📕 Definition: From staking to lending crypto, DeFi offers investors numerous ways to earn income on their crypto coins. Here are the top 3 ways to earn yield in decentralized finance (DeFi).

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

🍒 tasty takeaways

DeFi cryptocurrency lending protocols enable crypto users to borrow and lend money faster and more efficiently than traditional financial services.

AAVE, JustLend, and Compound Finance are the largest protocols by total value locked, all of which have proven themselves on the market for several years.

Available assets for borrowing and lending: AAVE (17), JustLend (15), Compound Finance (20).

Earn Yield in DeFi

Most people use self-custodial wallets to secure their digital assets and trade crypto on decentralized exchanges (DEXs), such as Uniswap.

But decentralized finance (DeFi) is much more than simply swapping crypto!

In this article, we will show you 3 ways you can use your self-custody tastycrypto wallet to earn yield in DeFi.

❓New to DeFi? Start Here!

1. Stake Your Crypto

Staking crypto is one of the most popular ways for DeFi participants to earn a yield on idle cryptocurrency.

If you own coins that use the ‘proof-of-stake’ consensus mechanism, like ether (ETH), you can choose to stake those coins and earn yield.

📖 Read! 5 Best Ways to Stake Your Ethereum

How Does Staking Work?

There are two predominate consensus mechanisms that blockchain networks use: proof-of-work (PoW) and proof-of-stake (PoS). A consensus mechanism is a system that the participants of a blockchain network use to come to an agreement on the state of the network.

In PoW networks, like bitcoin, miners worldwide race to solve a cryptographic puzzle. This work validates bitcoin transactions so they can get added to the blockchain. The miner who solves the math problem first is rewarded in bitcoin.

In PoS networks, like Ethereum, blocks are validated and added to the chain by stakers. To become a staker in a PoS network you need to own any amount of that network’s native coin, and choose to stake that coin. A PoS network will choose at random one of the staked coins and do the match required to validate a block on that stakers computer.

The more coins you stake in this lottery system, the greater the odds are a network will select your computer to do the math required to validate the transactions.

The winner/validator receives crypto as a reward for their work.

But you don’t have to actually own a staking computer (node) to become a staker; you can let a decentralized protocol do the work for you!

Read! DeFi Self-Custody Crypto Wallet FAQs

Staking in DeFi

When you stake via a staking protocol, you delegate coins to that network. They will in turn add your coins to their staking pool; if a network chooses a coin from that protocols pool, the protocols nodes will do the math required, and you will receive a portion of the rewards in crypto.

In Ethereum, a new block is added to the blockchain every 11 seconds. Since we can determine the total amount of staked coins in existence relative to the pool we participate in, we can calculate our staking rewards in an APR.

Staking With Lido

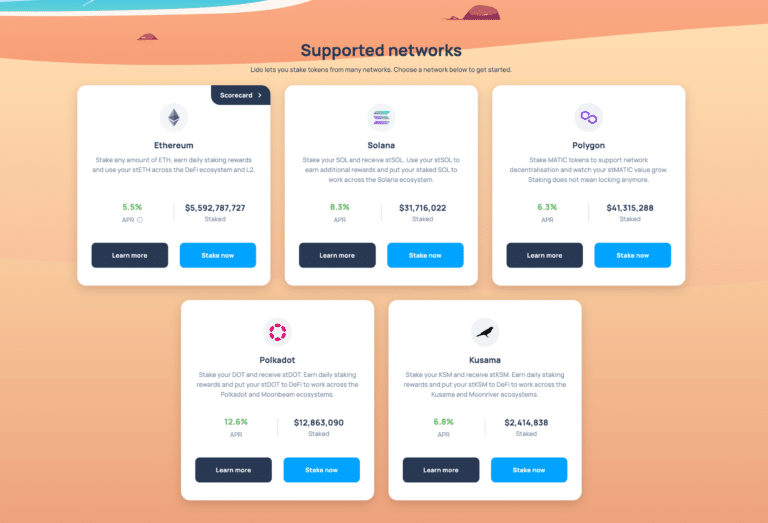

According to DeFiLlama, Lido is the second most popular DeFi protocol in existence.

Lido is a staking protocol. If you own Ethereum in your tastycrypto wallet, you can connect your wallet to the Lido network and begin staking your ETH coins via the protocol’s smart contracts immediately.

Here are the current staking rates at Lido. Bear in mind that the tastycrypto wallet will only initially be available on the Ethereum network (more to come!)

2. Lend Your Crypto

Lending your crypto through DeFi protocols offers investors more options and far greater transparency than lending with centralized exchanges such as Blockfi and Gemini Earn (Genesis).

The best part of DeFi lending is that it employs over-collateralization ratios. This means that the creditworthiness of the borrower does not matter to the lender. Collateralization ratios of 150% are pretty standard in DeFi borrowing and lending protocols, which means that a borrower needs to put up an amount of crypto 50% greater than the value of the loan.

In DeFi lending, we can see this all happening in real time. There are no opaque curtains veiling what is going on behind the scenes as there were at Genesis and Blockfi.

If a loan goes undercollateralized in DeFi, it is immediately liquidated by a ‘keeper’; minus a small fee, the initial deposit is then returned to the borrower. This helps to assure bad borrowers from bringing down the system.

Borrowing and Lending in DeFi

You have several different options when it comes to borrowing and lending in DeFi.

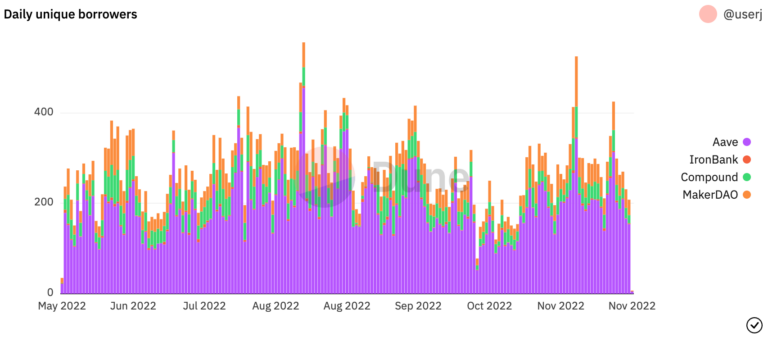

The below image, from Dune Analytics, shows the four most popular borrowing and lending protocols in DeFi.

To either lend or borrow in a DeFi protocol, you simply need to open the protocol’s website, connect your tastycrypto wallet and select whether you want to be a borrower or a lender.

Let’s take a closer look at lending on Aave next, the most popular DeFi lending/borrowing protocol.

Lending With Aave

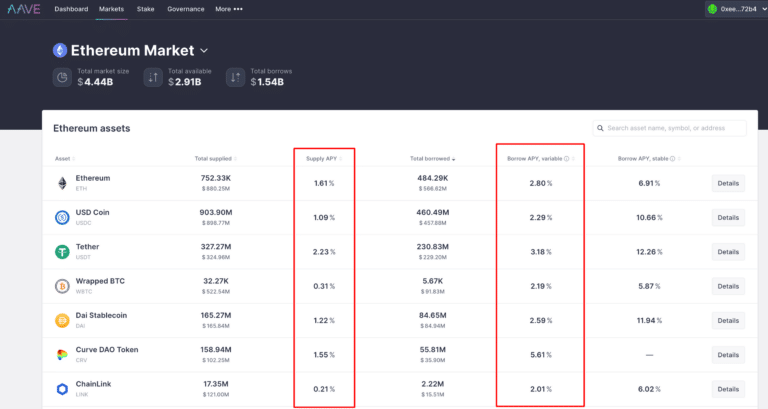

The below image from Aave shows the protocol’s current lending and borrowing rates.

To become a lender or borrower, you simply connect your wallet, click on the crypto you want to engage with and confirm the dollar amount of your transaction. You can exit your position at any time.

Curious how much of your portfolio should be in crypto? Read our article: Here’s why to invest in crypto and how much.

3. Become A Market Maker

In traditional finance, the barriers to entry make it impossible for a retail trader to become a market maker.

In DeFi, anybody can become a market maker and earn the fees that come with it.

Liquidity Pools in DeFi

In traditional finance markets, market makers are financial participants who provide market liquidity by buying and selling financial assets using an order book.

In DeFi, market liquidity is provided via smart contracts called automated market makers (AMMs).

AMMs pool together liquidity on decentralized exchanges (DEXs) to allow traders to access numerous crypto pairs for trading.

In order to join a liquidity pool and become a DeFi market maker, you simply need to designate two cryptocurrencies of the same value to a liquidity pool.

For example, if you owned $1k worth of both USD Coin (USDC) and $1k worth ether (ETH), you could contribute both of these cryptocurrencies to the USDC/ETH liquidity pool in whatever DEX you want to work with.

As traders buy and sell that pair, you get a portion of the fees charged by the DEX. The amount of fees you receive is in proportion to the amount of crypto you have in the pool. For example, if you have $1k of a $100k pool, you will earn 1% of the fees generated by that pool.

Liquidity Pools and Impermanent Loss

One downside of liquidity pools is impermanent loss, which represents how much money you could have made had you simply owned the cryptocurrencies outright and not invested in a liquidity pool.

For example, let’s say we have $1k of both USDC and $1k of ETH in a liquidity pool.

Following this investment, ETH begins to climb in value. As more traders buy ETH and sell USDC from the pool, the amount of ETH we own will decrease while the amount of USDC will increase.

Though the total value of our pool will always be the product of our two cryptos in the pool, (x * y = k – $2,000) the value of ETH in the marketplace has increased, but we can not participate in this price increase because our funds are locked in the pool.

Alternatively, if we did nothing at all with our crypto, the value of our cryptos would exceed $2,000. We have more USDC coins, true, but this coin is a US dollar stablecoin, so one USDC coin will always be worth $1.

The price of ETH, however, fluctuates based on supply and demand. Since it went up in this scenario, our ETH would have been worth an amount greater than $1000 – our starting value.

Liquidity Pools With Uniswap

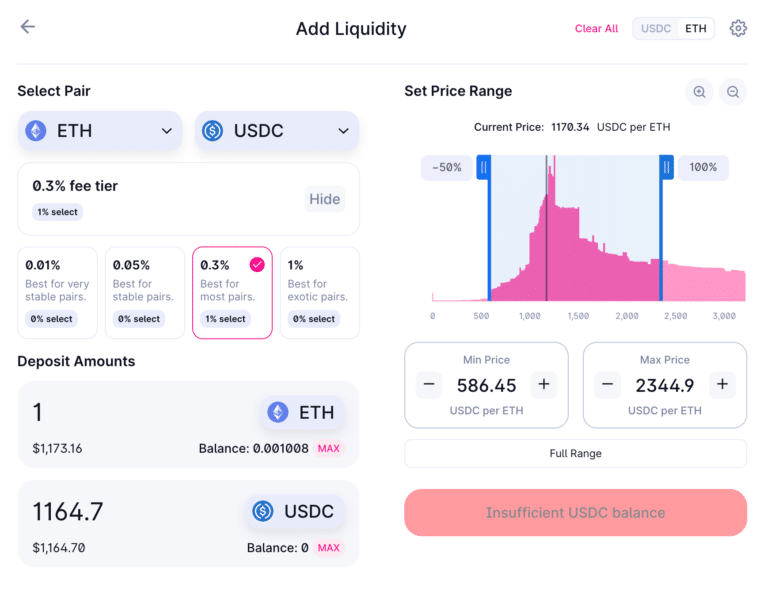

The below image shows a liquidity pool being created using ETH and USDC on the Uniswap protocol.

This is the latest version of Uniswap (V3), and it appears quite a bit more complicated than previous iterations.

We start off by selecting the two cryptocurrencies we want to add to a pool (top left). In this case, it is ETH and USDC.

Next, we select a fee tier. Naturally, you may want to select the highest fee tier; but there may be little to no action here. Why would a trader pay 1% if they can pay 0.3% to trade a pair?

Generally speaking, pools with similar cryptocurrencies within them (like two stable coins), will see the most action (and fees) in the 0.05% tier. Dissimilar crypto pairs (like wrapped bitcoin and wrapped ether) will fall into the 0.3% tier and exotics will fall into the 1% tier.

You can read more about the tier fees in this great Medium article.

Next up, you choose a range that you want to provide liquidity for (the pink chart). You can read more about ranges here.

After you have successfully contributed two cryptocurrencies of an equal value to a liquidity pool, the Uniswap protocol will give you liquidity provider tokens (LP tokens), which represent your stake in the liquidity pool. These tokens are also used to distribute your rewards for being a liquidity provider.

If you no longer want to be a liquidity provider, you simply cash in your liquidity tokens and get your crypto back (+ the fees you made!). The number of your tokens will be different from when you started the pool, but their value will be the same.

3 DeFi Risks

It is impossible to earn a return in this world without taking on some degree of risk. DeFi is no exception to this rule. Here are the top 3 risks that come with investing in DeFi.

1. DeFi Software Risks

There is always a chance that the DeFi protocol you are using has faulty code or bugs. To mitigate these risks, it is best to make sure independent audits have been performed on the protocol’s smart contracts.

TempleDAO, a yield farming DeFi protocol, was hacked in October of 2022 for 2.3 million dollars. The hacker found vulnerabilities in the protocol’s smart contracts.

2. Counterparty Risk

Whenever you lend anything, there is always counterparty risk. DeFi protocols generally require collateralization ratios of greater than 100%, which helps to mitigate this risk.

Counterparty risk in crypto may occur in very volatile markets when keepers can not liquidate undercollateralized loans in adequate time.

3. Crypto Token Risk

Token risk is a fundamental risk of DeFi that no investor is immune from. This risk involves the actually cryptocurrencies you are using on a DeFi protocol, not the protocol itself.

For example, if you are lending out a US dollar stablecoin on Aave, there is a chance that your stablecoin could lose its peg.

This happened with the TerraUSD (UST) algo stablecoin in 2022. This coin lost its peg in mid-2022 and is now trading for less than a penny.

In addition to making sure protocols have been adequately audited, it is, therefore, necessary for crypto investors to also make sure the crypto tokens they are using are safe and reputable. For stablecoins, this may require you to make sure that the stablecoin is actually backed by US dollars, and not backed by algorithms, which was what backed TerraUSD.

If a DeFi protocol is offering ridiculously high payout on tokens you have never heard of, there is usually a reason why. Always research cryptocurrencies before trading them.

📕 Read Next: Best Ways to Invest in Web3

*Please bear in mind that DeFi participants must pay gas fees on all Ethereum transactions. These fees are charged by the network in order to add your transactions to the blockchain.

Happy trading!

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.