Decentralized Wallet Definition: A decentralized wallet is a type of crypto wallet that specializes in providing easy access to decentralized finance (DeFi) applications. These self-custody wallets give users direct access to their private keys.

Written by: Anatol Antonovici | Updated August 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Decentralized wallets give users complete control over their digital assets and direct access to decentralized finance. These wallets hold your crypto assets without the involvement of any intermediary, enabling peer-to-peer interactions.

Table of Contents

🍒 tasty takeaways

Non-custodial wallets are used for interacting with decentralized applications and accessing decentralized financial services on blockchains.

Benefits of decentralized wallets include full control, access to DeFi and Web3 without KYC, enhanced security, and P2P transactions.

Centralized wallets, like those from Coinbase or Binance, keep control of private keys, whereas decentralized wallets give users control over their keys.

What Is a Decentralized Crypto Wallet?

A decentralized wallet is a cryptocurrency wallet that enables users to hold their private keys on their own, ensuring they have complete control over their digital assets. The main goal of such a wallet is to completely eliminate any involvement of a third party to permit peer-to-peer (P2P) transactions.

Keeping your crypto in a decentralized wallet is like keeping cash in your pocket – there are no intermediaries like banks, transactions remain private, and you have complete autonomy.

When you keep your money in a bank, it’s similar to storing your cryptocurrency on centralized exchanges like Coinbase or Binance. The digital wallets these exchanges provide are centralized, meaning users don’t have control over their private keys.

Building on the Promise of Decentralization

We should give credit to centralized exchanges and their hot wallets: they’ve done a great job of accelerating crypto adoption and bridging the gap between digital assets like Bitcoin and traditional finance (TradFi). However, Bitcoin and other digital currencies powered by blockchain technology were designed to avoid centralization.

To build on the promise of more democratic financial services, developers came out with trustless solutions that rely on P2P interactions. This is what we call decentralized finance (DeFi) – one of the biggest trends in blockchain, and this is where decentralized wallets are needed most.

What is Decentralized Finance (DeFi)?

DeFi is an emerging sector that comprises financial services built on blockchain infrastructure. Decentranlized applications in DeFi provide many functions, including

- Trading

- Staking

- Lending

- Insurance

- Market making

- Flash loans

- Yield farming

Unlike traditional financial services, which rely on intermediaries like banks, brokerage firms, payment apps, etc., DeFi protocols enable P2P interactions. The conditions and settlements are managed exclusively by smart contracts. Some projects are transitioning to decentralized governance as well to cut middlemen entirely. All interactions in DeFi require self-custody decentralized wallets.

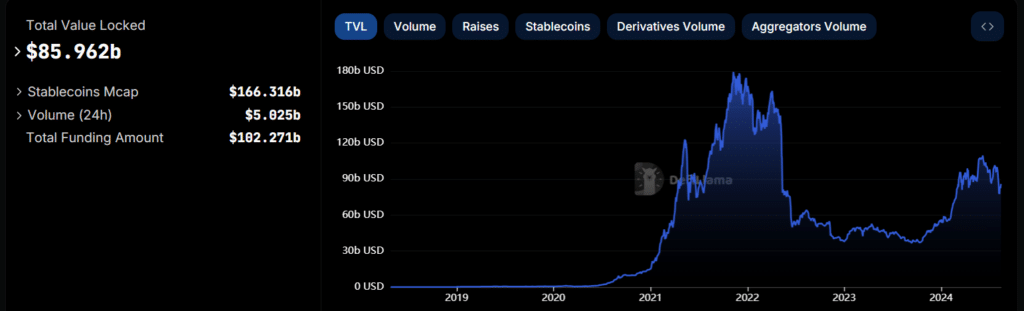

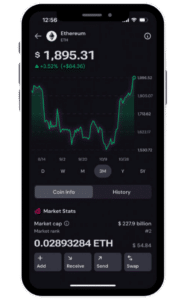

As of mid-August 2024, DeFi is a $86 billion market in terms of total value locked (TVL) across all protocols. The Ethereum blockchain dominates this sector, accounting for nearly 58% of TVL.

Source: DeFiLlama

Decentralized Wallets vs. Centralized Wallets

| Attribute | Decentralized Wallets | Centralized Wallets |

|---|---|---|

| Control Over Assets | Full control over digital assets | Control held by the platform (e.g., Coinbase, Binance) |

| Private Keys Management | Users hold their private keys | Platform holds the private keys |

| Interactions | Peer-to-peer (P2P) | Through the platform |

| Connection with DeFi | Direct access to DeFi and Web3 | Limited or no direct access |

| KYC (Know Your Customer) | Not required | Often required for registration |

| Security | Enhanced security; users safeguard private keys | Security managed by the platform; risk of breaches |

| Interactions with Dapps | Direct interaction with dapps | Limited or indirect interaction |

| Access to Traditional Finance | Not primary focus | Often acts as a bridge to traditional finance |

| Example Platforms/Wallets | MetaMask, Trust Wallet, tastycrypto | tastytrade, Coinbase, Binance |

Centralized wallets operate under the control of a third party, much like conventional banks. Wallets provided by platforms such as Coinbase and Binance maintain custody of your cryptocurrencies without granting you direct access to the private keys, which confirm genuine ownership of your digital assets.

Most centralized wallets are what we call ‘hot wallets,’ meaning that they’re always connected to the internet.

The main difference between centralized and decentralized wallets has to do with control and custody. Unlike centralized wallets, DeFi wallets are non-custodial (aka self-custody), meaning that holders have full control over their funds. These decentralized wallets enable users to interact with decentralized applications (dapps) without sharing private keys and having to pass through KYC processes.

What Are the Benefits of Decentralized Wallets?

Decentralized wallets offer several benefits:

- They give full control over crypto funds, reducing risks related to third-party breaches and hacks. To maintain a high level of security, users must store their private keys safely.

- Only decentralized wallets can interact with decentralized exchanges (DEXs) and other dapps, opening the door to DeFi opportunities and Web3 services.

- With decentralized wallets, users can access DeFi and Web3 without having to pass through KYC processes and share personal information.

- Decentralized wallets give users more independence, facilitating P2P transactions without relying on any other entity.

- Decentralized wallets are still legal to use while providing the highest level of anonymity and independence.

Top 5 Decentralized Wallets

Before diving into the top decentralized wallets, it’s important to mention that self-custodial wallets can be either “hot” or “cold.” Hot wallets are online-based (though only the software is online; the private keys remain with you), while cold wallets, like USB drives, are completely offline.

To improve security, you can back up your wallet with a seed phrase.

Here are the top 5 decentralized wallets:

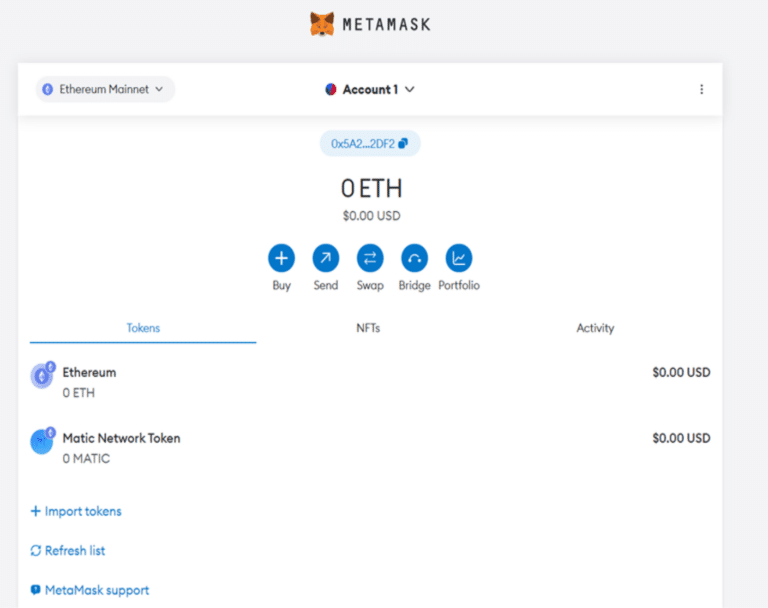

1. MetaMask— this is the most widely-used DeFi wallet. It is available as a browser extension or mobile app on Android and iOS devices. It supports ERC-20 (Ethereum-based) tokens and non-fungible tokens (NFTs). It also supports other networks, such as Polygon, BNB Chain, Arbitrum, and Avalanche. However, this wallet has no compatibility with Bitcoin. MetaMask offers additional functionality, enabling users to buy, swap, and bridge tokens.

2. Trust Wallet – with a user-friendly interface, Trust Wallet supports Bitcoin, Dogecoin, Litecoin, Solana, and over 70 other networks. It also comes as a mobile app and browser extension.

3. Coinbase Wallet – Coinbase is the largest US-based cryptocurrency exchange. This crypto exchange offers a centralized wallet in addition to a decentralized hot wallet supporting thousands of tokens to access DeFi and the Coinbase ecosystem as well.

4. Ledger Nano S Plus — this is a hardware wallet that allows you to keep crypto offline. It can integrate with many software wallets, including MetaMask.

5. tastycrypto — this is our wallet! You can download it to your browser or your phone by clicking ‘download’ from the header. tastycrypto it a Bitcoin and Ethereum wallet (ERC-20 Wallet).

FAQs

A DeFi wallet offers non-custodial storage for digital assets, offering full control and access to DeFi and Web3.

Centralized wallets are controlled by third parties, such as crypto exchanges like Coinbase or Binance. They hold the private keys and require registration. On the other hand, decentralized wallets are non-custodial, giving users full control over assets.

Decentralized wallets require no registration. For example, you can simply download MetaMask, and you’ll already have the private keys with you, being able to make transactions.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences