📕 Stablecoin Definition: A stablecoin represents any cryptocurrency that pegs its price to a separate asset class, such as the US Dollar or gold.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Stablecoins offer crypto investors the stability of fiat currencies in the cryptocurrency ecosystem. These coins (which are actually tokens) play a major role in decentralized finance, or ‘DeFi’. Learn how they work here!

🍒 tasty takeaways

Stablecoins peg their price to a separate asset class, such as fiat currency or a commodity.

Stablecoins offer crypto participants an alternative to transferring their digital assets to cash – an expensive and long process.

US Dollar stablecoins are the most popular stablecoins.

Stablecoins offer investors a respite from the volatility of cryptocurrency.

Stablecoin varieties include fiat-backed stablecoins, cryptocurrency-backed stablecoins, algorithmic stablecoins, and commodity-backed stablecoins.

Algorithmic stablecoins are backed (fully or partly) by math and are therefore riskier than fully collateralized stablecoins.

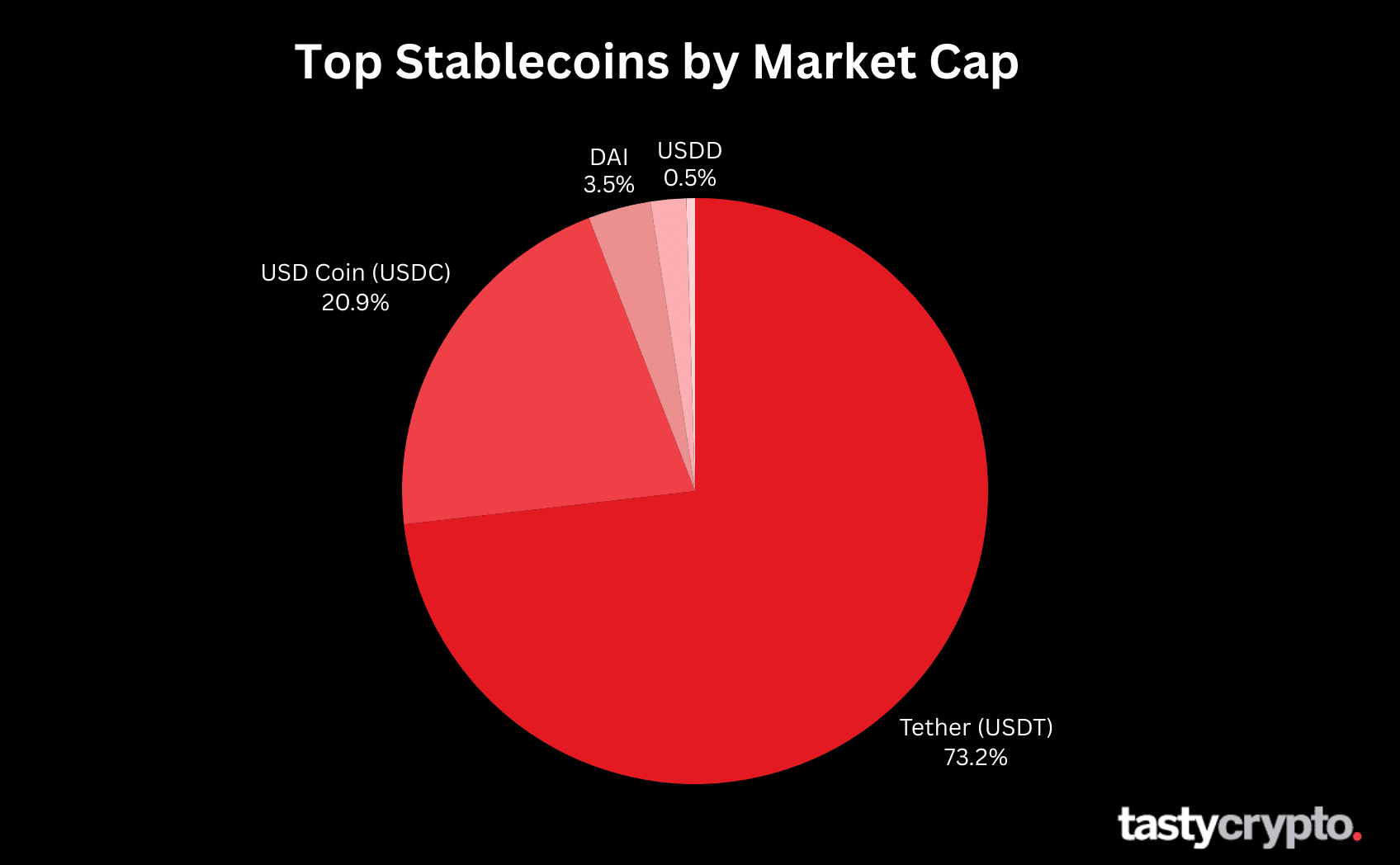

Tether (USDT) and USD Coin (USDC) are the most popular stablecoins

What Are Stablecoins?

Stablecoins are a type of cryptocurrency that peg their value to a different asset, such as a commodity or fiat currency. These digital currencies use reserves as well as oracles and smart contracts to assure their price stays in line with that of their representative asset.

The most popular stablecoins are fiat-backed stablecoins that peg their price to the US Dollar. These coins dominate the stablecoin market.

Stablecoins are popular in decentralized exchanges (DEXs) and decentralized finance (DeFi).

🍒 7 Best Stablecoins in Crypto

Stablecoins vs Other Cryptocurrencies

Cryptocurrencies are one of the most volatile asset classes in existence. This unreliability of price can be unnerving to crypto investors.

Stablecoins offer crypto investors price stability by pegging their prices to different asset classes that often have lower price volatility.

In addition to offering crypto investors a safe haven to park their digital assets, stablecoins offer a very efficient and almost immediate way of transferring funds globally.

The same is true for other cryptocurrencies, but stablecoins assure the pegged value you send will be the pegged value received by the recipient.

For example, if a crypto participant using a self-custody wallet sent a party overseas 1 bitcoin, there is a good chance that the value of that bitcoin sent will soon fluctuate. If that participant were instead to convert that bitcoin to a US dollar stablecoin and then send it, they could be assured the value received by the recipient will always be equal to that of the US Dollar.

📕 Read! Self-Custody Wallet FAQs

Why Are Stablecoins Important?

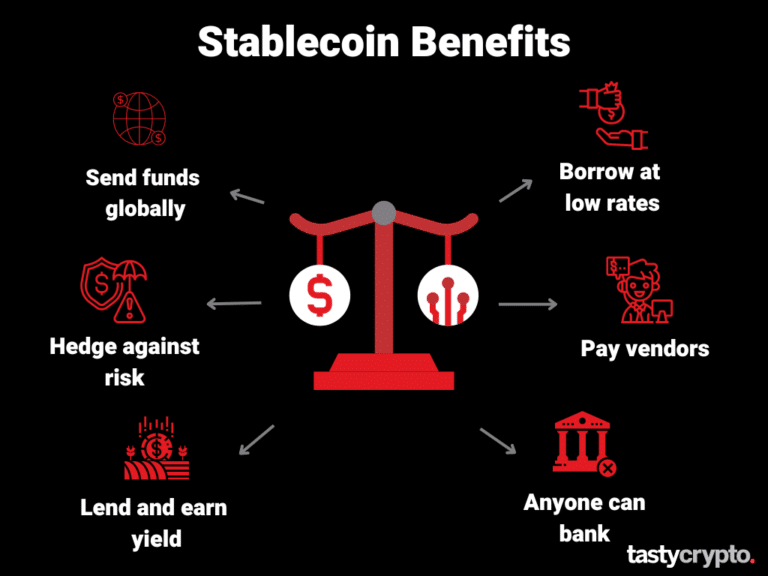

Stablecoins play a huge role in both cryptocurrency and blockchain. In addition to offering investors a safe way to store and send cryptocurrencies, stablecoins bring several other utilities to the crypto ecosystem.

Stablecoins offer both investors and banks a more efficient way of sending funds internationally.

Stablecoins can be used to hedge against crypto market risk.

Lending stablecoins offers investors yields greater than yields received at banks on fiat currency.

Borrowing stablecoins offers rates superior to those of banks.

Stablecoins can be used as a less volatile medium of exchange at online marketplaces.

Stablecoins offer the world’s 1.4 unbanked population a way to borrow funds.

Stablecoins offer an alternative to converting digital assets to cash, a long and expensive process.

4 Types of Stablecoins

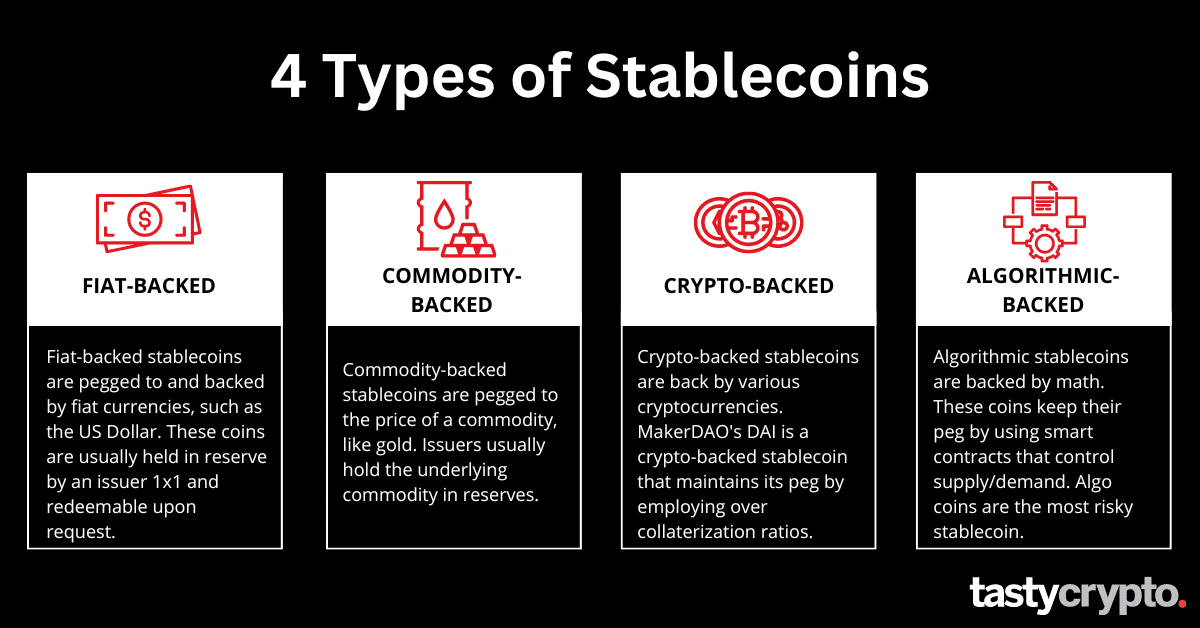

There are four different categories of stablecoins.

1. Fiat-Backed Stablecoins

Fiat-backed stablecoins are by far the most popular type of stablecoins. These coins peg their price to a fiat currency, such as the US Dollar. Not all US Dollar stablecoins, however, are created equal.

The ideal US Dollar stablecoin is both redeemable and backed by cash, cash equivalents, or short-dated U.S. treasuries on a 1X1 basis.

For example, Circle, the issuer of the USDC stablecoin, one of the most popular US Dollar stablecoins, said this about the USDC reserves:

"USDC is always redeemable 1:1 for US dollars. USDC reserves are held in the management and custody of leading US financial institutions, including BlackRock and BNY Mellon."

— Circle

This is in contrast to other popular US Dollar stablecoins, such as Tether’s USDT. The backing and reserves of USDT, the world’s largest stablecoin, have come into question.

However, even though USDC is backed, this does not mean it can not lose its peg. USDC plunged to $0.87 in March of 2023.

In 2023, PayPal launched their own US Dollar-backed stablecoin. Read how PYUSD works here!

2. Commodity-Backed Stablecoins

Commodity-backed stablecoins peg their price to that of a commodity. Types of commodity stablecoins include oil, real estate, and precious metals.

Like fiat-backed stablecoins, commodity-backed stablecoins are backed by some form of the underlying commodity held in reserve by the issuer.

For example, PAX Gold (PAXG) is a commodity-backed stablecoin that pegs its price to one fine troy ounce of a London Good Delivery gold bar.

If you own one PAXG token, you own one of these gold bars, which are held in a vault in the custody of its issuer, the Paxos Trust Company. However, you must have a large quantity of the tokens to be able to redeem them.

“You may redeem for a Physical gold bar by initiating a sell request through the Paxos wallet dashboard on the PAX Gold page. For redemption of PAXG into Gold Bars, you will need to have a minimum of 430 PAXG plus fees given that London Good Delivery gold bars range from 370-430oz.”

Paxos Trust Company

3. Cryptocurrency-Backed Stablecoins

Stablecoins can also be backed by cryptocurrency.

The most popular crypto-backed stablecoin is MakerDAOs DAI stablecoin.

DAI is similar to a US Dollar stablecoin in that its price is pegged to the dollar. DAI, however, uses cryptocurrency like ether (ETH) instead of US currency for its reserve assets.

Wrapped Coins

Wrapped coins are sometimes referred to as stablecoins, but these coins operate in a class all of their own. Wrapped coins are popular for crypto participants who wish to access cryptocurrencies not offered on the network they interact with.

For example, wrapped bitcoin (WBTC) is an ERC-20 token that allows Ethereum blockchain (ETH) participants a way to access bitcoin (BTC) on the Ethereum network. Wrapped ether is another popular coin used in DeFi.

WBTC is a community-led token that uses smart contracts to peg its value to the price of bitcoin via its token 1×1.

4. Algorithmic Stablecoins

An algorithmic (algo) stablecoin is a type of cryptocurrency that pegs its price to that of another asset, such as a fiat currency or commodity. Unlike the previous coins on our list, algo stablecoins, also known as uncollateralized stablecoins, are not backed by the asset to which they are pegged. Instead, these coins use smart contracts and complex math to achieve their peg.

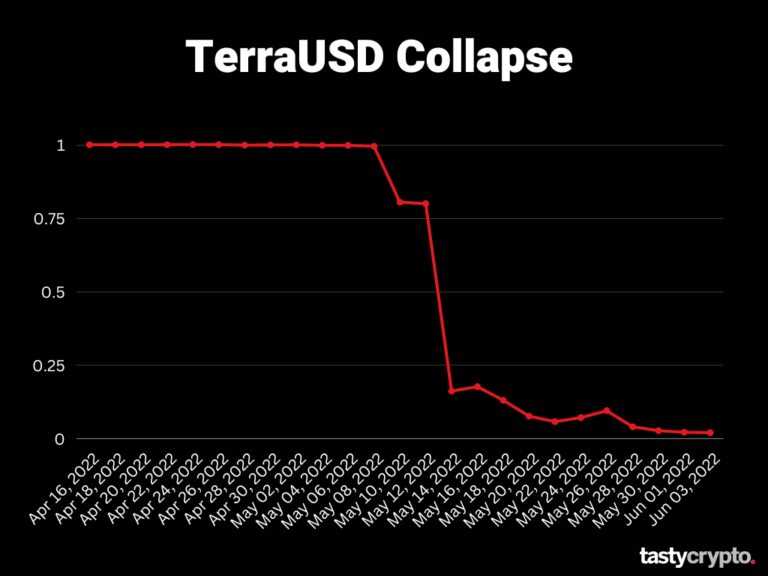

Not holding the underlying reserves on a 1:1 basis introduces many risks to algo coins. The collapse of the Terra blockchain showed us the inherent risks of this type of cryptocurrency.

To read more about the risks of algorithmic stablecoins, read this article from The Federal Reserve.

How Do Stablecoins Remain Stable?

Difference stablecoins have different ways of maintaining their peg.

Fiat-backed stablecoins that are collateralized maintain their peg because these tokens are (in theory) redeemable for the actual currency. For example, if the USD Coin (USDC) fell below $1, an investor could in theory buy it at the discounted price, then redeem it with the issuer for $1 in actual cash, making the spread as the difference.

Crypto-backed stablecoins maintain their peg through various methods. MakerDAO’s DAI token is created by borrowers who put up collateral. This collateralization ratio is very high for borrowers, typically 150%. When/if this collateralization ratio is breached, the loan will be liquidated by ‘keepers’, thus maintaining the integrity of the coins peg.

Commodity-backed stablecoins act similarly to fiat-backed stablecoins when it comes to maintaining their peg. Like collateralized fiat stablecoins, commodity stablecoins hold the actual commodity in reserve. If, for example, a gold-backed stablecoin falls below its peg, an investor could ‘redeem’ their token for actual gold and make a profit.

Algorithmic stablecoins maintain their peg through smart contacts that regulate supply and demand. These smart contracts failed in 2022 when Terra’s LUNA (UST) algo coin lost its peg. Due to the massive selling in UST, the algorithm was unable to keep up with the selling demand and, essentially, broke. The UST token is currently worth less than a penny.

What Are The Risks of Stablecoins?

Here are the top five risks associated with stablecoin.

1. De-pegging risk

This type of risk is most associated with non or under-collateralized stablecoins. If a collateralized stablecoin network indeed holds its reserves on a 1×1 basis, this risk should be mitigated. However, this is not always the case. The collateralized US Dollar stablecoin Tether (USDT) has lost its peg many times in the past, but typically very briefly and usually only a few pennies. This may be due in part to questions raised about the stablecoins cash reserves.

2. Counter-Party risk

Some stablecoins, such as Gemini’s US dollar (GUSD) stablecoin, are issued by a central organization (Gemini). If Gemini were to become insolvent, it is possible that holders of GUSD may be unable to access their stablecoin. This situation could also cause the coin to lose its peg.

3. Smart Contract Risk

Web3 is governed by smart contracts. In stablecoins, smart contracts provide many functions, including:

Process automation.

Supply and demand regulation.

Issuance and redemption of stablecoins.

If a smart contract were to fail or be hacked, this could lead to the de-pegging of a cryptocurrency.

4. Regulation risk

There is very little regulation in the cryptocurrency market today. The US government is undecided as to whether crypto should be regulated by the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). If the SEC regulates crypto, they may deem stablecoins as securities, which may have an effect on the price of stablecoins.

Additionally, it is possible for a government to make stablecoins illegal at any given time. This may adversely effect the issuers of stablecoins.

5. Liquidity risk

Like all financial assets, stablecoins are subject to liquidity risk. If the ecosystem around a stablecoin is not robust, or there are few participants, the spreads on these coins may widen. For example, the bid for an illiquid stablecoin may be $0.97, and the offer $1.03.

⚠ Alert: Before investing in a stablecoin, it may be wise to assure the issuer of the coin has had at least two independent audits performed.

5 Popular Stablecoins

According to coinmarketcap, the below 5 stablecoins are currently the most popular as determined by their TVL (total value locked).

🚨 All of the below stablecoins are US Dollar stablecoins.

1. Tether (USDT)

-

Type: US Dollar Stablecoin

-

Issuer: Tether

-

Market Capitalization: $112B

-

Daily Volume: $69.6

2. USD Coin (USDC)

-

Type: US Dollar stablecoin

-

Issuer: Circle (associated with Coinbase)

-

Market Capitalization: $32B

-

Daily Volume: $6.5B

3. Dai (DAI)

-

Type: – Decentralized Stablecoin

-

Issuer: MakerDAO

-

Market Capitalization: $5.3B

-

Daily Volume:$266M

4. First Digital USD (FDUSD) – Decentralized Stablecoin

-

Type: US Dollar Stablecoin

-

Issuer: First Digital Labs

-

Market Capitalization: $3B

-

Daily Volume: $8B

5. Decentralized USD (USDD)

-

Type: Decentralized Stablecoin

-

Issuer: Tron DAO

-

Market Cap: $730M

-

Daily Volume: $15M

*Two additional popular US Dollar stablecoins include TrueUSD (TRU) and Gemini Dollar (GUSD).

Final Word

Stablecoins play an integral role in the cryptocurrency ecosystem. Among other utilities, stablecoins:

-

Allow lenders to earn yield in an otherwise low-interest rate economy.

-

Permit for the efficient transfer of funds globally.

-

Offer investors a respite from the wild price fluctuations of cryptocurrency

FAQs

Stablecoin investors face many risks that could cause them to lose money. Some of these risks include de-pegging risk, smart contract risk, issuer risk, and regulatory risk.

Stablecoins have many use cases in crypto. Price stability is perhaps the most prominent feature of stablecoins.

The best stablecoins are issued by reputable and transparent organizations that back their coins 1×1 with reserves. For the greatest security, it is wise to make sure a stablecoin issuer provides redemption services.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?

Wrapped Crypto Tokens: A Beginner’s Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.