Ethereum (ETH) is generally considered a better blockchain than Solana (SOL). This is because Ethereum has a more established ecosystem, greater dominance in the DeFi space, and wider adoption of its smart contract technology.

Written by: Anatol Antonovici | Updated January 24, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Solana, one of the top-performing blockchains in recent years, has positioned itself as a significant challenger to Ethereum. In this article, we compare the two blockchains and their respective cryptocurrencies to see if Solana can really become the much-discussed “Ethereum killer.”

🍒 tasty takeaways

- Ethereum (ETH) is a PoS blockchain that dominates the DeFi space and hosts thousands of utility and security tokens.

- Solana (SOL) is a PoS blockchain that has a 3% market share in DeFi while Ethereum has a 50%+ DeFi market share

- Solana has surpassed Ethereum in monthly NFT sales.

- Solana has been growing rapidly during the last months, helping SOL surge over 600% in 2023.

- Ethereum’s transition to PoS has enhanced its scalability and efficiency, but Solana still leads in transaction processing speed, handling about 65,000 transactions per second.

Ethereum vs Solana: Summary

| Ethereum (ETH) | Solana (SOL) | |

|---|---|---|

| Blockchain Type | PoS Blockchain, dominates DeFi | PoS Blockchain, 3% market share in DeFi |

| NFT Sales | Popular in NFT space | Surpassed Ethereum in monthly NFT sales |

| 2023 Growth | Transitioned to PoS, improved scalability | SOL surged over 600% |

| Transaction Speed | Up to 30 tps (planning for 100,000 tps) | 65,000 tps |

| Decentralization | More nodes, higher decentralization | Fewer nodes, uses DPoS |

| Security | Larger developer community, tested security | Nakamoto Coefficient of 22 |

| Transaction Fees | Average fee ~$5 | Standard fee ~$0.0003 |

| Ecosystem | Larger ecosystem of dapps | Rapid ecosystem growth in 2023 |

| DeFi TVL | Over $32 billion, 50%+ market share | Over $2 billion, 3.20% market share |

| Staking | 5% reward rate, 32 ETH minimum | 6.7% reward rate, no minimum |

What is Ethereum?

- Token: Ether (ETH)

- Category: Blockchain for DeFi & smart contracts

- Advantage: Established ecosystem, broad adoption

Ethereum is an open-source blockchain network launched in 2014 by Vitalik Buterin. Initially designed to address Bitcoin‘s (BTC) limitations (high fees and slow speed), Ethereum quickly became the underlying infrastructure for thousands of decentralized projects.

We Interviewed Vitalik in 2014!

Ethereum Upgrades & Scalability

Following a recent major upgrade, Ethereum switched to the Proof of Stake (PoS) consensus mechanism from its prior Proof of Work (PoW) algorithm. This enables faster transactions, lower gas fees, and eco-friendly operations.

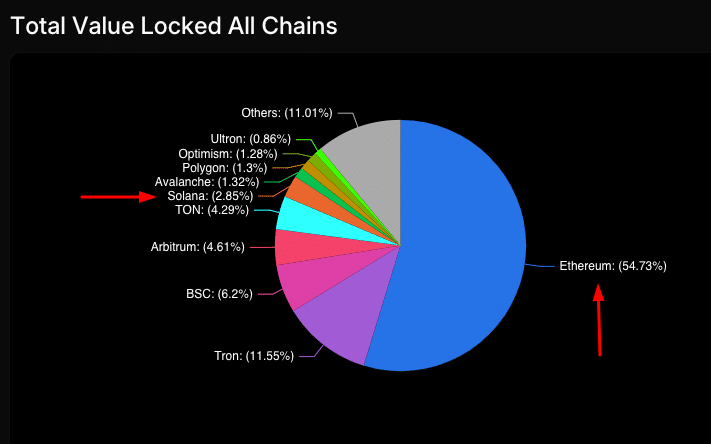

The Ethereum network currently dominates the decentralized finance (DeFi) sector, accounting for over 50% of all total value locked (TVL). Most decentralized exchange (DEX) marketplaces, the lifeblood of DeFi, prefer building on Ethereum over Solana.

What is Solana?

- Token: Sol (SOL)

- Category: Highly scalable blockchain

- Advantage: High transaction throughput, low Transaction Fees

Solana is a public blockchain supporting the smart contract feature. Launched in 2020, it is among the ‘Ethereum killer’ candidates, a term for blockchain technology projects designed to outperform Ethereum in efficiency.

Solana uses a Delegated Proof of Stake (DPoS) version that relies on a voting and reputation system to secure the network and validate new transactions. To support consensus, it also uses a unique functionality called Proof of History, which generates timestamps for each block and acts as a network-wide clock. This helps Solana offer fast transactions with instant finality.

🍒Cardano (ADA) vs Solana (SOL)

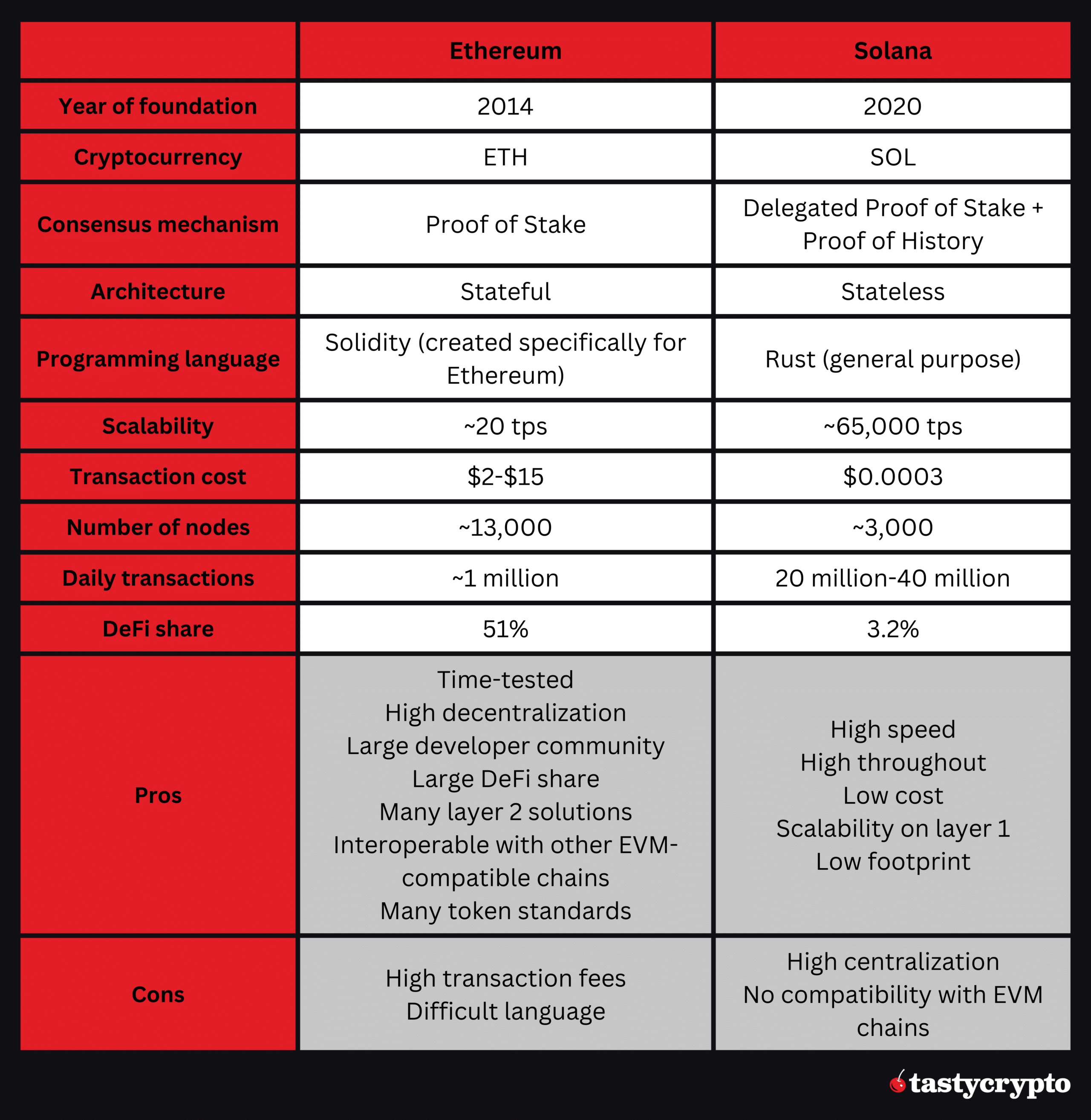

Now let’s dive into a head-to-head comparison by going through several factors:

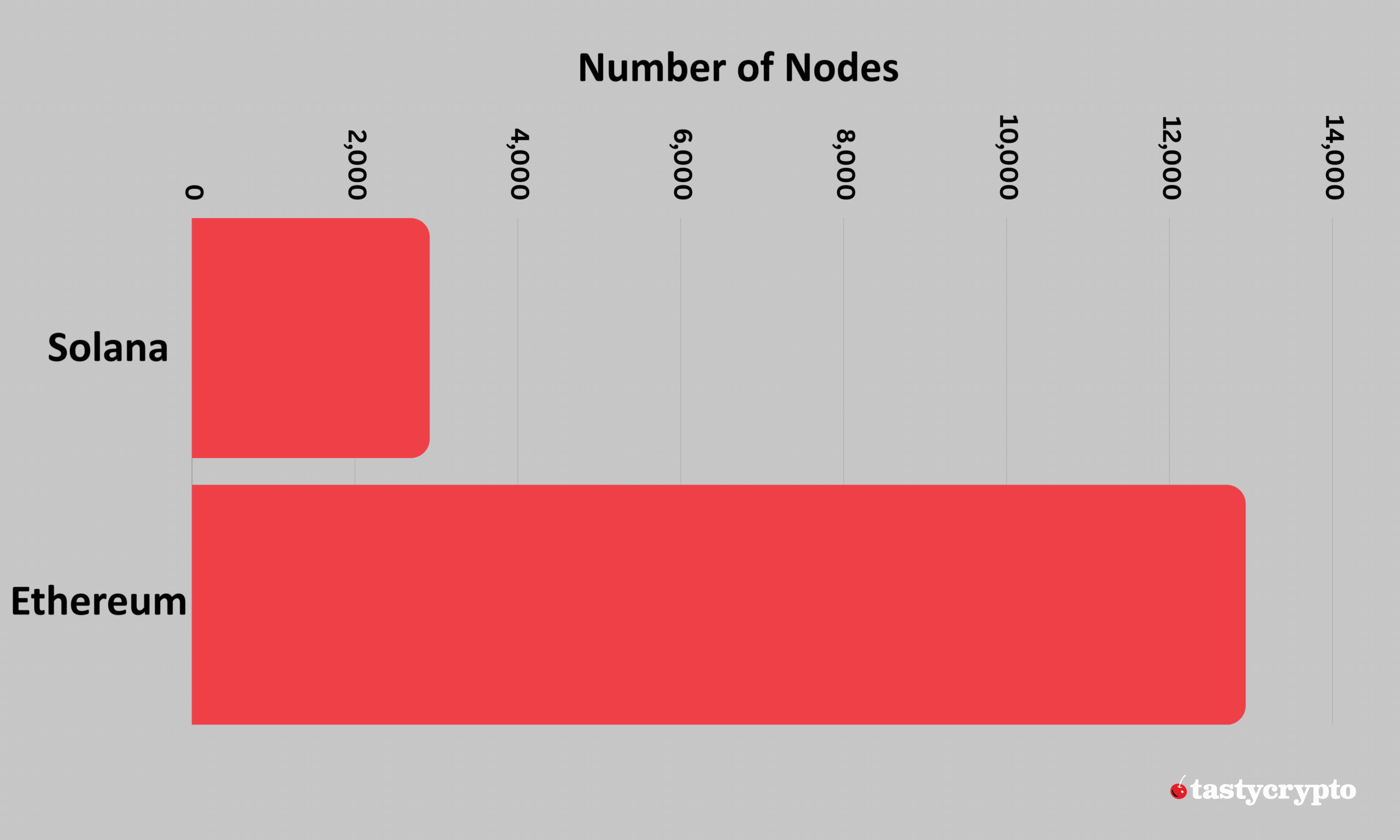

Ethereum vs Solana: Decentralization

Judging by the number of nodes, Ethereum has a higher degree of decentralization. Remember, in blockchain, decentralization is a very good thing as it diversifies risk and control.

As of today, Solana has 2,919 nodes, while Ethereum has almost 13,000 nodes. This means Solana has 23% as many nodes as Ethereum. Solana also uses the DPoS version, which involves a smaller set of validators that are selected by SOL stakers.

Ethereum vs Solana: Security

Despite being less decentralized, Solana might be more resilient against malicious actors. This is what we concluded from the Nakamoto Coefficient, which represents the smallest number of entities that can act collectively to shut down a blockchain. Presently, the Nakamoto Coefficient is 1 for Ethereum compared to 22 for Solana.

Still, Ethereum has a longer history of security testing and a larger developer community.

Ethereum vs Solana: Scalability & Speed

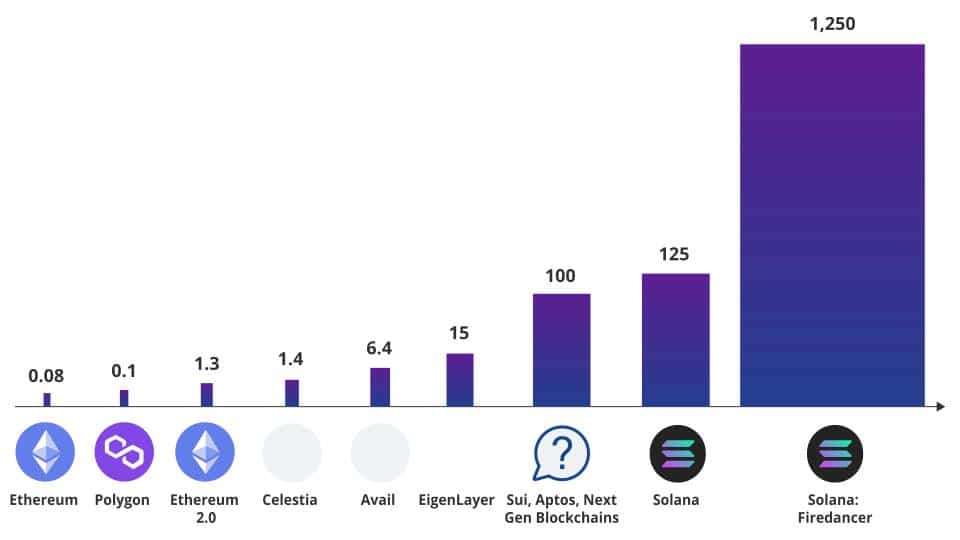

Following the gradual transition to PoS, Ethereum has become more scalable and efficient. However, it still cannot beat Solana, which is one of the fastest blockchains out there. Solana can handle about 65,000 transactions per second (tps), while Ethereum can process up to 30 tps. Ethereum is planning to boost its transaction speed capacity to 100,000 tps after upgrades in the future.

Solana is processing over 20 million transactions per day, or about 600 million transactions/month, as seen below.

Ethereum handles about 1 million transactions per day.

Solana has the highest throughput, being able to process over 100 MB/s. The data capacity will increase by a factor of 10 after the Firedancer upgrade.

Source: Vaneck

While Solana-based projects can scale on layer 1, Ethereum relies on multiple on-chain layer 2 solutions (e.g., Arbitrum, Optimism & Polygon) designed to bring efficiency by settling transactions outside the mainnet.

Ethereum vs Solana: Fees

Solana was built for efficiency, and it offers much lower transaction costs compared to Ethereum. The standard fee on Solana is ~$0.0003. Users can also pay prioritization fees, which are about 75% of the main fee. This is extremely cheap compared to Ethereum’s average fee of $5 per transaction.

Ethereum vs Solana: Ecosystem

Ethereum has a much larger ecosystem of dapps, but the Solana ecosystem showed exponential growth in 2023.

DeFi

Ethereum accounts for about half of TVL in DeFi protocols, with over $32 billion as of January 2024. Solana has surpassed the $2 billion mark, having a 3.20% share in DeFi.

Source: DeFi Llama

NFTs

Ethereum has also dominated the NFT space, but Solana is quickly catching up. In December 2023, the monthly NFT sales volume on Solana beat Ethereum NFT sales for the first time, according to CryptoSlam data. Solana NFT sales hit a record $366.5 million that month, versus Ethereum’s $353.2 million.

Notably, CryptoSlam excludes suspected ‘wash trading,’ which accounted for about $381 million in Ethereum‘s case and just $10 million for Solana.

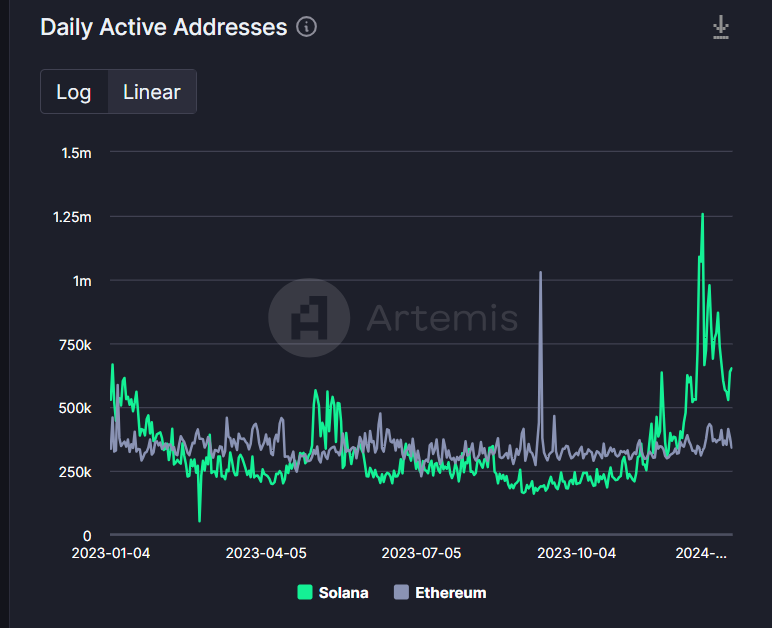

Active addresses

The adoption rate of Solana is impressive. Solana’s measure of daily active addresses has recovered to surpass that of Ethereum.

Source: Artemis

ETH vs SOL: Price Performance

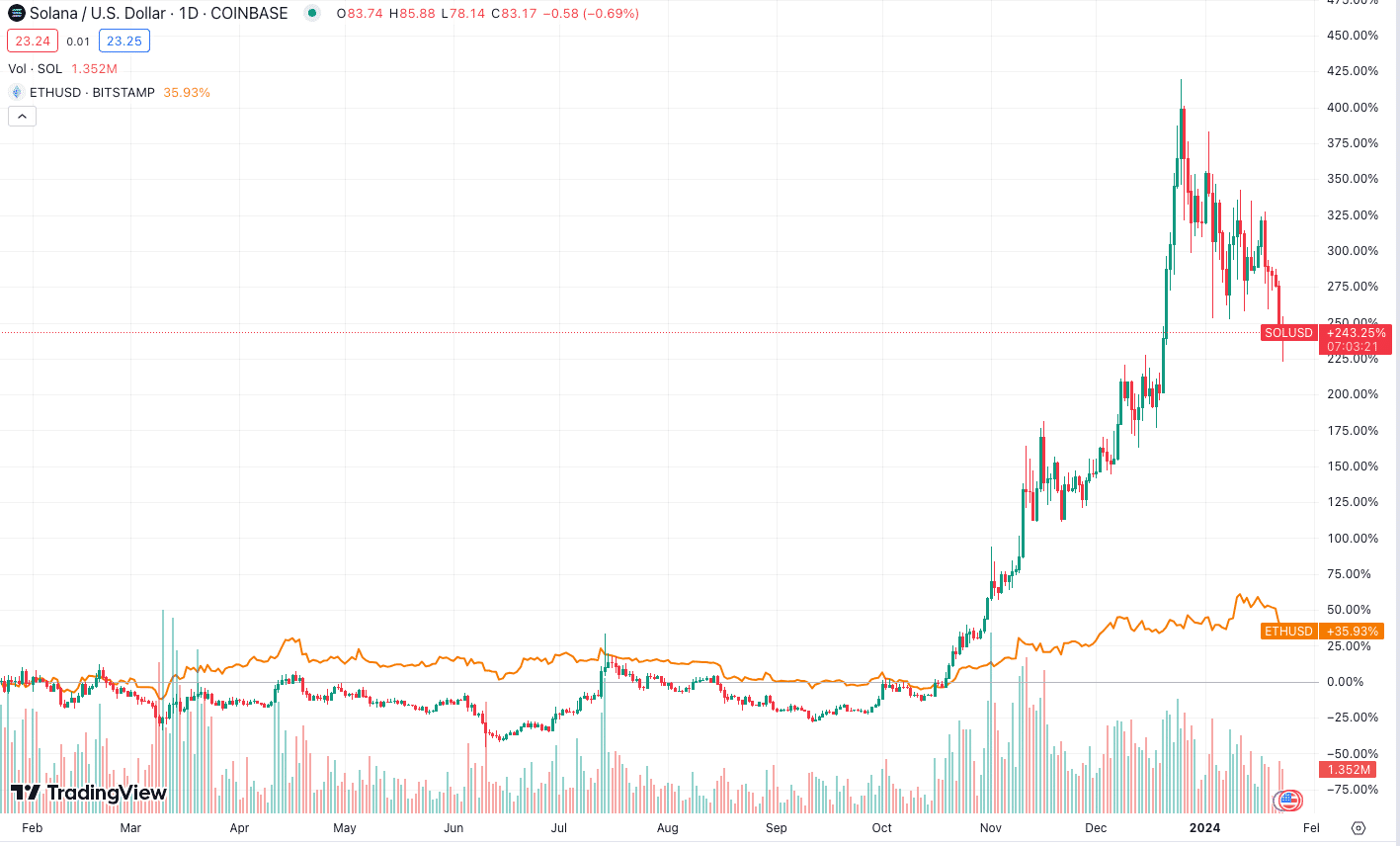

From an investment perspective, Solana’s SOL cryptocurrency has been a big winner, beating ETH by a wide margin.

SOL has been driven by Solana’s rapid adoption across DeFi, NFTs, and Web3. The price of SOL has surged over 200% during the last 12 months, while ETH added 35% during the same period.

Source: TradingView

Thanks to its rapid surge, Solana has become the fifth-largest cryptocurrency by market cap, competing with Binance’s BNB coin for the 4th position.

Ethereum vs Solana: Staking

Both Ethereum and Solana employ a PoS version, which means they enable users to stake the native crypto coin to earn rewards. Unlike Solana, Ethereum requires a minimum deposit of 32 Ether (over $70,000 in current prices). This barrier led to the rise of liquid staking platforms, where users can stake any amount of ETH and receive token derivatives in return, enabling them to explore DeFi opportunities.

The reward rate for ETH staking is about 5% per year versus 6.7% for SOL.

Final Verdict

The fact that Solana is competing with Ethereum on several fronts is a big achievement. Still, the choice between the two is based on individual use cases and preferences. For example, Web3 applications expecting high activity can opt for Solana, while DeFi projects seeking robust developer communities and EVM compatibility can go with Ethereum or its layer 2 solutions.

Here is a more in-depth comparison between the two:

FAQs

Ethereum is a leading Proof of Stake (PoS) blockchain network known for popularizing smart contracts. It enables the creation of decentralized applications (dApps) and various types of tokens.

Solana is a high-performance blockchain supporting smart contracts and is known for its speed and efficiency. It uses a unique combination of Delegated Proof of Stake (DPoS) and Proof of History (PoH) for network security and transaction validation.

Ethereum has a larger ecosystem and dominates the decentralized finance (DeFi) market. Solana focuses on scalability and efficiency, hosting applications with high activity.

While Solana is a real competitor, especially considering its speed and transaction fees, it’s still early to call it an Ethereum killer, with Ethereum accounting for 50% of the decentralized finance space.

Cardano distinguishes itself with a research-driven approach and a focus on sustainability, while Solana excels in transaction speed and low fees. Solana (SOL) has a much higher adoption rate than Cardano (ADA).

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com