Fetch.ai is an Ethereum-based blockchain and AI platform that simplifies the automation of tasks such as flight booking or parking space reservation through its decentralized machine learning applications.

It offers an ecosystem with tools for building and deploying AI services, powered by an Ethereum token (FET), across four key layers: AI Agents, the Agentverse, AI Engine, and Fetch Network.

Written by: Anatol Antonovici | Updated April 10, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Fetch.ai is a leading crypto AI ecosystem powered by its native cryptocurrency, FET. Is it a good time to get exposure to Fetch? Let’s find out! 🏃

Table of Contents

🍒 tasty takeaways

Fetch.ai is a decentralized AI ecosystem that enables users to create and deploy AI agents to automate various tasks.

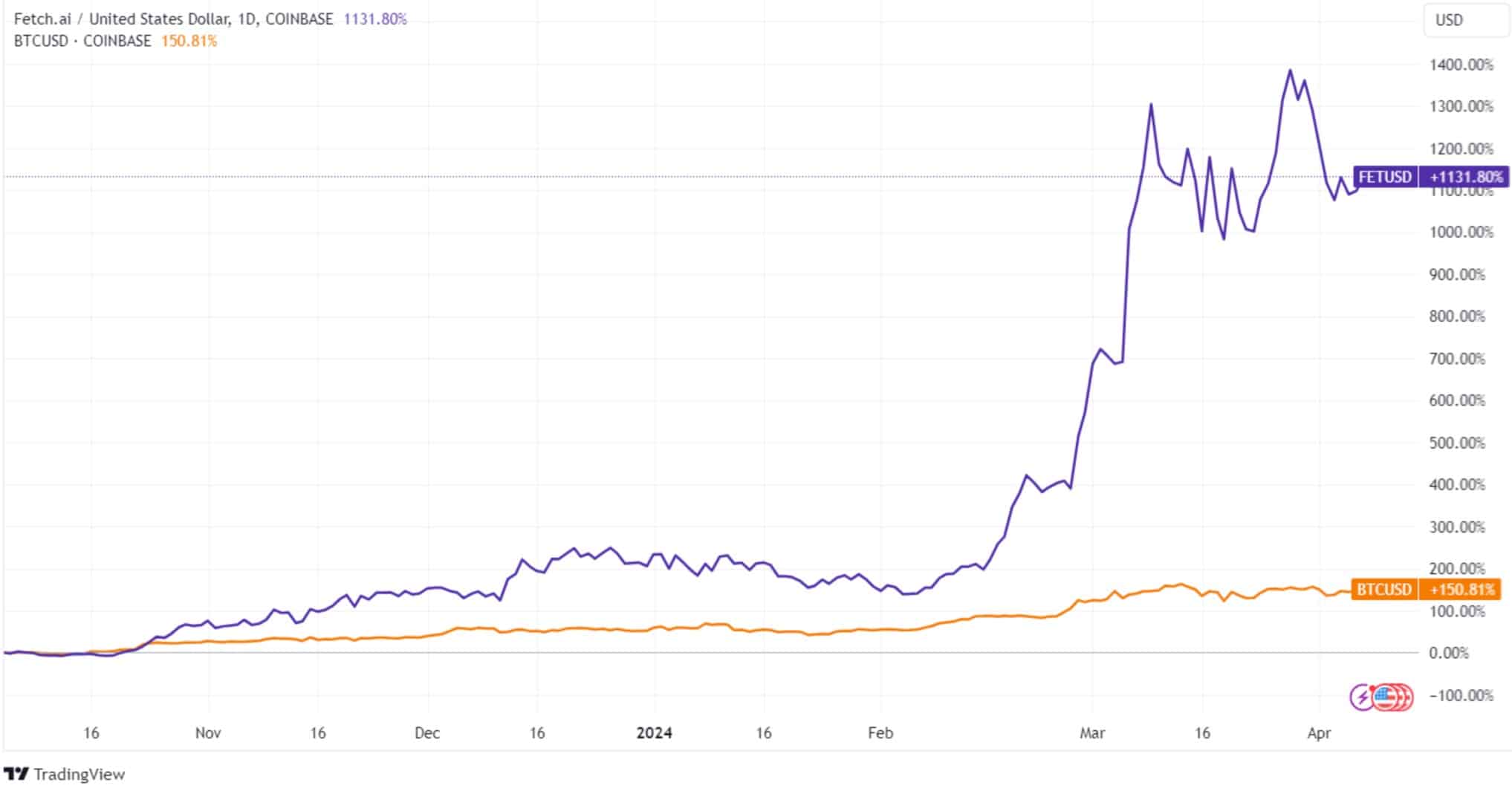

Its native crypto coin, FET, has surged over 1,100% in USD terms since the end of 2023.

Fetch is merging with two other crypto AI projects, SingularityNET and Ocean Protocol, and their tokens will convert to ASI.

Fetch.ai Summary

| Feature | Details |

|---|---|

| Platform | Ethereum-based AI and blockchain for task automation. |

| Applications | Decentralized finance, Web3, supply chains, IoT, and more. |

| Cryptocurrency | FET token, used for transactions, AI deployment, staking. |

| Investment Potential | High risk, significant opportunities with over 1,100% surge in value. |

| Mergers | Merging with SingularityNET and Ocean Protocol into ASI token. |

| Investment Outlook | Risky with major opportunities; ASI token merger presents a unique prospect. |

What Is Fetch.ai?

Fetch.ai is a blockchain-based platform that leverages artificial intelligence (AI) and machine learning (ML) technologies to automate transactions and processes across a variety of industries. It enables users to build and deploy AI agents for applications ranging from decentralized finance (DeFi), Web3, supply chains, Internet of Things (IoT), energy management, transportation, and business and individual tasks.

For instance, Fetch.ai can streamline your search for flights or rental apartments by automating the process of searching, comparing, and booking.

The goal of Fetch.ai is to decentralize AI and automate everyday transactions.

Its native cryptocurrency, FET, is used to pay for transactions on the network, deploy AI, and participate in block validation by staking.

How Does Fetch.ai Work?

The Fetch.ai network revolves around autonomous economic agents or AI agents. These autonomous software services can connect with other AI apps and online services to get real-time data and take action.

AI agents are the basic building blocks of Fetch.ai.

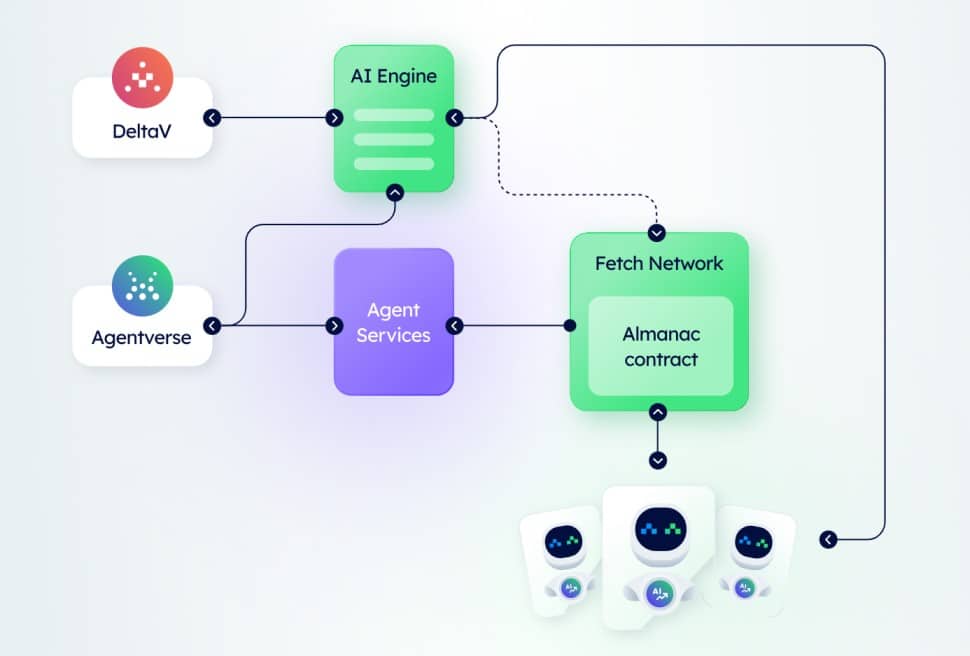

The Fetch.ai architecture is made up of four key components:

1. AI Agents

Agents are programs with decision-making power that can operate freely in a decentralized environment. They can act on behalf of individuals, companies, and devices, being able to connect, search, and transact.

Agents can achieve their goals without human participation, although users can input parameters to customize them.

Thanks to AI and ML technologies, AI agents can learn and improve.

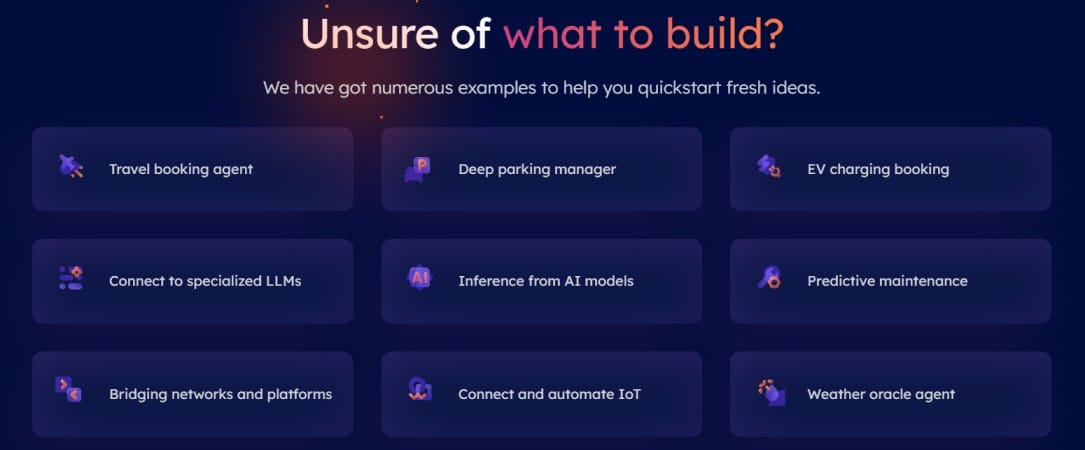

Users can build public or private agents depending on their needs. Fetch.ai offers several templates to streamline AI agent deployment.

Source: Fetch.ai

2. Agentverse

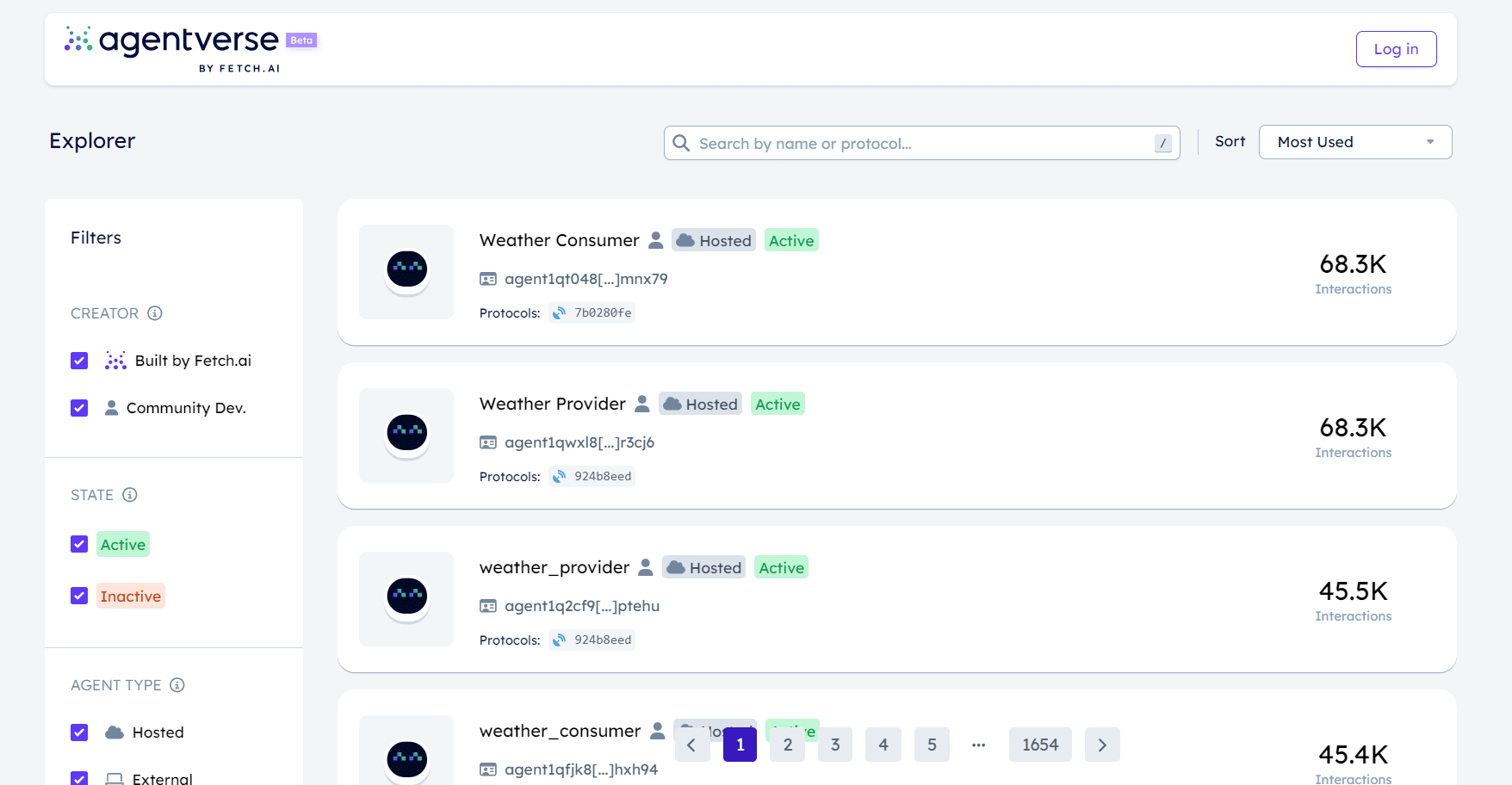

Agentverse is a dashboard where users deploy and manage their agents. It represents a Software as a Service (SaaS) platform for the registration of Agent services.

Users can post their agents on Agentverse, and the AI Engine can promote them to other users.

Agentverse offers tools and libraries for creating, training, and integrating AI agents into various systems.

Source: Agentverse

All agents hosted in the Agentverse are registered in the Almanac, a smart contract deployed on the Fetch.ai blockchain network.

3. AI Engine

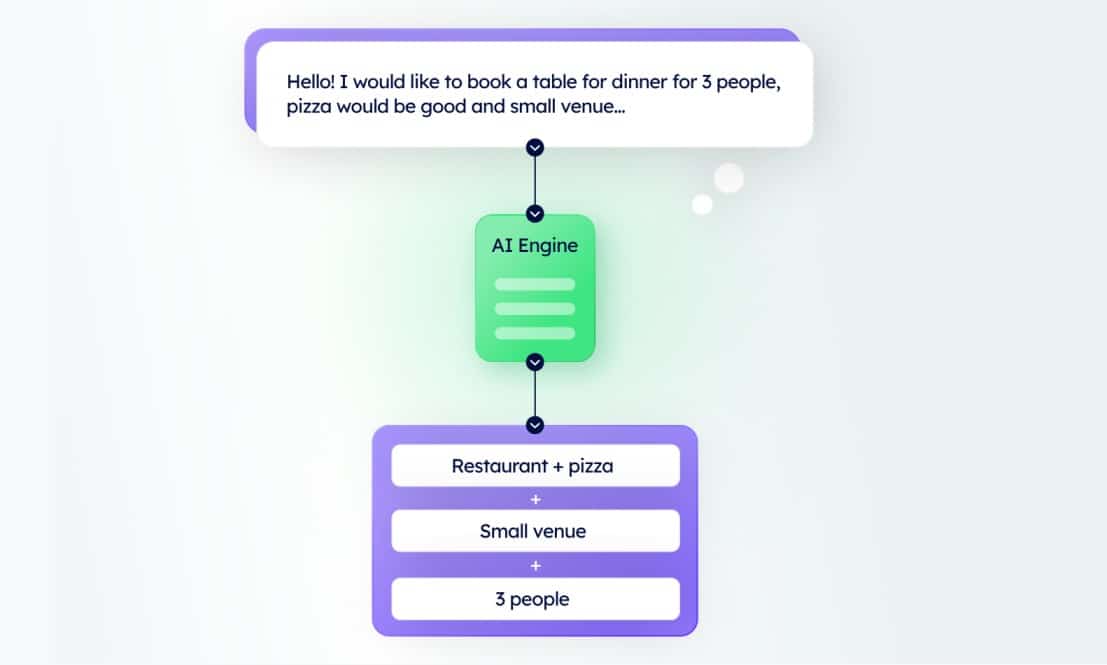

The AI Engine is a system that merges agents with human-readable text input to develop a scalable AI infrastructure supporting Large Language Models (LLMs).

Its main goal is to analyze human input and connect it to agents. For example, users can ask the AI Engine to perform a task, which will take action based on your prompt using the appropriate agents.

Source: Fetch.ai Docs

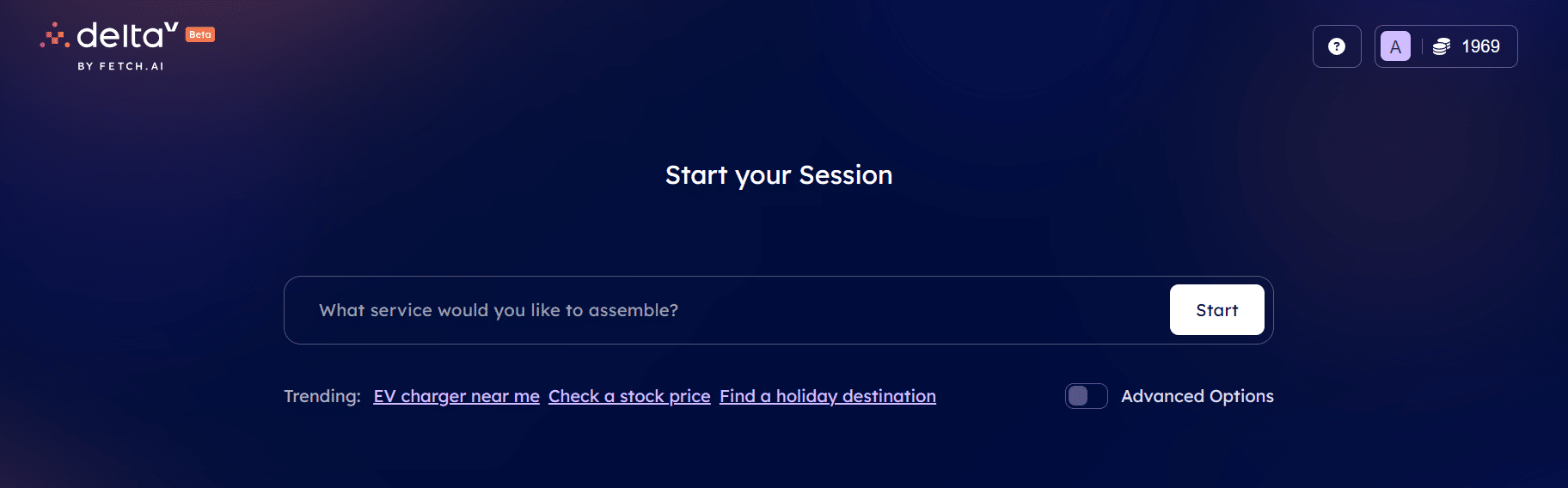

The AI Engine is at the heart of DeltaV, a ChatGPT-like chat interface that connects users with AI agents registered in the Agentverse. Users can connect with their Google account or their Fetch Wallet.

Source: Fetch.ai deltav

As of today, DeltaV is still in Beta mode and requires further improvements. For example, it suggested a holiday destination in Canada while I asked in Europe.

4. Fetch Network

The Fetch network is the blockchain layer of Fetch.ai. All transactions are processed on this layer, while AI Agents reside on the network’s Almanac smart contracts.

The Fetch ledger is a Proof of Stake (PoS) network where validators stake FET to create new blocks.

Here is the relationship between Fetch.ai’s core elements:

Source: Fetch.ai docs

$100M Infrastructure Investment

In March 2024, Fetch.ai announced a $100 million investment in Fetch Compute, its proprietary infrastructure program.

The program aims to provide developers and users with AI tools, computing power, and training capabilities. Fetch Compute will deploy graphics processing units (GPUs) like Nvidia H200, H100, and A100 models.

The strategic investment comes from the Fetch Ecosystem Fund, reflecting the community’s trust in the Fetch network.

Fetch.ai CEO Humayun Sheikh said:

“Fetch Compute is not just an infrastructure investment; it's an investment in the future of AI and the ecosystem of innovative developers who are pushing the boundaries of what's possible with our platform.”

— Humayun Sheikh

FET Token

The FET token is used to pay for AI services and transaction fees, staking, and AI deployment.

FET launched in 2019 as an ERC-20 token on Ethereum, but it eventually moved to Fetch.ai’s mainnet, which leverages Cosmos SDK.

FET has a circulating supply of over 840 million coins and no total supply limit.

As of this writing, the FET price is $2.69, and the company has a market cap of over $2.2 billion.

The token has surged over 1,100% since the end of 2023, outperforming Bitcoin (BTC), Ethereum (ETH), and other major digital assets by a margin.

Source: TradingView

Superintelligence Alliance Token

The Fetch.ai ecosystem will undergo a major upgrade as it joins forces with other blockchain-based AI platforms, SingularityNET and Ocean Protocol, to create a unified AI environment and a new token called Superintelligence Alliance Token (ASI).

The announcement surprised the crypto community, as mergers are a rarity in the blockchain world, especially when they involve combining multiple tokens into a new one.

The new token will have a total supply of about 2.6 billion, which suggests a combined value of about $7.5 billion.

Is Fetch.ai a Good Investment?

Currently, investing in FET is risky but presents some major opportunities.

FET holders will soon be able to convert their tokens to ASI in a 1:1 ratio. The long-term potential of ASI is yet to be determined, but with the combined strengths of these three entities, ASI has the potential to become a leading altcoin. When it goes live, it is expected to rank 20th on CoinMarketCap.

FAQs

What is Fetch.ai?

Fetch.ai is a blockchain-based AI platform that enables users to create, deploy, and sell AI agents that can automate transactions and various tasks across multiple industries.

Is Fetch.ai a good investment?

Investing in FET carries risks but also offers significant opportunities, especially with the upcoming conversion to a new Superintelligence Alliance (ASI) token. It has the potential to grow as part of a major collaborative ecosystem.

What is the Superintelligence Alliance Token (ASI)?

The Superintelligence Alliance Token (ASI) is a new crypto AI ecosystem and digital currency resulting from the merger of Fetch.ai, SingularityNET, and Ocean Protocol.

How do I buy Fetch.ai?

You can buy FET on major crypto exchanges like Coinbase and Binance or use the Swap feature on tastycrypto, our self-custody wallet.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com