Self-custody crypto wallets giver users direct control over their private keys. In this FAQ article, we will answer all of the questions Googlers have about self-custody Web3 cryptocurrency wallets.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

What does self-custody mean in crypto?

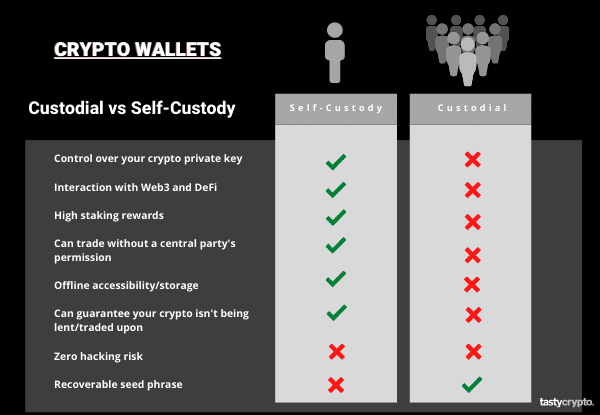

In cryptocurrency, self-custody refers to the ability of a crypto participant to maintain ownership and control over their private keys. Self-custody crypto wallets, therefore, give users this control.

This is in contrast to ‘custodial’ wallets, which imply that a cryptocurrency exchange safeguards a user’s private keys.

Is self-custody the same as non-custodial?

Self-custody is the same as non-custodial. These terms can be used interchangeably. In both of these wallet types, users have control over their private keys.

📚 Read! Custodial vs Self-Custody Crypto Wallets Explained

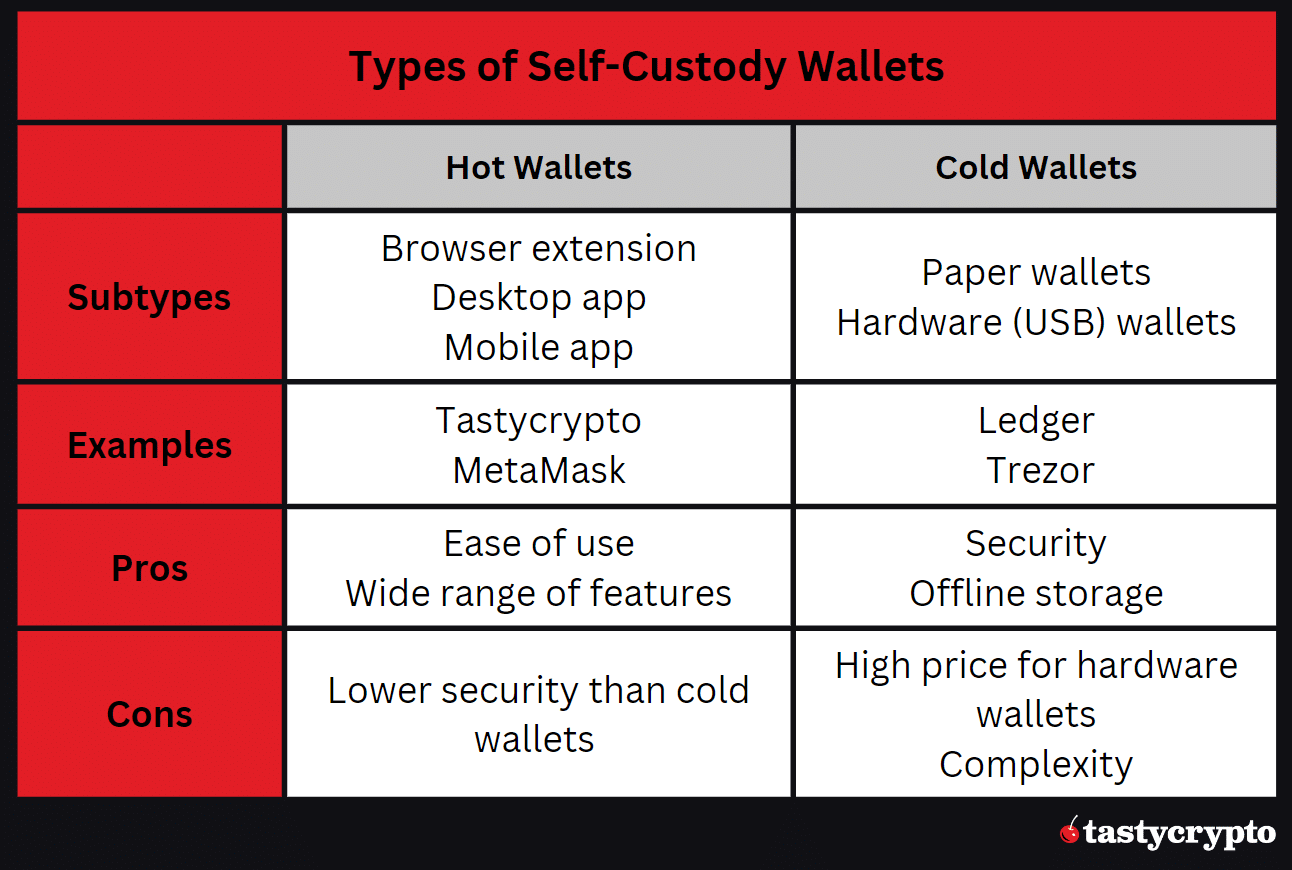

What is a hot wallet in crypto?

In cryptocurrency, a hot wallet is any type of cryptocurrency wallet that is connected to the internet. Hot wallets include:

Mobile wallets

Desktop wallets

Browser extensions wallets

USB wallets (when internet connected)

Hot wallets can be used to trade crypto, stake crypto, lend and borrow crypto as well as participate in crypto market making (automated market making).

Should I move my crypto to a hot wallet?

You should move your crypto to a hot wallet if you want to interact with a Web3 decentralized application (dApp).

Cold wallets are best for users who simply want to hold digital assets with no desire to actively trade or connect to dApps like DeFi applications.

What is a cold wallet in crypto?

In cryptocurrency, a cold wallet is any type of crypto wallet that is not connected to the internet. Paper wallets and hardware wallets (Ledger) are two popular cold wallets. Some cold wallets, like USB wallets (hardware wallets), can be connected and disconnected from the internet at will. This provides for maximum security and utility.

Cold wallets are more popular in bitcoin (BTC) as this network does not support smart contracts, which are building Web3.

Can self-custody wallets be hacked?

Yes, self-custody wallets can be hacked. Since hot wallets are constantly connected to the internet, these wallets have a much greater chance of being hacked than cold wallets.

What is an example of a self-custody wallet?

An example of a self-custody wallet is the tastycrypto wallet. The tastycrypto wallet gives users direct access to their private keys. This permits greater security and allows users to interact with dApps as well as trade and store non-fungible tokens (NFTs).

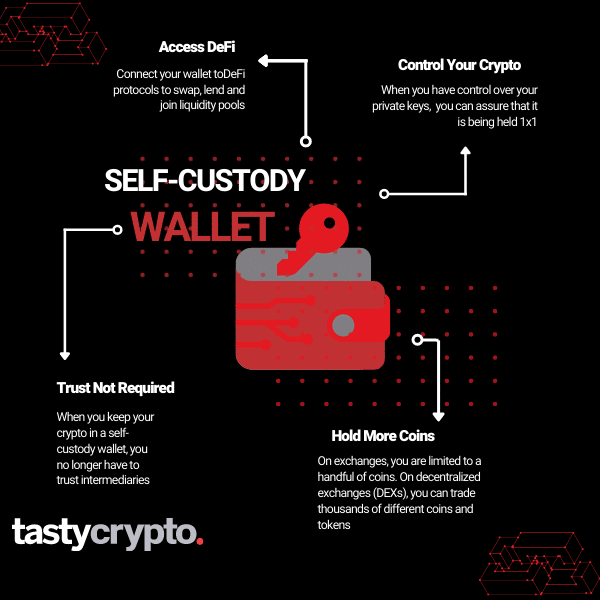

What are the benefits of self-custody?

Some benefits of self-custody crypto wallets include:

Higher security

Lower transaction fees

Connect to dApps

Trade thousands of tokens

Collect NFTs

More privacy

Trust not required

💡 Learn how to connect to dApps using tastycrypto with WalletConnect!

How do I get a self-custody wallet?

Self-custody wallets are easy to get. To obtain a ‘hot’ self-custody wallet, simply download the wallet from a provider (like tastycrypto), write down the seed phrase, and you’re up and running! This process is much simpler than opening a brokerage account as there are no know-your-customer (KYC) regulations for crypto.

How do self-custody wallets work?

Self-custody wallets are software programs that store crypto users’ private keys. When you create a self-custody wallet, you are issued a seed phrase (private key). This private key is stored in your wallet.

Having access to private keys allows users to interact with dApps, play games, and trade NFTs.

‘Cold’ crypto wallets work by storing privates key offline.

‘Hot’ crypto wallets work by storing private keys on a piece of software, like a phone or a web browser.

How do self-custody and private keys work?

When you open a self-custody wallet, you are issued a private key. This key allows you to interact with blockchains like the Ethereum network.

Private keys are used to sign transactions on blockchain networks. Self-custody wallets are accessed via a seed phrase, which unlocks your private keys within the wallet. If a user loses their seed phrase, they will lose access to the corresponding digital assets within the wallet.

📚 Read! Private Keys vs Seed Phrases vs Recovery Phrases

What crypto wallets are non-custodial?

There are a few varieties of non-custodial crypto wallets.

Desktop wallets

Mobile Wallets

Browser wallet

USB wallets

Paper wallets

Two popular non-custodial crypto wallets include MetaMask and tastycrypto.

What is the safest wallet for crypto?

The safest wallet for crypto is a cold wallet. Cold wallets are stored offline. This all but eliminates the risk of hacking. The greatest risk to cold wallets is if the owner loses the seed phrase. This would prevent the owner of the crypto wallet from accessing the crypto within it.

Do crypto wallets report IRS?

Yes. In the United States, the IRS requires crypto participants to report their crypto gains and losses as property. If your crypto is held with an exchange like Coinbase, the IRS can view your trading activity directly through the exchange without your consent.

Can cold wallets be custodial?

Cold wallets can indeed be custodial. Large exchanges like Coinbase store a portion of their user’s cryptocurrency in cold wallets.

All crypto is held in either cold or hot wallets, regardless of who manages the digital assets within them.

How safe is a non-custodial (self-custody) wallet?

Non-custodial wallets are generally safer than custodial wallets, but risks do exist. A few risks of non-custodial wallets include:

-

Hacking risk

-

Theft

-

Physical damage to a cold wallet

-

Loss of seed phrase

-

Human error

📚 Read Next: DeFi Self-Custody Wallet FAQs

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences