📕 Gas Fees Definition: Ethereum gas fees are the fees paid by participants of the Ethereum blockchain in order to have their transactions added to the Ethereum blockchain.

Written by: Mike Martin | Updated June 14, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Gas fees are the fees users pay Ethereum validators for adding their transactions to the blockchain. Gas fees, however, can fluctuate widely in price. Learn how they work here!

🍒 tasty takeaways

Blockchain networks charge users fees in order to add transactions to a blockchain.

In bitcoin, these network fees go to ‘miners’ for verifying transactions; in Ethereum, these fees (called gas fees) go to ‘validators’.

The total amount a user is willing to pay to have a transaction added to the Ethereum blockchain is called the ‘gas limit’.

Gas fees fluctuate due to supply and demand, time of day, and network congestion.

Gas fees are calculated by multiplying the transaction cost by the current gas price.

The introduction of sharding in 2023 will dramatically reduce gas fees on Ethereum.

What Are Gas Fees?

The great security that blockchain networks provide is not free.

In order to have any transaction added to a blockchain, be it a swap or NFT, network fees must be paid. In proof-of-work networks (PoW), like Bitcoin, these transaction fees go to ‘miners’. In proof-of-stake (PoS) networks, like Etheruem, these fees go to ‘validators’

In the Ethereum network, these validator fees are called ‘gas fees’.

“Gas is essential to the Ethereum network. It is the fuel that allows it to operate, in the same way that a car needs gasoline to run.”

-Ethereum.org

Gas fees are dynamic: they fluctuate with supply and demand and network congestion.

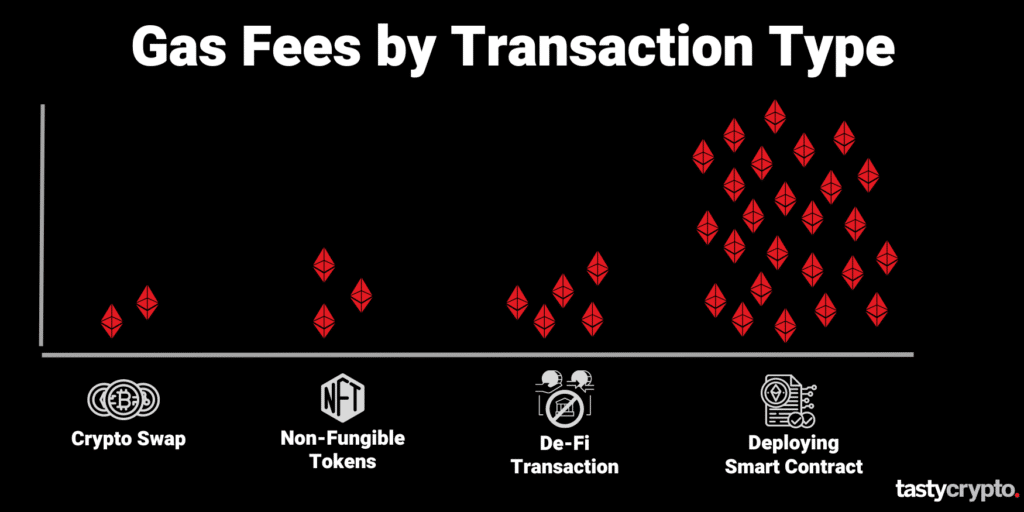

Gas fees also vary depending on the type of transaction being performed. A simple crypto swap will typically cost a few US dollars in gas fees, while deploying more complex smart contracts may cost thousands of dollars.

This amount a participant is willing to pay to have their transaction validated is called the ‘gas limit’.

All gas fees are denominated and quoted in ‘GWEI’. Let’s look at the current live gas fees, and then we’ll dive into GWEI to understand what that means!

Live Gas Fees

What Is a GWEI?

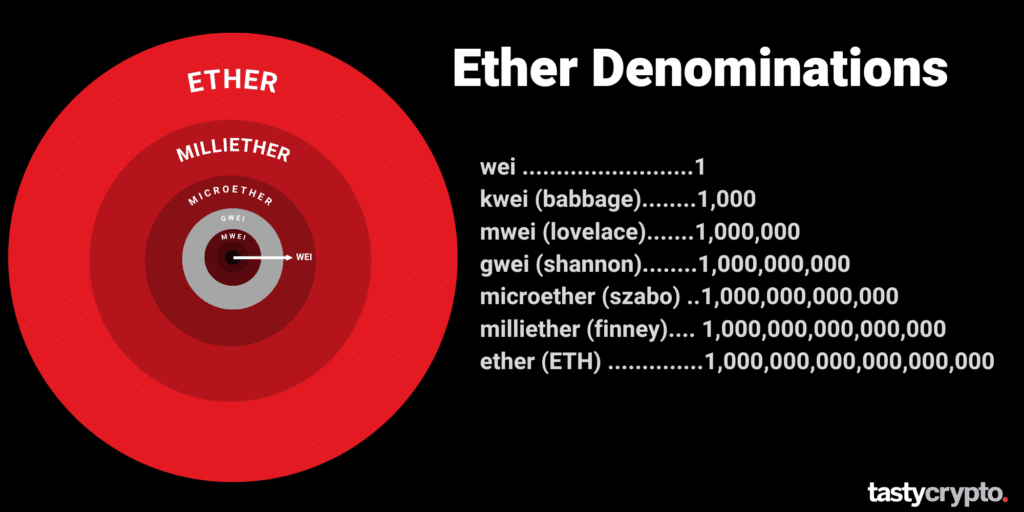

As with most currencies, cryptocurrencies are divisible. The divisibility of crypto makes it easier for us to understand the value of transactions. GWEI can be thought of as Ether’s ‘cents’.

For example, as opposed to saying the current gas fee is 0.000000001 ETH, saying that gas fee is one ‘GWEI’ is much more comprehensive.

Let’s now look at all denominations of ether (ETH). Notice that the smallest unit of ETH is a ‘wei’, which represents one quintillionth of one ether.

- wei — 1

- kwei (babbage) —— 1,000

- mwei (lovelace) — 1,000,000

- gwei (shannon) — 1,000,000,000 🍒

- microether (szabo) — 1,000,000,000,000

- milliether (finney) — 1,000,000,000,000,000

- ether (ETH) — 1,000,000,000,000,000,000

‘GWEI’ actually blends together two words- giga and WEI. WEI means one, and giga is the prefix for billion. There are, therefore, one billion WEI in one GWEI and one billion GWEI in one ETH.

How Are Gas Fees Calculated in US Dollars?

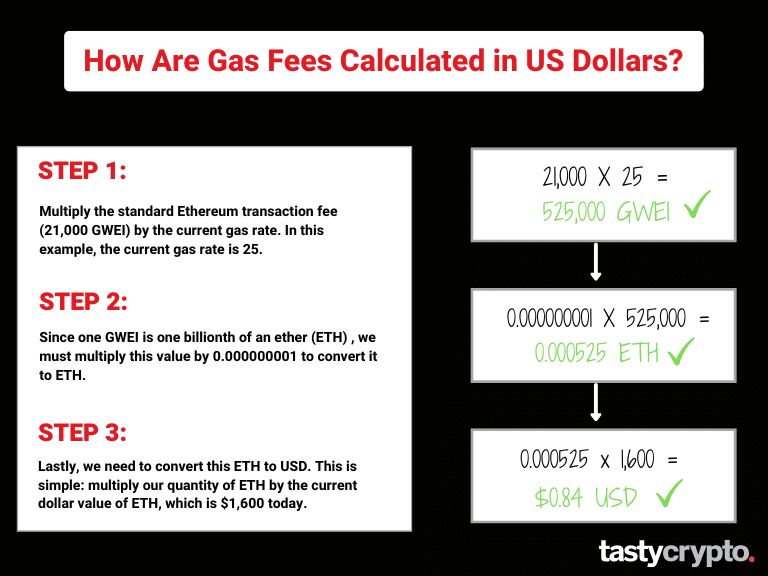

The minimum amount of GWEI required to add a transaction to the Ethereum blockchain is 21,000 GWEI.

The first step in calculating gas fees and converting them to US Dollars is to take this base amount and multiply it by the current gas price. Etherscan approximates this price for us:

Let’s say we want to make sure our transaction is validated in the next block, so we choose to pay the ‘High’ gas cost 25 GWEI.

21,000 X 25 = 525,000 GWEI

We learned earlier that 1 GWEI is one billionth of an ETH.

So to determine this GWEI value in ETH, we must multiply the amount in GWEI by 0.000000001

0.000000001 X 525,000 GWEI = 0.000525 ETH

Lastly, we can convert this 0.000525 ETH to US Dollar by multiplying it by the current price of ETH, which is $1,600.

0.000525 x 1,600 = $0.84

Therefore, a basic transaction will cost us 84 cents currently.

Summary: 25 gwei/gas X 21,000 gas = 525,000 GWEI = 0.000525 ETH = $0.84.

In addition to this base fee, you will also need to pay a priority fee, or ‘tip’, to the validator.

Gas Fees and Transaction Types

Gas fees can be compared to the cost of gasoline in a car trip. In a car trip, the further and faster you drive, the more it will cost you in gasoline. In Ethereum, the more computational steps required for your transactions, and the faster you want it added to the blockchain, the higher the gas fees will be.

For example, if you were to sell an NFT (non-fungible token) on a marketplace like Uniswap, your gas fees would probably only be a couple of dollars. Think of this as driving from New York City to Connecticut.

Now if you were to do a more complex transaction, like a complicated DeFi (decentralized finance) on a dApp that involves engaging several smart contracts on the Ethereum Virtual Machine (EVM), the gas fees would be far more expensive. This would be like driving from New York City to Florida.

If you wanted to actually deploy a smart contract on Ethereum, the gas fees could easily exceed $10,000, which would be like circling the earth several times!

What Determines Gas Fees?

The main determinant for gas fee prices is the supply of validators and the demand for transaction verification.

In addition to supply and demand, gas fees are affected by:

The time of day

The lowest gas fees usually occur when most of the US sleeps.

The time of the week

Ether gas fees are most expensive on week days.

The speed of your order

For faster execution, you have to pay more in gas fees.

Ether whales

Gas fees jump when whales (large holders of ETH) transact.

Network congestion

How busy the network is.

Gas Fees and Ethereum 2.0

In late 2022, Ethereum changed their consensus mechanism from proof-of-work to proof-of-stake in an event dubbed ‘The Merge’.

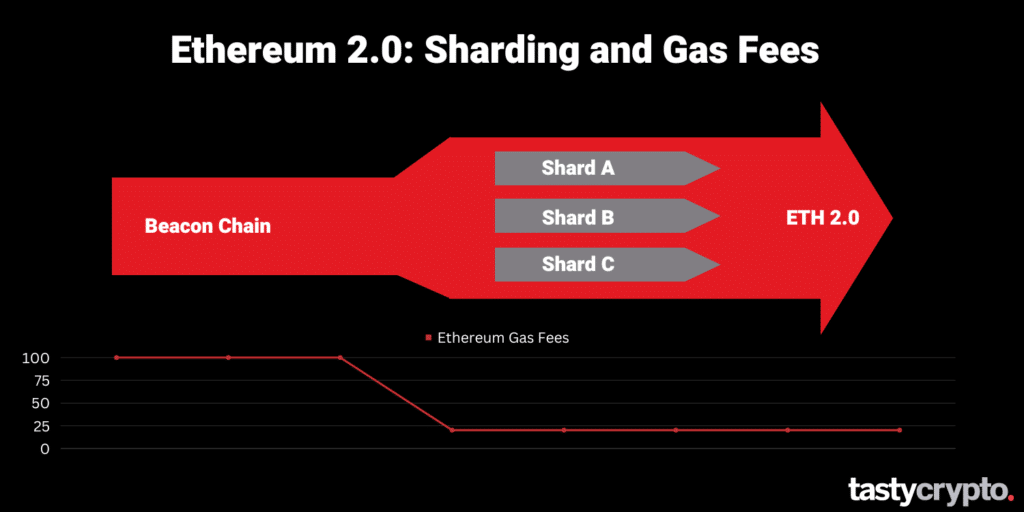

The Merge officially began in late 2022, and completed in 2023. One reason The Merge happened was to introduce sharding, which involves a horizontal split of Ethereum’s database. This split will help spread out the large amounts of data the network processes and increase transaction throughput.

The main value-add of sharding will be a dramatic reduction in the gas fees required to transact on Ethereum. This gas fee reduction will dramatically increase the network’s ability to scale.

🚨 If you’re trading crypto on a centralized exchange, you don’t pay gas fees – you pay maker/taker fees. Read how these fees work here!

Additional Reading

FAQs

Polygon is a layer-2 scaling solution for the Ethereum network, which means that it is compatible with the EVM (Ethereum Virtual Machine).

Read: Layer 2’s – Polygon vs Arbitrum vs Optimism

Unlike Ethereum, Polygon uses ‘rollups’ to bundle together thousands of transactions. This helps to increase the number of transactions stored in a block, and therefore reduces fees. Polygon’s network fees are paid in MATIC, the blockchains naive token.

Ethereum gas fees are lowest on both weekends and in the middle of the night for the United States. Gas fees tend to be at their highest on Friday during market hours.

Although you can not directly write off Ethereum gas fees, you can use them to reduce the cost basis of crypto swaps. This will help to lower your taxes when you sell your digital assets.

ETH gas fees can be high for many reasons. Network congestion is the main reason why ETH gas fees are high. Layer 2 solution, like Polygon and Arbitrum offer reduced gas fees through sharding.

Ether gas fees can be reduced by waiting to place your transaction until the network is less congested. The Ethereum network is at its slowest over the weekend and when the US stock market is closed.

The gas fees for ether (ETH) are at their lowest between 9:00 and 11:00 UTC. In the US, these hours are generally in the middle of the night.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?

Wrapped Crypto Tokens: A Beginner’s Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.