Despite trading below its all-time high, Bitcoin is showing signs of resilience. Technical indicators, on-chain data, and anticipated events like the 2024 halving and potential SEC approval of a Bitcoin ETF indicate bitcoin (BTC) is far from dead.

Written by: Anatol Antonovici | Updated October 31, 2023

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Two years ago, Bitcoin (BTC) traded above $65,000, reaching its all-time high (ATH) of nearly $70,000 in November 2021. But with the onset of the ‘crypto winter’ in late 2021 and its continuation into 2022, its value plummeted by almost 80%. By the start of 2023, the leading cryptocurrency by market capitalization was trading below $17,000.

For months, crypto traders couldn’t see the light at the end of the tunnel – does this mean Bitcoin is dead?

This might seem like an ongoing debate for years amid every bearish market, but the truth is that this question can be relevant only if BTC collapses altogether due to a 51% attack, e.g., when quantum computers become beyond powerful. Otherwise, Bitcoin is never dead.

🍒 tasty takeaways

- As of the end of October 2023, Bitcoin’s price has doubled since the start of the year, recovering from the bursting of previous bubbles.

- The upcoming golden cross and other technical indicators suggest a bullish scenario in the coming months for bitcoin (BTC).

- The next Bitcoin halving and the SEC’s potential approval of a Bitcoin ETF are two key events to watch in 2024.

- Bitcoin leverages blockchain technology and stands as the dominant player in a unique asset class. Despite bans from China and skepticism from the traditional financial (TradFi) system, its position arguably makes it future-proof.

Summary

| Bitcoin 2024 Analysis & Predictions | |

|---|---|

| Status | Resilient with signs of a positive trajectory. |

| Price as of Oct 2023 | $33,500 after doubling since start of year. |

| Technical Indicators | Upcoming golden cross; bullish scenario forecasted. |

| Key Events in 2024 | Bitcoin halving & potential SEC approval of Bitcoin ETF. |

| Position | Dominant in unique asset class; resilient despite challenges. |

| 2024 Price Prediction | Potentially hitting $100,000 mark. |

Bitcoin Has Been Dead Before

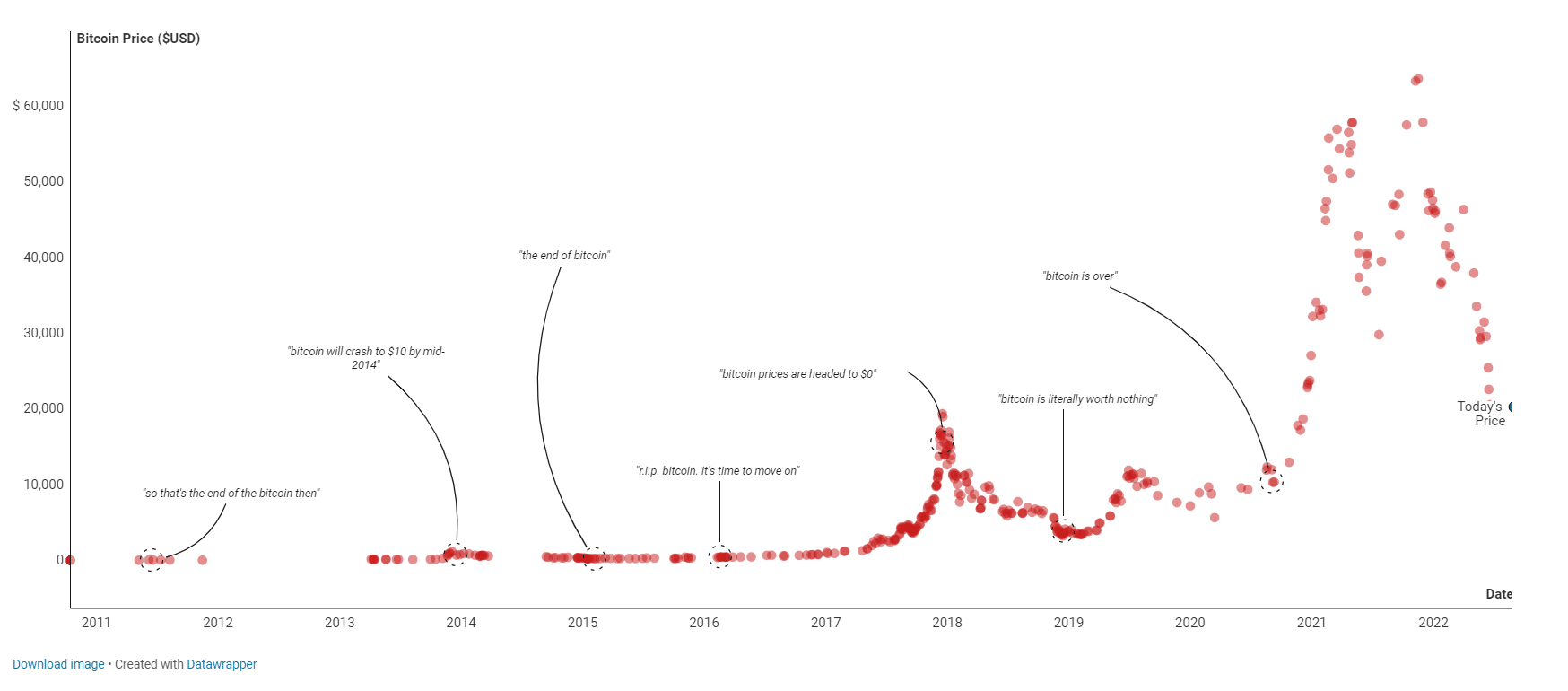

Skeptics have been consistently wrong with their predictions since Bitcoin’s inception. The cryptocurrency has been declared ‘dead’ more than 400 times, with media giants like CNBC and Bloomberg contributing dozens of those proclamations.

See the chart below for a compilation of skeptical headlines.

Source: BuyBitcoinWorldwide

Some of these headlines include:

- “The Exact Date For Bitcoin’s Final Crash To $0.00” (2014)

- “R.I.P. Bitcoin. It’s Time To Move On” (2016)

- “Bitcoin, the Biggest Bubble in History, Is Popping” (2018)

- “Bitcoin and Ethereum will go to zero” (2022).

You can check out the full list here!

Bitcoin Today

By the end of October 2023, Bitcoin’s price is trading just over $33,500. This surge followed a notable rally that started in mid-October, reaching a 16-month peak of $35,000 the last week. For context, the cryptocurrency was valued at under $25,000 as recently as mid-September.

The latest rally has helped BTC consolidate above the psychological level of $30,000 and perhaps marks the final nail in the coffin for the multi-month bearish sentiment.

Bitcoin has surged 100% this year, far surpassing the returns of the S&P 500. While there’s potential for more bullish momentum in the coming year, it’s also important to consider the possibility of a noticeable correction.

The introduction of Ordinals and Bitcoin layer 2s have helped to solidify Bitcoins dominance in 2023.

Bitcoin Analysis

Let’s now analyze Bitcoin from all sides.

Technical Analysis

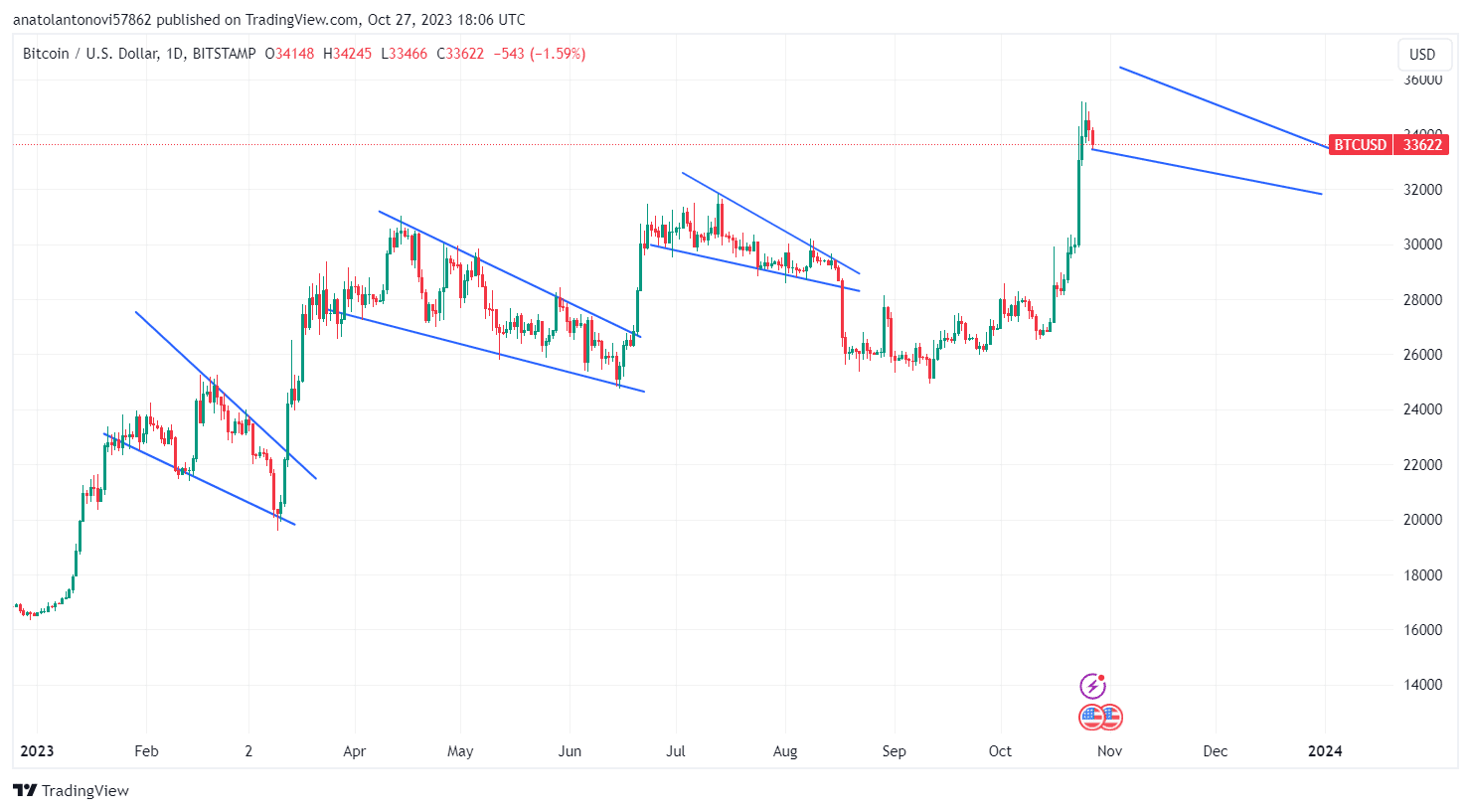

Bitcoin started the year below $17,000 and has yet to breach this level again. Interestingly, this year is marked by several so-called flag patterns, which are trend continuation chart patterns formed by a flagpole (extensive rally) and a consolidation period.

Specifically, larger timeframes display bullish flag wedges:

Source: TradingView

If this pattern continues, the latest rally might become the flagpole of another such pattern, in which case the price should update the year-to-date high very soon.

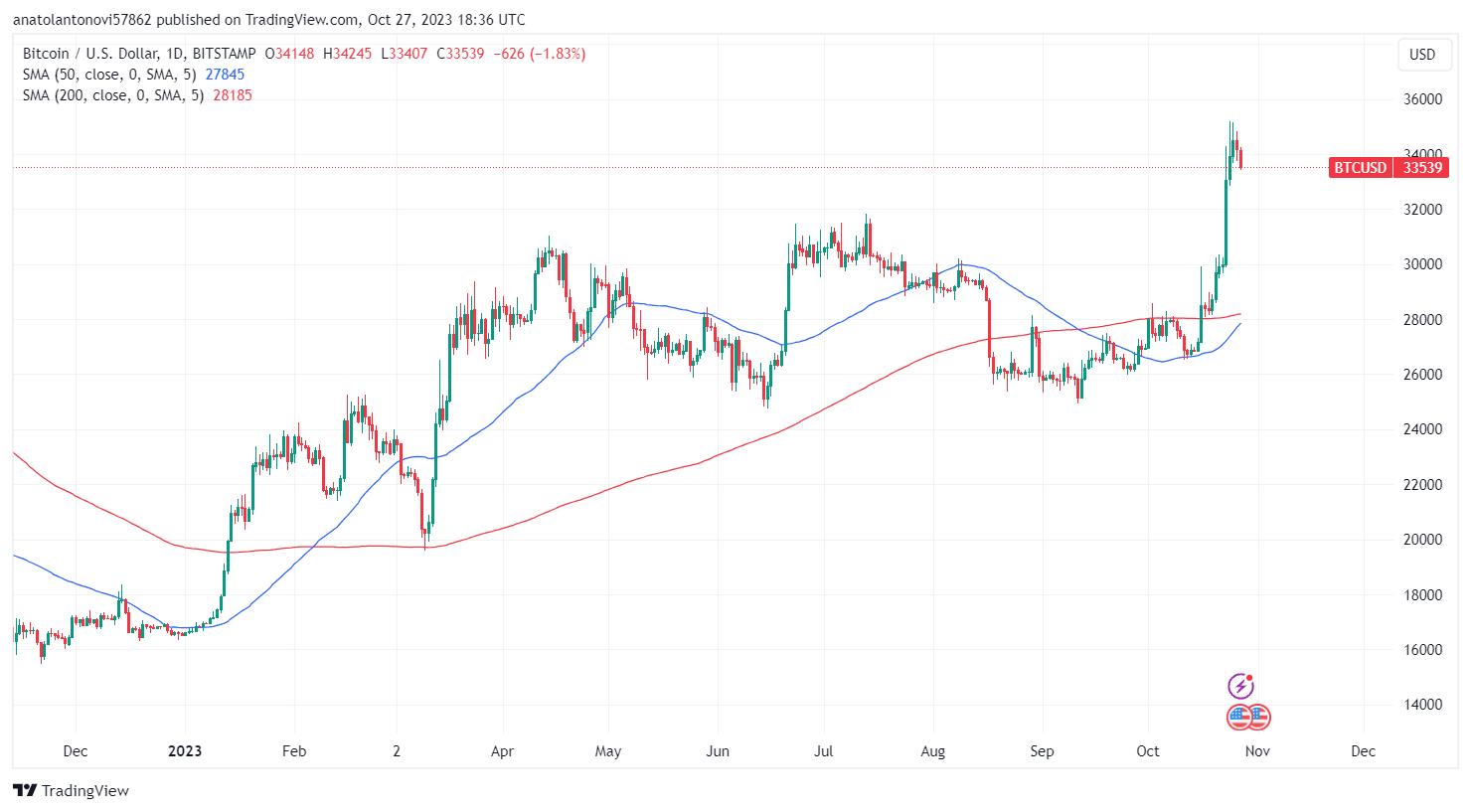

Another bullish signal is the upcoming golden cross, which happens when the 50-day moving average (MA) crosses the 200-day MA from bottom to top. The last time this happened was in February.

Source: TradingView

So far, technical analysis indicators show that Bitcoin isn’t dead but recovering.

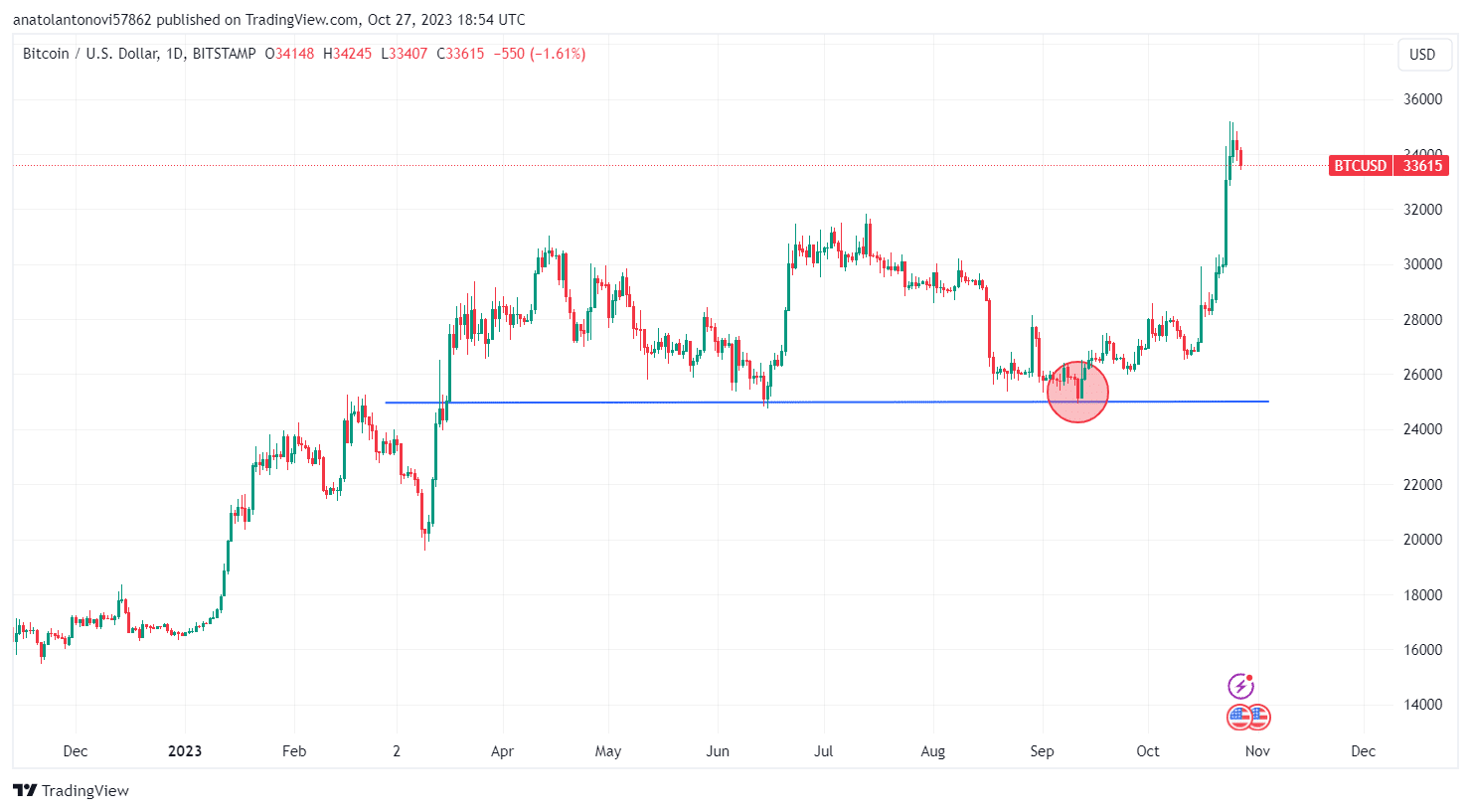

September was a crucial period for Bitcoin, as the previous two flags could be treated as a double top, which is a strong bearish pattern. If the price had broken below the pattern’s neckline, it may have returned below $20,000.

Source: TradingView

Fundamental Analysis

Let’s now look at some bitcoin fundamental analysis. In 2021, Bitcoin’s status as a store of value (SOV) was further solidified, especially in the wake of soaring inflation in developed nations such as the US and the European Union (EU). Many large investors turned to crypto as a hedge against the declining value of fiat currencies.

While Bitcoin has lost momentum in 2022 due to a series of failing crypto companies (including FTX) and central banks raising interest rates to curb inflation, the oldest cryptocurrency remains strong amid global uncertainty caused by major geopolitical tensions and conflicts.

Thanks to a deflationary model, Bitcoin’s supply is capped at 21 million, while the issuance rate is gradually declining thanks to the programmed halving, which we’ll briefly discuss below.

On-Chain Data

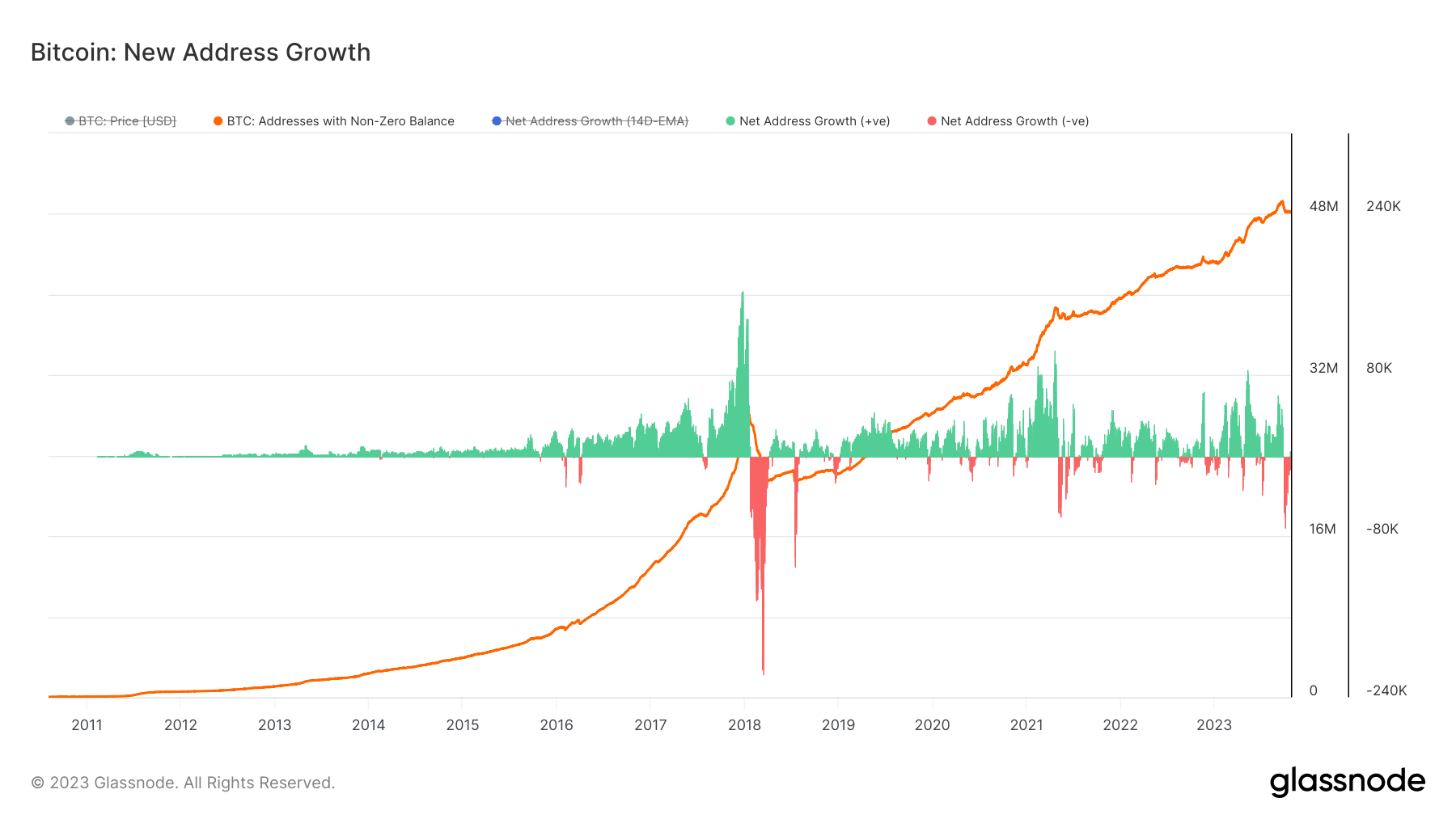

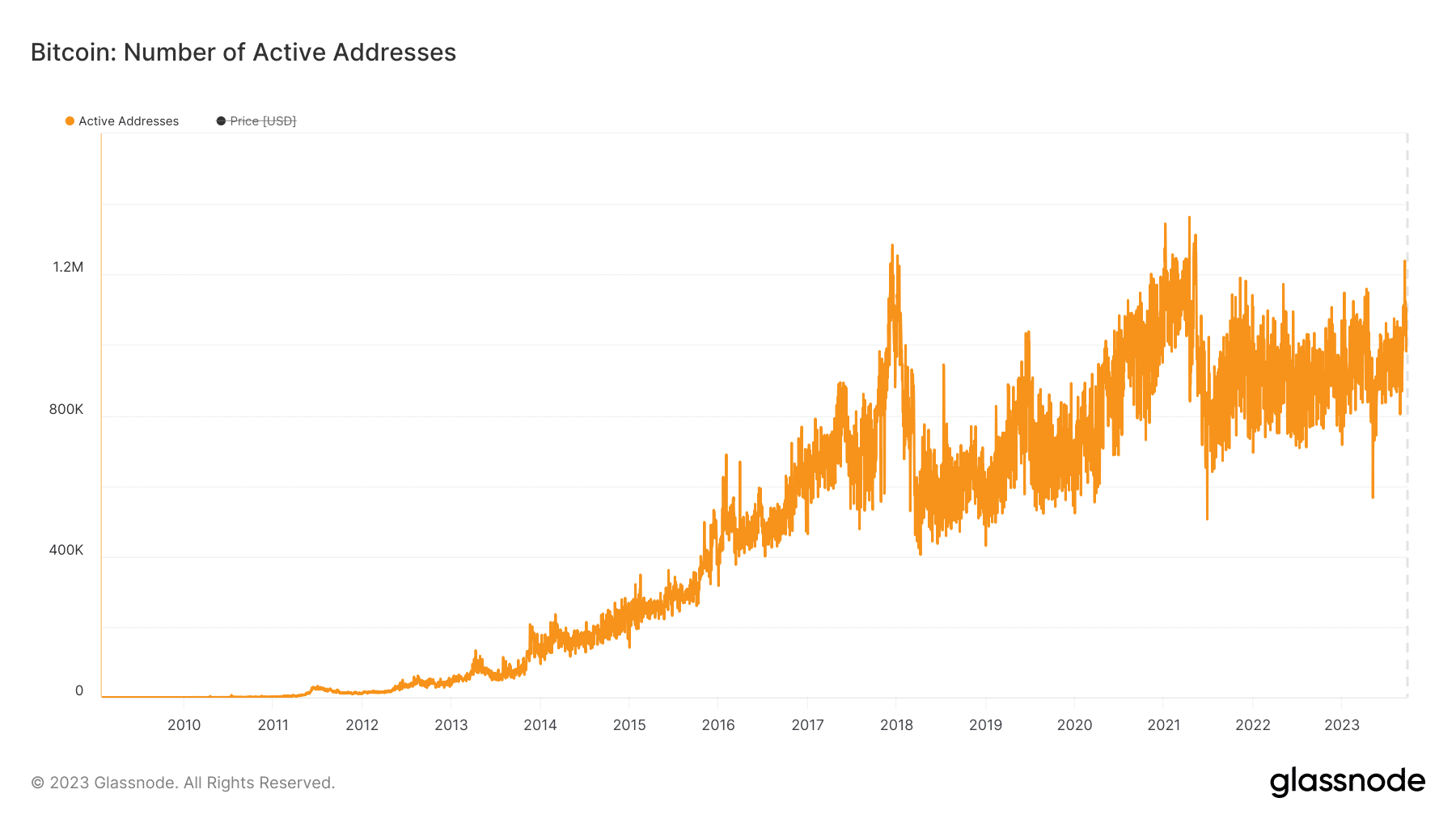

On-chain data indicates that both retail and institutional adoption of Bitcoin is steadily increasing, despite challenges. These include volatility, limited scalability, a narrow range of use cases, regulatory uncertainty, security issues associated with centralized and decentralzied crypto exchanges, and inherent complexity.

As per Glassnode data, the number of Bitcoin crypto wallet addresses with non-zero balances is about to hit 50 million. 2023 has been a very active period for new address creation.

Source: Glassnode

Meanwhile, the number of daily active BTC addresses has consolidated near 1 million, which is not far from the 2021 and 2017 peaks.

Source: Glassnode

🍒 You can check more metrics related to Bitcoin adoption here.

On-chain data doesn’t indicate that Bitcoin is dead – on the contrary, it continues to attract new investors.

What’s Influencing Bitcoin’s Price Today

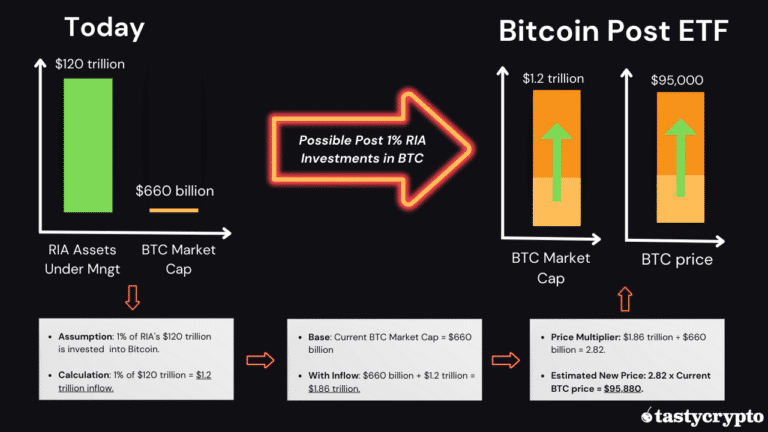

Currently, the spotlight is on the US Securities and Exchange Commission (SEC). Although the SEC has been hesitant in approving numerous Bitcoin exchange-traded fund (ETFs), there’s growing anticipation that it might greenlight one or more in 2024.

If financial giants like Blackrock, Fidelity, VanEck, ARK Invest, and Galaxy Digital secure approval, Bitcoin could see a substantial inflow of institutional funds from the US, potentially propelling its price to new heights.

For example, if RIAs invested 1% of their AUM into a spot bitcoin ETF, this would push the price of bitcoin (BTC) to over $90k, as seen below.

Additional driving factors include the underperforming traditional markets, exemplified by the S&P 500 index hitting its lowest since May, and escalating geopolitical tensions, notably the ongoing war in Ukraine and emerging conflicts in Israel.

What Can Stop a Bitcoin Rally?

Several signs suggest the Bitcoin rally currently building momentum might continue, but multiple challenges could stifle its recovery.

For starters, while Bitcoin operates without borders, global regulations vary considerably. The ongoing regulatory ambiguity in the US, a pivotal player in the crypto space, compounds these challenges. Earlier this year, Bitcoin enthusiast Chamath Palihapitiya went so far as to declare, “crypto is dead in America.”

This sentiment is echoed by major crypto entities like Coinbase and Gemini, who are debating departing the US market.

Furthermore, if the SEC continues to delay Bitcoin ETF approvals into 2024, we could see a resurgence of bearish sentiment.

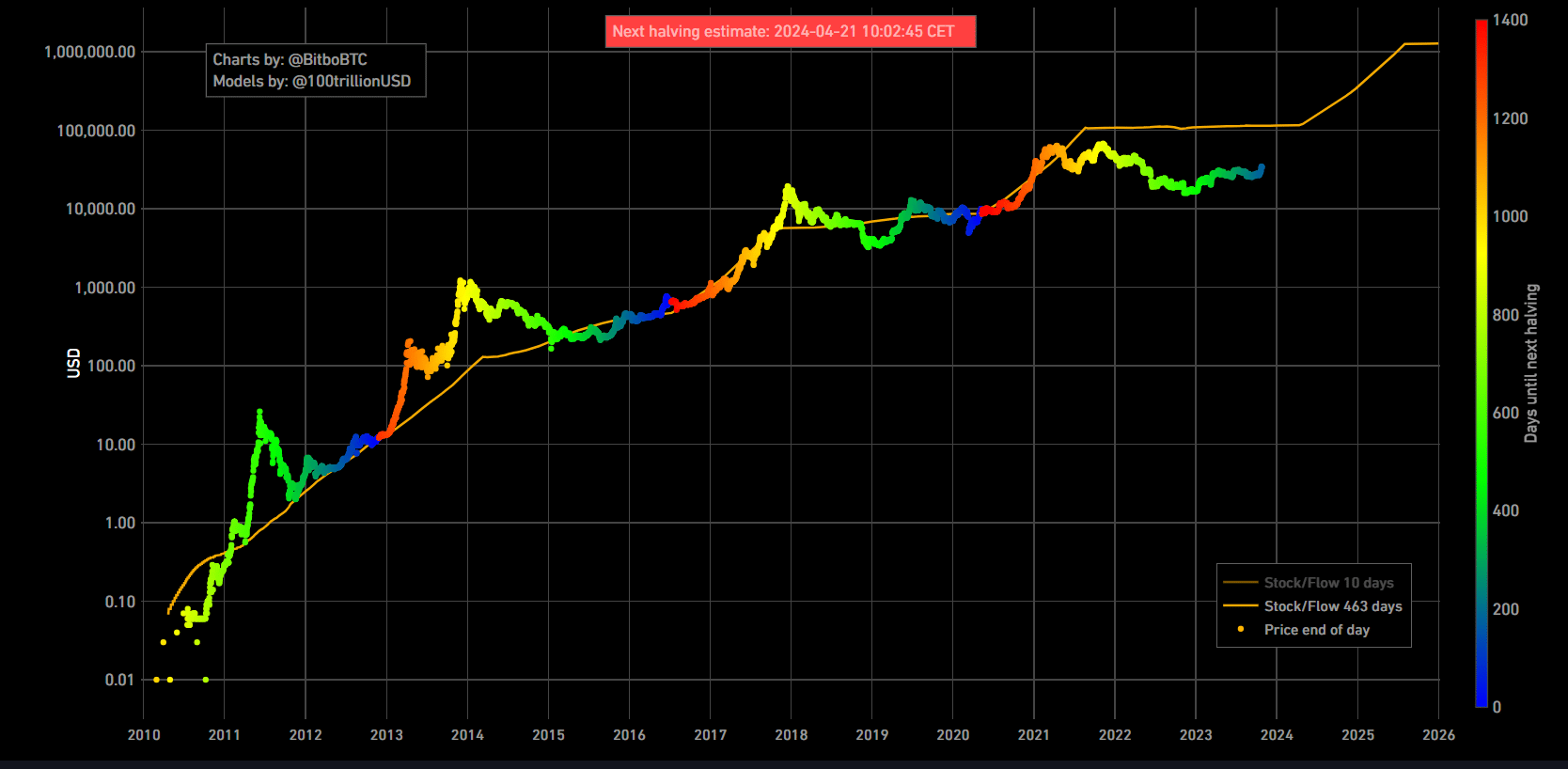

Next Bitcoin Halving & BTC Supply

The Bitcoin halving is a highly anticipated event, historically linked to bullish trends based on past occurrences. The upcoming halving is slated for May 2024, when the mining reward will decrease from 6.25 to 3.1 BTC.

🍒 For a deeper understanding of Bitcoin halving, you can read about Bitcoin halving in our article!

In essence, Bitcoin’s inflation rate will steadily decline, intensifying supply constraints.

The renowned stock-to-flow (S2F) model, which measures an asset’s scarcity, indicates that Bitcoin’s value should already be hovering around $100,000.

Although the crypto winter led to Bitcoin’s first significant divergence from the S2F projection on the downside, it doesn’t signify the end of Bitcoin.

With the upcoming halving tightening supply, there’s potential for the price to reach a new all-time high (ATH). Additionally, Bitcoin’s supply is further constricted by hodlers.

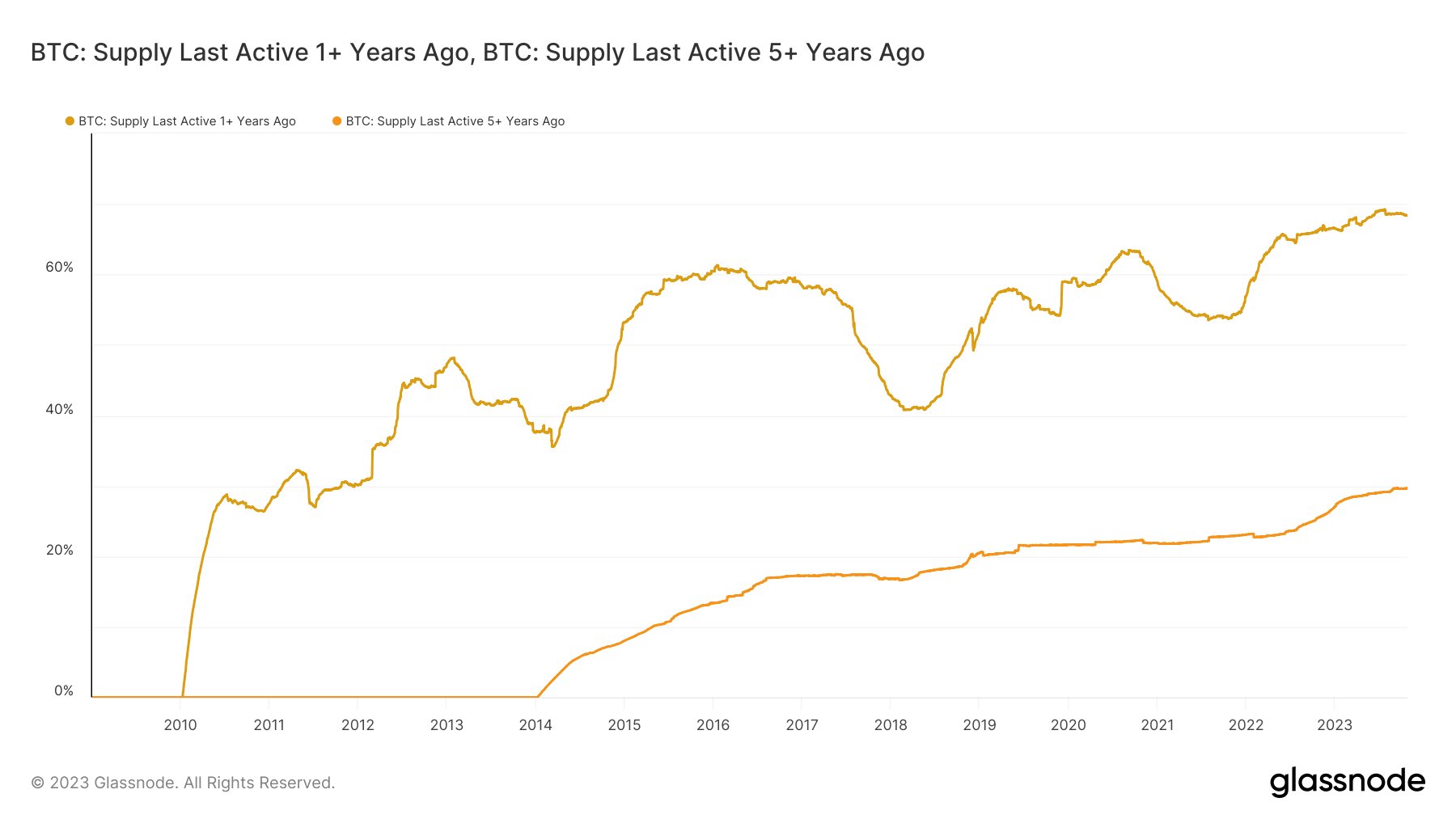

Notably, a record 70% of BTC hasn’t been transacted in over a year, and an unprecedented 30% has remained stationary for more than five years.

Source: Glassnode

2024 Bitcoin Price Prediction

After breaking above major resistance at $30,000, Bitcoin is free to extend the rally and seek to update the ATH next year and perhaps even hit the $100,000 mark.

Adamant Research expects Bitcoin to find resistance above $40,000 and eventually break the $120,000 mark after a multi-year bull market. Analysts at Standard Chartered and Matrixport are even more bullish and expect BTC to hit $100k and $125k, respectively, by the end of 2024.

Even if Bitcoin fails to update the ATH next year, it still can’t be counted as dead, as the next bullish cycle can send it to new highs due to a limited supply and increasing adoption.

FAQs

Yes – Bitcoin is a blockchain-based decentralized network secured by a large ecosystem of nodes dispersed worldwide. It has unique advantages that cannot be offered by traditional finance and even other digital assets, including true decentralization, transparency, borderless transactions without intermediaries, and censorship resistance. Additionally, the introduction of Ordinals expand Bitcoin’s use-cases to NFTs.

Most crypto experts believe Bitcoin is capable of recovering and updating the all-time high, especially after the halving event that will further tighten the supply side.

Predicting the price of Bitcoin is a difficult task, but the cryptocurrency has all the prerequisites to increase in value compared to 2023.

There are several factors that can drive the price of Bitcoin. While the supply side will be further squeezed by the halving event and hodlers, the cryptocurrency is expected to experience an inflow of institutional funds from Wall Street giants, especially if the SEC approves Bitcoin ETFs.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com