Definition: In cryptocurrency, slippage refers to the difference between the expected and the actual fill price of a transaction.

Written by: Mike Martin | Updated June 28, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In the cryptocurrency market, slippage refers to the difference between the anticipated and actual fill price of a crypto trade/swap. Slippage represents the price changes that occur in the time between when a trader places a trade and when that trade is confirmed and executed.

Slippage, however, is not always bad. Sometimes, prices move in your favor! Over the long run (if you’re an active trader) the effects of positive slippage and negative slippage should even out for you.

🍒 tasty takeaways

Slippage is the difference between the actual and estimated fill price.

Price volatility and low liquidity are the two main causes of crypto slippage.

Slippage levels can be specified with a ‘slippage tolerance’ setting.

Slippage formula: Slippage (%) = (Executed Price – Expected Price) / Expected Price) * 100

Slippage Summary

| Section | Summary |

|---|---|

| Definition | Slippage in crypto refers to the difference between the expected and the actual fill price of a transaction, representing price changes occurring between placing and confirming a trade. |

| Causes | Caused by price volatility, low liquidity due to few buyers, sellers, and liquidity providers, high transaction volume, and network congestion in blockchains. |

| Slippage Tolerance | It is a setting allowing users to specify acceptable slippage levels, generally between 1% - 5%, crucial for assets with low liquidity and high volatility on DEXs like Uniswap. |

| Orders and Calculation | Market and limit orders affect slippage differently. Slippage (%) is calculated using: (Executed Price – Expected Price) / Expected Price * 100. |

| Importance | Designating a slippage percentage is crucial for risk management in trading crypto assets, it can also be beneficial if the prices move in favor. |

What Causes Slippage?

In cryptocurrency, slippage is caused by 4 market conditions.

➡ Price Volatility

In volatile markets, prices move fast. When this happens, there is a good chance that the price of the cryptocurrency you are trying to buy or sell will change in value from when you send the trade to when it is confirmed.

➡ Low liquidity

Low liquidity in crypto markets causes slippage. Three conditions can cause low liquidity in crypto.

1. A small number of buyers and sellers

2. Thin order books (for centralized crypto exchanges)

3. Few liquidity providers (for decentralized exchanges – DEXs)

➡ High transaction volume

When there are a lot of traders buying and selling in a market, this puts pressure on market makers and liquidity pools. When traditional market makers and automated market makers can’t keep up with demand, this low liquidity can cause slippage.

➡ Network Congestion

When blockchain networks such as Ethereum and Bitcoin are congested, slippage can occur. Network congestion particularly affects decentralized finance (DeFi) exchanges. Every blockchain transaction must first be validated and confirmed. When networks are busy, orders get hung up in mempools until a validator (or miner) gets to it. This delay causes slippage.

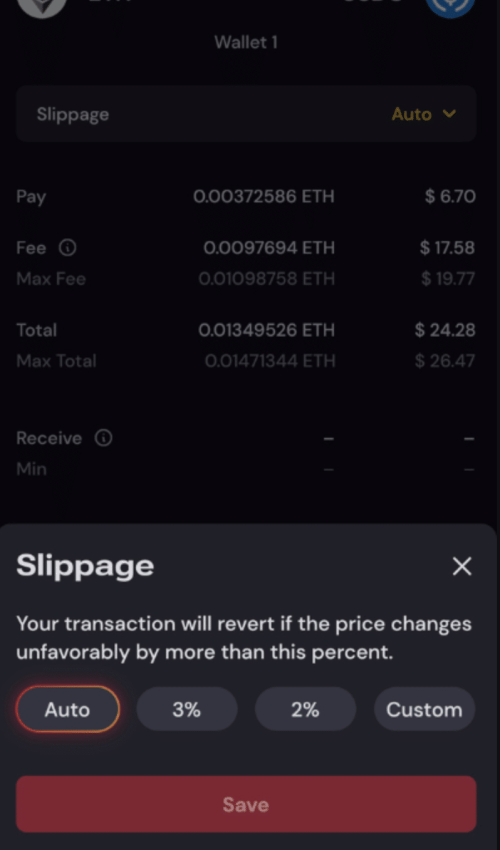

Slippage Tolerance

Slippage tolerance is very important on decentralized exchanges (DEXs) like Uniswap, particularly for digital assets with low liquidity and high volatility. Slippage tolerance, a setting that many self-custody crypto wallets (like tastycrypto) offer, allows users to specify how much slippage they are willing to accept for a particular transaction. Generally, slippage tolerances are set between 1% – 5%.

Slippage Example

Let’s look at how the slippage tolerance calculator looks on the tastycrypto wallet.

When you set your slippage tolerance, your provider will fill as much of your order as possible (sometimes not all for large orders) while staying within the price bounds that you have specified.

Let’s look at an example with a hypothetical ether (ETH) trade.

ETH Price: $3,000

Slippage Setting: 2%

If you were to place a buy order on ETH at $3,000 with a 2% slippage tolerance, that order would not be filled if the price of ETH were to rise 2% higher ($3,000 + $60) from when you sent the trade to when it was actually filled (confirmed on a blockchain). For sell orders, the same rules would apply, but on the downside.

Your swap will cancel automatically if slippage exceeds your designated level.

But remember, slippage can lead to a better price as well!

Slippage: Market and Limit Orders

Some crypto trading platforms in both DeFi and centralized finance (e.g., Binance and Coinbase) offer limit and market orders.

Limit orders specify a price at which you are willing to be filled. They are often used to take profits. With these order types, you will not be filled worse than the price you specified so slippage is not an issue (in most cases).

Market orders are filled immediately at the current market price, regardless of what that may be. Setting your slippage for market orders, therefore, is very important.

Slippage Percentage Calculator

In order to determine the slippage you received on any filled order, use the below formula:

Slippage Calculation:

Slippage (%) = (Executed Price – Expected Price) / Expected Price) * 100

Let’s look at an example with a bitcoin (BTC) buy trade.

BTC anticipated price: $65,000

BTC actual price: $64,800

Now we just plug the numbers in.

Slippage Calculation: (65,000 – 64,800) / 64,800* 100

Slippage: 0.3%

In this buy example, slippage resulted in a higher fill price. Just as often, however, slippage will lead to lower prices.

📚 Read next: What are gas fees and how do they work?

Slippage Summary

Crypto traders would be wise to designate a slippage percentage before sending trades. Trading crypto assets can be a very risky business; taking every precaution possible will help your crypto portfolio over the long term.

Note: Slippage is used in many financial markets, including forex.

Additional Reading

Slippage FAQs

You can avoid slippage in crypto by setting a ‘slippage tolerance’ in your crypto wallet, which limits the price range at which you are willing to buy or sell a cryptocurrency.

A reasonable slippage tolerance would be set between 2% and 5%.

Slippage matters in crypto as it determines your fill price. Slippage is of particular importance in illiquid and volatile markets.

Low slippage is usually a sign that the crypto market you are trading is liquid, which is positive.

Yes. Positive slippage occurs when an actual fill price is better than the anticipated fill price.

The best order type to use to avoid slippage is a limit order, which will only be filled at or better than the limit price you have specified.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

Crypto Burning Guide: What It Means and How It Works

Crypto Coin vs Token: What’s The Difference?

Leverage in Crypto Trading: 6 Key Examples

What Is Slippage in Crypto? Beginners Guide