Invest in the future of the Internet with ETFs, Web3 stocks, cryptocurrencies, NFTs, AI, DeFi and the metaverse.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Web3 is poised to become the next iteration of the internet. In this article, we’ll go over the 7 best ways to get exposure to this fast-growing tech sector.

🍒 tasty takeaways

Web3 differs from Web2 in that this technology is rooted in decentralized blockchain networks.

Web3 stocks: Invest in stocks of companies building Web3 technology, such as NVDA, AMD, and IBM.

Web3 ETFs: Purchase ETFs with exposure to Web3, such as BLOK and BLCN.

Crypto Coins & Tokens: Buy digital currencies like Ethereum (ETH) and other tokens associated with Web3.

Decentralized Finance (DeFi): Participate in Web3 protocols that offer opportunities to stake crypto, lend crypto, or become a market maker to earn rewards and fees.

NFTs: Buy NFTs directly or invest in ERC-20 governance tokens of NFT marketplaces like BLUR.

AI: Invest in AI companies like Microsoft, Apple, Adobe, and Amazon that are devoting resources to artificial intelligence, which plays a significant role in Web3.

Metaverse: Add exposure to the metaverse, which is built on Web3 technology, by investing in metaverse stocks like META or through the Global X Metaverse ETF (VR).

Summary

| Investment Type | Description | Examples |

|---|---|---|

| Web3 Stocks | Invest in companies developing Web3 tech. | NVDA, AMD, IBM |

| Web3 ETFs | ETFs with Web3 exposure. | BLOK, BLCN |

| Crypto Coins & Tokens | Invest in digital currencies and tokens. | Ethereum (ETH), Others |

| DeFi | Participate in decentralized finance protocols. | Stake, lend crypto |

| NFTs | Invest in non-fungible tokens or related tokens. | BLUR, OpenSea |

| AI | Invest in AI-focused companies. | Microsoft, Apple, Adobe, Amazon |

| Metaverse | Gain exposure to the metaverse. | META, Global X Metaverse ETF (VR) |

What is Web3?

Web3 is a broad term that encompasses many different components, some of which include blockchain, AI, DAOs, the metaverse, and augmented/virtual reality.

Before we dive into our list of best Web3 investments, let’s look at a few characteristics of this rapidly growing sector.

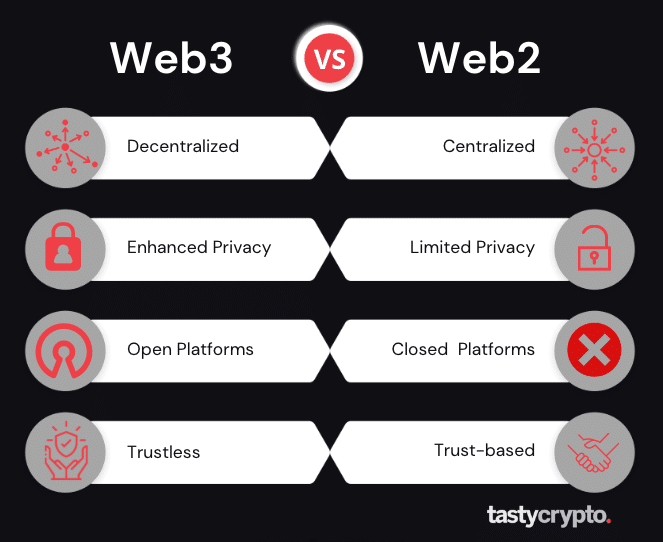

Web3 is decentralized. Web3 relies upon peer-to-peer digital ledgers or blockchain technology. This dispersion of control is in contrast to the manual process-heavy Web2 businesses that dominate the world today.

Control over your data. In Web3, your data is stored on a secure blockchain, not the servers of a centralized company. This means your data is not sold to the highest bidder (as it is today on most Web2 social media apps).

Web3 is efficient. Smart contracts streamline numerous processes that Web2 companies allocate substantial resources to.

Web3 is trustless. Web3 is powered mainly by the Ethereum network, which is a trustless blockchain. All participants in a blockchain have a say in the state of the network. Since the majority of participants will act in their best interest, bad actors will not be able to carry out their intentions.

Web3 vs Web2

Let’s now look at a few characteristics that separate Web3 from Web2.

Now that we have a better idea of what Web3 actually is, let’s look at a few of the best ways to invest in it!

1. Buy Web3 Stocks

Perhaps the easiest (although not the best) way to get exposure to Web3 is through the stock market. Let’s now look at a few companies that are heavily invested in Web3 technology.

Nvidia (NVDA)

Nvidia manufactures graphic processing units (GPUs), which are vital in the development of Web3 technology. Another popular chip manufacturer building Web3 is Advanced Micro Devices (AMD).

Coinbase: (COIN)

In order to participate in Web3, you must first own cryptocurrency. Coinbase is the largest cryptocurrency exchange in the US. Additionally, Coinbase has recently released a Web3 self-custody crypto wallet. Self-custody wallets are the gateway to Web3.

IBM

IBM is deeply invested in blockchain technology and Web3.

2. Buy Web3 ETFs

ETFs are always a great way to diversify away single stock risk. Here are a few ETFs with exposure to Web3.

Amplify BLOK

Amplify’s BLOK ETF invests in companies involved in the blockchain space. Its top holdings include Microstrategy (MSTR), GMO Internet Group (GMOYF), and Coinbase (COIN).

Siren BLCN

Siren’s Nasdaq NexGen Economy ETF seeks to track the NASDAQ Blockchain Economy Index. This ETF has a lot in common with BLOK. Its top holdings include Coinbase (COIN), Marathon Digital (MARA), and Microstrategy (MSTR). BLCN is a passively managed fund while BLOK is an actively managed fund.

Grayscale Ethereum Trust: ETH

Grayscale’s ‘ETH’ ETF seeks to passively track the performance of ether (ETH), which is the native cryptocurrency of the Ethereum mainnet. Ethereum is the predominant blockchain powering Web3, so exposure to this crypto is a must for any investor looking for Web3 exposure. It is worth noting that because of its ‘trust’ structure, Grayscale’s ETH does not track the price of ether 1×1; huge discounts often occur.

3. Invest in Crypto Coins & Tokens

If you want direct exposure to Web3 and blockchain, your best bet is to invest in the crypto market directly. This can be done by purchasing digital currencies (crypto coins and tokens).

📚 Read: Crypto for Beginners

Crypto coins represent the native currency of a blockchain network (bitcoin is the coin behind the Bitcoin network) while crypto tokens represent the currency of decentralized applications built atop a blockchain network, usually Ethereum.

Since Bitcoin does not store smart contracts, its presence in Web3 is limited. Ethereum is the single best crypto investment to make in Web3 as this blockchain validates and stores the majority of data and transactions that occur in Web3. Web3 is also being built on alternate blockchains like Solana (SOL) and scaled on layer 2s like Polygon (MATIC).

📚 Read! Layer 1 vs Layer 2 Scaling Solutions

New to crypto investing? Check out our list of free research tools here!!

Most Popular Crypos by Market Cap

Here are the most popular crypto coins according to CoinMarketCap:

Bitcoin (BTC)

Ether (ETH)

BNB (BNB)

Solana (SOL)

And here are the most popular tokens in the DeFi space: according to DeFi Llama:

Lido (LIDO)

Aave (AAVE)

Maker (MKR)

Uniswap (UNI)

📚 Read: 11 Best Defi Crypto Coins to Buy In 2023

How to Buy Crypto

tasty offers users two ways to invest in ETH (and other cryptos!):

Buy crypto on the tastytrade platform

Buy crypto on the tastycrypto self-custody wallet

Note: When you store your crypto in a self-custody wallet, you alone have access to your private keys. Storing crypto in a self-custody wallet also gives you access to hundreds of different tokens and allows you to interact with decentralized applications, or dApps!

Some of the most popular Web3 tokens to buy power decentralized finance, or ‘DeFi’ protocols. Let’s learn about DeFi next!

4. Invest in DeFi

DeFi (decentralized finance) is revolutionizing the way the world interacts with money. Like all blockchain activities, DeFi is run by smart contracts that operate on a peer-to-peer ecosystem.

If you have a self-custody wallet, you can participate in financial activities usually reserved for the elite. Here are just a few ways you can make money in DeFi:

Stake crypto: If you own a proof-of-stake crypto (like ether) you can stake this crypto and earn rewards. Staking helps to validate transactions and allows blockchains to advance. Staking rates are usually paid in an ‘API’, and work a little like interest being paid in a bank account.

Lend crypto: DeFi protocols like Aave allow investors to lend out their crypto to other participants in ‘pools’. Crypto lenders are paid an interest rate usually far superior to lending rates at traditional banks for lending crypto.

Become a market maker: In DeFi, anyone can be a market maker by depositing two cryptocurrencies into a ‘liquidity pool’. As traders buy and sell from your designated pool, you earn passive income in fees.

5. Invest in NFTs

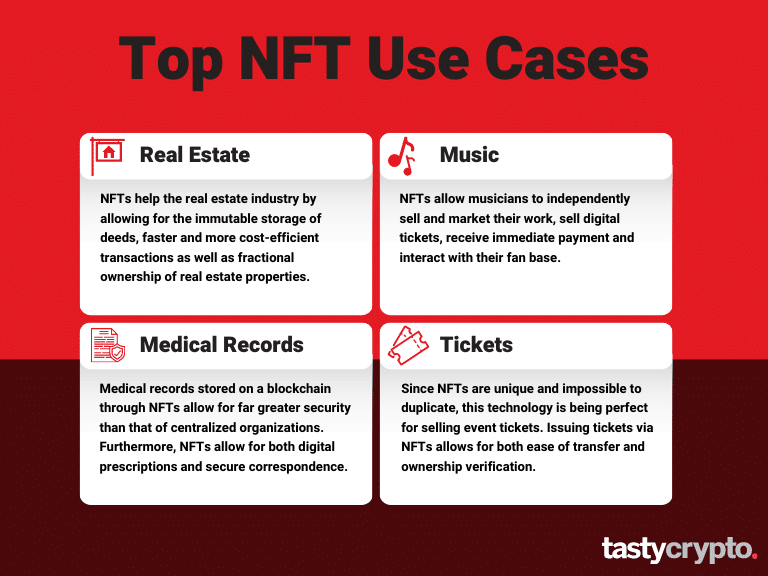

Non-fungible tokens (NFTs) are non-interchangeable, representative digital assets that are stored on a blockchain network that can not be copied. Most people associate NFTs with digital art collections like Bored Ape Yacht Club and CryptoPunks.

However, the use cases of NFTs extend far beyond art.

In order to invest in NFTs, you’ll first need to connect your self-custody wallet to an NFT marketplace, like OpenSea, LooksRare or Blur.

🤔 New to self-custody? Download our wallet today and explore the Web3 ecosystem for free!

If you don’t want to buy NFTs directly, you can still get exposure to this space by buying the ERC-20 governance tokens of NFT marketplaces, like ‘BLUR’.

6. Invest in AI

In 2024, artificial intelligence is playing a major role in the evolution of Web3. Here are a few mega market cap companies that are devoting significant resources to the advancement of AI.

Microsoft (MSFT)

Apple (AAPL)

Adobe (ADBE)

Amazon (AMZN)

- Artificial Superintelligence Alliance (ASI); former FET token.

- Render (RNDR)

- Injective (INJ)

- Bittensor (TAO)

- The Graph (GRT)

7. Invest in the Metaverse

Web3 is the foundational technology upon which metaverses are built. Therefore, no Web3 portfolio would be complete without some metaverse exposure.

Metaverse Stocks:

Meta Platforms (META)

Meta Platforms, Inc., formerly named Facebook, has been making huge (some say reckless) investments in the metaverse. If this bet pays off, their stock should do well.

Metaverse ETF (VR)

Global X’s Metaverse ETF (VR) invests in companies positioned to benefit from the development of the Metaverse.

Metaverse Tokens

You can easily invest in metaverse tokens with the tastycrypto self-custody wallet. Here are a few popular ERC-20 tokens in this space.

Internet Computer (ICP)

Decentraland (MANA)

ApeCoin (APE)

The SandBox (SAND)

Additional Reading

- CoinLedger: How to Invest in Web3: Investor’s Guide 2023

- 101 Blockchains: Know the Risks of Web 3.0

FAQs

You can not directly buy Web3. The best way to get exposure to Web3 is through cryptocurrencies like ether (ETH) or ETFs like Amplify’s ‘BLOK’ ETF.

The best crypto to buy for Web3 is ether. This is because Web3 is predominately built on the backbone of the Ethereum network.

Some ways to make money from Web3 include trading cryptocurrencies, staking crypto, investing in NFTs, and participating in DeFi activities.

Web3 is the latest iteration of the web and incorporates cryptocurrency in its ecosystem.

Web3 is decentralized and is therefore owned by all parties that participate in it. There is no single central entity behind Web3.

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences