Definition: The DeFi Pulse Index is a capitalization-weighted ERC-20 token that tracks the price of popular decentralized finance tokens such as UniSwap.

Written by: Anatol Antonovici | Updated August 26, 2024

Fact checked by: Ryan Grace

The DeFi Pulse Index (DPI) is a capitalization-weighted investable index that gives investors exposure to the most popular decentralized finance (DeFi) platforms in existence. In this article, we’ll explain the details of this on-chain index and show you how it works.

Table of Contents

🍒 tasty takeaways

The DeFi Pulse Index (DPI) is a capitalization-weighted index that tracks the performance of the top 10 decentralized finance (DeFi) tokens. DPI allows investors diversified exposure to DeFi through a single asset.

The index’s weights are determined based on a token’s market cap derived from circulating supply. The larger a coin’s relative market cap, the greater its weight in the index.

The DPI includes tokens from leading DeFi platforms such as Uniswap, Aave, Maker, Synthetix, Compound, Lido DAO, Loopring Coin V2, Yearn.Finance, Rocket Pool, and Balancer.

DPI, an ERC-20 token, can be purchased with a self-custody wallet on decentralized exchanges like Uniswap and SushiSwap.

DeFi Pulse Index Summary

| Item | Description |

|---|---|

| DeFi Pulse Index (DPI) | A capitalization-weighted index that tracks the performance of the top 10 decentralized finance (DeFi) tokens. |

| Components | Uniswap, Aave, Maker, Synthetix, Compound, Lido DAO, Loopring Coin V2, Yearn.Finance, Rocket Pool, Balancer. |

| DeFi Importance | DeFi aims to build financial services on decentralized applications, replacing centralized authorities with code. |

| DeFi Pulse Index History | Launched in September 2020 by DeFi Pulse and Set Labs. DPI is an ERC-20 token providing exposure to DeFi. |

| Inclusion and Weighting Criteria | Based on market cap with descriptive, supply, project traction, and user safety considerations. |

| Performance | DPI's price correlates with the DeFi sector and wider crypto market, peaking at over $600 in April 2021. |

| How to Purchase | DPI can be purchased with a self-custody wallet on decentralized exchanges like Uniswap and SushiSwap. |

What is the DeFi Pulse Index?

The DeFi Pulse Index (DPI) is a capitalization-weighted index that tracks the performance of the top 10 crypto tokens in the decentralized finance sector. The index has a corresponding token, DPI, which provides investors exposure to this index through a single asset.

📝 Note: You can purchase the DPI Index with the self-custody tastycrypto wallet instantly!

Indices are popular across traditional finance (TradFi). Exchange-traded funds (ETFs) are the TradFi vehicles through which investors get access to an index. DPI acts like an ETF in that they provide easy access to a diversified index through one asset.

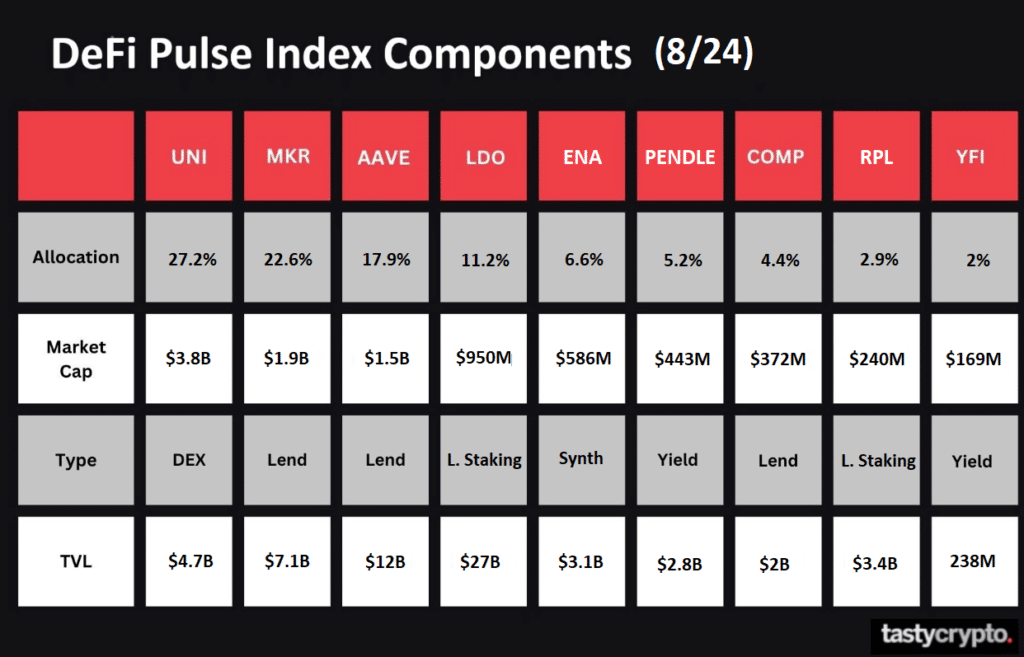

The DeFi Pulse Index is weighted based on a tokens market cap derived from circulating supply. The greater a coin’s relative market cap, the greater the weight it will have in the DPI portfolio. Uniswap, for example, has such a high market cap that it constitutes 26% of the DPI portfolio!

DeFi Pulse Index Components

As of August 9, 2024, the DeFi Pulse Index price is hovering above $70, with a market cap of over $14 million, according to data from CoinGecko.

📚 Read: Market Cap vs TVL

Here are the 10 DeFi tokens tracked by the index in August of 2024:

DeFi Pulse Components: In Depth

Uniswap (UNI) – this is the largest decentralized exchange (DEX) by trading volume. It relies on the Automated Market Maker (AMM) model, which eliminates the need for centralized order books. With AMMs, traders can buy and sell tokens like Wrapped Bitcoin (WBTC) and Ethereum (ETH) without the involvement of a centralized authority simply by connecting their self-custody crypto wallets to the app.

The total value locked (TVL) on the three Uniswap versions – V1, V2, and V3 – is about $4.7 billion.- Maker (MKR) – another major lending protocol, Maker is different from Aave and other lending competitors by offering its native decentralized stablecoin – a cryptocurrency whose price is pegged to the USD based on a 1:1 ratio.

Aave (AAVE) – currently the largest DeFi lending protocol, Aave enables users to borrow and lend crypto assets in a decentralized environment. At the time of writing, the Aave ecosystem has over $12 billion in TVL.

Lido DAO (LDO) – Lido is a liquid staking solution that enables users to stake their tokens without locking them up. By staking through Lido, users get a corresponding amount of substitute tokens to leverage yield opportunities in DeFi. Lido accounts for about 30% of the entire DeFi space in terms of TVL.

Ethena (ENA) – this DeFi protocol offers an algorithmic stablecoin that provides a better model than the infamous Terra USD.

- Pendle (PENDLE) – Pendle Finance is a DeFi protocol that enables users to tokenize future yields from DeFi assets and transform them into tradable tokens.

- Compound (COMP) – this is another major DeFi lending protocol that competes with Aave. Over $2 billion has been locked in Compound’s pools.

Rocket Pool (RPL) – this is a Lido-like liquid staking protocol with a TVL of $3.4 billion. You can compare Lido with Rocket Pool here.

Yearn.Finance (YFI) – this yield aggregator helps crypto holders explore yield farming opportunities in DeFi.

What Is DeFi and Why Is It Important?

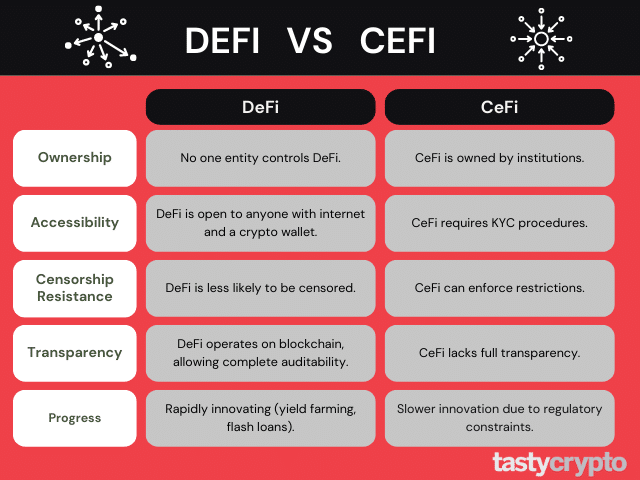

DeFi is a major blockchain trend that started to gain traction in the summer of 2020 with the launch of Compound’s governance token. The goal of DeFi is to build all kinds of financial services on decentralized applications, or dApps.

DeFi works by using smart contracts to automate processes that are typically labor heavy in traditional finance/centralized finance.

So far, Ethereum has dominated this sector as the main underlying network, although competitors like Binance Smart Chain, Avalanche, Arbitrum, Optimism, and Polygon are growing their presence. All but Binance on this list are Layer 2’s. Layer 2 networks help to reduce the fees in DeFi and increase transaction throughput.

📚 Read: Layer 2’s Compared: Arbitrum vs Polygon vs Optimism

Major traditional finance players, such as ING and Bank of America, came to the conclusion that DeFi was more disruptive than Bitcoin itself.

In DeFi, crypto holders interact with decentralized applications (dApps) in which the rules are enforced code instead of centralized authorities like banks and financial regulators.

While DeFi has departed from its peak, it holds a lot of promise and may someday challenge traditional finance.

DeFi Pulse Index History

The DeFi Pulse Index was launched in September 2020 by data firm DeFi Pulse in partnership with crypto-finance firm Set Labs and is provided by Index Cooperative (Index Coop), a Decentralized Autonomous Organization (DAO) operating several on-chain crypto indexes and other DeFi products.

The index has a corresponding token, DPI, which leverages Ethereum’s ERC-20 standard.

Scott Lewis of DeFi Pulse explained DPI’s goal:

“We want a way that people can get exposure to DeFi without having to go and buy every token individually, because that costs a lot of gas.”

— Scott Lewis

📚 Read: What Are Gas fees?

On a side note, DeFi Pulse was once a predominant DeFi analytics tool. Today, however, DeFiLlama is the main DeFi resource.

DeFi Token Inclusion and Weighting Criteria

The DeFi Pulse Index weighs tokens based on their market cap weights, with a 25% cap per token to avoid too much concentration. Note that Uniswap currently has a weighting of 26%, so the index will probably rebalance soon.

As for token selection, it relies on four criteria:

Descriptive – tokens must be available on Ethereum and not be considered security tokens across various jurisdictions.

Supply – the token supply has to be predictable over the next five years, and at least 7.5% of the total supply must be circulating.

Project traction – the project must be useful, have significant usage, and be older than six months.

User safety – the protocol has to be audited by third parties and has sufficient liquidity.

DeFi Index Performance

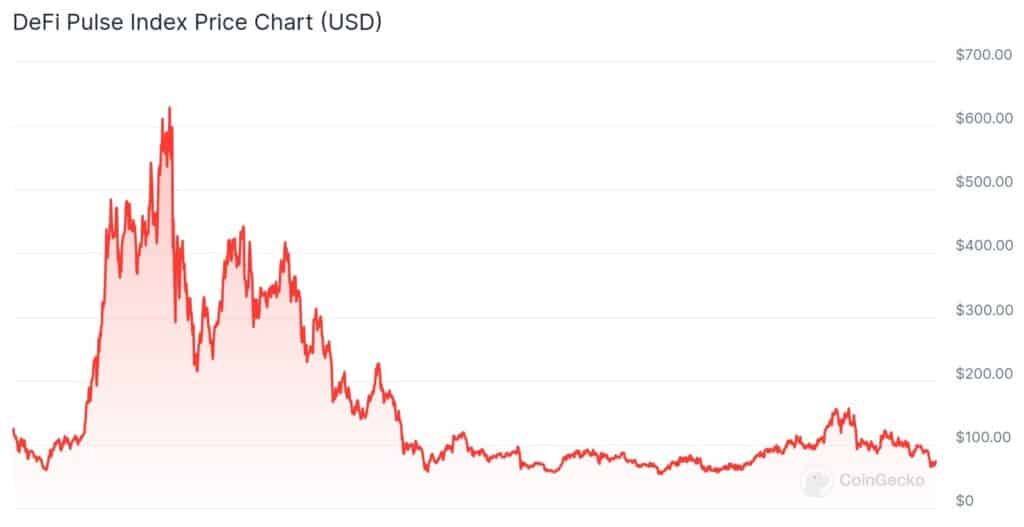

The DeFi Pulse Index price has a direct correlation to the DeFi sector and the wider crypto market, although the long-term trends may diverge. The DPI token hit an all-time high in April 2021 at over $600, when the DeFi TVL exceeded the $100 billion mark.

In November 2021, when DeFi was a $200+ billion market, DPI was trading at over $400, as seen in the below chart.

When the ‘crypto winter’ came in 2022, the index started to lose traction in USD terms. The token has been trading below the $100 mark for more than a year.

At the time of writing, DPI’s 24-hour trading volume is over $360,000.

Additional Reading:

FAQs

The DeFi Pulse Index is a diversification tool for DeFi-oriented investors. It tracks the top 10 Ethereum-based DeFi tokens, which are adjusted based on their market cap. The index is represented by an ERC-20 token with the ticker DPI.

The DPI token is available for purchase on DEXs through self-custody wallets like Uniswap and SushiSwap, as well as on centralized crypto exchanges like Gemini and KuCoin.

DPI comes with several risks. Two of these risks are market volatility and smart contract risk. Additionally, the index currently has an allocation of 27% to Uniswap (UNI). This heavy concentration in one token can further increase volatility.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences