Ethena is a decentralized stablecoin protocol that offers a synthetic dollar for DeFi and Web3 use. The ecosystem has a governance token, ENA, which has the potential to become one of the top cryptos in 2024.

Written by: Anatol Antonovici | Updated April 17, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Ethena’s USDe stablecoin stands out in the crypto world by pairing a delta hedging strategy with blockchain technology, ensuring stability, scalability, and resistance to censorship. Ethena’s governance token, ENA, currently trades at $0.55 but may have great upside potential.

Table of Contents

🍒 tasty takeaways

Ethena’s USDe stablecoin uses a complex price-peg mechanism that enables it to be stable, scalable, and censorship-resistant.

ENA is the governance token of the Ethena ecosystem.

ENA launched in April 2024 with a price of $0.55 and has the potential to grow to $5 and beyond.

Summary

| Feature | Description |

|---|---|

| Protocol | Ethena is a decentralized stablecoin protocol offering a synthetic dollar for DeFi and Web3 uses. |

| Stablecoin USDe | Uses delta hedging for stability, scalability, and censorship-resistance. |

| ENA Token Launch | Launched at $0.55, projected to rise to $5 and beyond. |

| Decentralization | USDe is backed by crypto assets, providing a censorship-resistant currency. |

| Yield Opportunities | Staking USDe offers high yields from protocol-generated sources. |

| Market Potential | ENA could become a leading crypto as it gains market traction and investor interest. |

What Is Ethena?

Ethena is an Ethereum-based stablecoin protocol that aims to challenge traditional banking system infrastructure (TradFi). Its flagship product, USDe, is a decentralized stablecoin which mirrors the US dollar (for now!).

Unlike centralized USD stablecoins USDC and USDT, backed by fiat reserves, Ethena’s USDe is a synthetic dollar backed by crypto assets and futures. This approach is meant to provide a censorship-resistant form of money.

Because of this, USDe shares more similarities with Maker’s DAI than with USDC or USDT.

Ethena recently launched a governance token, ENA, and offers a decentralized USD-denominated savings instrument.

Ethena Investors

Ethena Labs developed a decentralized ecosystem. In two Rounds, it raised over $20 million from investors such as Arthur Hayes of BitMEX, Binance Labs, Bybit, Dragonfly, Delphi Digital, Huobi Ventures, OKX Ventures, and Deribit.

How Does Ethena Work?

USDe is a stablecoin for decentralized finance (DeFi). Its price peg is ensured by a complex mechanism called delta hedging. It represents a risk management strategy in which short futures positions offset the collateral’s price change risk.

For example, if Ethereum is used as collateral, USDe will dynamically adjust the delta position by taking short positions against Ethereum derivatives on third-party futures trading platforms such as Binance, BitMex, or Deribit. If the price of Ethereum drops, the short positions become profitable, maintaining a balanced reserve to back USDe.

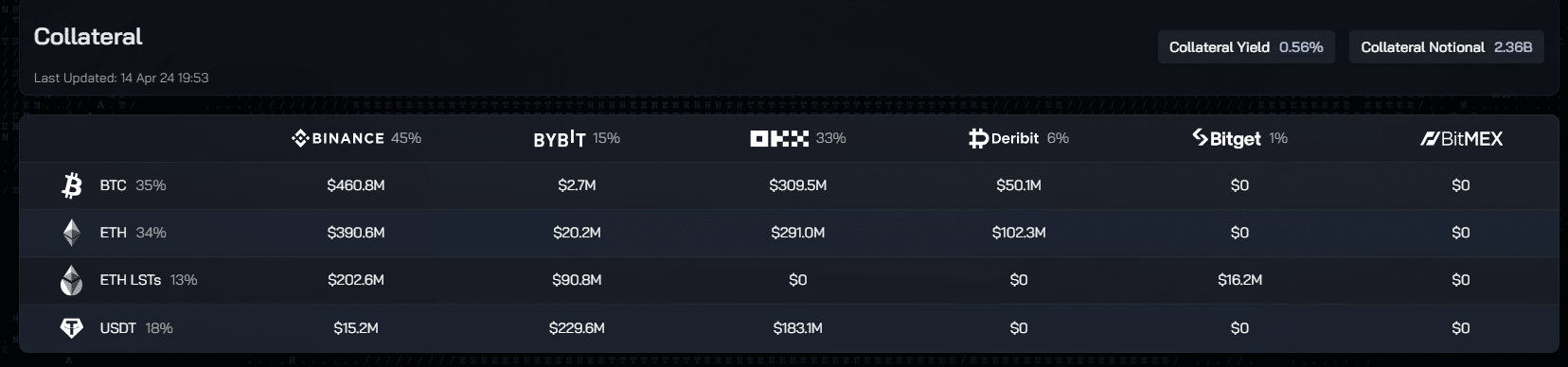

Here is an overview of Ethena’s collateral that includes Bitcoin (BTC), Ether (ETH), and LSTs:

Source: Ethena

Minting USDe

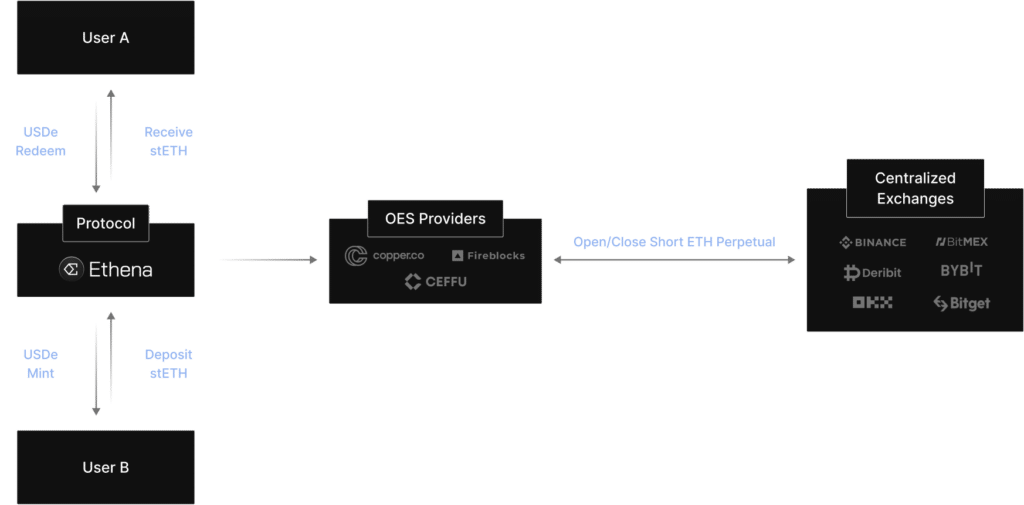

Users can mint USDe by depositing Ethereum or liquid staking tokens (LSTs) like stETH as collateral. Minting may involve slippage and execution fees. Once users deposit ETH or LSTs, Ethena opens short positions on derivative exchanges to achieve delta neutrality.

Conversely, users can redeem their USDe for Ethereum or LSTs.

Source: Ethena Labs

Staking USDe

Users can stake USDe to earn rewards as part of the Internet Bond program. Participants transfer their stablecoin to the Staked USDe smart contract to receive sUSDe in return.

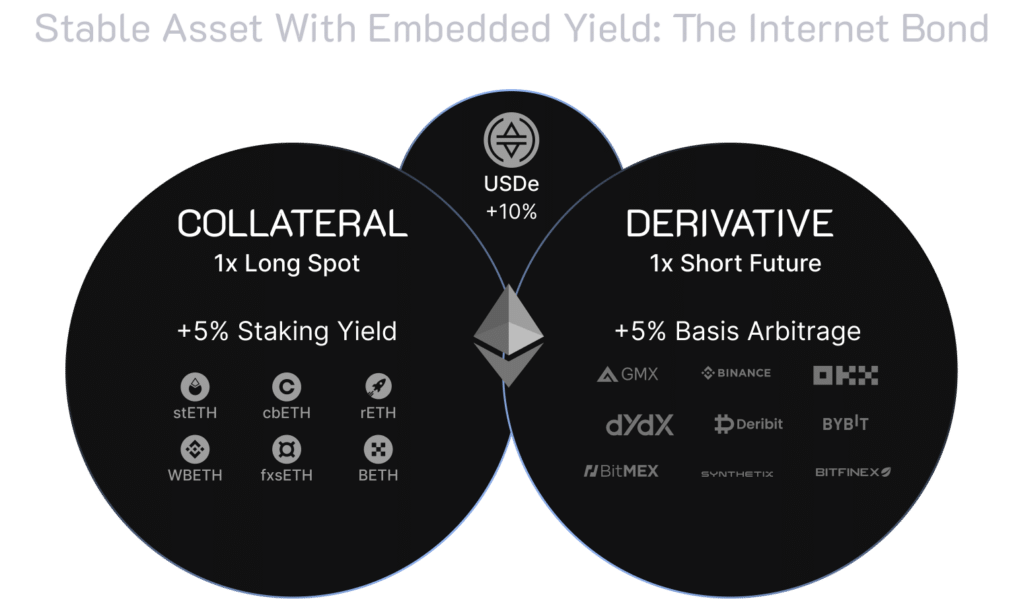

This is a passive income opportunity that can offer generous returns based on the protocol’s generated yield, which comes from two sources:

- Rewards from staking Ethereum.

- Funding and basis spread earned from the derivatives positions.

Source: Ethena Labs

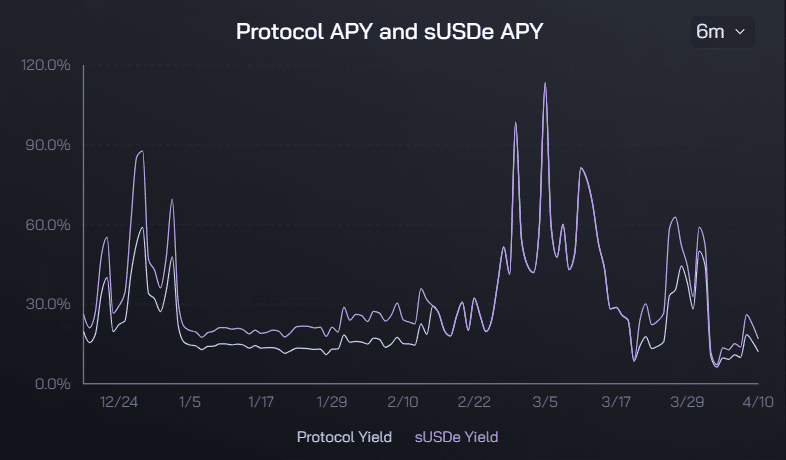

This is what Ethena calls internet native yield. Today’s annual percentage yield (APY) for staking USDe is over 17%. This yield jumped to over 100% at the beginning of March!

Source: app.ethena

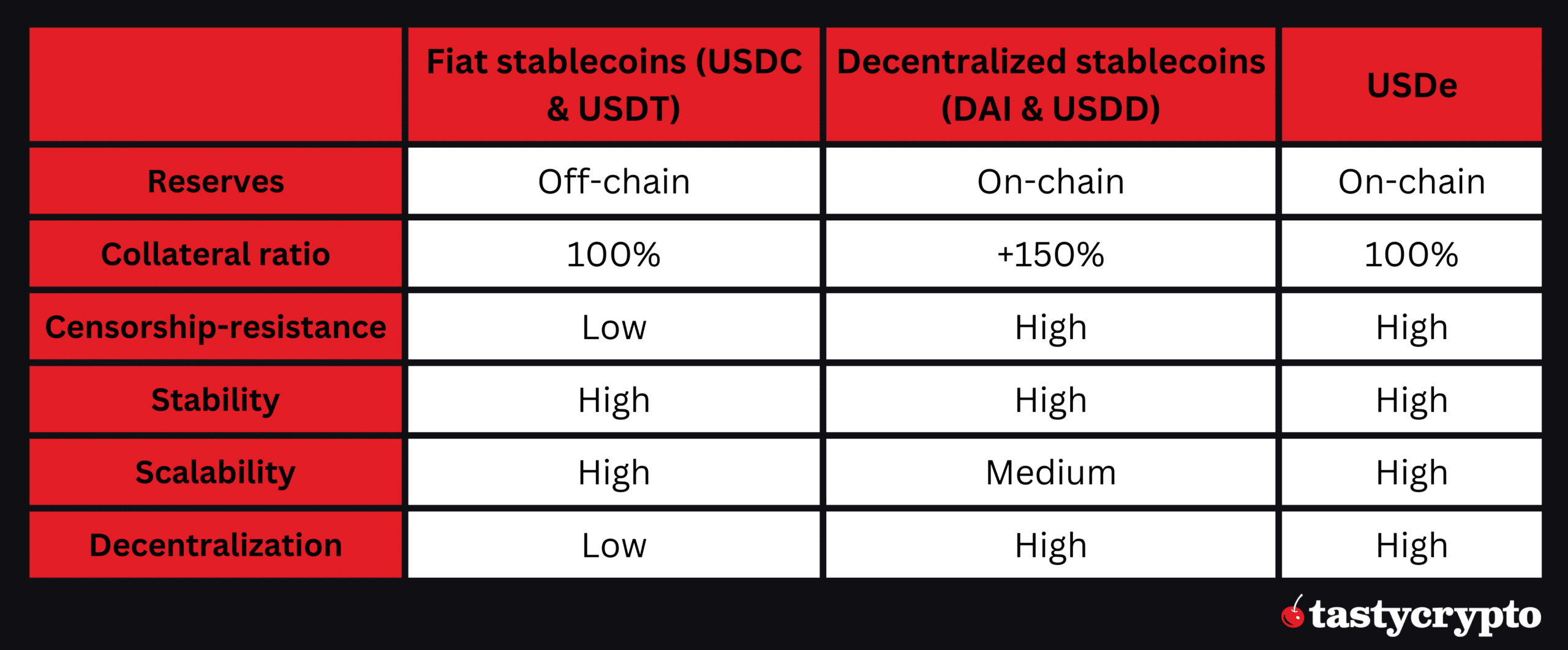

How Does USDe Compare to Other Stablecoins?

The goal of Ethena was to build an ideal USD stablecoin that is stable, scalable, and censorship-resistant.

USDC and USDT are stable and scalable, but they are not censorship-resistant. Conversely, DAI loses scalability due to over-collateralization. Remember the infamous Terra USD (UST), which had a weak peg mechanism that was ultimately exploited?

USDe aims to achieve all three key elements by staying decentralized like DAI and UST but avoiding over-collateralization or peg fragility thanks to its unique delta hedging mechanism.

In addition to building an ideal stablecoin, Ethena aims to offer a savings product to users worldwide.

USDe Concerns

Despite Ethena’s unique approach, some analysts are still skeptical. Folkvang CEO Mike van Rossum expressed worries about risk exposure from derivative platforms. He stated:

“There are a lot of things that can go wrong here. Such as any issue with any of the exchanges these positions (and collat) are managed on. As well as issues around trying to execute hundreds of millions (or billions) in very volatile markets.”

— Mike van Rossum

In response to concerns that USDe may have the fate of Terra, Ethena Labs founder Guy Young said:

“It is a really weak, surface-level argument to compare what Ethena is doing to Luna.”

— Guy Young

Ethena Risk Radar

In April 2024, Arthur Hayes revealed the “Ethena Risk Radar” on intotheblock.com, which monitors the stablecoin’s peg, DEX liquidity, and other metrics.

What Is ENA?

At the beginning of April, Ethena launched its governance token, ENA, which will give holders the right to decide the protocol’s future.

ENA is an ERC-20 standard token that can be staked for rewards. The protocol yield is usually lower than USDe yield.

ENA Tokenomics & Metrics

ENA launched with a market capitalization of about $800 million and quickly rose to $1.8 billion the next day.

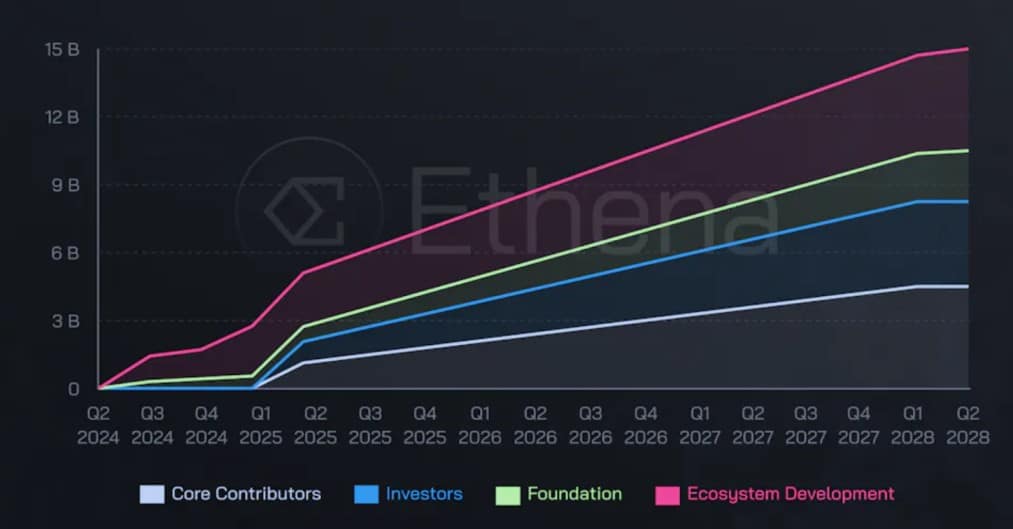

The total supply is 15 billion ENA tokens; over 9% are circulating.

Only 30% of the total supply is allocated to ecosystem development, i.e., Ethena users. The rest of ENA is allocated to the team, investors, and its fund. Here is the vesting schedule:

Source: mirror.xzy

5% of the supply has already been distributed to USDe stakers through airdrops.

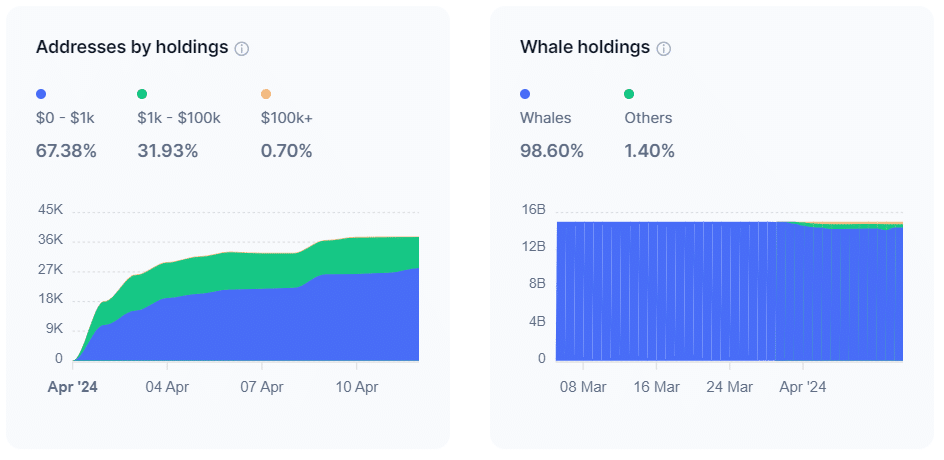

Today, over 28k addresses hold ENA, although almost 99% of it is held by large investors, aka whales.

Source: CoinMarketCap Analytics

How Far Can ENA Go in 2024?

Ethena made a lot of noise with its ENA launch, and the token may continue to thrive in 2024, as its USDe stablecoin has unique characteristics and ENA staking offers high rewards.

ENA already ranks 13 on CoinMarketCap by 30-day trading volume, although it has been around for only two weeks, reflecting investor interest in the project.

Delphi Labs CEO Maria Macedo anticipates that USDe will become the third largest stablecoin after USDT and USDC, while Ethena will become the highest revenue-generating crypto project this year.

If the general crypto market moves horizontally or continues to expand this year, ENA can increase several times to hit the $5 mark. Arthur Hayes is even more optimistic and expects the price to hit $10.

FAQs

What is Ethena?

Ethena is a stablecoin protocol that leverages the Ethereum blockchain. It offers a USD-backed stablecoin called USDe, which eliminates the high volatility of cryptocurrencies and can be used in DeFi.

How is USDe different from other stablecoins?

Unlike centralized stablecoins like Tether’s USDT and Circle’s USDC, which are backed by fiat reserves, USDe is a synthetic dollar backed by crypto assets and short futures positions, which are dynamically adjusted as part of a strategy called delta hedging.

What is ENA?

ENA is the governance token of the Ethena protocol, enabling holders to participate in voting and staking for rewards.

Where can I buy ENA?

ENA was launched at the beginning of April 2024 and can be purchased on multiple crypto exchanges, including Binance and Uniswap.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com