The post-pandemic increase in the cost of living has highlighted the need for inflation-proof assets. In this article, we picked the best investments that can protect you from inflation.

Written by: Anatol Antonovici | Updated June 11, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

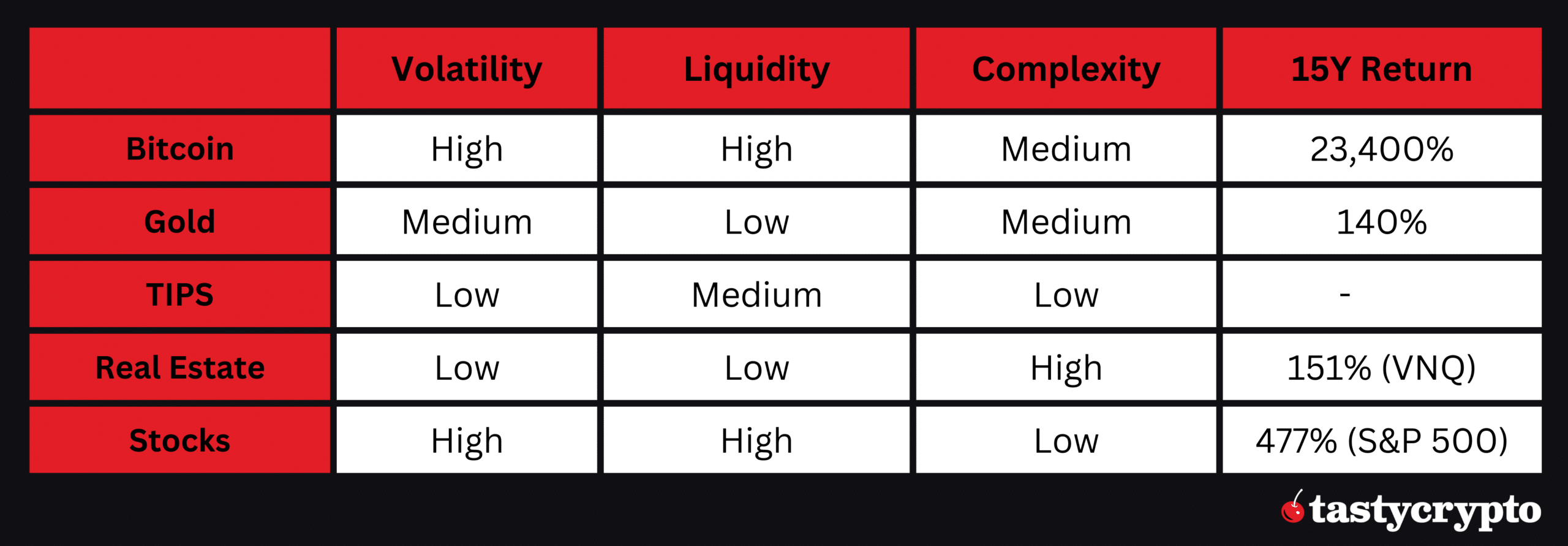

The best inflation-proof investments are Bitcoin, gold, real estate, stocks, and TIPS. In this article, we’ll explore every one of these asset classes.

Table of Contents

🍒 tasty takeaways

Inflation is an inherent part of the modern economy, making inflation-proof investments indispensable.

The best assets to beat inflation include Bitcoin, gold, real estate, stocks, and TIPS.

Crypto and stocks can provide the highest inflation-adjusted returns.

Summary

| Investment | Details |

|---|---|

| Bitcoin | The oldest cryptocurrency, now seen as a store of value due to its programmed scarcity and robust blockchain technology. |

| Gold | The oldest inflation hedge, effective for long-term value preservation, with significant gains over the last 15 years. |

| TIPS | Treasury Inflation-Protected Securities, offering a safe option with interest rates that rise with inflation. |

| Real Estate | Fundamental asset that performs well during high inflation, with REITs providing an accessible investment option. |

| Stocks | Can provide high inflation-adjusted returns, especially when diversified and combined with other assets like crypto. |

Catching Up with Inflation

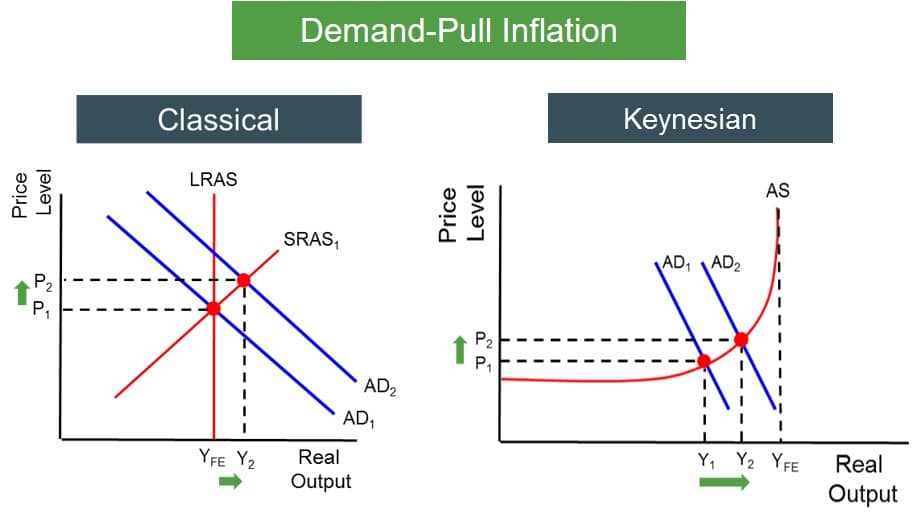

Inflation is an inherent part of modern economics, partially due to the influence of Keynesian theories, the main idea of which is to stimulate an economy by driving demand with new capital. The US first implemented this approach to escape the Great Depression in 1929.

Source: EZY Education

Friedrich Hayek was a major opponent of the economic solutions proposed by John Maynard Keynes, being concerned about the lasting impact of inflation.

From Gold-Pegged USD to Fluctuating Fiat

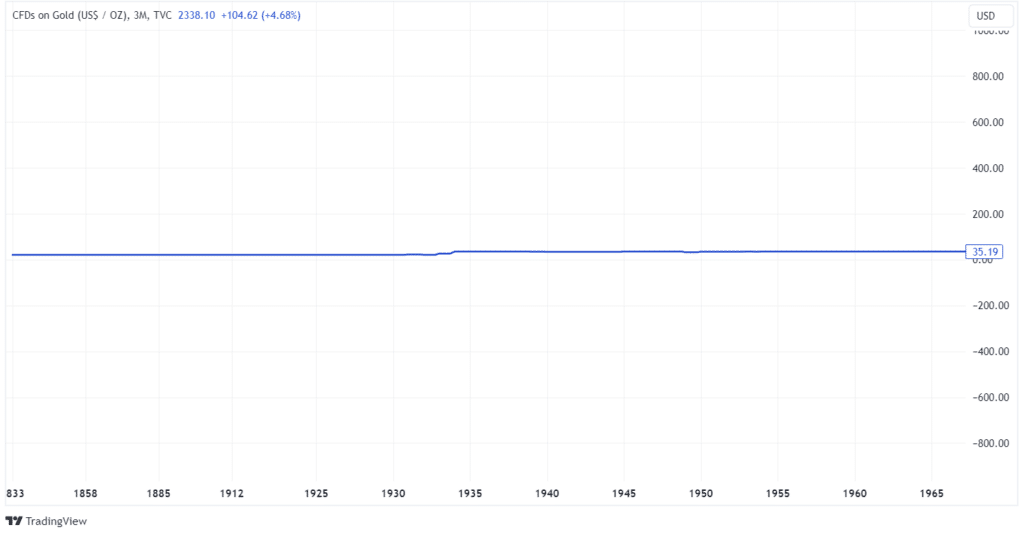

Although the US adopted Keynesian principles, the Bretton Woods agreement tied its hands by pegging the dollar to gold, limiting how much money could be printed. This changed with the Nixon Shock in 1971, when the USD became a floating currency backed by nothing, with demand for oil filling the void.

Since then, holding cash has meant losing value, and investors are constantly pressured to seek assets that could beat inflation. It’s not like the old days when 1 dollar had the same purchasing power after more than 100 years, as reflected in the past performance of gold:

Source: TradingView

Now let’s discuss the best investment assets for an inflationary environment.

1. Bitcoin

Bitcoin is the oldest cryptocurrency but represents the newest asset class. While it was meant to be a peer-to-peer money system, it has gradually turned into a store of value (SOV) asset.

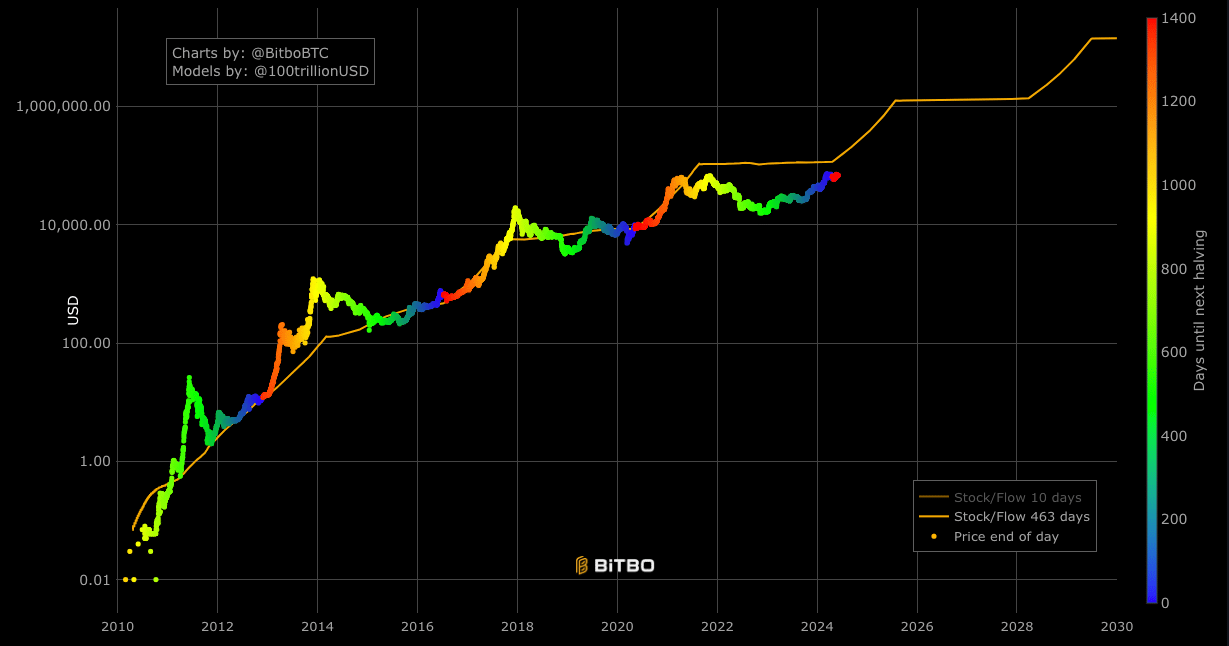

Despite its high volatility, Bitcoin has been proposed as an inflation hedge mainly due to its programmed scarcity. With a fixed maximum supply of 21 million coins and a low issuance rate, the crypto coin is one of the scarcest assets out there.

Another important aspect is that Bitcoin is backed by robust blockchain technology, which makes it unbreakable.

While it’s too early to assess Bitcoin’s inflation hedge potential for the long term, the digital currency has performed well in the medium term, as shown by the stock-to-flow model (S2F), which we mentioned earlier.

2. Gold

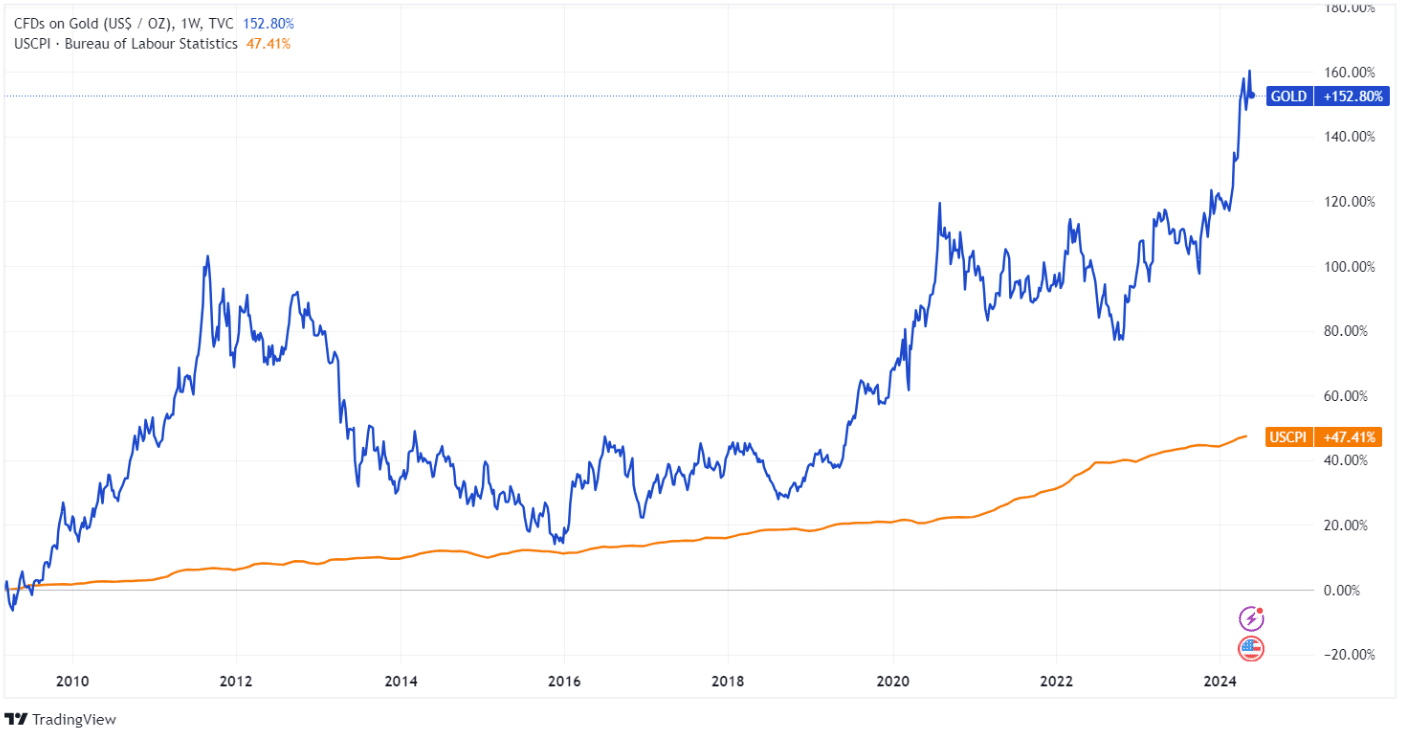

Gold is the oldest inflation hedge, but contrary to popular belief, the precious metal may fail to protect from inflation in the short term. It remains a viable option for preserving value over a longer duration.

You can read our comparison between Bitcoin and gold as an investment strategy for mitigating the effects of inflation.

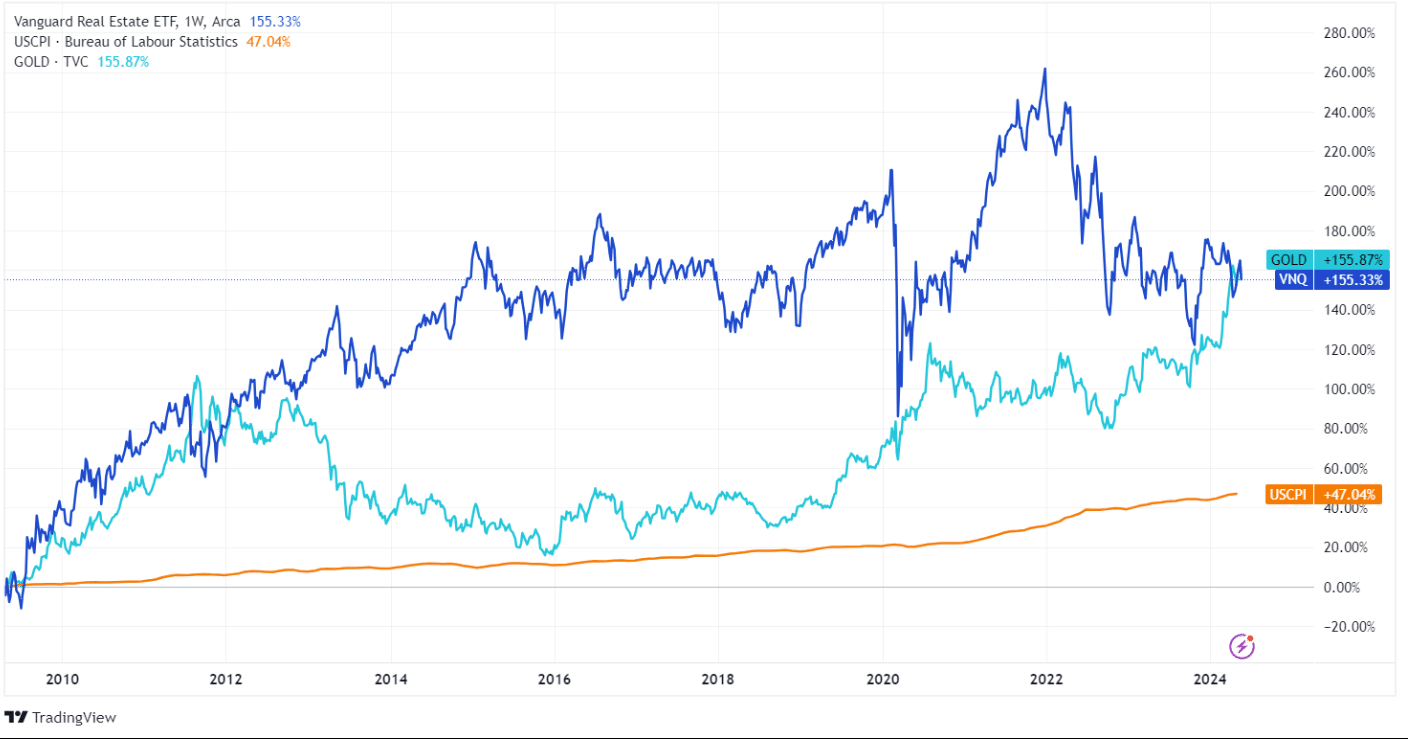

Recent data shows that gold has been able to beat the rate of inflation over the last 15 years. Since 2009, the US Consumer Price Index (CPI) has increased 47%, while the yellow metal has gained over 150%.

Storing physical gold or holding Bitcoin in a digital wallet requires special considerations, but traditional investors can gain exposure through exchange-traded funds (ETFs). Gold investors can also buy mutual fund shares.

3. TIPS

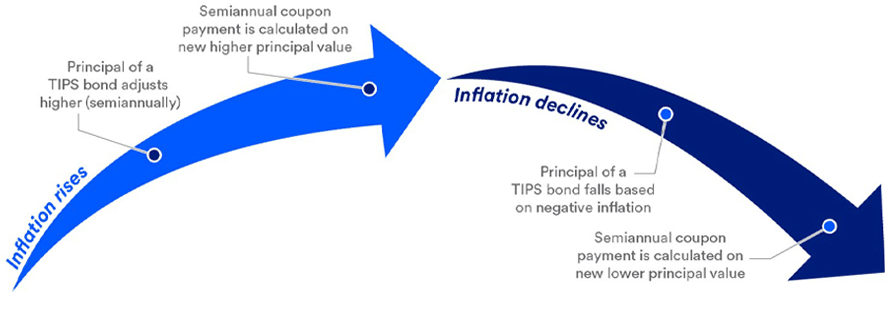

Treasury Inflation-Protected Securities (TIPS) are one of the safest options to protect from rising inflation. This fixed-income product is suitable for investors with low risk tolerance.

TIPS are treasury bonds that pay higher interest rates when inflation goes up, and vice versa. Their rates move in tandem with the CPI, offering an inherent inflation hedge.

Source: US Bank

TIPS are usually long-term bonds, being issued in 5, 10, and 30-year maturities. As a rule, they pay interest twice a year at an interest rate fixed at auction.

4. Real Estate

Housing is one of the most fundamental assets, which makes property perform well during high inflation. However, investing in property is difficult due to complexity and low liquidity.

REITs

One of the best approaches is to buy into real estate investment trusts (REITs), which are companies owning and operating income-producing properties, predominantly commercial properties. They are required to share 90% of their income with investors, paying generous dividends that keep up with higher inflation.

While there are hundreds of REITs, retail investors can allocate to an index fund, such as the Vanguard Real Estate ETF (VNQ).

Interestingly, VNQ shares have an inverse relationship with gold on large timeframes and a direct relationship on short-term charts, yet both beat inflation in the long run.

Source: TradingView

5. Stocks

While the stock market may suffer during sudden spikes in inflation rates, individual stocks can not only beat rising prices but offer inflation-adjusted returns.

Crypto assets and stocks can provide much higher returns than gold, raw materials, and bonds. However, the risks are also higher, and the best investment approach is diversification.

The good news is that it has never been easier to invest in stocks. There are dozens of brokerage firms offering low-cost trading options, user-friendly technology, and educational support.

Thanks to Bitcoin ETFs, you can now build an investment portfolio that combines crypto with stocks. Several crypto portfolio trackers support company shares, making it easy to build a diversified portfolio that combines the return potential of crypto with the stability of large-cap stocks.

FAQs

What is the cause of inflation, and how does it affect the economy?

Inflation is an inherent part of the economy as part of the monetary policy set by most central banks, including the Federal Reserve, which aims to maintain low and stable inflation rates. While a targeted inflation of 2% can drive demand and help the economy, higher inflation affects the cost of living.

What is the best investment to beat inflation?

Treasury Inflation-Protected Securities (TIPS) are the safest assets that keep up with inflation, but they don’t provide significant returns. Other inflation hedges include Bitcoin, gold, real estate, and stocks.

Do certificates of deposit (CDs) make sense in an inflationary environment?

CDs may not be the best choice during high inflation scenarios, as they usually don’t keep pace with increasing inflation. Even high-yield savings accounts may fail to protect against surging inflation.

Is Bitcoin a good hedge against inflation?

Bitcoin is a promising inflation hedge but not in the short-term. The cryptocurrency can show wild fluctuations, making active portfolio management a demanding task. However, holding Bitcoin for years can preserve value.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com