The Graph simplifies access to blockchain data by indexing and querying it, making it easier for developers to create data-driven applications. The native token for The Graph is GRT.

Written by: Anatol Antonovici | Updated April 3, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

The Graph is an indexing protocol for blockchain data. It enables developers to build APIs for indexing and querying on-chain data, facilitating the analysis of data from Ethereum and other blockchains for end users.

Table of Contents

🍒 tasty takeaways

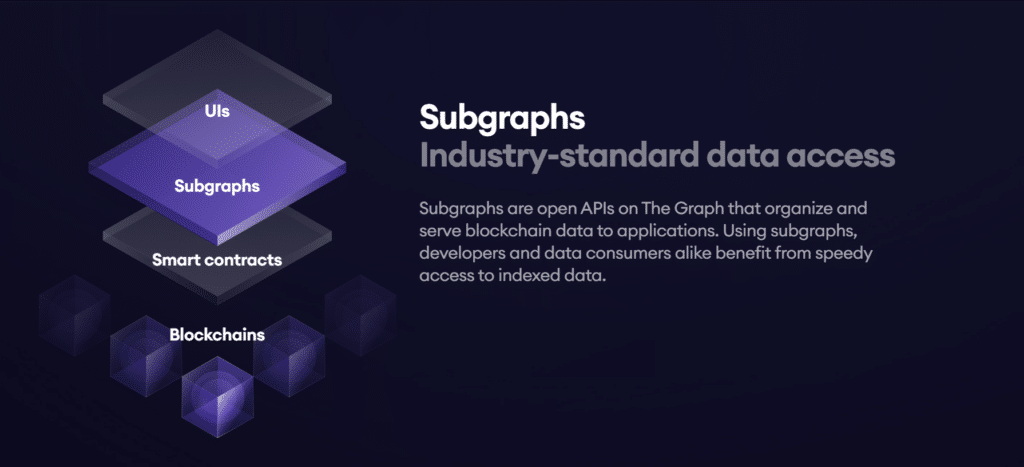

The Graph lets developers create open-source APIs called subgraphs, which extract and organize blockchain data within a graph based on user queries.

The ecosystem is fueled by the native GRT token, which is staked for rewards and used as a payment option for data querying.

While built on Ethereum, The Graph can index data on multiple chains, including Avalanche, Arbitrum, Optimism, NEAR, Cosmos, and Polygon.

The Graph Summary

| Feature | Description |

|---|---|

| Function | Indexes and queries blockchain data, aiding dApp development. |

| Native Token | GRT, used for staking, rewards, and data querying payments. |

| Multi-Chain | Compatible with Ethereum, Avalanche, Arbitrum, and more. |

| Use Cases | Crucial for DeFi and NFT data analysis and accessibility. |

| Ecosystem Roles | Indexers, Curators, Delegators, Fishermen, Arbitrators. |

| AI Integration | Plans for AI-based querying to enhance efficiency. |

What Is The Graph?

The Graph is a decentralized and open-source protocol for blockchain data indexing and querying. It enables users to collect, store, and analyze data from Ethereum (ETH) and other blockchain networks. You can think of it as the Google of the blockchain ecosystem.

Thanks to the Graph, developers can build decentralized applications (dapps) that use reliable and accurate data from blockchains and smart contracts stored on them. The protocol also makes it easier for consumers to search for blockchain data.

🍒 Here’s How Decentralized Applications (dapps) Work.

Multi-Chain Access

While originally launched on the Ethereum blockchain, The Graph’s system possesses the capability to index and query data from a wide range of other blockchain networks.

Access to DeFi Data

The protocol can be employed for many use cases. For example, it plays an important role in decentralized finance (DeFi) – an ecosystem of community-driven financial applications built on public blockchains and accessed from a self-custody wallet. The Graph greatly improves access to DeFi data.

The Graph can also analyze non-fungible token (NFT) data used for NFT marketplaces and other related apps.

How Does the Graph Work?

The Graph operates open-source application programming interfaces (APIs) called subgraphs. They represent indexes that extract and arrange data within a blockchain graph based on user queries. The network can process billions of queries each month.

Queries can be posed by any dapp via GraphQL, a popular language originally developed by Facebook (now Meta) to collect data for a users’ news feed.

Developers and ecosystem participants can utilize GRT, the native token, to facilitate the creation and usage of a subgraph.

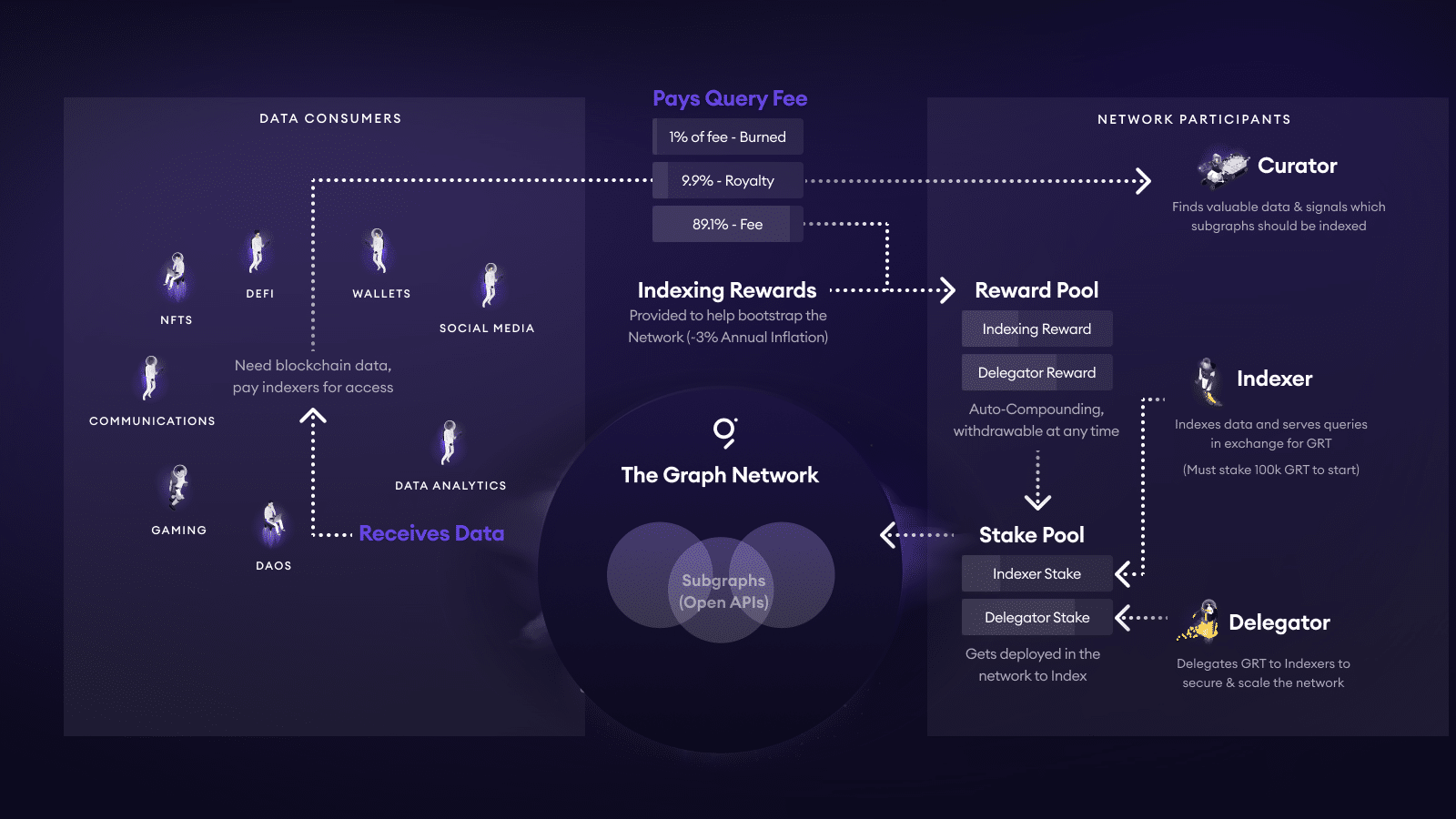

Source: The Graph

The Graph Ecosystem

The Graph network is an intricate ecosystem involving several key participants, each fulfilling distinct roles. These include:

- Indexers – node operators are responsible for providing indexing and querying services for the signaled subgraphs. They are required to stake GRT. Indexers earn rewards from contributing to the network. If Indexers provide incorrect data to dapps or if they index incorrectly, the staked GRT can be slashed.

- Curators – these are subgraph developers and consumers who assess which specific subgraphs are of good quality and worthy to be indexed by The Graph. They can signal subgraphs to Indexers by attaching GRT to a subgraph in exchange for shares and royalties.

- Delegators – they stake GRT by delegating to one or several Indexers without having to install a node. The rewards are then shared between Indexers and Delegators.

🍒 9 Best Cryptos for Staking in 2024

The network also hosts fishermen, who validate the accuracy of query responses, and arbitrators, who check whether Indexers engage in malicious activities.

Finally, end users pay in GRT to submit queries for on-chain data.

Source: TheGraph

The Graph and Artificial Intelligence

In 2023, The Graph revealed the biggest upgrade plans since its launch. One of the features of the “New Era” roadmap is to add artificial intelligence-based (AI) querying.

🍒 9 Best AI Crypto Coins for 2024

Other upgrades revolve around increasing the efficiency and speed of indexing, expanding support for new languages and chains, and scaling GRT operations by adopting Arbitrum – a layer 2 solution for Ethereum.

Bittensor is another popular AI coin. Here’s how Bittensor works!

How to Use The Graph

Developers can create and manage subgraphs through Subgraph Studio, while consumers can access blockchain data with Graph Explorer.

Here are the steps to query on-chain data using The Graph:

- Open the Graph Explorer to interact with the platform. It displays hundreds of subgraphs.

- Select a subgraph to query and click on it.

- Define your query and use the Graph Node to query the picked subgraph.

Benefits of The Graph

The Graph occupies a unique position in the blockchain industry by offering the following benefits:

- Supporting a decentralized future – The Graph contributes to a decentralized future by offering access to accurate and quality data without relying on centralized entities. It supports the growth of dapps, including Web3 DeFi applications.

- Decentralized governance – The Graph represents a community-driven ecosystem run by a decentralized autonomous organization (DAO).

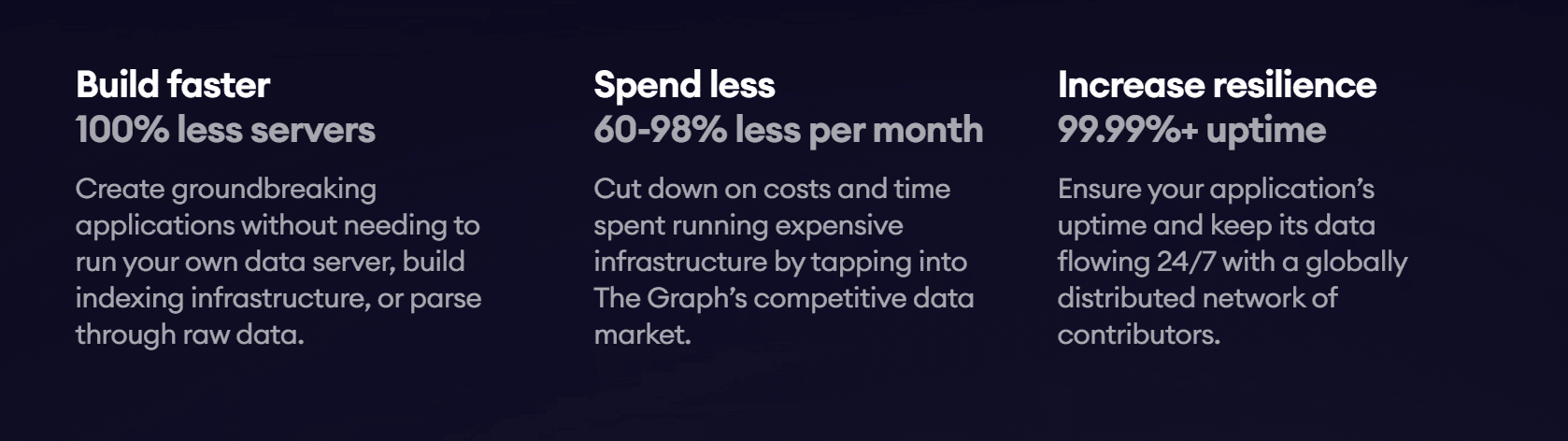

- Flexibility and convenience for dapp developers – The Graph offers developers the flexibility to use existing subgraphs or create custom ones tailored to their needs. Dapp developers don’t need to build proprietary query services or depend on third-party data.

Source: TheGraph

The Graph Cryptocurrency (GRT): Tokenomics

GRT is the utility token of The Graph. It is used as the main payment option within the platform’s ecosystem. Also, market participants, including indexers, delegators, and curators, receive rewards in GRT, with token holders being able to participate in the governance process.

🍒 Coins vs Tokens: Now How They Differ

The Graph token is a $1.6 billion market, maintaining in the top 50 largest cryptocurrencies by market cap in USD terms. It has decreased by approximately 70% from its all-time high valuation of $5.7 billion in November 2021.

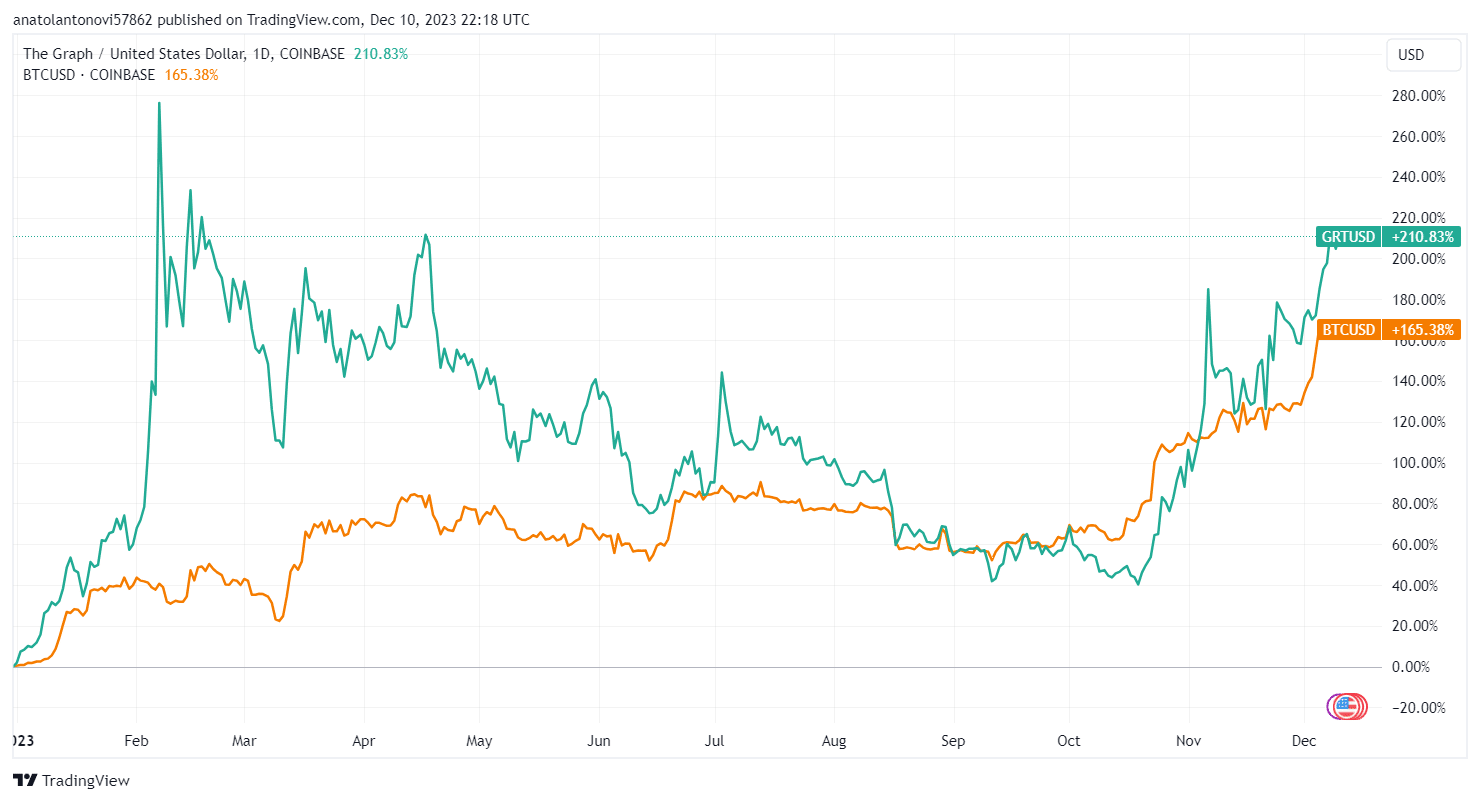

The Graph price has tripled since the beginning of 2023, outperforming the bullish Bitcoin (BTC).

Source: TradingView

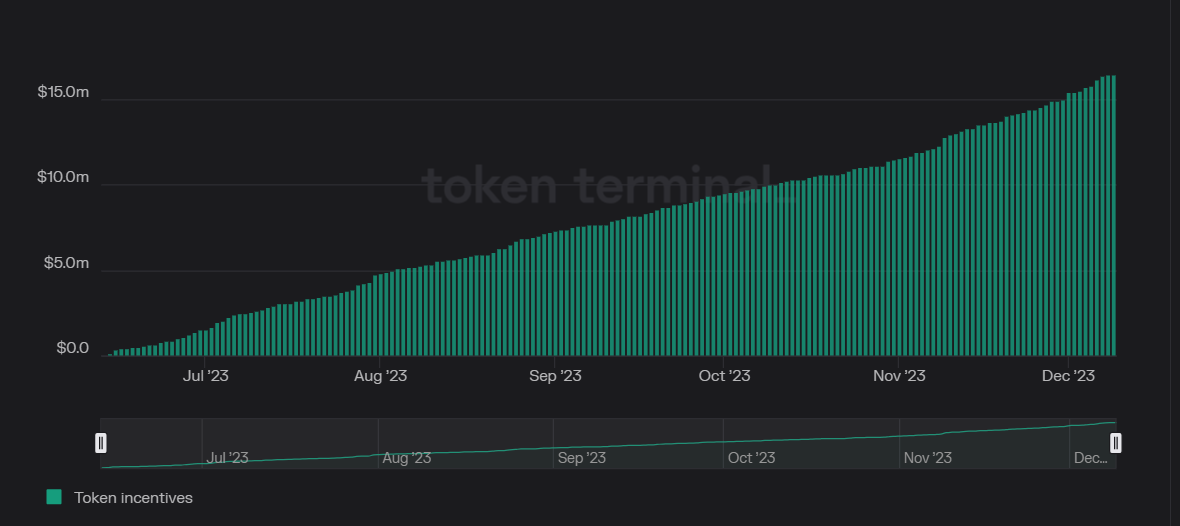

In 2023, over $30 million worth of GRT has been paid to indexers and delegators.

Source: TokenTerminal

GRT’s circulating supply is 9.3 billion tokens, while the total supply is 10.7 billion tokens. The token’s inflation rate target is about 3% per year, with new GRT being distributed to indexers.

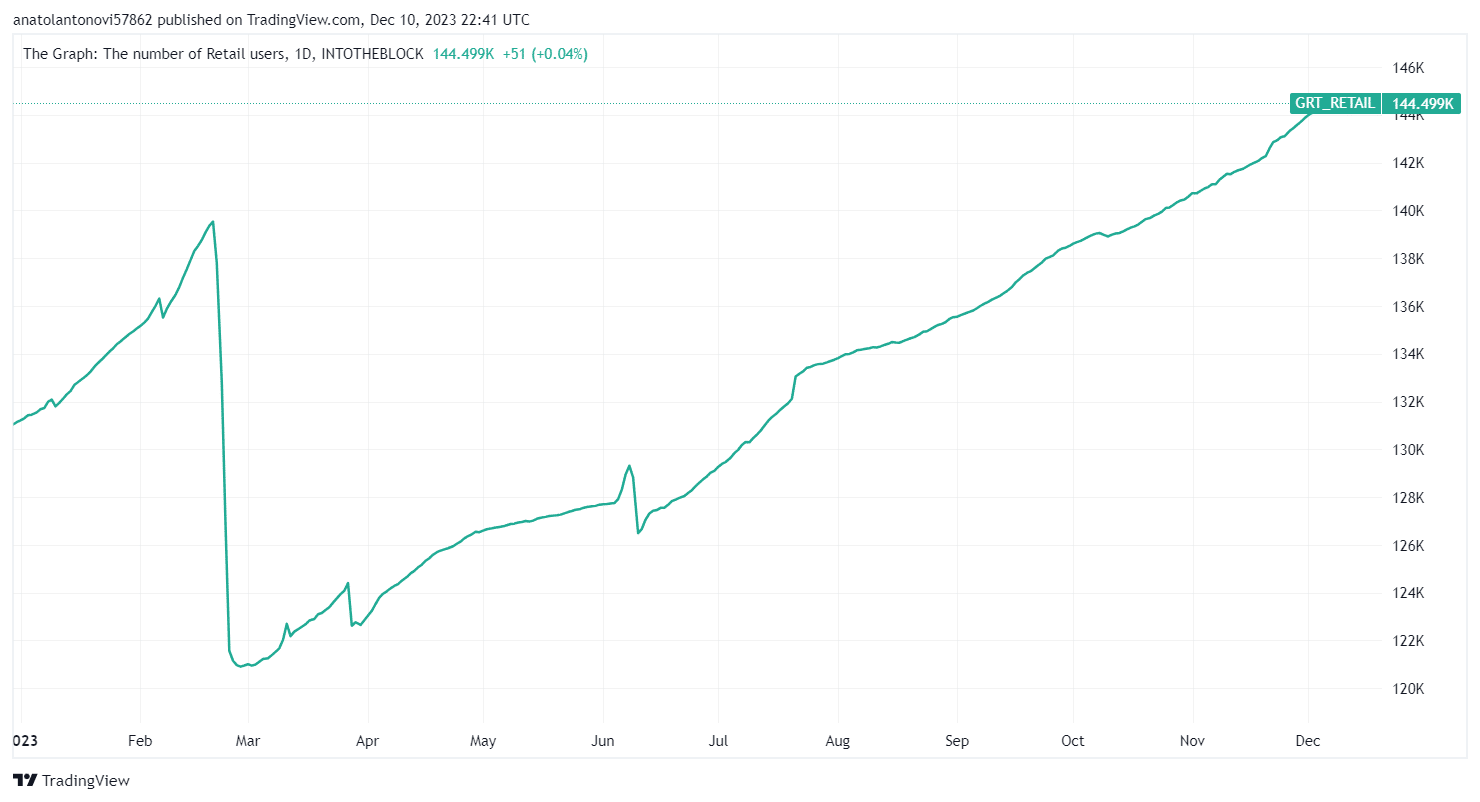

The Graph is Growing

The Graph protocol continues to gain traction, with the number of retail users hitting record levels.

Source: TradingView

How Can I Buy The Graph (GRT)?

The Graph (GRT) is an ERC-20 token, so you can purchase it within the tastycrypto app. You can download the tastycrypto self-custody crypto wallet on both Android and iOS. 👇

FAQs

The Graph is a decentralized indexing protocol for organizing blockchain data and making it accessible via GraphQL – an open-source data query language for APIs. It helps decentralized applications access accurate on-chain data efficiently.

The Graph was launched in 2018 as a development by Jannis Pohlmann, Yaniv Tal, and Brandon Ramirez. The Graph Council and The Graph Foundation play a significant role in supporting the ecosystem, but the community-driven decentralized autonomous organization (DAO) has the most weight in the governance process.

GRT is an Ethereum-based ERC-20 token that has been designed to perform certain functions within the ecosystem, being used for staking and payments. The utility aspect drives its price, which has gained over 200% year-to-date. The Graph’s unique position will likely support GRT’s value, but much depends on the broader crypto market conditions as well.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com