Layer 2s (L2s) on the Ethereum blockchain have become one of the hottest topics in the cryptocurrency space. In this article, we discuss the fastest-growing layer 2s in 2024.

Written by: Anatol Antonovici | Updated May 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Ethereum Layer 2s (L2s) are blockchains built on top of Ethereum to improve its scalability and user experience. L2s process transactions outside the Ethereum mainnet more efficiently, reducing gas fees and increasing throughput.

Table of Contents

🍒 tasty takeaways

Base, Blast, and Mantle are the fastest-growing L2s leveraging optimistic rollups.

Linea is the fastest-growing zkEVM network.

Bitcoin layer 2s are also surging, with Merlin gaining $1 billion in TVL in just one month.

Ethereum Layer 2 Summary

| Layer 2 Project | Description |

|---|---|

| Base | An Ethereum L2 using optimistic rollups and backed by Coinbase, showing significant growth with a TVL increase to $1.7 billion in 2024. |

| Blast | Launched by the team behind Blur, this L2 uses optimistic rollups, achieving a TVL of $1.75 billion in just two months. |

| Mantle | First L2 governed by a DAO, uses a three-layer modular chain, with a notable TVL rise to $450 million following a major upgrade. |

| Linea | Uses ZK proof technology for enhanced security and privacy, with TVL tripling to over $300 million in just a month. |

| Starknet | A ZK rollup network showing robust growth with a TVL increase to $335 million and a significant reduction in fees post-Dencun upgrade. |

| Merlin | A Bitcoin L2 experiencing rapid growth, with TVL soaring from $64 million to over $1 billion in one month. |

Layer 2 Ecosystem in 2024

The growth of Ethereum Layer 2 solutions has accelerated in 2024.

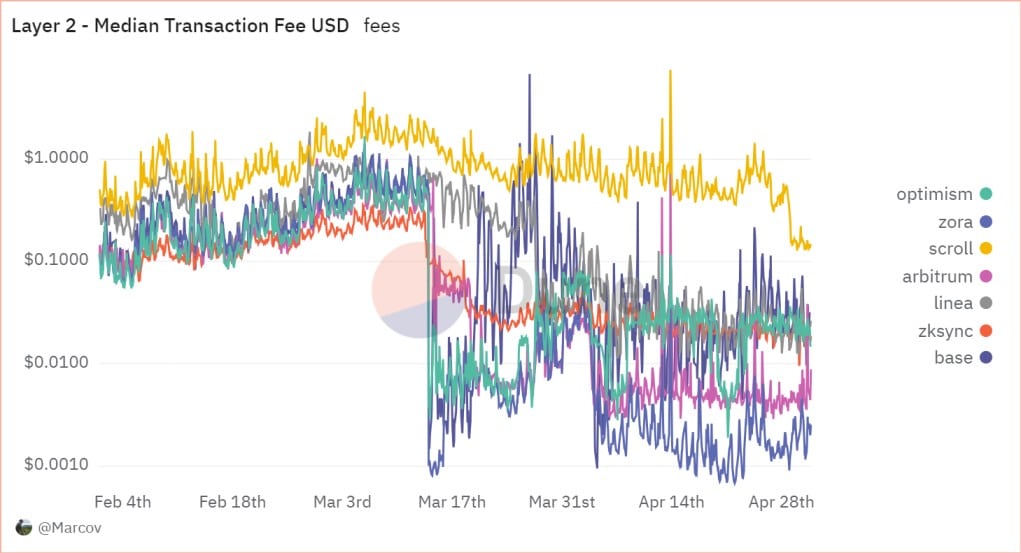

In mid-March, Ethereum implemented the Dencun upgrade, which enabled L2s to store data more efficiently and cut transaction costs by up to 95%.

Since this release, gas fees on Base, Polygon, Optimism, Arbitrum, and zkSync have significantly decreased.

Source: Dune Analytics

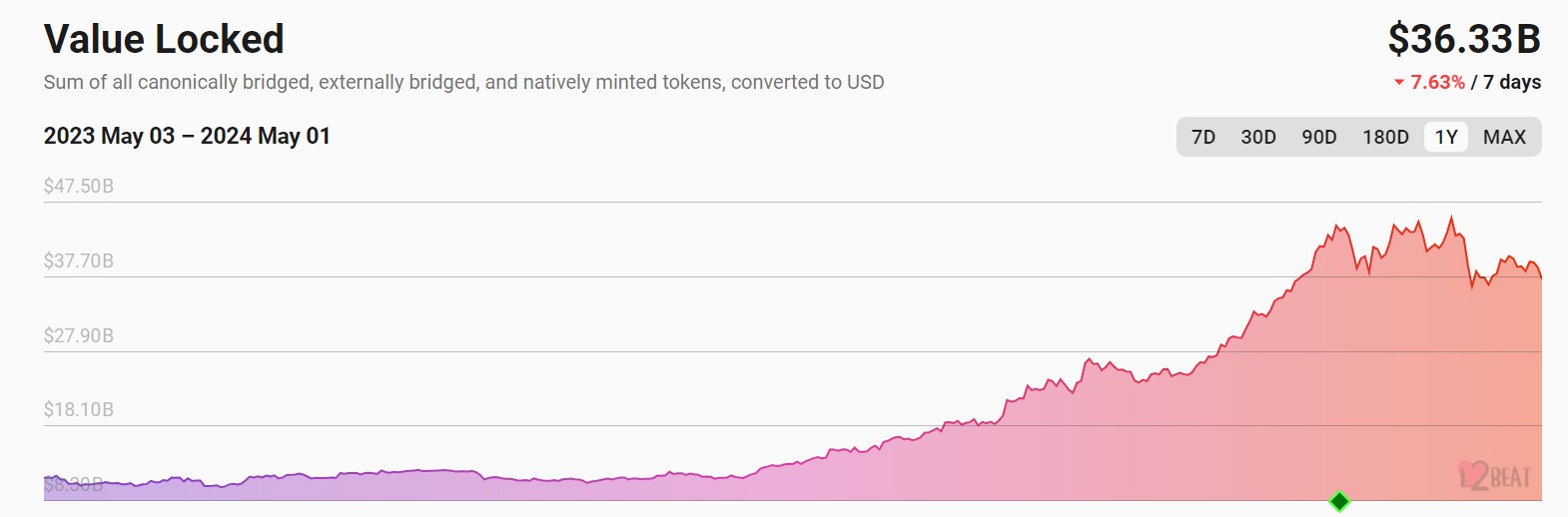

This upgrade has spurred rapid growth across Ethereum layer 2s, pushing the total value locked (TVL) to a record $45 billion in mid-April, as per L2Beat data, which includes bridged TVL.

Source: l2beat

Here are the 7 fastest-growing L2s to watch in 2024:

1. Base

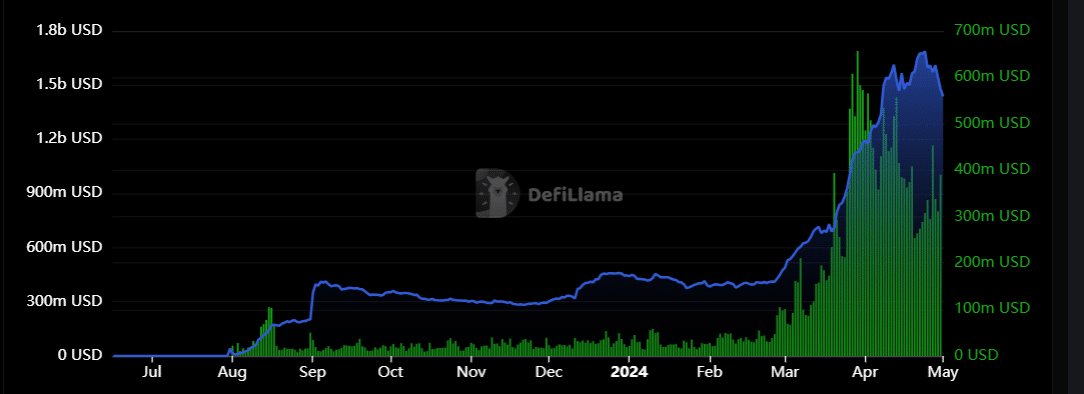

Base is an Ethereum L2 backed by the popular crypto exchange Coinbase. It uses optimistic rollups, leveraging OP Stack technology.

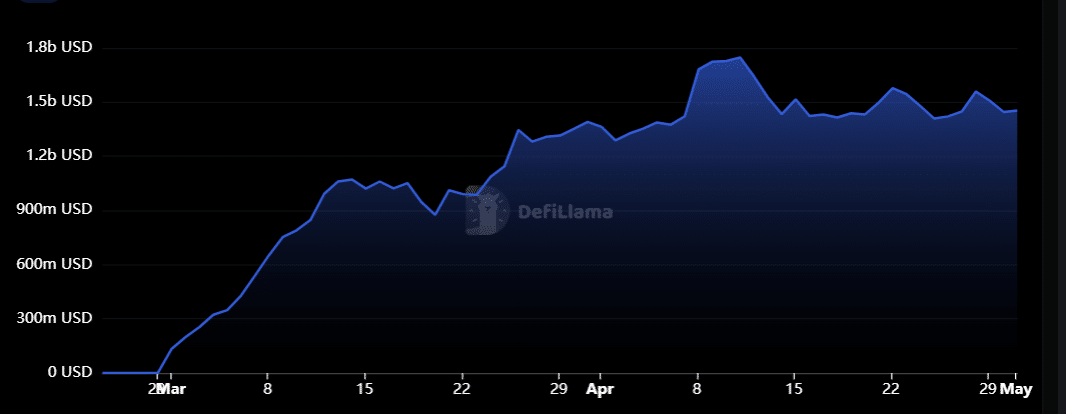

This scaling solution has seen rapid growth in 2024, with its TVL surging from $440 million at the beginning of the year to a record $1.7 billion by the end of April.

Source: DeFiLlama

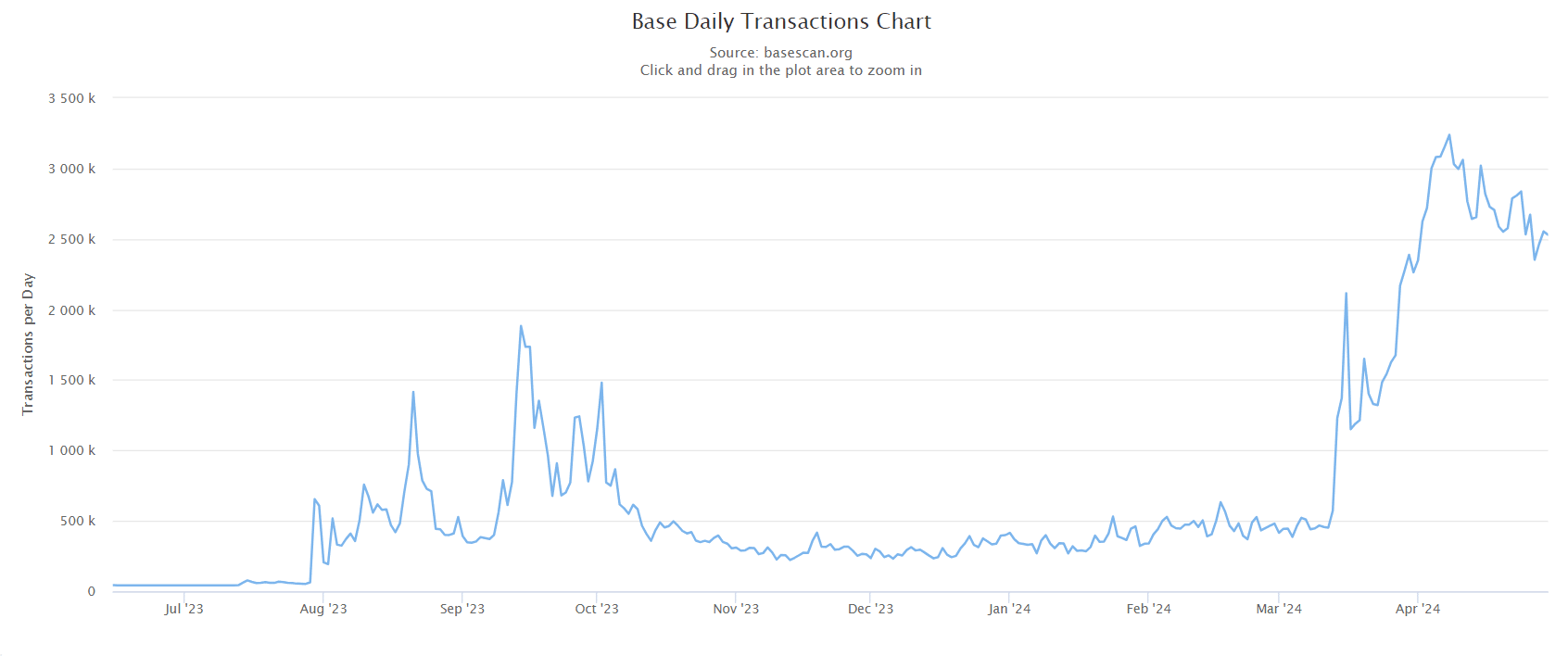

Additionally, daily transactions broke above the 3 million mark at the beginning of April.

Source: BaseScan

Base’s most active decentralized finance (DeFi) apps are Aerodrome Finance and Uniswap, both decentralized exchanges (DEXs). We recently reported that Base activity has been mainly driven by meme coins like Degen and Brett.

Base has been growing so fast that some suggested it could overcome the Ethereum network itself, although Ethereum co-founder Vitalik Buterin is not worried about such a scenario. Afterall, Base is built atop Buterin’s Ethereum.

2. Blast

Blast is an Ethereum L2 that launched its mainnet at the end of February. The scaling solution has been developed by the same team behind Blur, the most significant non-fungible token (NFT) marketplace by trading volume.

Like Base, Blast also uses OP Stack’s code for its optimistic rollups.

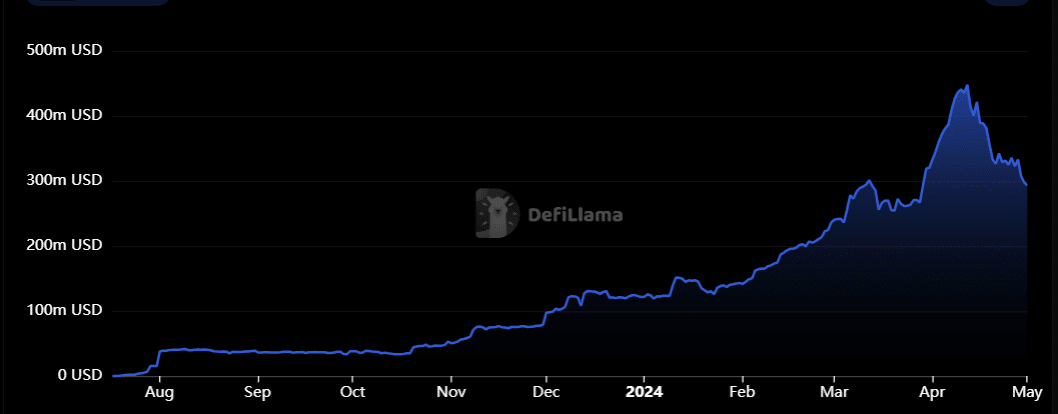

Blast’s TVL skyrocketed to $1.75 billion in less than two months, surpassing Layer 1 blockchains like Avalanche.

Source: DeFiLlama

This L2 stands out by offering native yield. Users can hold specific tokens, such as USDC or ETH, and earn passive income.

Blast is preparing to launch its token in May.

3. Mantle

Mantle is the first L2 incubated and governed by a decentralized autonomous organization (DAO). The L2 is the result of BitDAO, launched by crypto exchange Bybit.

What sets Mantle apart is its integration of EigenLayer to create a three-layer modular chain, with Ethereum settling transactions, EigenLayer ensuring data availability and Mantle handling execution.

Mantle, launched in 2023, saw its TVL soaring from about $120 million at the beginning of this year to a record $450 million in mid-April.

Source: DeFiLlama

4. Linea

Linea is an Ethereum L2 developed by Consensys, a blockchain software company. It uses zero-knowledge (ZK) proof technology and is EVM-compatible.

ZK rollups are considered more secure than optimistic rollups while offering privacy.

🍒 ZK Rollups vs Optimistic Rollups: Comparing Layer 2s

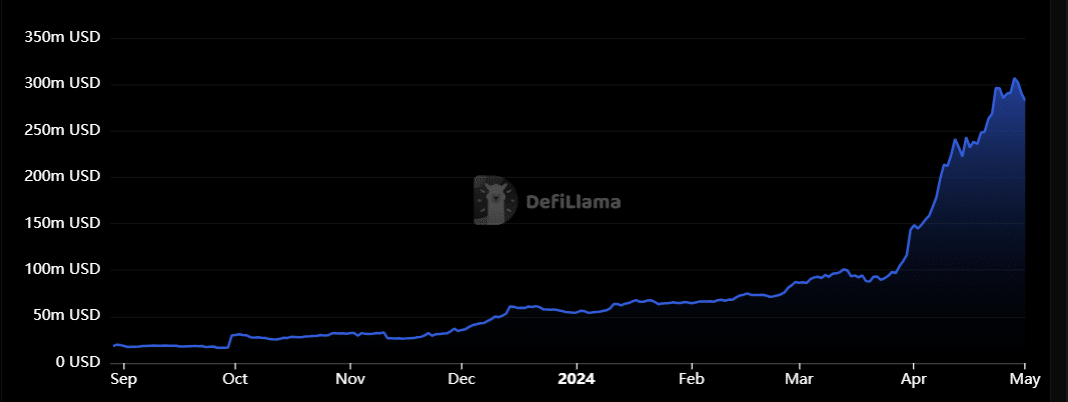

Linea’s TVL tripled from the end of March to the end of April, breaking above the $300 million mark.

Source: DeFiLlama

The most popular DeFi app on Linea is ZeroLend, which is active on four other chains. The DeFi lending protocol’s TVL on Linea surged 8,000% over the last month alone.

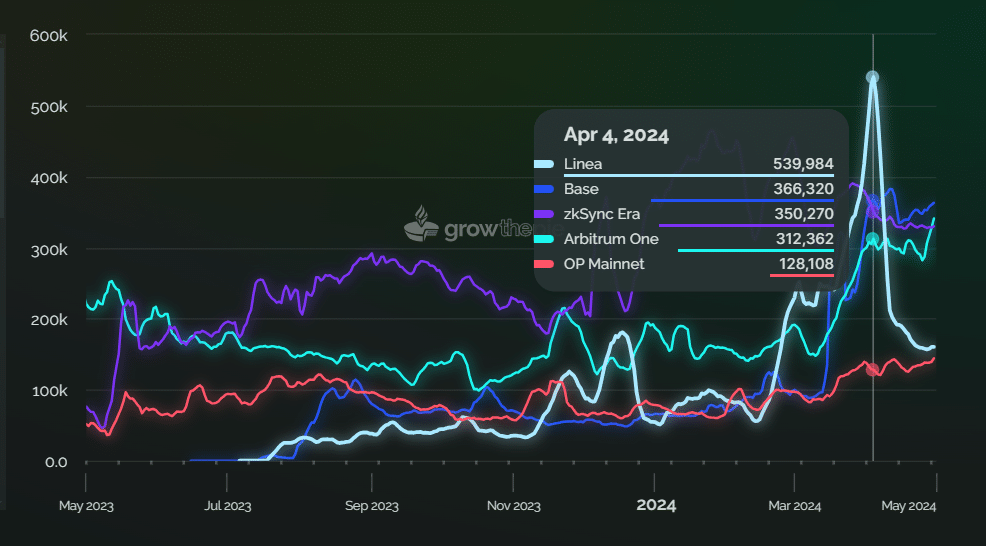

At the beginning of April, Linea had the largest number of active users, surpassing Arbitrum, OP, and Base.

Source: growthepie

5. Starknet

Starknet is another fast-growing ZK rollup network for Ethereum.

DefiLlama data shows that Starknet’s TVL grew from $37 million at the beginning of the year to over $335 million on April 9.

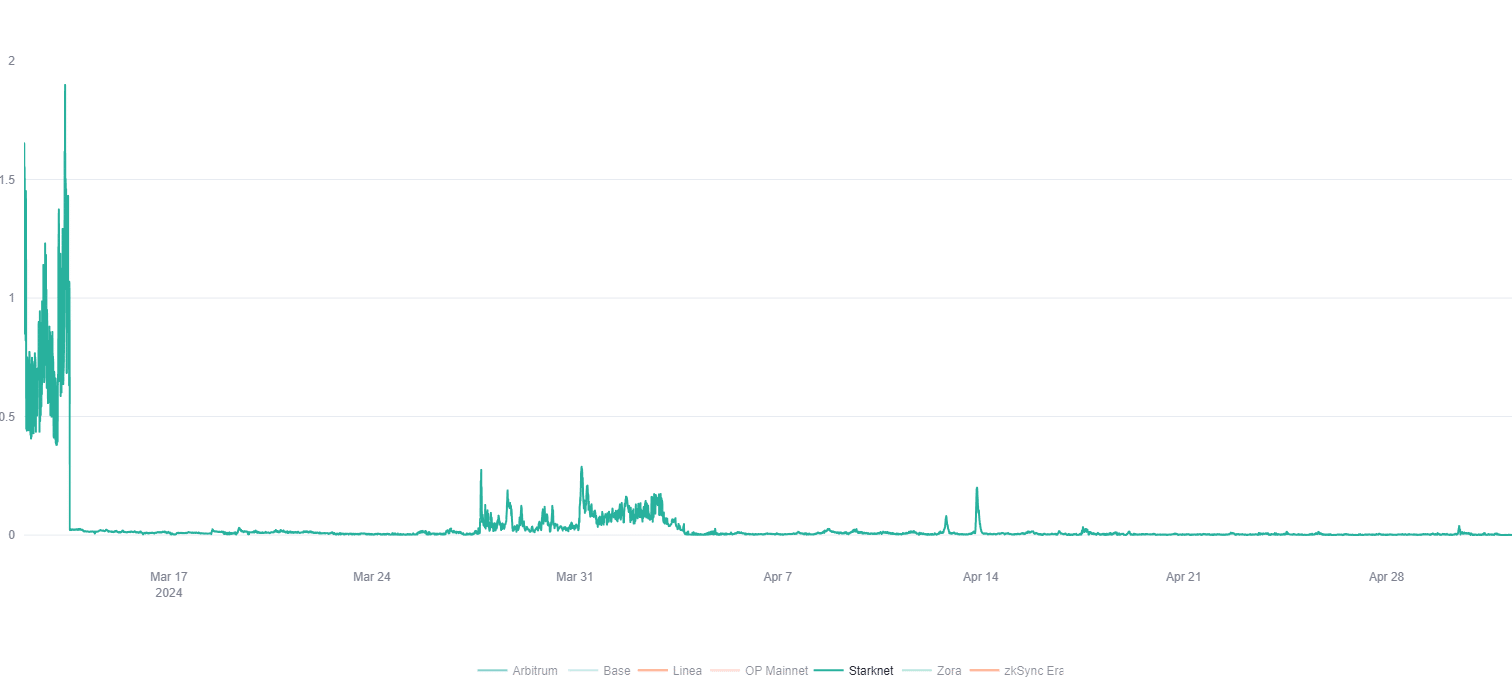

Starknet experienced a steeper fee cut than other L2s after Ethereum’s Dencun upgrade.

Source: growthepie

The ZK rollup network released its 2024 roadmap, pledging improved performance and lower fees.

Starknet launched its token, STRK, at the end of February.

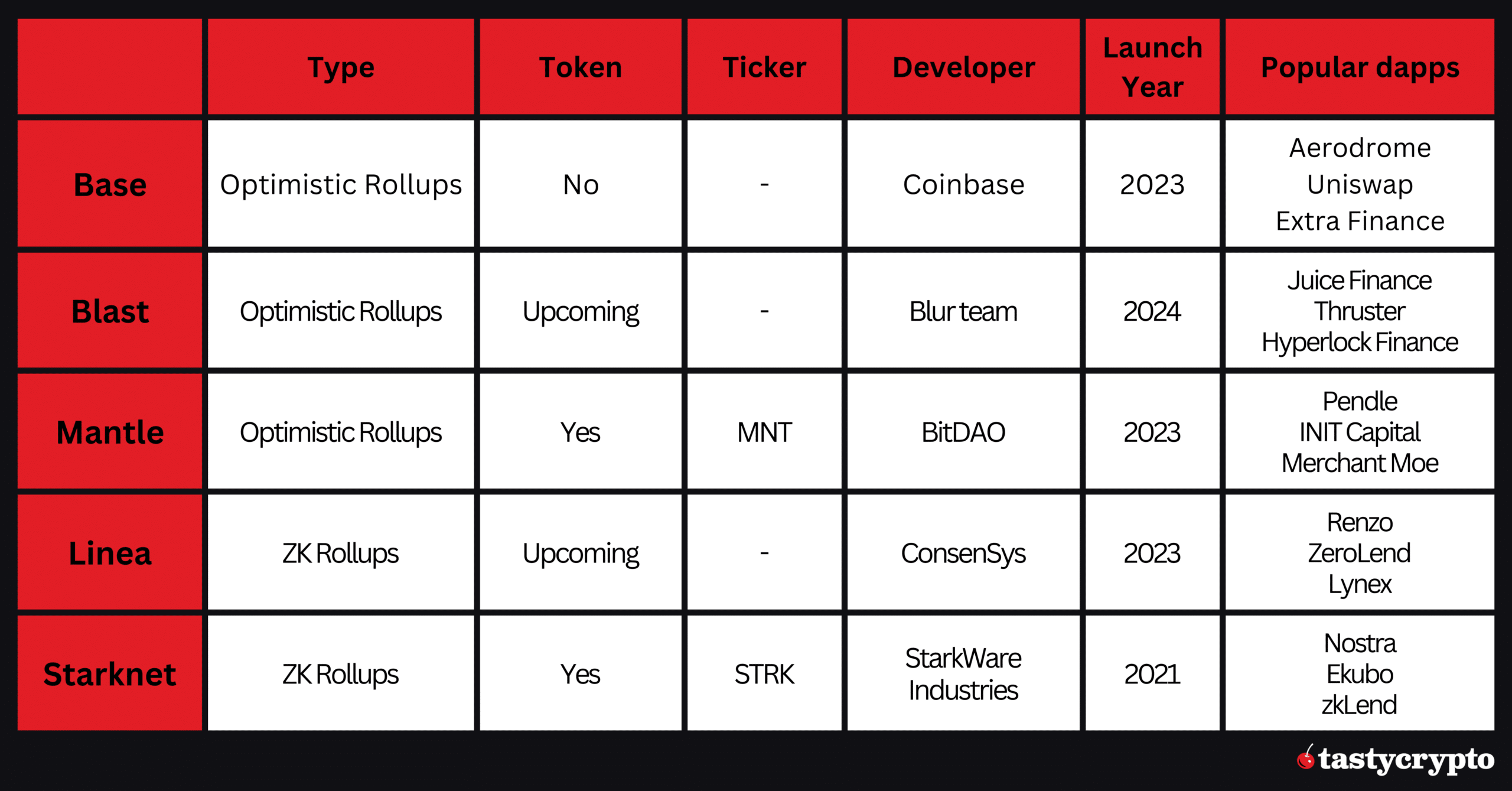

Comparing Ethereum Layer 2s

The below table compares the Ethereum layer 2s mentioned above.

Worthy Mention: X Layer

After Base’s impressive performance, OKX, a popular crypto exchange, decided to follow in Coinbase’s footsteps and build its version of a L2 called X Layer.

The scaling solution’s mainnet went live on April 15, joining the fast-growing L2 sector.

DefiLlama data shows that X Layer has already attracted over $7 million in TVL. The L2 has two native DEXs, including StationDEX and PotatoSwap, each having a TVL of about $1 million.

ZeroLend, which we mentioned earlier, is currently the most popular decentralized application (dapp) on the new chain.

Merlin: Fast-Growing L2 on Bitcoin

Interestingly, the Bitcoin L2 sector is gaining traction as well. Bitcoin L2s are experiencing a revival amid the hype around the halving event and the launch of the Runes protocol. Runes offer an alternative to Ordinals, enabling developers to create fungible tokens with a much smaller footprint.

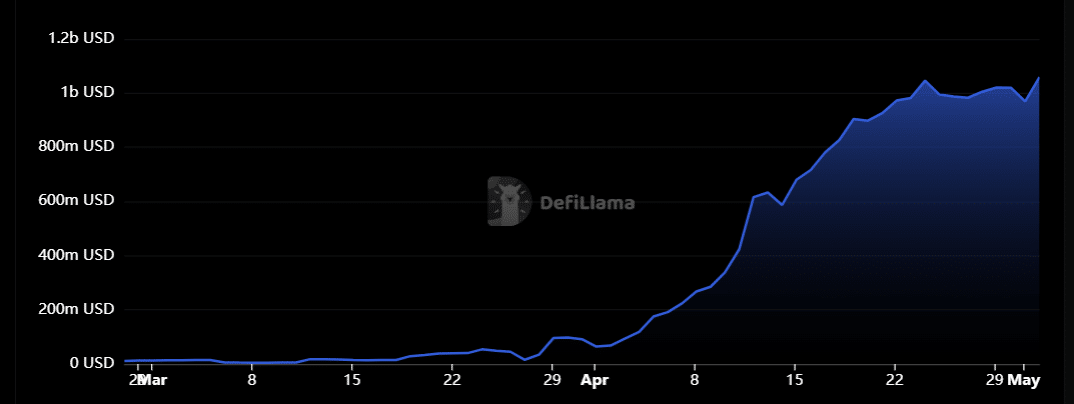

One of the fastest-growing L2 on Bitcoin is Merlin, whose TVL has skyrocketed from $64 million at the beginning of April to over $1 billion one month later.

Source: DeFiLlama

DefiLlama tracks 11 dapps on Merlin. The largest one by TVL is the Solv Fund, a decentralized project that brings native yield to Bitcoin. Users can deposit BTC in Solv’s trading strategy vault and get the liquid strategy token SolvBTC, compatible with Ethereum and DeFi apps.

While Solv is live on five chains, Merlin has several dedicated dapps, including Avalon Finance, MerlinSwap, and Mage Finance.

FAQs

What are Ethereum layer 2s?

Ethereum Layer 2s are blockchains built on top of Ethereum to improve its scalability and user experience. They process transactions outside the Ethereum mainnet more efficiently, reducing gas fees and increasing throughput.

What types of layer 2s are there?

There are two main types of layer 2 blockchains: optimistic rollups and zero-knowledge rollups, or ZK rollups. The former are more popular due to efficiency and EVM-compatibility. However, the delay in transaction finality is a significant tradeoff to consider. ZK rollups focus on privacy and security, but are more complex. Besides these two, there are sidechains like Polygon, but they have decreased in popularity.

What drives the Ethereum layer 2 sector right now?

Layer 2 networks have been expanding in 2024, especially after Ethereum implemented its Dencun upgrade, which enables them to cut transaction costs by up to 95%.

What are the fastest-growing layer 2s?

Some of the fastest-growing layer 2s today are Base, Linea, Blast, Mantle, and Starknet.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com