Polymath simplifies digital investments by providing a single platform to create, issue, and manage blockchain-based security tokens. Leveraging their ERC 1400 standard, they have enabled over 200 tokens on Ethereum, streamlining smart investments in one place.

Written by: Anatol Antonovici | Updated February 7, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Polymath, a leading tokenization platform, has garnered significant attention thanks to the recent growth in crypto projects involving real-world assets (RWAs).

Table of Contents

🍒 tasty takeaways

Polymath is an Ethereum-based tokenization platform focused on security tokens.

It has launched the first security token-oriented blockchain network called Polymesh.

The Polymath ecosystem is fueled by POLY and POLYX tokens.

Summary

| Feature | Description |

|---|---|

| Platform | Polymath simplifies the creation, issue, and management of security tokens on Ethereum, leveraging the ERC-1400 standard. |

| Tokenization Focus | Tokenization of real-world assets (RWAs) like company shares, bonds, and real estate. |

| Blockchain Base | Ethereum (ETH) for initial development; Polymesh for dedicated security token blockchain. |

| Tokens | POLY and POLYX fuel the ecosystem, enabling operations and governance. |

| ERC-1400 Standard | Introduces compliance, document management, and enhanced security token controls. |

| Security Tokens | Digital assets representing traditional securities, required to comply with legal regulations. |

| Benefits | Includes liquidity, programmability, transparency, borderless capital raising, security, and convenience. |

| Polymesh | A public permissioned chain designed for security tokens, emphasizing KYC, compliance, confidentiality, and governance. |

| Tokenization Process | From asset selection, ecosystem assembly, compliance rule setting, to token deployment and management. |

| POLY vs. POLYX | POLY is used on Ethereum; POLYX is for Polymesh, with a 1:1 upgrade path. |

What Is Polymath?

Polymath is a protocol and service that facilitates the issuance and management of security tokens, which can represent anything from company shares to bonds and real estate.

The platform helps enterprises and other entities tokenize real-world assets, predominantly legal securities. Using Ethereum (ETH) as its underlying blockchain, Polymath has been advocating for a unified security token standard, ERC-1400.

Polymath launched in 2018 and published the first draft of the ERC-1400 standard in the same year. It has quickly grown into one of the leading tokenization platforms.

What Is Ethereum’s ERC-1400 Standard?

The ERC-1400 was developed to address the compliance needs of tokenized securities, which the common ERC-20 standard for utility tokens couldn’t meet.

The ERC-1400 standard, although similar to the ERC-20, introduces specific regulations for fundamental compliance mechanisms, management of documents, and controls over security tokens, including features like delegation and mandatory transfers.

It also introduces partial fungibility, enabling fractional ownership.

Source: Polymath

What Are Security Tokens?

Security tokens are blockchain-based digital assets representing traditional securities, which are fungible and tradable financial instruments that hold value. Relevant examples of securities include company shares and corporate or government bonds.

Companies and government agencies can raise capital by issuing securities to investors. Securities are highly regulated across most jurisdictions. In the US, they must be registered with the Securities and Exchange Commission (SEC).

Security tokens, which utilize blockchain technology, are required to adhere to all applicable legal regulations, as they are recognized as legal securities.

There are three main types of security tokens:

- Equity tokens – digital securities representing equity assets, such as company shares

- Asset-backed tokens – these provide ownership rights of real-world assets (RWAs), such as real estate, art, and commodities.

- Debt tokens – digital securities representing debt-related instruments, including corporate and government bonds and real estate mortgages.

Benefits of Security Tokens

- Liquidity – security tokens bring more liquidity by making trading easier on primary and secondary markets. Also, thanks to the fractional ownership feature, non-liquidity assets like real estate can be sold to pools of investors, including retail ones.

- Programmability – security tokens can embed compliance at the code level, helping regulators monitor their activity.

- Transparency – blockchain maintains an immutable digital record of ownership and transactions.

- Borderless – companies can raise capital from all over the world in line with regulations.

- Security – security tokens benefit from the unmatched security of blockchain technology.

- Convenience – instead of going public through an Initial Public Offering (IPO), companies can hold Security Token Offerings (STOs) – a fundraising mechanism with fewer obligations.

What is Polymesh?

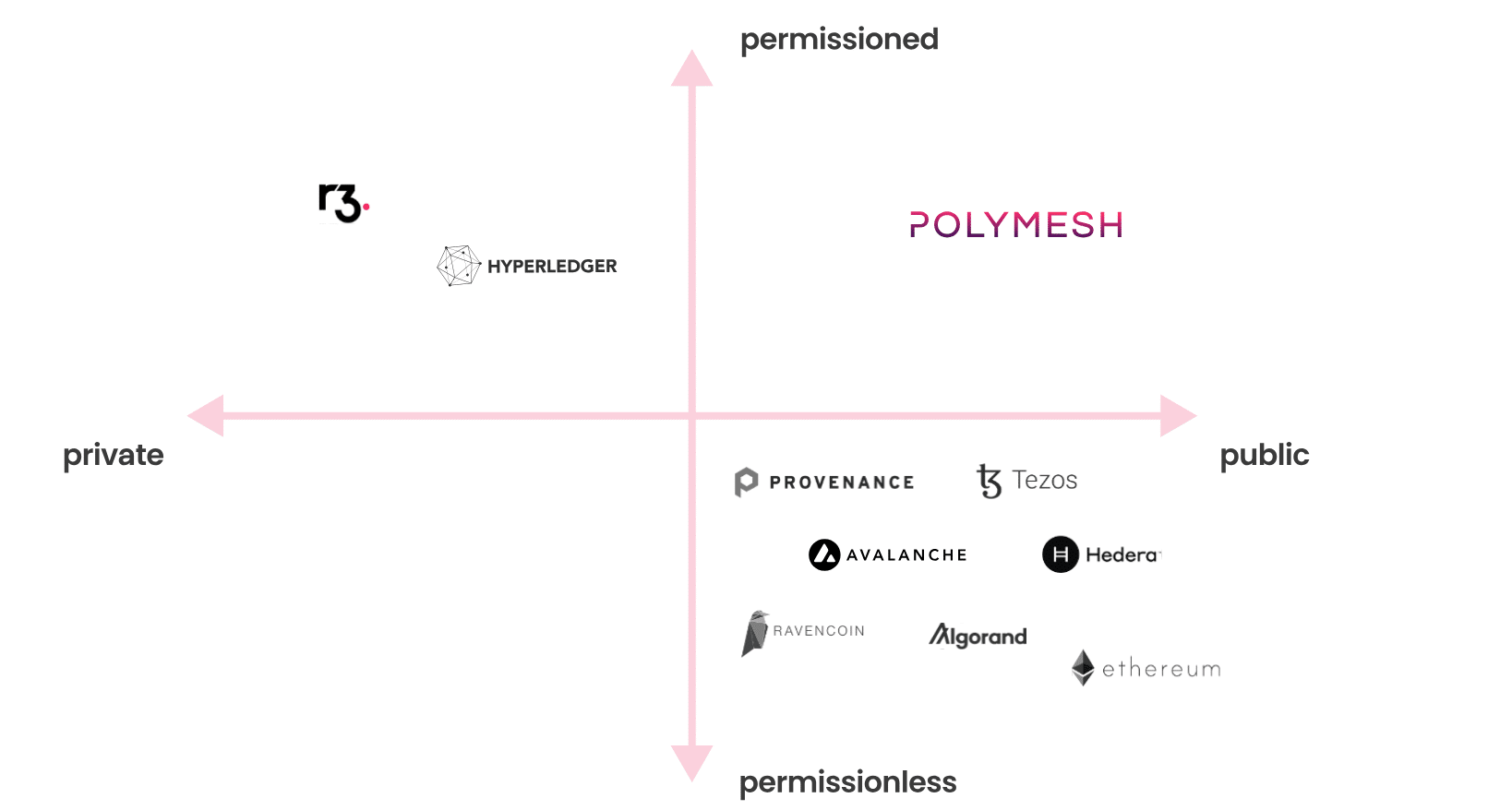

While initially relying on Ethereum, Polymath eventually developed its own blockchain and security token infrastructure known as Polymesh. It is the first decentralized network focusing specifically on security tokens.

Polymesh is a public permissioned chain and mandates users to pass through KYC verification for onboarding.

Source: Polymesh

Institutions and individuals can use Polymesh to issue, manage, and trade security tokens and other tokenized assets.

🍒 Crypto Coin vs Token: What’s The Difference?

The blockchain platform is founded on five key pillars:

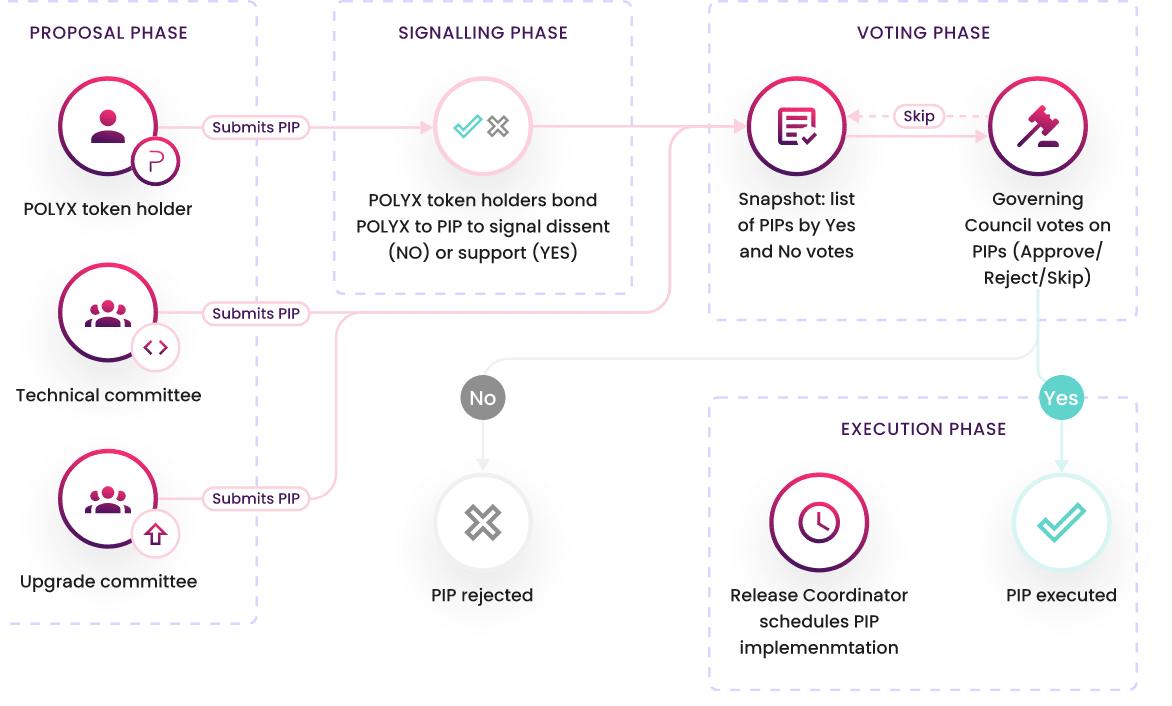

- Governance – the blockchain relies on a council of stakeholders known as the Governance Council, which decides the evolution of the ecosystem. Users holding the native token, POLYX, can also participate in governance.

Source: Polymesh

- Identity – all actors on Polymesh are verified, being open to using all services.

- Compliance – Polymesh has built compliance functionality into the core of the chain.

- Confidentiality – Polymesh has developed a new patent-pending protocol for securely managing digital assets in a confidential and auditable way.

- Settlement – the network offers instant settlement for security token transactions.

Polymesh extends beyond Ethereum‘s ERC-1400 standard, offering capabilities like STOs, external audits, document management, corporate actions, custody, and ID-based access.

How Does Polymath Work?

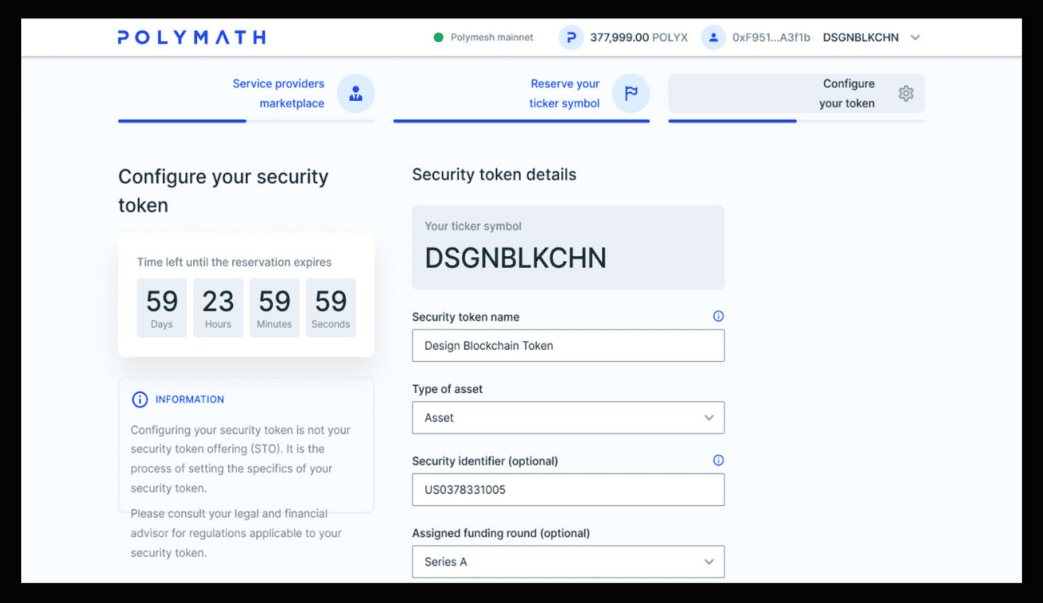

Enterprises can tokenize assets using Polymatch’s Token Studio. Creating assets on Ethereum will require connecting a digital self-custody wallet like tastycrypto or MetaMask, while tokenizing on Polymesh requires connecting the Polymesh wallet.

While tokenization involves multiple processes, Polymath’s tokenization guide highlights a few key steps as follows:

- Assemble ecosystem – start by identifying the asset to be tokenized and then take your time to develop an ecosystem that includes custodians, KYC/AML providers, legal and tax advisors, marketing teams, and decentralized exchanges for trading on secondary markets.

- Configure the token – now you can configure the token. Define the token’s category, name, symbol, divisibility, and other specifics. Also, you can establish a tokenomics model that suits your project’s specific requirements.

Source: Polymesh

- Set compliance rules – you can incorporate the main token rules to comply with regulations. Polymath enables users to include KYC/AML verification capabilities, ownership and transfer restrictions by jurisdiction or behavior, voting rights, and automated enforcement, among others.

- Deploy, distribute, and manage the tokens – you are ready to launch the security token by determining its price, minting it on the blockchain, and distributing it to stakeholders. Consider fundraising events like STOs for wider distribution to secondary markets. During their lifetime, you can manage your assets by executing actions like minting, burning, pausing, freezing, or token recovery.

- Execute corporate actions – Polymath helps issuers monitor investor engagement and token transactions. Users can extract and use blockchain data for accurate reporting to tax authorities and regulators, ensuring consistent compliance and transparency.

POLY and POLYX Tokens

POLY is the native token of the Polymath platform.

POLYX is the native coin of Polymesh.

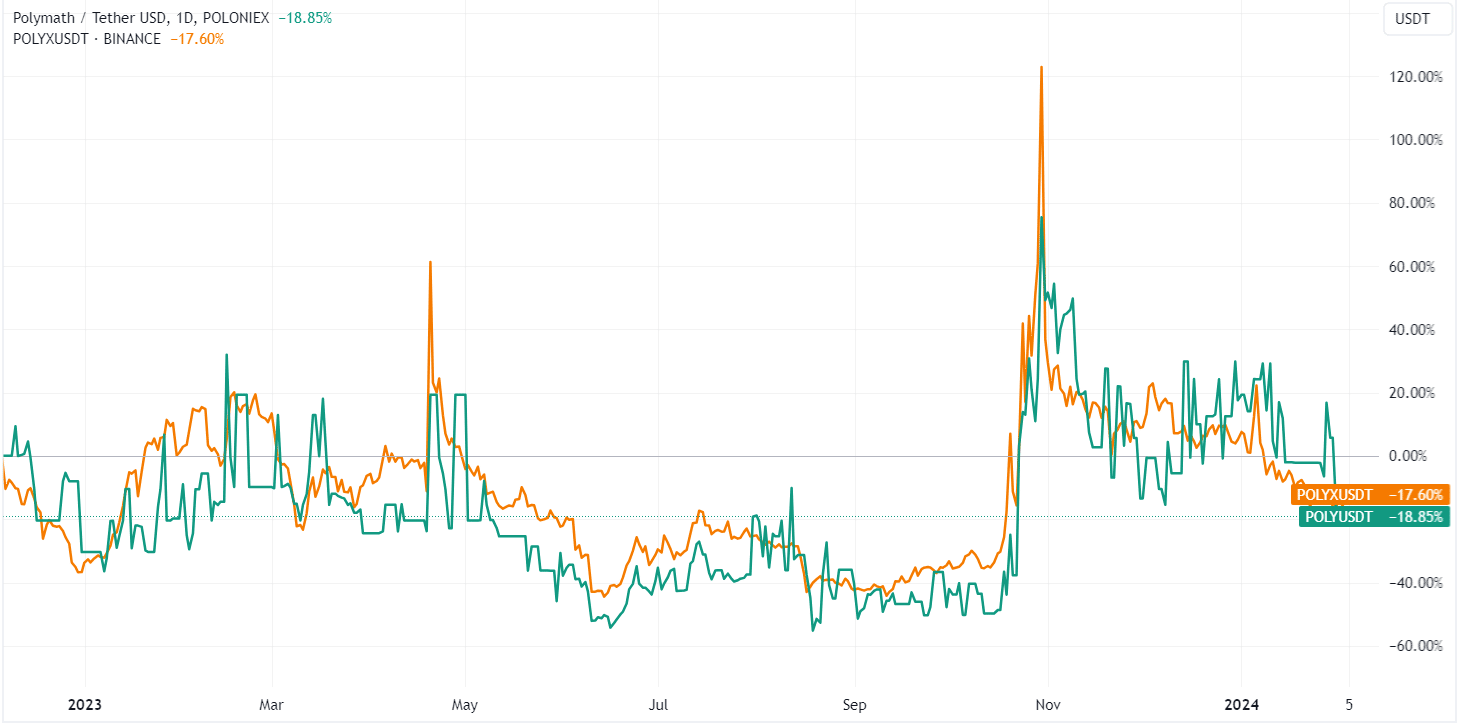

POLY is an ERC-20 token, and holders can optionally upgrade to POLYX based on a 1:1 ratio. Therefore, Polymath expects the circulating supply of POLYX to increase at the expense of POLY tokens, having an unlimited total supply.

Both cryptocurrencies fluctuate, and their price can vary by about 1 cent or more during higher volatility.

As of today, POLY is a $130+ million market, while POLYX has a market cap of $120+ million. The current price of Polymath tokens is fluctuating near $0.15.

FAQs

Polymath is a tokenization platform that facilitates the issuing and managing of security tokens on blockchain, enabling entities to tokenize real-world assets (RWAs) like shares and bonds.

Polymesh is Polymath’s own blockchain and security token infrastructure, designed specifically for security tokens, featuring KYC verification, built-in compliance, confidentiality protocols, and instant settlement.

POLY is Polymath‘s original ERC-20 token used on Ethereum, while POLYX is the native coin of Polymesh. POLY holders can upgrade to POLYX based on a 1:1 ratio.

You can buy Polymath tokens on crypto exchanges that support them. POLYX is available on multiple centralized exchanges, including Binance. POLY is also available on Poloniex only, but it can also be purchased through Uniswap, a decentralized crypto exchange (DEX). Coinbase suspended POLY trading last December.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com