In 2025, Ethereum may reach or exceed $10,000, with predictions suggesting a surge to over $30,000 by 2030, and escalating to multi-million dollar valuations by 2040 and 2050.

Written by: Anatol Antonovici | Updated March 26, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

How much will Ethereum cost next year, in 2030, and a few decades from now? Is there a model to help us make an accurate ETH price prediction? Let’s find out!

Table of Contents

🍒 tasty takeaways

2025 Prediction: Ethereum could reach or exceed $10,000, following the potential approval of the first ETH ETFs by the US SEC

2030 Prediction: Anticipated to surge over $30,000, as Ethereum continues to play a pivotal role in the blockchain ecosystem and digital finance.

2040 Prediction: Ethereum’s valuation could escalate into the $100k+ range, contingent on its adaptation to technological advancements and market demands.

2050 Prediction: Continued growth could see Ethereum’s price reaching unprecedented levels, provided it maintains its competitive edge and relevance in the evolving crypto landscape.

What Determines Ethereum’s Price?

As with any other asset, Ethereum’s price is influenced by two general factors: supply and demand. Narrowing supply and increasing demand always support price.

Let’s next see how these two aspects may unfold in the future to provide a more accurate price prediction for the future price of ether (ETH).

🍒 What Is Ethereum and How Does It Work? The Ultimate ETH Guide

Ethereum Supply

Unlike Bitcoin, Ethereum does not have a capped maximum supply. In theory, the system can issue an infinite number of ETH, similar to how fiat money works. However, unlike fiat, Ethereum doesn’t have a central bank that can abuse its monetary policy.

Instead, its decentralized system aims to keep a balanced approach. Ethereum’s supply has been deflationary during the last few years, meaning the number of newly minted ETH coins has decreased.

Conversely, Bitcoin’s programmatic inflation rate gradually reduces after each halving event, but it’s still positive.

Ethereum Has Been a Deflationary Asset

Following the implementation of the EIP-1559 upgrade in August 2021, a portion of the gas fees incurred on Ethereum transactions is permanently destroyed or “burned,” effectively reducing the circulating supply of Ether. The paradox is that the more users transact on the Ethereum blockchain, the higher the burn rate, which increases the price of ETH.

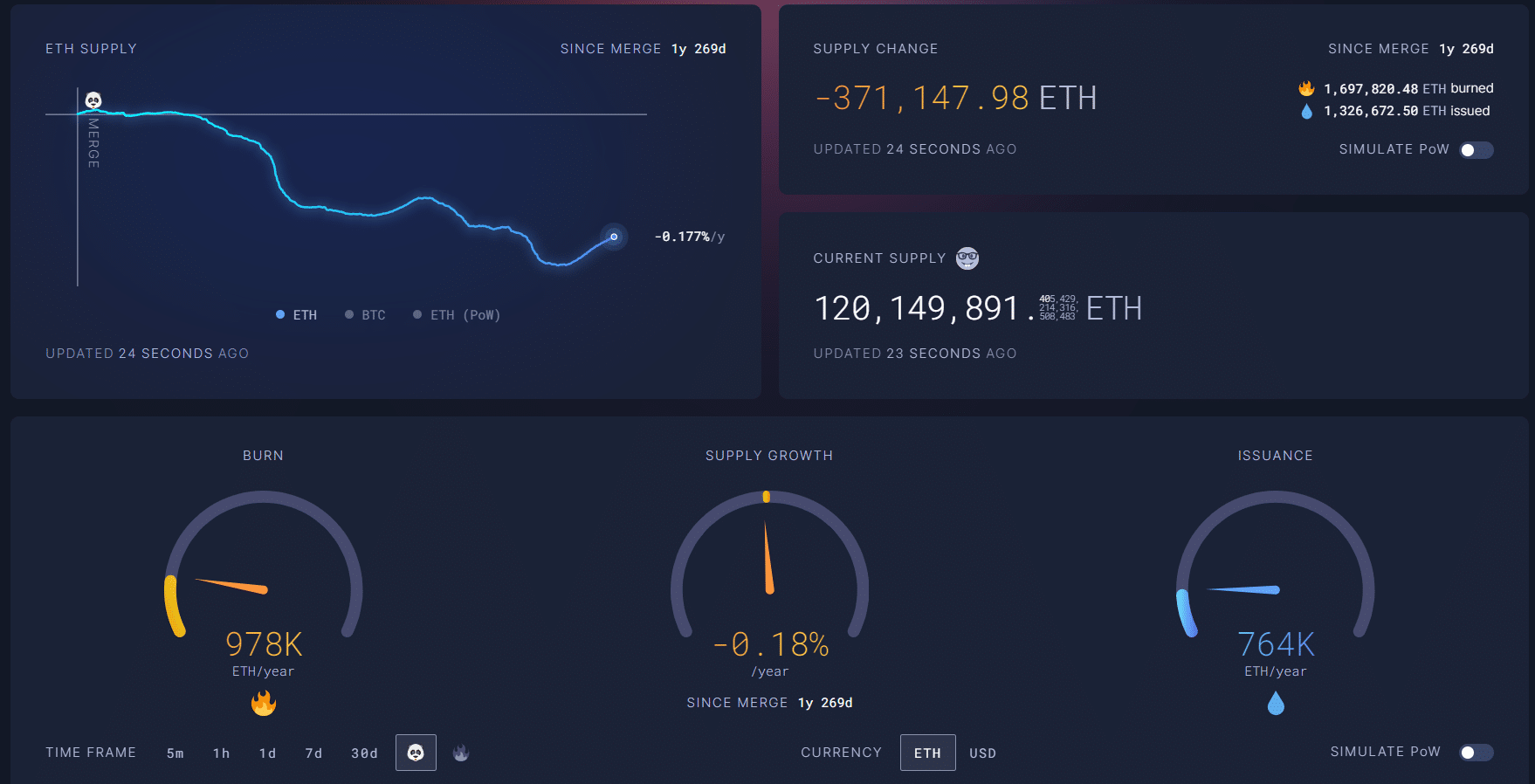

Following the adoption of the Proof of Stake (PoS) consensus mechanism, Ethereum’s supply declined by 370k ETH, currently at about 120 million coins. While Bitcoin has an inflation rate of 0.84%, Ethereum has a negative inflation rate of -0.18%.

Source: Ultra Sound Money

It’s worth noting that new ETH is constantly issued to validators who add new blocks, but the burn mechanism currently impacts the supply more.

Ethereum Demand

Ethereum’s supply increased from about 90 million ETH in 2017 to over 120.1 million in 2024. Such gradual changes cannot greatly impact the price of ETH. What affects ETH valuation is the demand side.

Ethereum differs from Bitcoin, regarded as a store of value (SoV), aka digital gold, and is hoarded by institutional and retail investors to hedge against inflation and preserve wealth. The second-largest cryptocurrency by market cap acts as a utility coin and is directly influenced by the level of adoption and activity in its ecosystem.

Ethereum Use Cases

Thanks to the smart contract feature, the Ethereum network can host decentralized applications (dapps) and tokens, providing the underlying technology for thousands of crypto projects. The adoption of Ethereum by crypto projects supports the ETH price.

The network is used for various use cases:

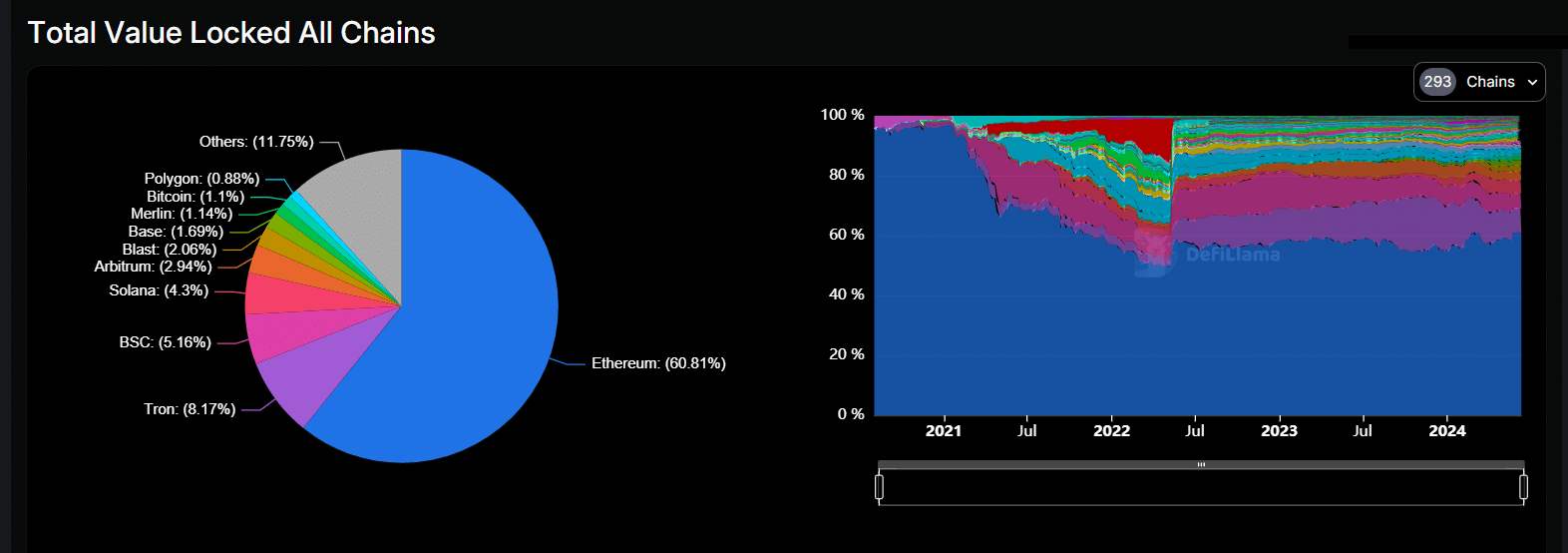

- DeFi – Ethereum dominates the decentralized finance (DeFi) sector, one of the most significant blockchain markets.

Source: DefiLlama

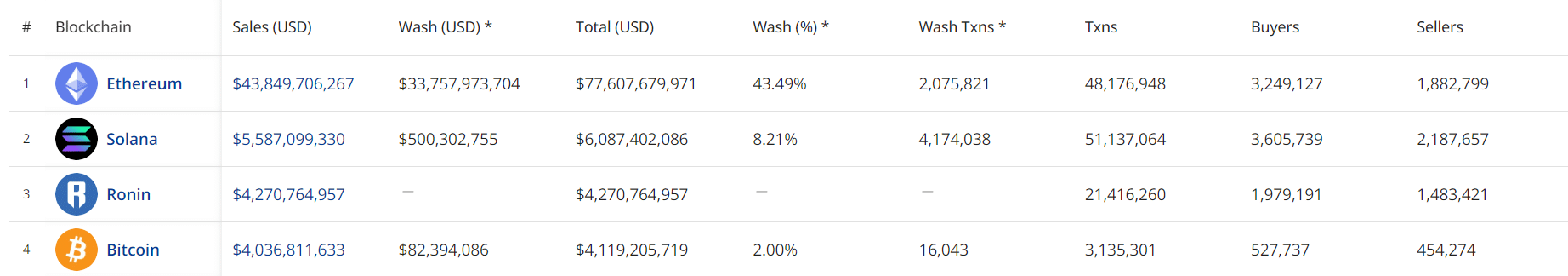

- NFTs – Ethereum is the blockchain network with the greatest all-time non-fungible token (NFT) activity.

Source: CryptoSlam!

- Web3 – Ethereum is the blockchain of choice for many Web3 apps, including metaverse and gaming projects.

- Stablecoins – the two largest USD stablecoins, USDT and USDC, are mostly issued on Ethereum.

Ethereum Adoption

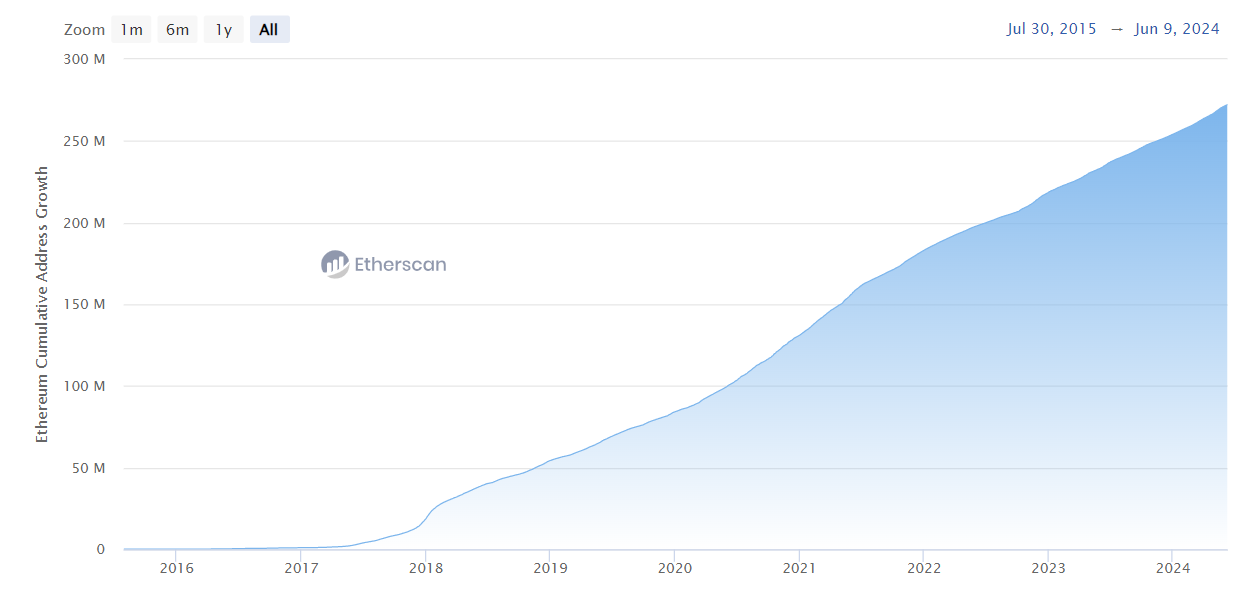

Thanks to increased adoption, the number of ETH crypto wallets has increased from 20 million in 2018 to over 270 million as of mid-June 2024. The average number of daily active addresses is also increasing.

Source: Etherscan

Correlation to Bitcoin

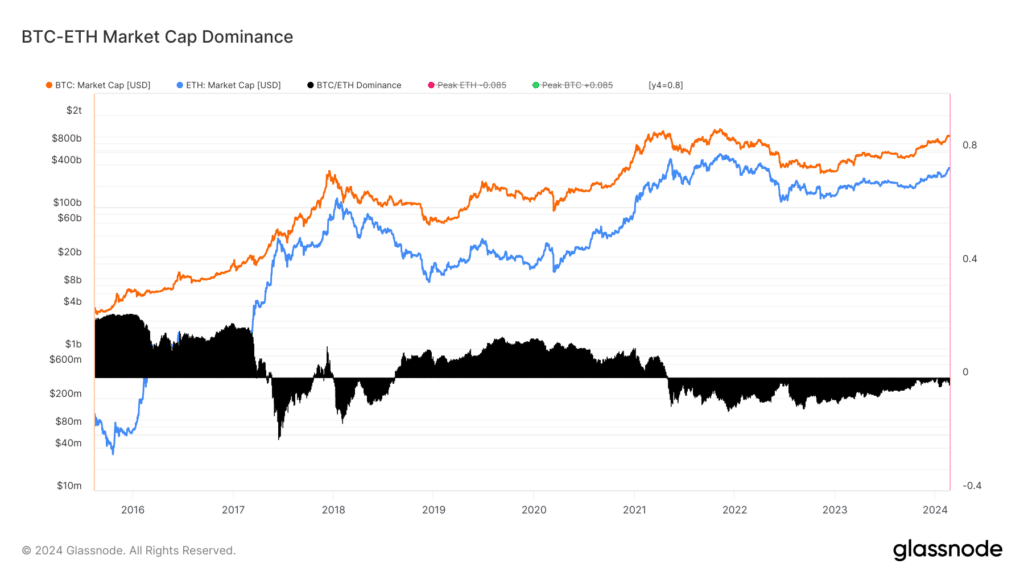

Ethereum’s market is interconnected with broader financial ecosystems and is influenced by various external factors beyond its supply and demand dynamics. Notably, the demand for Ethereum often surges in response to a bullish Bitcoin market, drawing increased investments from both retail and, significantly, institutional investors.

ETH shows a high correlation to Bitcoin, and it’s important to consider this when predicting its price.

Source: Glassnode

USD Inflation

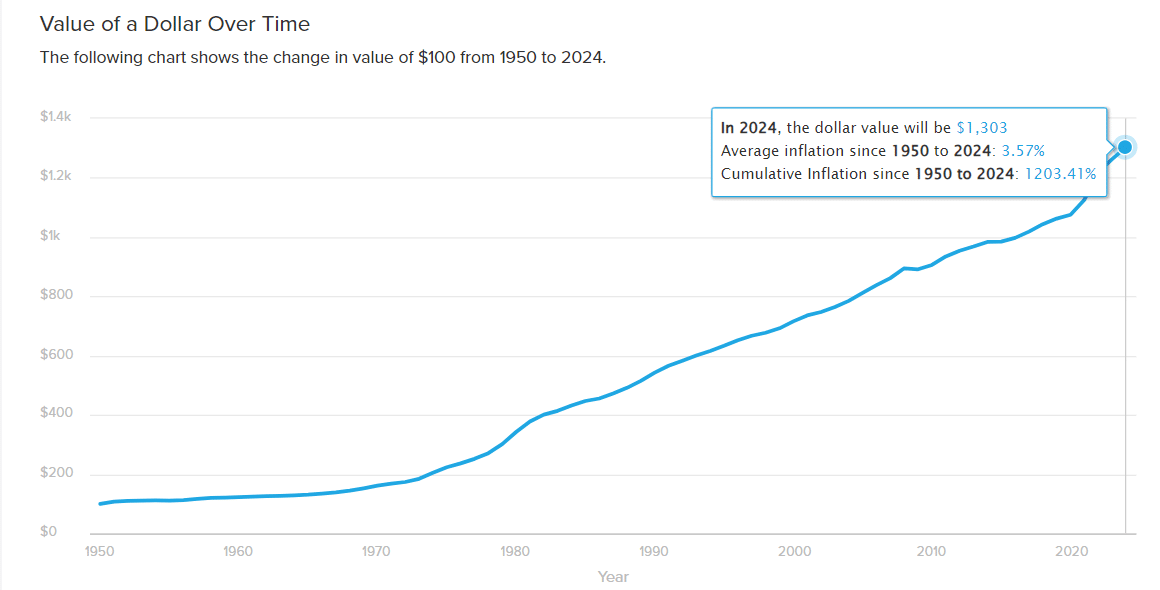

When making long-term predictions, such as for decades ahead, it’s important to consider the cumulative inflation of the US dollar, which is weakening by the year. For example, $1 in 1950 is worth $13 today, marking a 1,200% increase in cost

Source: smartasset

During the next few decades, Ethereum and other crypto assets with relatively stable supplies can surge based on inflation alone. The worst-case scenario is that a potential hyperinflation could cause the US dollar to lose a majority of its value (highly unlikely).

Ethereum Competition

Despite external factors, Ethereum’s value is deeply rooted in the health and vibrancy of its ecosystem. Ethereum’s price could face negative impacts if it loses market share to competitors offering superior technologies.

For example, Solana (SOL) has been the fastest-growing blockchain since 2023, offering higher speed and better efficiency than Ethereum.

The swift evolution of technology challenges Ethereum to keep pace. Already transitioning to a Proof of Stake (PoS) system and planning for sharding to improve scalability, Ethereum is making crucial advancements. However, what lies ahead remains uncertain as the blockchain landscape evolves.

Embracing Tech Innovation

Ethereum should always be able to anticipate tech novelties before competitors, whether that be artificial intelligence (AI) or new tokenization trends.

Ethereum Outlook 2025

Ethereum’s current price exceeds $3,600, and it hit a record high of over $4,800 in 2021. Next year, ETH will likely still show a high correlation to BTC. The bullish outlook for the oldest crypto bodes well for Ethereum. It may finally update its all-time high (ATH) and break above the $5,000 mark.

Following Bitcoin’s footsteps, Ethereum is waiting for the first spot exchange-traded funds (ETFs) to be approved by the US Securities and Exchange Commission (SEC). At the end of May 2024, the SEC green-lighted rule change to allow Ethereum ETFs.

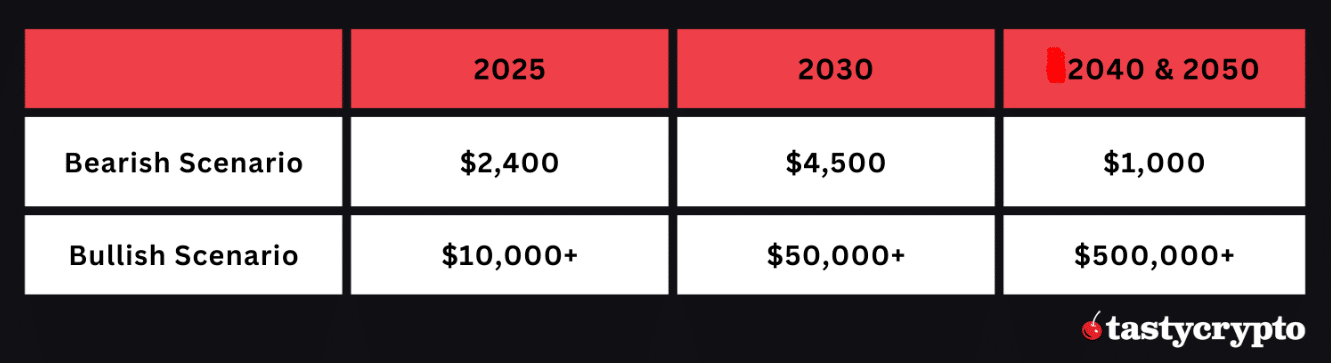

If ETH ETFs get the SEC’s nod, the price of ETH may surge to $10,000 in 2025. In the bearish scenario, ETH will find support around $2,400.

Source: TradingView

Ethereum Potential Price for 2030

Considering all the abovementioned factors, long-term predictions for Ethereum become highly speculative.

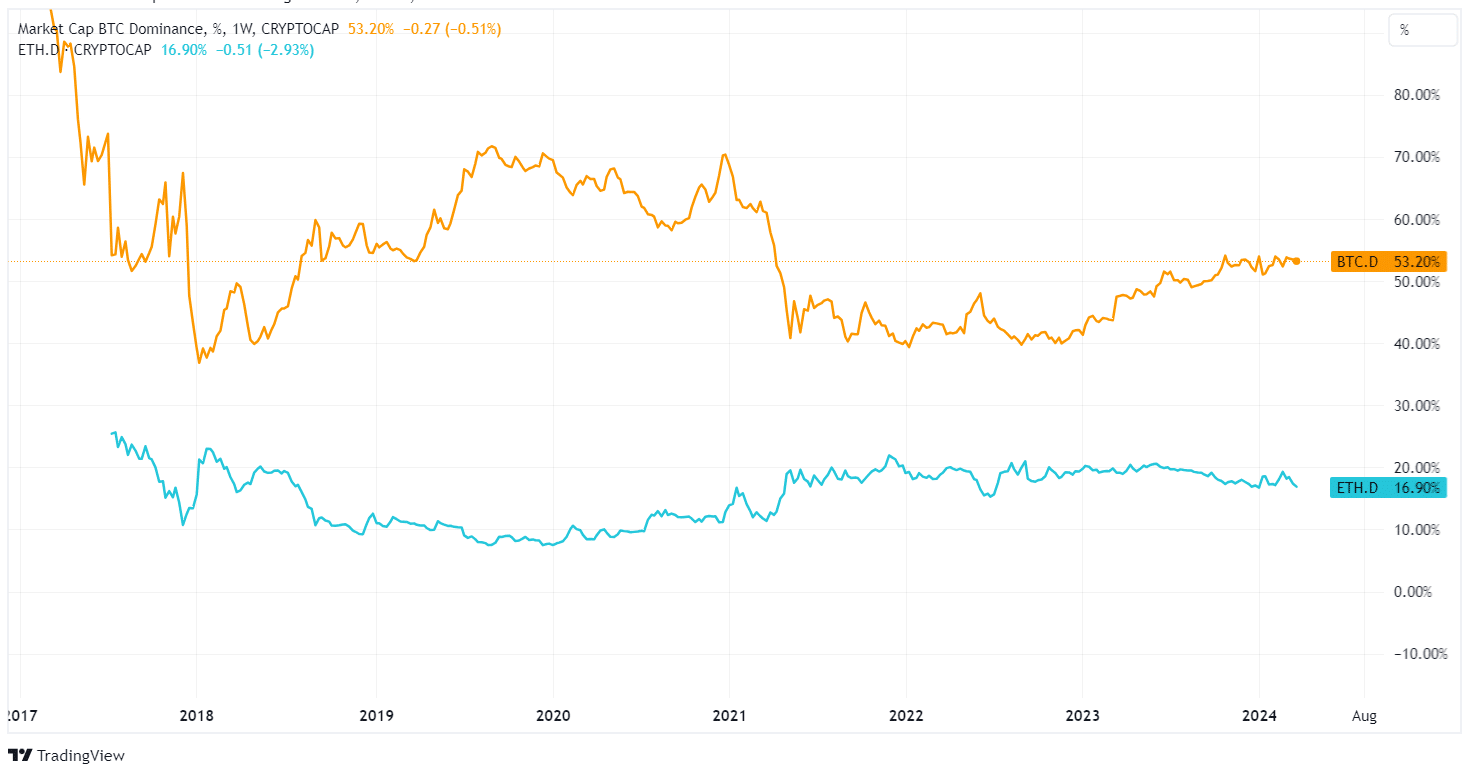

Since 2021, Ethereum’s crypto market share has fluctuated within a horizontal range between 17% and 24%.

Source: TradingView

If it maintains its dominance at similar levels, its price may grow to over $30,000, considering the $25 trillion crypto valuation shared by ARK Invest CEO Cathie Woods.

Raoul Pal, a former Goldman Sachs hedge fund manager, said that global cryptocurrency market capitalization could grow to a staggering $250 trillion, which may push ETH’s price well above $100,000.

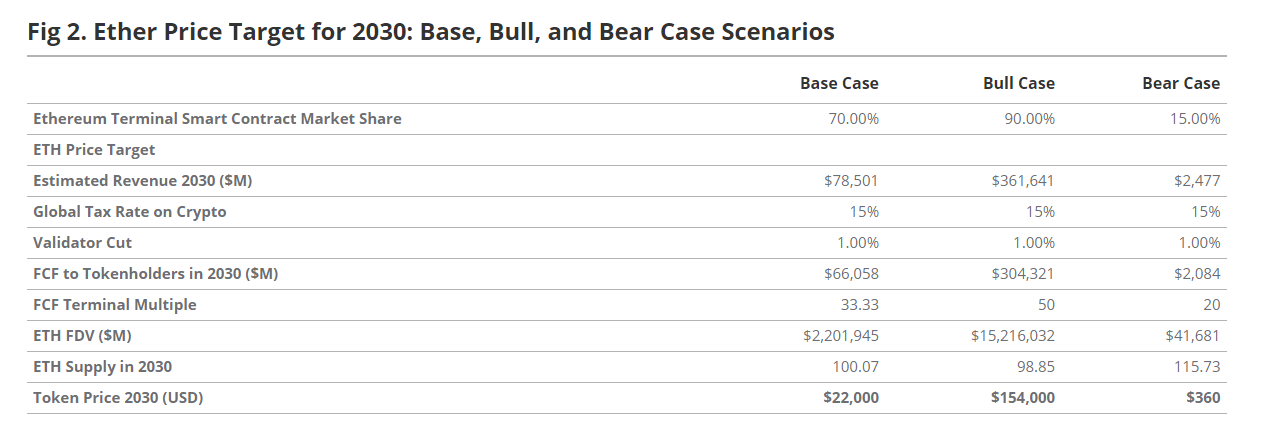

In June 2024, VanEck came up with a more realistic prediction for the base case, anticipating a price of $22,000 per ETH by 2030. According to one of the main Ethereum ETF applicants, the bull case suggests a price of $154,000, in line with Goldman Sachs’ price target.

FAQs

Can you give an accurate Ethereum price prediction?

Due to the many factors influencing the price of Ethereum and other altcoins, short-term and especially long-term predictions are highly speculative. Digital assets show high volatility, and you should only invest what you can afford to lose. Make sure you conduct your research based on in-depth price analysis.

What is the price prediction for Ethereum in 2025?

Ethereum (ETH) may find support at $2,400 and go to as high as $10,000 if the SEC approves the first Ethereum ETFs.

How much will 1 Ethereum be worth in 2030?

If Ethereum maintains a similar dominance level, it can grow to over $30,000, based on ARK CEO Cathie Wood’s valuation of the global crypto market at over $25 trillion.

Where will Ethereum be in 2040 and 2050?

Price predictions for such time frames are almost impossible due to the wide range of possibilities. If Ethereum loses competition against Solana or a new AI-powered chain, it may become a tiny market. If it adapts to market conditions, it can have a six-digit price.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com