DeFi, or decentralized finance, is the fastest growing segment of Web3. From staking to market making, learn about the best DeFi coins to invest in here.

Written by: Mike Martin | Updated June 25, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In this guide, we will review the most popular decentralized finance (DeFi) cryptocurrency coins for 2024.

🍒 tasty takeaways

DEXs dominate DeFi with Uniswap (UNI) holding a $6.44 billion market cap.

Lido (LIDO) leads staking protocols with a $3 billion TVL.

Aave (AAVE) tops lending/borrowing with a $2 billion TVL.

GMX (GMX) is the largest DeFi derivatives protocol by TVL.

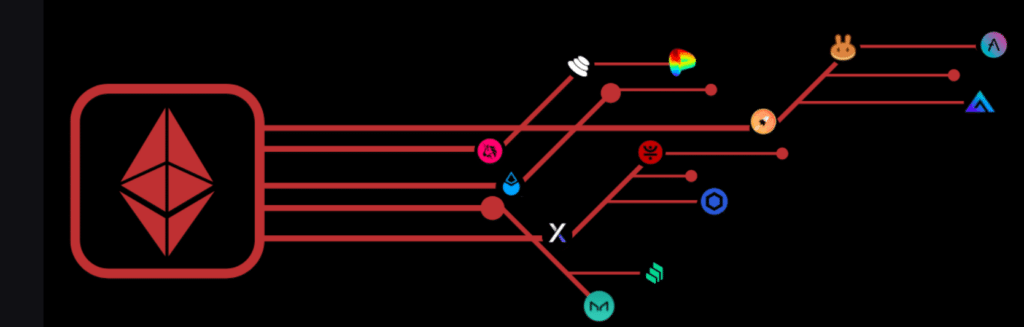

Ethereum is the main blockchain for DeFi, making ETH a key asset.

Summary

| 🍒 Protocol | Token | Market Cap | Type |

|---|---|---|---|

| Uniswap | UNI | $4.49 billion | DEX |

| Curve Finance | CRV | $521 million | DEX |

| PancakeSwap | CAKE | $693 million | DEX |

| Balancer | BAL | $200 million | DEX |

| Lido | LIDO | $1.75 billion | Staking |

| Rocket Pool | RPL | $419 million | Staking |

| Aave | AAVE | $1.34 billion | Lending/Borrowing |

| Just | JST | $319 million | Lending/Borrowing |

| Compound | COMP | $462 million | Lending/Borrowing |

| GMX | GMX | $239 million | Derivative |

| dYdX | DYDX | $997 million | Derivative |

All DeFi protocols operate under open-source blockchain technology. The predominant blockchain for DeFi is Ethereum. Therefore, no DeFi portfolio would be complete without ether (ETH).

In order to determine the weighting of your DeFi token portfolio, it will be helpful to have an understanding of the various DeFi markets and their respective sizes as gauged by total value locked.

Let’s get started!

🤔 Take Note! Though commonly referred to as ‘coins’, the cryptocurrencies produced by DeFi protocols are actually tokens, the ERC-20 token standard to be precise. Coins vs Tokens Explained

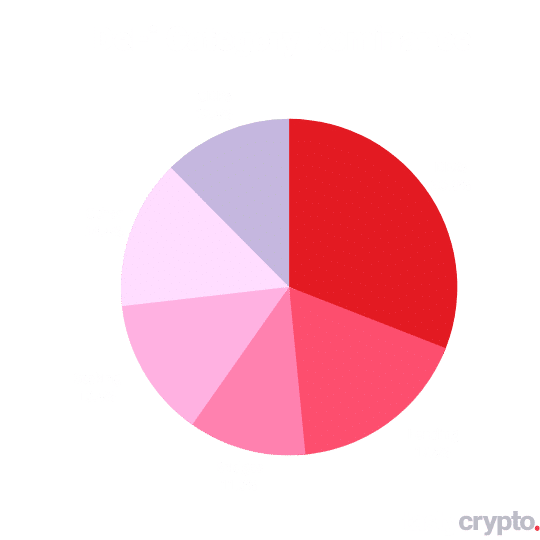

Top DeFi Categories: Total Value Locked

Let’s next break these segments down into percentages so we can have a ballpark figure of how much of our DeFi portfolio to invest in each.

Total DeFi Value: $96 billion USD

DEXs: 31%

Lending: 17%

Staking: 13%

CDP (Collateralized Debt Position): 12%

Bridges: 11%

Other: 14%

4 Best DEX Protocol Coins

DEX stands for decentralized crypto exchange. Unlike traditional exchanges, decentralized exchanges allow users to maintain custody over their private keys. This control helps crypto participants to secure their cryptocurrency.

Here are the most popular DEXs and their respective coins. Charts provided by messari.

1. Uniswap

Protocol: Uniswap (V1, V2 & V3)

Token symbol: UNI

Market cap: $5.5 billion

Total value Locked (TVL): $5.6 billion

Chains: Ethereum, Arbitrum, Polygon, Optimism, Celo +14 more

Uniswap Performance

What is Uniswap (UNI)?

Uniswap is the largest decentralized crypto exchange (DEX) protocol in existence. This peer-to-peer crypto exchange provides liquidity to hundreds of different ERC-20 cryptocurrencies by employing automated market makers. Uniswap, launched in 2018, was the first DEX to gain widespread adoption. According to data from DefiLlama, UNI is currently the 7th largest decentralized finance (DeFi) protocol as measured by total value locked.

‘UNI’ is the native token that powers the Uniswap ecosystem.

✅ Diversify your entire DeFi portfolio with the DeFi Pulse Index (DPI) token!

2. Curve Finance

Protocol: Curve Finance

Token symbol: CRV

Market cap: $367 million

Total value locked (TVL): $2.23 billion

Chains: Ethereum, Avalanche, Arbitrum, Binance Smart Chain, Fantom, Harmony, Optimism, Polygon, Aurora, Celo, Gnosis, Moonbeam, Kava

Curve Performance

What is Curve Finance (CRV)?

Curve, launched in 2010, is the second-largest DEX protocol in 2024. Like Uniswap, Curve uses smart contracts (automated market makers) and liquidity pools to provide liquidity to hundreds of crypto pairs, although it focuses on stablecoins like USDT and USDC. Though Curve has less market share than Uniswap, this protocol is interoperable with ~12 different blockchain networks while Uniswap supports only 4.

The Curve DAO (decentralized autonomous organization) is controlled by owners of the ‘CRV’ governance token.

3. PancakeSwap

Protocol: PancakeSwap (AMM, AMM1 & StableSwap)

Token symbol: CAKE

Market cap: $564 million

Total value locked (TVL): $1.8 billion

Chains: Binance (BSC), Aptos, Ethereum, Base, Linea, Polygon zkEVM +3more

PancakeSwap Performance

What is Pancake Swap (CAKE)?

PancakeSwap is the largest and most-used DEX for the Binance’s BNB Smart Chain (BSC). Like the other DEXs on our list, PancakeSwap provides liquidity through automated market markets. In addition to BSC, PancakeSwap is compatible with eight other chains. PancakeSwap offers its users slightly lower fees than Uniswap.

‘CAKE’ is the token native to PancakeSwap. In addition to being a governance token, CAKE is used as an incentive for liquidity providers to become market makers on the Pancake Swap DEX.

📚 Read: Top DEXs for 2023

4. Balancer

Protocol: Balancer (V1 & V2)

Token symbol: BAL

Market cap: $171.8 million

Total value locked (TVL): $913 million

Chains: Ethereum, Arbitrum, Polygon, Optimism, Gnosis, Base

Balancer Performance

What is Balancer (BAL)?

Balancer is a DEX that offers investors access to non-standardized liquidity pools. Most DEXs contain only 2 cryptos in their liquidity pools; Balancer allows up to eight cryptocurrency tokens in their pools. With this exception, Balancer is almost identical to Uniswap.

Balancer (BAL) is the ERC-20 token that runs the Balancer ecosystem.

📚 Read! 5 DeFi Arbitrage Strategies

2 Best Staking Protocol Coins

Crypto-staking protocols allow crypto participants a decentralized solution to staking crypto. With the SEC beginning to crack down on centralized crypto staking activities in 2023, decentralized staking protocols have been exploding in popularity. Their respective tokens, too, have been rising in value. Here are a few more popular crypto-staking protocols to invest in for 2023.

1. Lido (LIDO)

Protocol: Lido (V1, V2, V3 & Arc)

Token symbol: LIDO

Market cap: $2.1 billion

Total value locked (TVL): $32 billion

Chains: Ethereum, Solana, Moonbeam, Moonriver, TerraClassic

Lido Performance

What is Lido?

In addition to being the most popular crypto-staking dApp (decentralized application), the Lido protocol is one of the most popular protocols in existence. Its impressive TVL of $32 billion puts it way ahead of its staking competitors. Lido allows any investor to stake crypto by investing in staking ‘pools’. The staking pools of Lido are ‘liquid’, which implies investors can unstake their coins at any time.

The ‘LIDO’ governance token allows investors to participate in the protocol’s governance, voting on such issues as staking rewards.

2. Rocket Pool (RPL)

Protocol: Rocket Pool

Token symbol: RPL

Market cap: $419 million

Total value locked (TVL): $4.1 billion

Chains: Ethereum

Rocket Pool Performance

What is Rocket Pool?

Rocket Pool is the second-largest liquid staking protocol. Currently, the only coin you can stake with Rocket Pool is ether (ETH). While Lido has a small permission set of nodes (those who actually do the validating), Rocket Pool allows anyone to be a node. This helps to spread out node risk. However, Rocket Pool does currently pay less APR on staking ETH when compared to Lido.

‘RPL’ is an ERC-20 utility token issued by Rocket Pool that allows its owners to vote on changes to the protocol.

3 Best Lending/Borrowing Protocol Coins

Borrowing and lending dApps are blockchain-based protocols that allow users to both borrow and lend crypto at APRs far superior to traditional financial services. To assure that loans don’t go underwater, over-collateralization ratios are employed in these networks.

📚 9 Best AI Crypto Coins for 2024

1. Aave (AAVE)

Protocol: Aave (V1. V2, V3 & Arc)

Token symbol: AAVE

Market cap: $1.34 billion

Total value locked (TVL): $12 billion

Chains: Ethereum, Polygon, BSC, Avalanche, Optimism, Arbitrum, Fantom, Harmony, Base, +3 more

AAVE Performance

What is Aave?

Aave is the fourth largest DeFi protocol in the world. It is also the largest dApp in the lending/borrowing space. Any crypto participant can earn interest by depositing cryptocurrencies into Aave liquidity pools. Borrowers can tap into these same pools to borrow cryptocurrency at very generous rates.

‘AAVE’ is the cryptocurrency native to the Aave network. This ERC-20 token permits its owners to vote on changes to the network.

2. Just (JST)

Protocol: JustLend. JustStables

Token symbol: JST

Market cap: $292 million

Total value locked (TVL): $5.6 billion

Chains: Tron

JST Performance

What is Just?

Just is the go-to lending and borrowing protocol for the Tron blockchain network. Just is considered a two-token protocol – its ecosystem is built around JST and USDJ (JustStable), the latter of which is a US dollar-pegged stablecoin.

The ‘JST’ token has many uses, some of which include voting on protocol changes and the payment of interest.

3. Compound (COMP)

Protocol: Compound (V3)

Token symbol: COMP

Market cap: $407 million

Total value locked (TVL): $2.30 billion

Chains: Ethereum, Arbitrum, Base, Polygon, Optimism, Scroll

COMP Performance

What is Compound?

Compound is an Ethereum borrowing/lending platform much like Aave. However, unlike Aave, Compund has not yet expanded to other Layer 1s and Layer 2s.

📚 Read! Best Layer 2s: Arbitrum vs Optimism vs Polygon

Compound does, however, offer tons of liquidity for its small niche and is always on the radar for yield farming.

‘COMP’ acts as both Compound’s utility and governance token.

2 Best Derivative Protocol Coins

Derivatives refer to financial instruments that derive their value from a different underlying asset. In crypto assets, derivate protocols represent decentralized versions of popular futures and options products that exist in traditional finance.

📚 Read: What Are DeFi Options?

1. GMX (GMX)

Protocol: GMX

Token symbol: GMX

Market cap: $267 million

Total value locked (TVL): $505 million

Chains: Avalanche, Arbitrum

GMX Performance

What is GMX?

GMX is one of the few protocols to come out of 2022 profitable. This DeFi protocol, offered only on the Avalanche and Arbitrum blockchains, is a decentralized spot and perpetual exchange. It is also the largest derivative protocol in existence. When you connect your self-custody wallet to GMX, you can speculate on the price of BTC, ETH, and AVAX with leverages of up to 50x.

‘GMX’ acts as both the utility and governance token for the GMX protocol.

📚 Read: 6 Ways to Leverage Your Crypto

2. dYdX (DYDX)

Protocol: dYdX

Token symbol: DYDX

Market cap: $330 million

Total value locked (TVL): $456 million

Chains: Ethereum

DYDX Performance

What is dYdX?

dYdX is an Ethereum-based derivatives protocol that offers margin trading on popular products such as BTC and ETH. Leverage on dYdX is maxed out at 25x.

‘DYDX’ is this protocol’s governance token. It is also a utility token, used to pay fees and staking rewards.

Worth Mention: EigenLayer

Token symbol: EIGEN

Market cap: N/A

Total value locked (TVL): $17.7 billion

Chains: Ethereum

New to the scene in 2024 is EigenLayer. This protocol introduces “restaking,” which involves deploying the same ETH for staking on Ethereum and other platforms. Though EigenLayer hasn’t released a token yet, they will be soon. Read more about EigenLayer here.

Best DeFi Coins FAQs

The most significant DeFi coins in 2023 are Lido (LIDO), MakerDAO (MKR), and Curve (CRV).

A good DeFi coin will have both high liquidity and an engaged community. Since most DeFi projects run on the Ethereum blockchain, buying ether (ETH) may be a good investment for DeFi newbies. Other popular DeFi coins with high liquidity and an engaged community include Compound (COMP), Maker (MKR), and Chainlink (LINK).

Cardano is a blockchain network, like Ethereum or Bitcoin, and not a DeFi project

The safest DeFi is the DeFi token with the lowest volatility. Ether (ETH) is the blockchain that supports most DeFi projects. Indirectly, buying ETH may be the safest DeFi investment.

DeFi and NFTs are not the same. DeFi stands for decentralized finance while NFTs represent ‘non-fungible tokens’. DeFi is an ecosystem while NFTs are unique, non-standardized digital assets.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty guides

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences