Tokenomics combines ‘token’ and ‘economics’ to analyze a cryptocurrency’s supply, demand, distribution, and value, including issuance, burn mechanisms, utility, and more. Tokenomics creates a framework for comparing tokens and informing investment decisions based on a project’s economic design.

Written by: Anatol Antonovici | Updated April 12, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

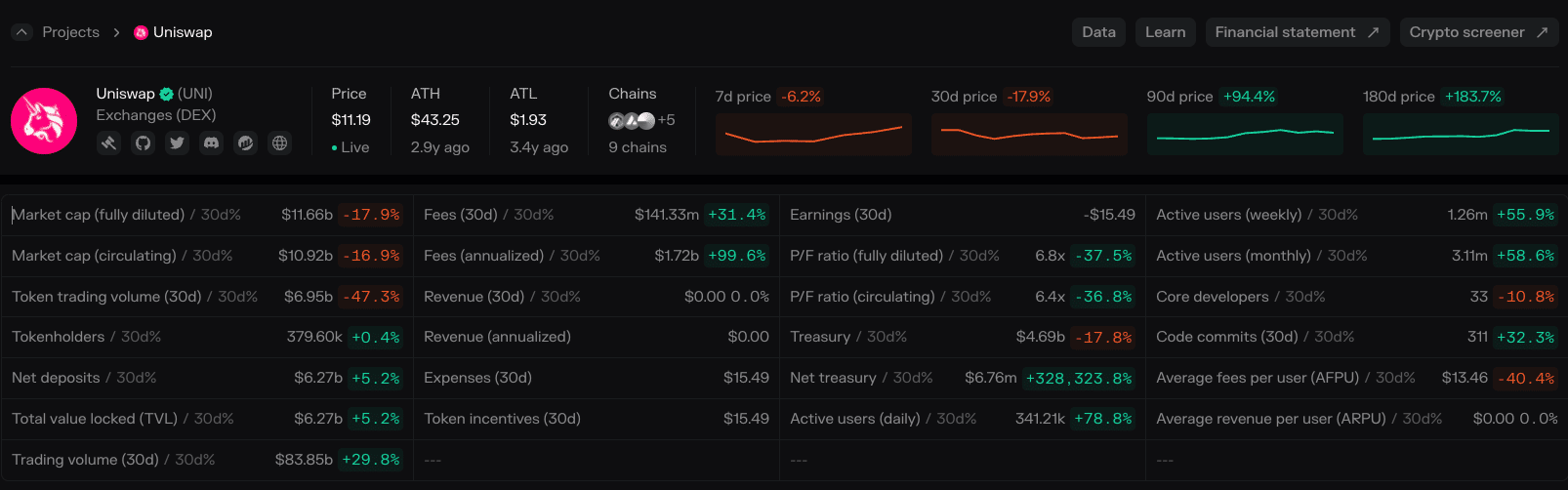

Source: Uniswap tokenomics: TokenTerminal

Tokenomics discusses the economic factors and methods that impact the value of a crypto asset.

🍒 tasty takeaways

The tokenomics design of a digital currency is like a company’s business model or a currency’s monetary policy.

The five key elements of a tokenomics design include token utility, token supply, token distribution, token incentives, and price stability mechanisms.

Crypto projects use game theory models to create sustainable token economics.

Table of Contents

Tokenomics Summary

| Aspect | Details |

|---|---|

| Tokenomics | Examines crypto economics: supply, demand, utility, and how these factors inform investment strategies. |

| Key Elements | Considers utility, supply, distribution models, incentive mechanisms, and price stability tactics. |

| Importance | Crucial for understanding a token's long-term viability and its potential investment value. |

| Supply | Looks at how supply mechanisms like issuance rates and caps impact a token's scarcity and value. |

| Distribution | Assesses how tokens are allocated to stakeholders, affecting the project's sustainability and equity. |

| Incentives | Evaluates rewards and motivations for users to participate in and contribute to the network. |

| Game Theory | Applies strategic decision-making models to encourage desired behaviors within the crypto ecosystem. |

What Is Tokenomics?

Tokenomics refers to the economic factors that influence the value of a digital asset. Think about utility, token supply, inflation rate, incentive mechanisms, etc.

While the term combines ‘token’ and ‘economics,’ it is used in the context of both crypto coins and tokens. Tokens are issued by Web3 protocols that run atop an existing blockchain, while coins are the native cryptocurrency of a blockchain.

When launching a proprietary token, a crypto project begins by outlining the foundational aspects of tokenomics and embedding these rules within the smart contract. The selected tokenomics model can significantly influence the rate of adoption and the value of the token

Why Is Tokenomics Important?

Understanding tokenomics is important for both token creators and investors. It’s like a company’s business model. The main rules that govern a token can determine whether it is sustainable and can maintain its value in the long term.

If a crypto project offers a great product or service but its proprietary token has bad tokenomics, it can lose the trust of the crypto community, which would negatively impact the project’s valuation.

Investors should look into a cryptocurrency’s tokenomics to assess its future value.

Key Components of Tokenomics Design

Here are the five key elements of a tokenomics design:

1. Token Utility

Utility refers to a token’s functionality within its ecosystem. For example, it can be used to pay for services within the ecosystem, grant access to certain features, contribute to the network’s security or give voting rights to participate in governance.

A token’s utility can determine its adoption and demand, guaranteeing intrinsic value without relying on the speculative factor.

There are different token types with different use cases. For example, many decentralized finance (DeFi) projects have governance tokens to ensure a community-driven operation. Elsewhere, meme coins like Dogecoin have no utility and depend on community hype and speculation.

2. Token Supply

The supply of a token, its denomination, issuance rate, and other supply mechanisms are programmed during development. The supply factors dictate the token’s scarcity and thus impact its valuation. Investors should pay close attention to the total supply and how much of it is circulating.

Here are the most important supply factors:

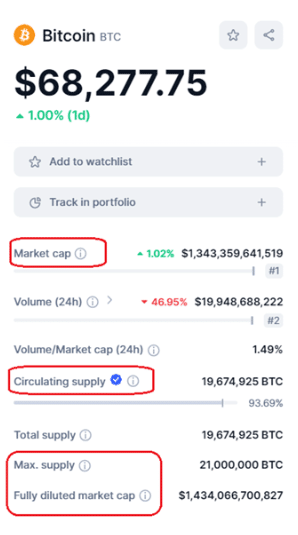

- Maximum supply—the maximum number of tokens that will ever be issued. Some cryptocurrencies have a limited total supply, e.g., Bitcoin (BTC) can have 21 million coins and is halved every four years. Other digital assets, such as Ethereum (ETH), have an infinite total supply.

- Circulating supply – the number of tokens or coins available at the moment. If the circulating supply represents a small portion of the total supply, then its price may be diluted.

- Market capitalization – the total value of all tokens in circulation.

- Fully diluted valuation – the value of the total supply multiplied by the current price.

You can check these metrics on crypto data resources like CoinMarketCap, DeFiLlama, and Token Terminal.

Source: CoinMarketCap

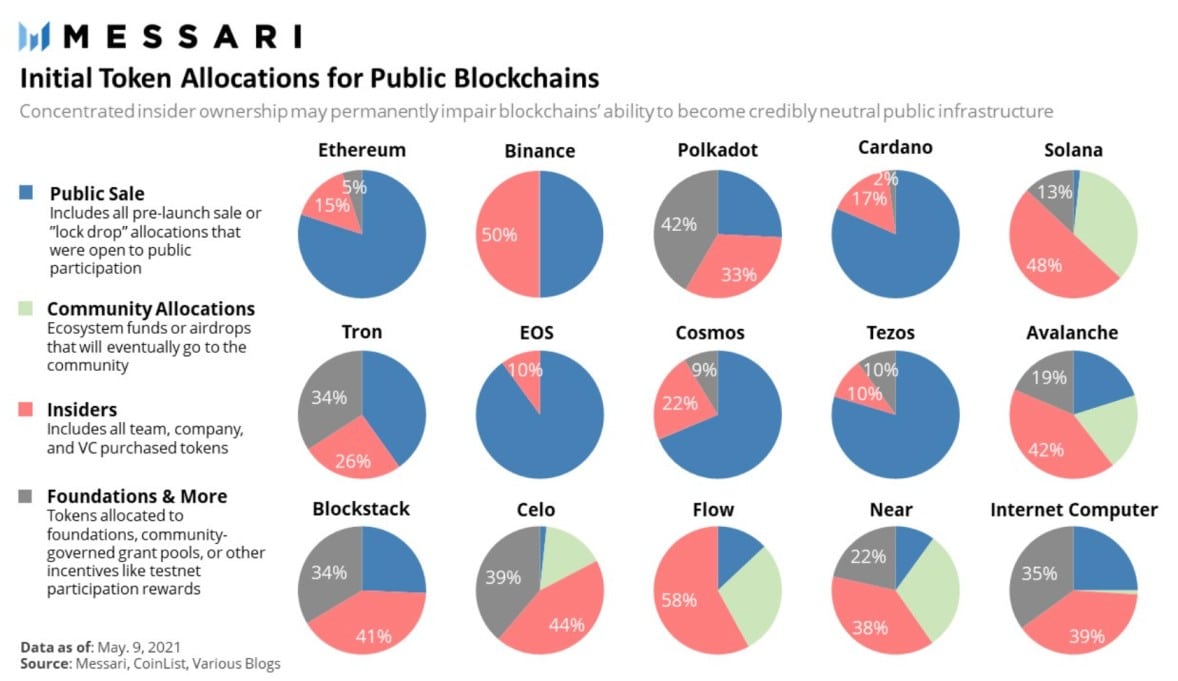

3. Token Distribution

Token distribution involves allocating tokens to the ecosystem’s stakeholders, including the founding team, developers, early investors, community, and users.

This plays a huge role in a crypto project’s success and long-term sustainability. The best approach is to avoid concentrating tokens on the team or early investors.

Here are some distribution models:

- Token vesting – to prevent immediate selloffs, most crypto projects implement vesting periods, which represent predetermined timeframes during which the allocated tokens are released to stakeholders. This gradual approach prevents market flooding and pump-and-dump schemes.

- Token sales—after allocating tokens to venture capital investors at a discount price, crypto projects can sell tokens to the public through initial coin offerings (ICOs) and initial exchange offerings (IEOs and IDOs).

- Airdrops – some crypto projects use airdrops to distribute tokens for free to increase awareness and attract users.

Here are some examples of initial token allocations:

Source: Messari – Twitter

4. Token Incentives

Crypto projects and blockchains use different incentive mechanisms to encourage market participants to use services and contribute to the network.

Some examples of incentive mechanisms include:

- Staking rewards – Proof of Stake (PoS) chains incentivize validators and delegators who stake their coins to support network operations and create new blocks.

- Liquidity mining – DeFi projects incentivize users who provide liquidity to their pools. For example, decentralized exchanges (DEXs) like Uniswap reward liquidity providers from the fees paid by traders.

- Emissions – blockchain and crypto projects can mint new tokens to distribute them as rewards for different actions. For example, play-to-earn (P2E) projects reward users for playing games.

5. Price stability mechanisms

Besides incentives, there are other methods to control the supply and demand:

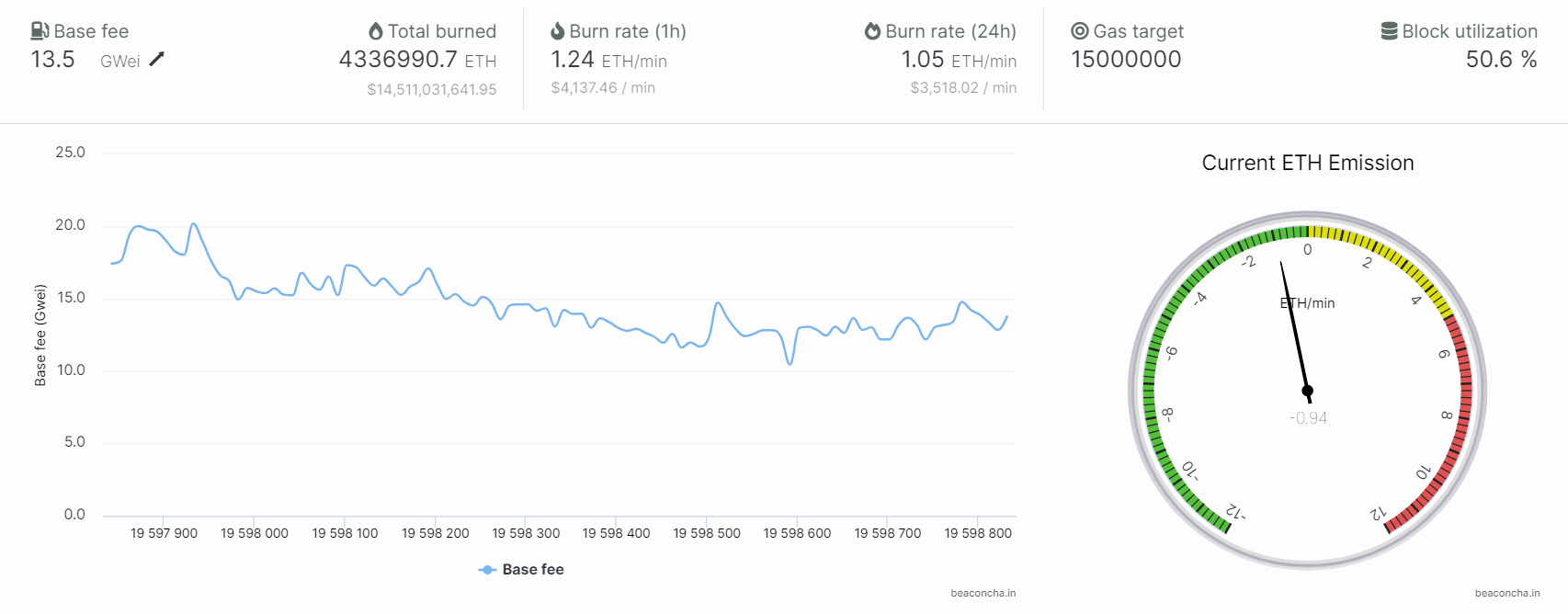

- Burning – deflationary tokens use burning mechanisms to eliminate tokens from circulation, which stimulates token value. For example, after the implementation of EIP-1559 upgrade on Ethereum, over 430,000 Ether from transaction fees has been burned, maintaining a negative inflation rate.

Source: Beaconcha.in: Burning

- Buy-backs – crypto projects can buy their tokens on the market to stimulate price and build trust. In 2023, lending platform Maker introduced a buyback mechanism for its MKR tokens.

Game Theory and Tokenomics

Game theory is a branch of mathematics that studies interactions and competitive situations where the outcome of an individual’s action depends on the choices of other participants. In an ideal game theory model, players use strategies to get the best payoffs.

In tokenomics, game theory models create mechanisms that incentivize desirable behavior and discourage bad actors. Staking and yield farming use game theory models to incentivize users without affecting the interests of token holders.

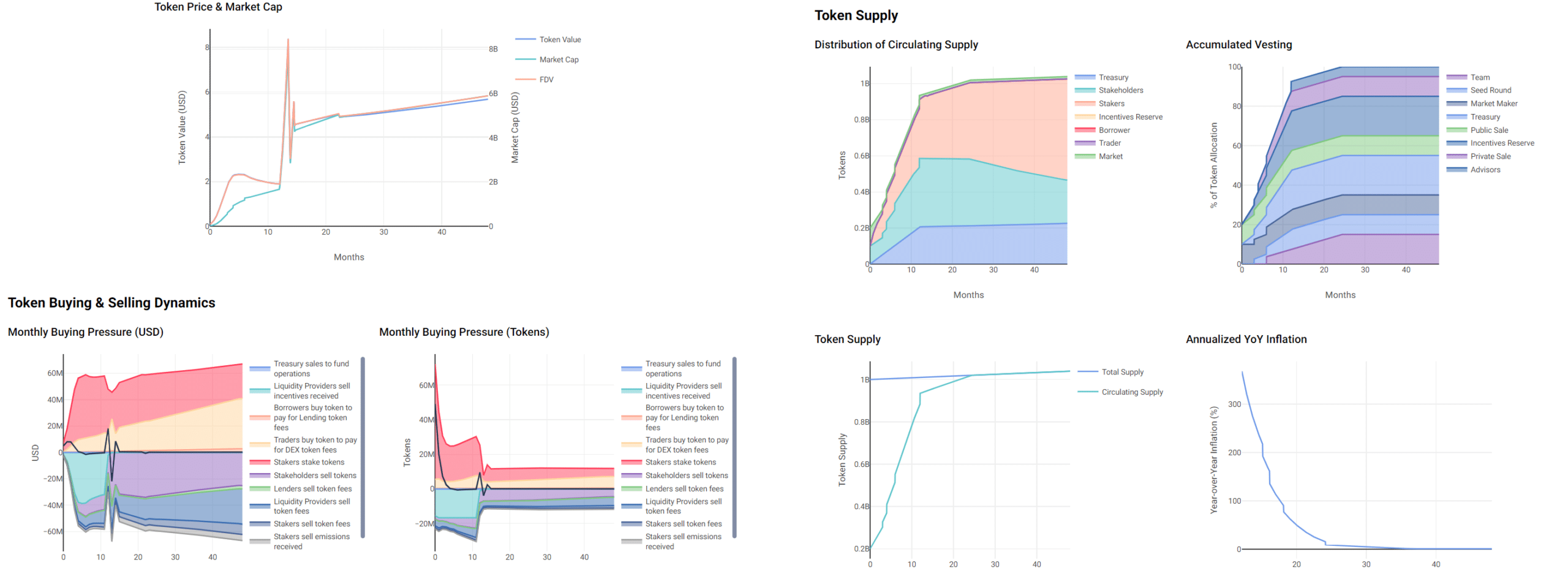

Simulating Tokenomics

To create a tokenomics model from scratch, you can use tokenomics simulation services like Cenit Finance or Machinations. To create an economic model, you can set the token price, supply, vesting period, incentives, and other factors.

Source: Simulator.cenit.finance

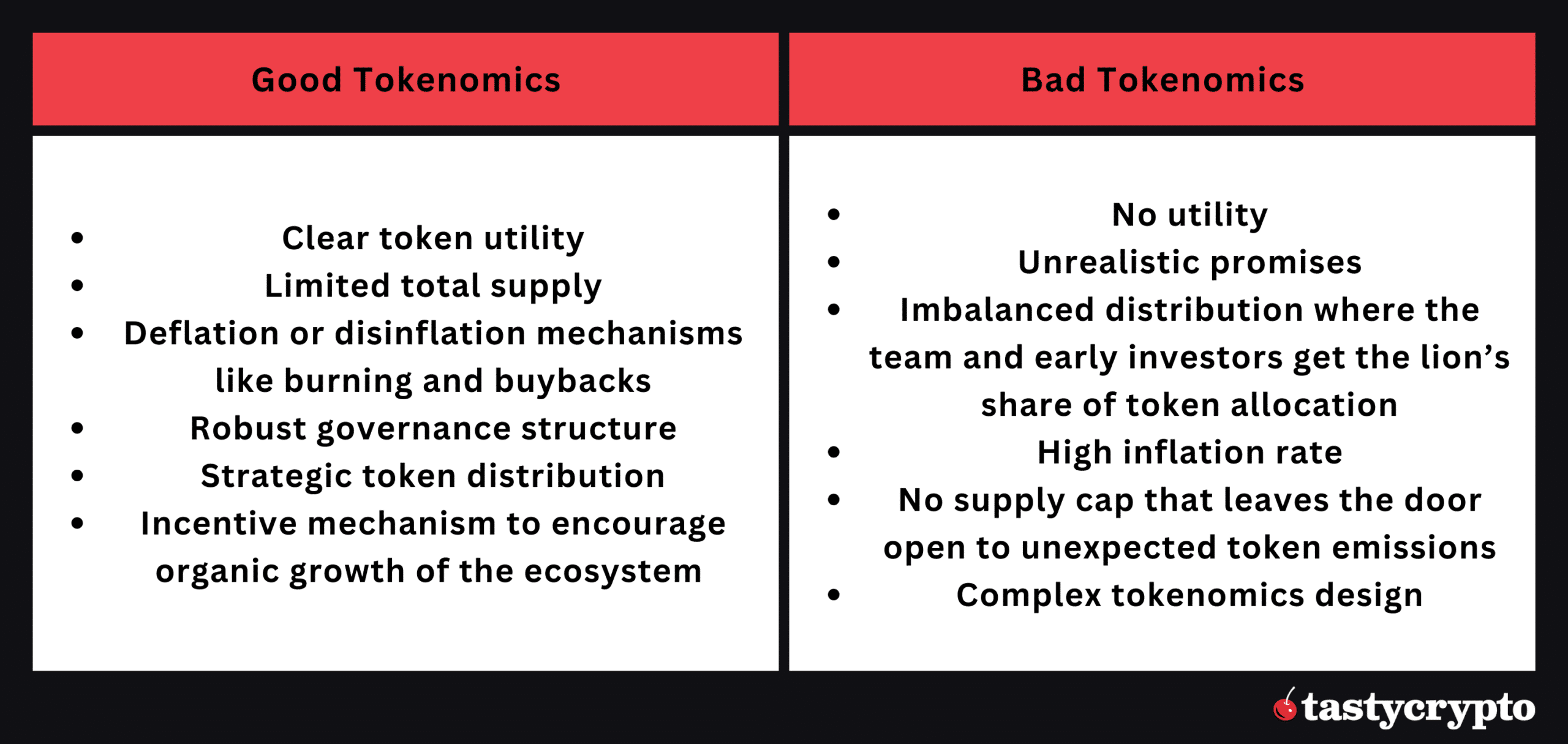

Good and Bad Tokenomics

Here are the elements of a good and a bad tokenomics design:

FAQs

What is tokenomics?

Tokenomics refers to the economic factors affecting a cryptocurrency’s value. These factors are predetermined during token development and are crucial to support long-term value.

What are the key components of tokenomics?

The five key components include token utility, supply, distribution, incentives, and price stability mechanisms.

How do you analyze tokenomics?

Investors can use resources like CoinMarketCap or more advanced analysis services to examine the token’s utility, key metrics (maximum, circulating supply, market cap), distribution methods, incentive mechanisms, and price stability methods. The tokenomics model can also be presented in a project’s whitepaper.

What is an example of good tokenomics?

Good tokenomics would feature clear token utility, a limited total supply with deflationary mechanisms (like token burning), a strategic and fair token distribution, a robust governance structure, and incentives promoting organic ecosystem growth.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com