deciding to interact or invest in a DeFi protocol. Remember, protocols operate under blockchains.

📚 Read: Importance of TVL

Cryptocurrencies are highly speculative assets, and their prices are in constant flux. While market caps reflect what a protocol (or network) may be worth in the future, TVL gives us a look at the current state of a protocol without guessing or forecasting.

For example, if you were going to invest in a bank, wouldn’t you first consider the total amount of assets it has custody over before looking at the market cap of the stock?

Market cap does, however, have some value as it gives investors insights into projects:

Market valuation

Size

Sector dominance

Potential

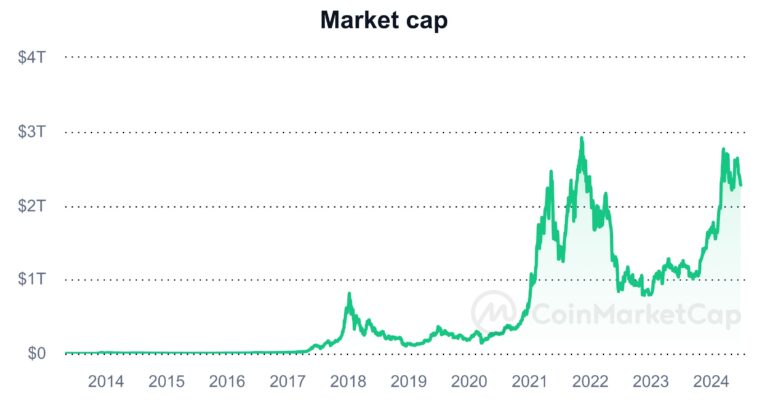

The below visual from CoinGecko shows the total crypto market cap in March of 2023, which is about 1 trillion US Dollars today.

Market Cap vs TVL Examples

Let’s now look at a few examples of comparing market cap to TVL.

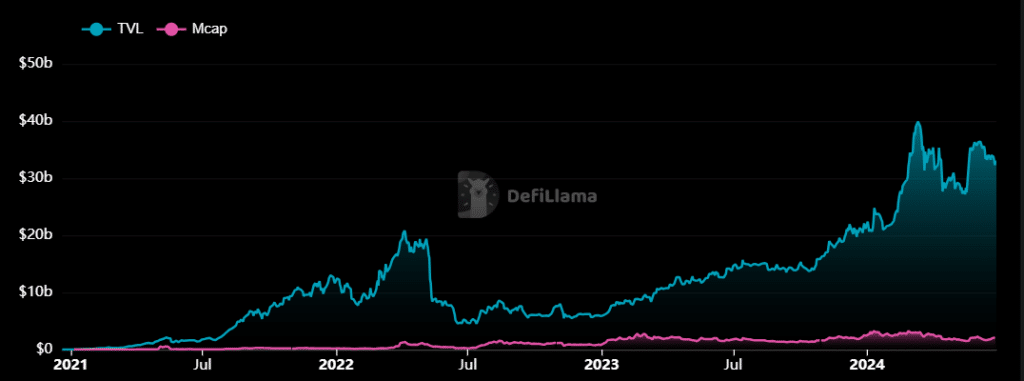

Lido: TVL and Market Cap

The below image, from DeFiLlama, shows us both the TVL (32.6 billion USD) and market cap (2.15 billion US Dollars) for the DeFi protocol Lido, which is an Ethereum (ETH) -based crypto-staking protocol.

As we can see, the TVL for Lido far surpasses its market cap. This is because of the engaging nature and ease of use of the protocol, which locks up crypto into staking pools for investors to earn a yield.

Across all Lido versions (there are 4), this protocol has over 10 billion US Dollars locked in its protocol.

Uniswap: TVL and Market Cap

Let’s now look at Uniswap (UNI), the largest DEX protocol in existence.

The above shows us that the TVL for UNI is about on par with its market cap. The total value locked in this protocol refers to the amount of cryptocurrency stored in its liquidity pools which are stored on smart contracts.

Crypto participants can buy and sell crypto directly on this protocol by connecting their self-custody crypto wallet to the Uniswap website.

📚 Read! Self-Custody Wallet FAQs

Let’s next explore the connection between TVL and market cap by learning about the TVL ratio.

What Is Market Cap to TVL Ratio?

Market Cap to TVL Ratio Calculation: Market Cap / TVL

The market cap to TVL ratio (called a ‘TVL ratio’) is most useful in informing investors of a DeFi project’s valuation in regard to its demand.

For example, if a protocol’s token has a low market cap but a high TVL, this may suggest that a token is undervalued.

A token may be more attractive to a potential investor if its TVL ratio falls below one. Generally speaking:

Protocols with TVL ratios above one are overvalued

Protocols with TVL ratios under 1 are undervalued

TVL ratios help investors to gauge numerous conditions, including:

Valuation (over or under)

Risk

Adoption and popularity

Investing risk

TVL Ratio Example

In this example, we will look at the TVL ratio of the DeFi project Aave, a borrowing and lending dApp (decentralized application).

AAVE Market Cap: $1.4 billion USD

AAVE TVL: $12.1 billion USD

The TVL ratio for Aave is, therefore, 1.14/ 12.1 = 0.094.

So since the TVL Ratio of Aave is under 1, is it undervalued?

Perhaps, but TVL ratios should be taken with a grain of salt. A lot of users borrow and lend with Aave, which gives it a disproportionately high TVL compared to other, less engaging DeFi protocols that still offer great services.

Take this ratio with a large grain of salt, and invest cautiously.

Crypto Asset Risks: investor.gov

TVL vs Market Cap vs TVL Ratio

TVL, market cap, and TVL ratio are all important things to consider before investing or interacting with a protocol. Though all three metrics offer their own distinct insight, I personally believe that TVL is the best indicator of determining the adoption and potential of a given DeFi protocol.

Top 5 Projects by TVL

The below 5 DeFi tokens currently have the highest TVL.

Lido – 32 billion USD

AAVE – 12 billion USD

MakerDAO– 7.7 billion USD

Ether.fi– 6.4 billion USD

Uniswap – 5.6 billion USD

Top 5 Cryptos by Market Cap

Here are the top 5 cryptos by market cap (including blockchain networks).

Bitcoin – 1.2 trillion USD

Ethereum – 404 billion USD

Tether – 112 billion USD

BNB – 84 billion USD

Solana – 62 billion USD

📚 Read: 23 Best Crypto Research Tools

🍒 Want to learn more DeFi terms? Check out our DeFi glossary!

FAQs

A DeFi protocol with a high TVL means that it has a large amount of cryptocurrency invested/staked in its network. A high TVL means a healthy protocol.

TVL is very important in crypto as it informs both participants and investors of the adoption, engagement, health, and demand of a DeFi protocol.

In June of 2024, Lido has a TVL of over 30 billion US Dollars, giving it the highest DeFi protocol TVL.

Market cap matters in crypto as it informs investors how many people believe in a project.

NFTs (non-fungible tokens) do not have TVLs as investors do not typically stake crypto through NFT marketplaces.

In June of 2024, the total value locked (TVL) on Solana DeFi protocols is 4 billion US Dollars.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty guides

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences