Most financial professionals agree that every investment portfolio should have some exposure to cryptocurrency. In this article, we’ll tell you why a 1% allocation may be ideal.

Written by: Mike Martin | Updated June 14, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Should you have crypto in your portfolio? If so, how much crypto should you have? Is crypto simply too risky to invest in? In this article, we’ll answer all your crypto investing questions!

🚨 Crypto is a broad term. When we say ‘crypto’ we refer to all digital assets with utility. In this ideal portfolio, bitcoin (BTC) and ether (ETH) have the highest overall weight (at least 50%) while a large basket of other altcoins represents the rest.

🍒 tasty takeaways

Even if you’re not well-versed in cryptocurrency, financial theory suggests that established digital assets like bitcoin and ether should be part of your investment portfolio due to their low correlation to traditional assets.

Interestingly, if you’re invested in a 401k, you might already have indirect exposure to cryptocurrencies.

Besides holding crypto, you can aim for higher returns by participating in DeFi activities, such as lending, liquid staking, and yield farming.

Regardless of whether you like crypto or even understand blockchain technology, financial theory suggests that popular cryptocurrencies like bitcoin and ether (Ethereum network) should have a place in your portfolio.

Indeed, if you have a 401k account, you probably already have crypto exposure without even knowing it: it has been estimated that nearly half of the 25 largest companies in the S&P 500 have crypto ties!

So how much crypto should you have? Let’s look at what some experts say, then figure out how much crypto should really be in your portfolio!

🍒 New to crypto? Check out our Guide: What is Cryptocurrency and How Does it Work?

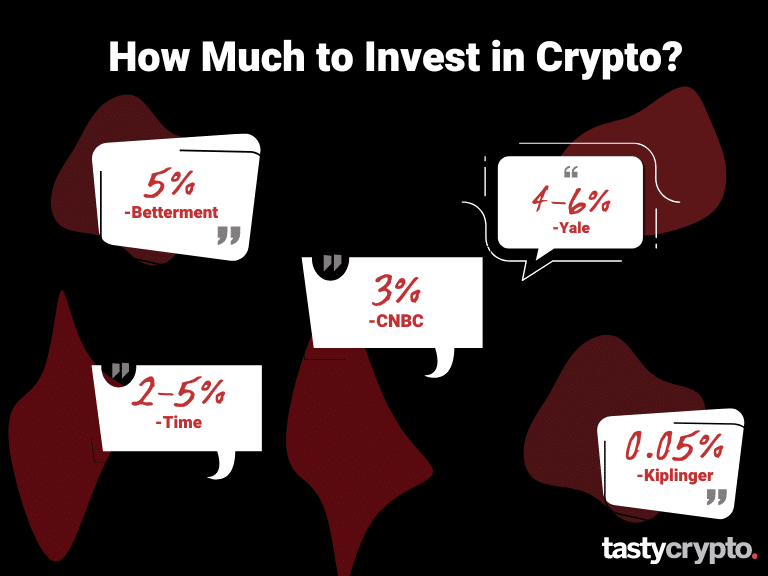

How Much Should I Invest in Crypto?

Betterment: 5%

“…we recommend investing 5% or less of your investable assets (your investable cash, stocks, bonds, mutual funds, exchange-traded funds, etc.) in crypto.”

Betterment staff

CNBC: 3%

“No more than 3% of their portfolio.”

Anjali Jariwala – certified financial planner & CPA

Time: 2-5%

“Investors who are interested in crypto should have between 2 and 5% of their net worth…” –

Vrishin Subramaniam – financial planner

Yale: 4% to 6%

Kiplinger: 0.05%

“…from the model’s standpoint 0.5% should be your starting allocation.”

Adam Grealish Head of Investments, Altruist

Modern portfolio theory suggests most of these (antiquated) preferred allocations may be too high given crypto’s diminished market cap of 1 trillion.

Let’s next find out why, and determine how much of your portfolio should really be in crypto assets next!

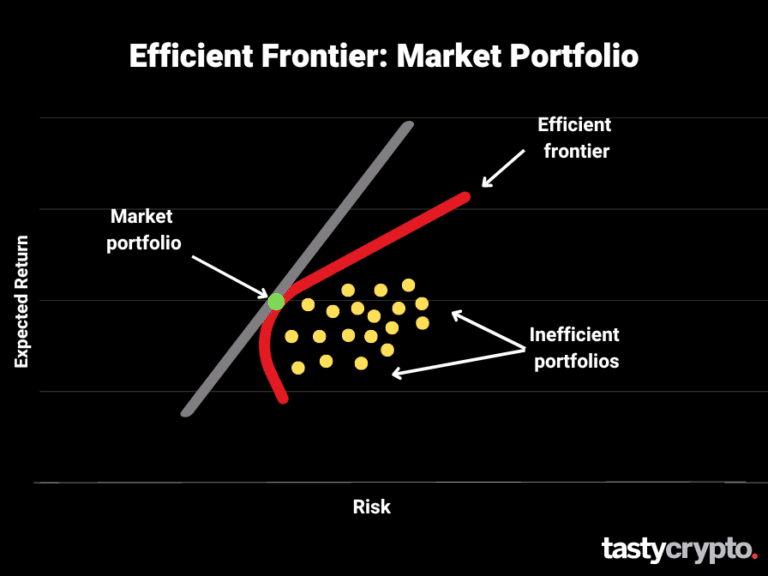

Modern portfolio theory, created by Harry Markowitz in 1952, is a portfolio construction theory that illustrates how risk-averse investors can maximize returns by holding a diversified portfolio of non-correlated assets.

“Diversifying sufficiently among uncorrelated risks can reduce portfolio risk toward zero”

— Harry Markowitz

The idea behind MPT is simple (and counter-intuitive!): the more non-correlated assets you add to your investment portfolio (both high-risk and low-risk) the lower the risk your portfolio has. MPT is very popular among modern financial advisors, CFPs and money managers.

So what’s crypo’s correlation to other asset classes? Let’s find out!

Crypto and Stock Market Correlation

The correlation between cryptocurrencies and the US stock market is in constant flux. Historically, there was little correlation between these two asset classes.

However, since 2021, that correlation has indeed increased. For MPT, this recent price action does not argue a very good case for cryptocurrencies (why not just invest in stocks?).

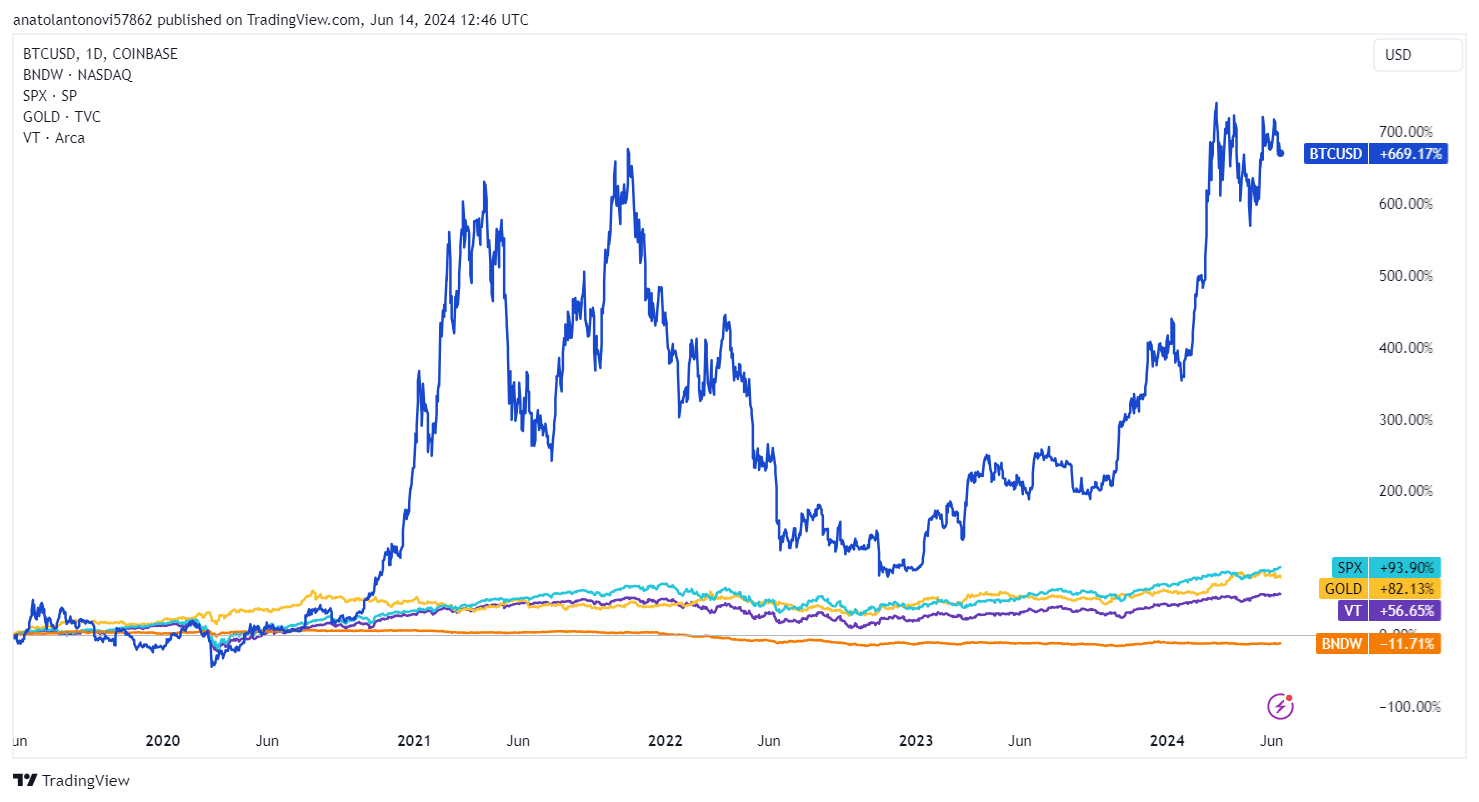

However, since the beginning of 2023, the crypto market has untethered itself from the stock market. Here’s where we’re at so far through 2024:

Gold (GLD): +13%

All global bonds (BNDW): -0.9%

S&P 500 (SPY): +14.6%

All global stocks (VT): +10.6%

Bitcoin (BTC): +58%

Let’s now visualize the five-year performance of these various assets.

BTC vs Stocks vs Bonds vs Gold: 2024

Bear in mind that bitcoin is one of the least volatile cryptocurrencies in existence. Therefore, the majority of cryptos are even less correlated to the different asset classes listed above.

Now that we understand MPT, let’s engage this theory by incorporating the ‘market portfolio’ in order to understand why cryptocurrencies like bitcoin (BTC) and ether (ETH) – assuming the historic non-correlation trend continues – should find a home in your portfolio.

Cryptocurrencies and The Market Portfolio

The market portfolio is a portfolio that includes within it every type of asset in the investable universe, including cryptocurrency. Every single asset in this portfolio is weighted to its presence in the overall market.

Here’s what William Sharpe, inventor of the ‘Sharpe Ratio’, said about this portfolio:

“In the CAPM, the market portfolio will have the greatest possible Sharpe Ratio and hence be the best investment.”

— William Sharpe

The best portfolio, therefore, will be the one that is the most diversified across all asset classes, including crypto.

Indeed, it will be impossible to include every investable asset in a portfolio (real estate, art, precious metals, etc.).

Since most investors have the majority of their portfolio in the stock market (like myself), let’s compare the global valuation of these traditional assets to cryptocurrencies:

Global Stock Market Market Cap: 111 trillion

Cryptocurrency Market Cap: 2.4 trillion

Therefore, when only looking at stocks (the fixed income market is huge), the ideal ‘weighted’ portfolio will have ~1% of its value in cryptocurrency given today’s valuation.

📕 Read! Crypto Glossary for Beginners

Crypto and the Black-Litterman Model

We learned that the current market cap for crypto is ~2.4 trillion. In years past, this valuation was as high as 3 trillion. If you like bitcoin (BTC) at 70k, you must love bitcoin during the downturns, such as the bearish market during the ‘crypto winter’ in 2022.

This introduces us to the Black-Litterman Model.

The Black-Litterman Model introduces plasticity into dogmatic financial models, such as CAPM and MPT. It accomplishes this by incorporating the convictions of investors into their investing decisions.

This would permit an investor to raise their crypto allocation higher than previous models indicate, making it rational for an investor to raise their crypto allocations during opportunistic times.

“How much should you invest in crypto? Whatever you’re comfortable with. If I had to give you a number, I would safely say 1%”

— Ryan Grace. Head of Digital Assets - tastycrypto

Ultimately, how much you invest in crypto will rely upon your risk tolerance and conviction in crypto.

Crypto: The Greatest Risk is Not Investing

We all know people who keep their retirement accounts in safe, fixed-income securities, or even cash. They do this because they are risk-averse. However, the greatest risk of (thoughtful) investing is not investing at all.

The S&P 500 has returned ~11% per year since 1957. A retirement saver who never invested in the stock market in the 1950s would have had to work years, if not decades, longer than a lifelong stock market participant.

When we are talking about cryptocurrency, the same is true. Regardless of your convictions (not to contradict the Black-Litterman model!), cryptocurrency has great upside potential. Not participating in this space could leave you trailing your peers and delaying retirement.

That isn’t to say you should invest a lot in crypto, a small amount will suffice (and satisfy your FOMO).

I Still Don’t Like in Crypto!

Still disagree?

Let’s make a bet.

I have a quarter on my thumbnail and I’m about to flip it.

If the coin lands on heads, I will pay you $300. If the coin lands on tails, you pay me $100.

Would you take that bet? Most people would. The upside in crypto far outweighs the downside. It is not unreasonable to say bitcoin will reach 70k again, more than tripling its current price.

Crypto and DeFi

There are other ways to participate in crypto rather than simply owning coins and NFTs outright.

Decentralized finance (DeFi) opens worlds of possibilities for investors to earn yield. DeFi is accessed through decentralized apps (dApps). In order to connect to a dApps, you will need a self-custody wallet, like the tastycrypto wallet!

Here are just a few ways you can earn yield in DeFi:

Stake crypto (Lido dApp)

Lend crypto (Aave dApp)

Provide liquidity and earn fees (Uniswap)

🍒 Part Two: Here’s How to Diversify Your Crypto Portfolio

Learn More About Crypto

Here are a few articles that may help to get you started on both crypto and its foundational technology, blockchain.

🚨 Warning! I have yet to meet a person who remains skeptical about blockchain and crypto after taking the time to learn about concepts like smart contracts and decentralized finance.

FAQs

Crypto ETFs are not worth it. This is because they perpetually shed value as the underlying futures that comprise them must be rolled. The best way to access crypto is to buy it directly through an exchange or a self-custody wallet.

With the current market cap of crypto at 1 trillion, investors should have 1% of their portfolio in crypto.

Yes, it is risky to put all of your money in crypto. Cryptocurrencies help to diversify a portfolio. Putting all your money into crypto could prove catastrophic.

The ideal crypto portfolio will have bitcoin (BTC), ether (ETH), and whatever altcoins you believe in.

Crypto ETFs are not worth it. This is because they perpetually shed value as the underlying futures that comprise them must be rolled. The best way to access crypto is to buy it directly through an exchange or a self-custody wallet.

🍒 tasty reads

What Is a Crypto Whitepaper? 5 Things to Look For

Crypto Fundamentals to Pick Winning Trades

Here’s How to Diversify a Crypto Portfolio

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.