Staking refers to the process of locking up cryptocurrency in order to help a blockchain validate transactions. Lido is the top staking platform while Rocket Pool comes in second.

Written by: Siyu Ren Heinrich | Updated August 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Staking your crypto allows you to earn interest on your digital assets, kind of like how you earn interest in fiat currency when you deposit it in a bank. When you stake crypto in a pool, you participate in the validation and continuation of a blockchain network and get paid for this work.

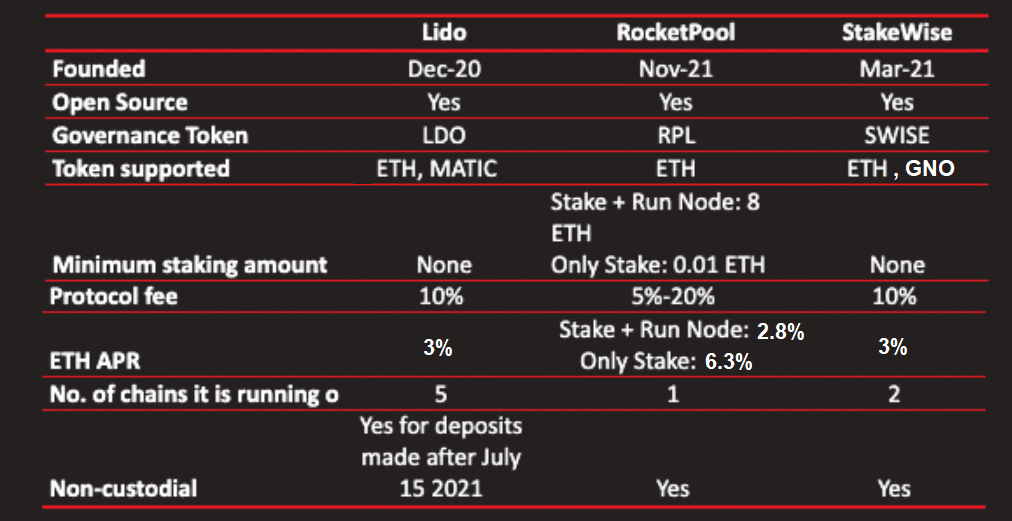

In this comparison, we examine three of the biggest liquid staking platforms for the Ethereum blockchain network: Lido, Rocket Pool, and StakeWise.

🍒 New to staking? Start here: What Is Staking and How Does It Work?

🍒 tasty takeaways

Lido is the largest liquid staking protocol in terms of total market share, offering staking on multiple blockchain networks.

Lido, Rocket Pool, and StakeWise are all well-established protocols that have demonstrated their reliability and success.

All 3 platforms have high-security standards.

Current annual percentage rates (APR) for liquid staking ether (ETH) are: Lido – 3%, Rocket Pool – 2.8% / 6.3%, and StakeWise – 3%.

All 3 protocols support self-custody staking.

Summary

| Platform | Launch Date | Market Share | APR | Minimum Stake | Security |

|---|---|---|---|---|---|

| Lido | December 2020 | 31% | Moderate | No Minimum | Regularly Audited |

| Rocket Pool | November 2021 | 2.8% | High | 0.01 ETH | Regularly Audited |

| StakeWise | March 2021 | 0.4% | Low | No Minimum | Regularly Audited |

ETH Staking Pools: Key Statistics and Facts

According to data from Dune:

Over 32 million ether (ETH) are currently being staked, which represents about 27% of the total ETH supply.

More than 1 million validators process transactions and add new blocks to the blockchain.

Staked ETH Sources: Liquid staking: 33%, centralized exchanges: 24%, staking pools: 16%

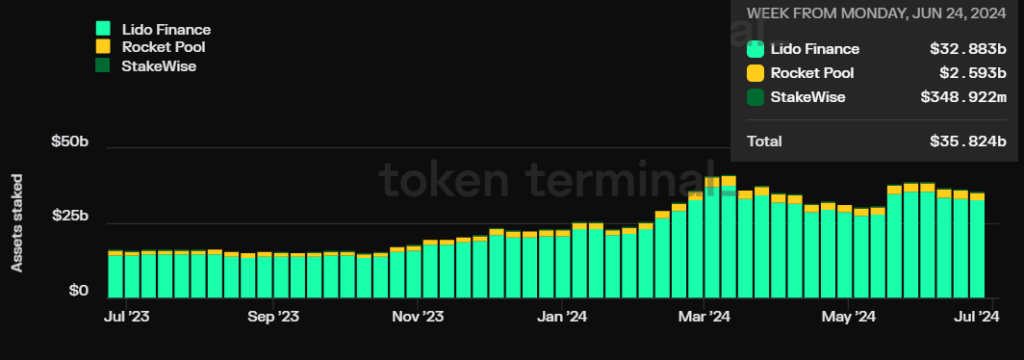

11 million out of the total 32 million ETH are currently being staked in Lido, Rocket Pool, and StakeWise. As the following chart shows, Lido holds the lion’s share of this.

Source: Token Terminal

🍒 New to liquid staking? Check out our beginner’s guide on liquid staking

What is Lido?

Lido Finance was launched in December 2020. It is an open-sourced DeFi (decentralized finance) liquid staking protocol running on 5 different blockchain networks.

Lido currently supports the staking of ETH (Ethereum) and Polygon (MATIC). Solana (SOL) was an option until February 2024.

Lidos’ market share is more than 29%, making it the largest ETH liquid staker on the market.

Lido currently offers a staking annual percentage rate (APR) of 3% for ETH, and charges a 10% protocol fee on rewards. There is no minimum amount of ETH required.

Lido offers a liquid staking token: $stETH. This token represents staked Ethereum in Lido, combining the value of the initial deposit + staking rewards.

The $stETH token can be used in Lido’s broad ecosystem, which includes more than 20 decentralized applications (dApps) such as Curve, Trust Wallet, and Yearn Finance.

The liquid staking token $stMATIC has also been integrated with a number of DeFi and CeFi applications.

📖 Read! 5 Best Ways to Stake Your Ethereum

Lido Governance Token: LDO

The $LDO token is an ERC20 token. It allows holders to vote on the decisions of different parameters of the Lido staking protocol which is governed by the Lido DAO. At its launch, 1 billion tokens were minted. At the moment 88% are in circulation.

Lido Security

Lido is regularly audited by a number of security companies and posts all the reports on its website. In the most recent audit from April 2023, 2 critical severity, 8 high severity, 17 medium severity, and 93 informal severity issues were found. These issues have either been fixed or acknowledged by the developers. Lido open-sources its code on GitHub and has a bug bounty program.

What is Rocket Pool?

Launched in November 2021, Rocket Pool is a decentralized staking protocol for Ethereum. Currently, it is running on the Ethereum network only.

As of today, Rocket Pool is the second largest liquid staking pool for Ethereum, accounting for 2.8% of the total market share.

There are two ways to stake with Rocket Pool:

Stake and run node: anyone with a minimum of 8 ETH can stake and run a node. This method offers a staking annual percentage rate (APR) of 6.3%, higher than the stake-only model.

Stake: anyone with 0.01 ETH can stake and receive $rETH tokens. More than 10 DeFi applications such as Bancor, Metamask, and Aave integrated $rETH in their services. What is special about this model is that the ETH staked is non-custodial, which means if node operators do not behave honestly, they lose their rewards. This does not affect $rETH holders. The staking annual percentage rate (APR) this model currently offers is 5.96%.

The commission fee Rocket Pool takes from staking rewards varies from 5% to 20% depending on how many node operators there are to stake ETH and how many ETH need to be staked.

Rocket Pool Governance Token: RPL

$RPL is Rocket Pool’s primary protocol token. It is used in the governance of the protocol and can also be staked on a Rocket Pool node. When it is staked, it acts as a form of insurance, basically ensuring good behavior. The more $RPL that is staked, the more rewards the node operator receives. 19.4 million tokens have been minted, all of which are in circulation.

Rocket Pool Security

Rocket Pool’s codes and smart contracts are open-source. You can find them on Rocket Pool’s GitHub. The protocol does regular security audits which they share in this overview. The most recent audit is from January 2023. 1 critical, 4 major, 7 medium, and 7 minor security issues found. These issues have either been fixed or acknowledged by the developers.

What is StakeWise?

StakeWise launched in March 2021. It is currently the eight largest liquid staking protocol.

The protocol allows for non-custodial staking and does not impose a minimum ETH stake requirement.

StakeWise’s current Ethereum staking annual percentage rate (APR) is 3%. The platform collects 10% of generated profits as a fee.

Up until 2023, StakeWise had a dual token model based on $sETH2 and $rETH2.

$sETH2 represented stakers’ deposits in StakeWise Pool on a 1:1 ratio. $rETH2 represented depositors’ ETH rewards in StakeWise Pool. In 2023, StakeWise switched to a single token model and introduce $osETH.

StakeWise Governance Token: SWISE

$SWISE is an essential part of the StakeWise DAO and is used for governance. It allows holders to vote for various aspects such as protocol fees and contract changes. $SWISE has a max supply of 1 billion tokens, of which around 26.1% are currently in circulation.

StakeWise Security

StakeWise has had several security audits carried out in the past. The last was in September 2022. At that time 0 critical, 2 medium, 6 low severity issues were found. Some of which, according to the developers, have already been fixed or are intentional functions. StakeWise codes are open source on GitHub. The protocol also has a bug bounty program.

Comparison: Lido vs. Rocket Pool vs. StakeWise

📝 If you’re interested in researching crypto projects on your own, check out the best tools for research and analysis!

FAQs

Staking pools democratize the process of staking crypto. In order to become an Ethereum validator, you need to have certain hardware and a large amount of cryptocurrency. Staking pools are decentralized protocols that pool together investors’ crypto and stake it on their behalf using the nodes of the protocol. This enables individuals to participate in staking even if they do not meet the individual requirements for becoming validators.

In classic staking, crypto is locked up in a staking pool. Liquidity staking protocols give their users tokens that represent the value of their crypto staked in a pool. Users can then use these tokens on other platforms (lending platforms, decentralized exchanges DEXs, etc).

A liquid staking derivative is a token that represents cryptocurrency currently staked in a staking pool. In Lido, tokens that represent staked ether are called $stETH tokens.

It is not possible to generalize which is the best staking pool. However, you can find the best pool for you if you consider a few important aspects of different protocols and weigh them according to your expectations and requirements:

Minimum staking amount

Annual percentage rate (APR)

Protocol fees

Custodial / non-custodial

Protocol security

Staking pools make money by charging users a fee for staking crypto on their protocols.

Yes, there are several risks when it comes to using staking pools. Some risks include faulty smart contracts, price risks, and slashing risks. To learn more about this check out our in-depth beginners’ guide on liquid staking.

Yes, Lido is non-custodial for deposits made after July 15th 2021. However, withdrawals and becoming a node operator are not permissionless at the moment.

Yes, you can stake ethereum (ETH) on Rocketpool. When you stake ETH on Rocketpool, you receive a liquid staking derivative token, rETH, that can be later redeemed for your staked crypto + rewards.

Siyu Ren Heinrich

5 years of experience in crypto research of writing practical blockchain and crypto analysis on Medium.

MSc in Computer Science, BSc in Smart Engineering, and BSc in Economics and Statistics.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences