Custodial wallets are exchange-held crypto wallets that store and manage the private keys on behalf of users, while self-custody wallets allow users to manage their own private keys directly.

Written by: Siyu Ren Heinrich | Updated August 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

When it comes to cryptocurrency storage, you’ve probably heard a lot of terms – such as hot wallet, cold wallet, self-custodial wallet, browser extension wallet, and hardware wallet.

This can be quite confusing.

In this article, we will explain the different kinds of crypto wallets, what their respective advantages and disadvantages are, and how to choose the right one for you.

Let’s start with the basics and look at how self-custody wallets and custodial wallets differ.

Table of Contents

🍒 tasty takeaways

In a custodial wallet, a cryptocurrency exchange safeguards a user’s private keys.

In a self-custody wallet, the owner of the wallet is responsible for maintaining a record of their private keys.

Custodial wallet passwords can be reset if forgotten.

Self-custody wallet seed phrases can not be recovered if lost.

All crypto wallets are either ‘hot’ (connected to the internet) or ‘cold’ (not connected to the internet).

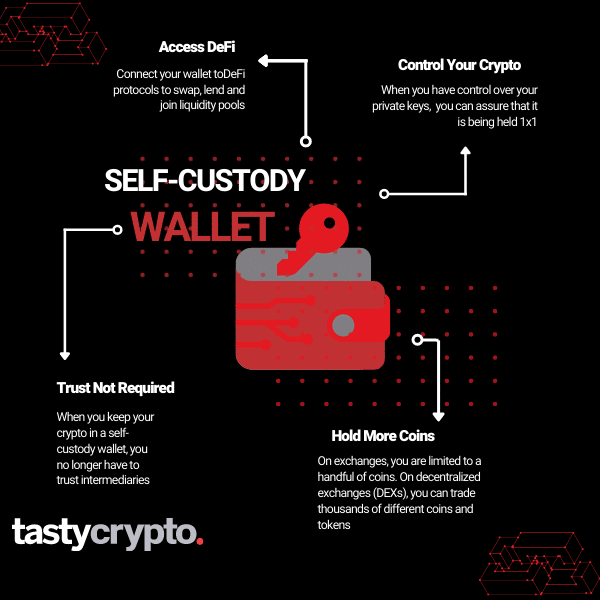

What Is A Self-Custody Wallet?

A self-custody wallet is also called a self-custodial wallet or a non-custodial wallet. It is a decentralized cryptocurrency wallet that you alone have full control over. This means that you are the only one who has the cryptographic keys to access the wallet and perform various functions such as sending cryptocurrencies.

Beware: if the private key or recovery phrase is lost, you can no longer access the funds you stored inside the wallet. Check out our in-depth guide about self-custody safety, if you want to learn more about this topic.

📚 Read! Here’s the difference between seed phrases, private keys and recovery phrases

What Is A Custodial Crypto Wallet?

A custodial crypto wallet is a wallet where you do not hold the keys to access your digital assets. In most cases, custodial wallets are provided by centralized services (for example, centralized crypto exchanges).

Custodial wallets are typically very user-friendly as users are not required to have a deep technical understanding to use them. If you forget or lose your password (key), you can still retrieve your funds by resetting the password. This is convenient but also comes with risks as this means you do not have complete control of your funds. If the custodial wallet provider gets hacked or goes bankrupt, there is a high chance that all funds are lost.

📚 Read! Self-Custody Wallet FAQs

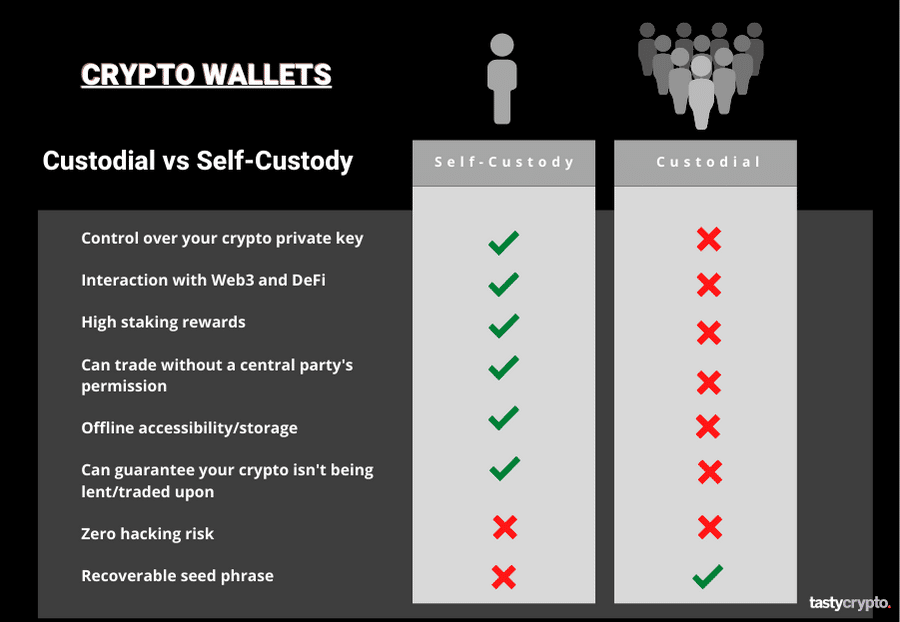

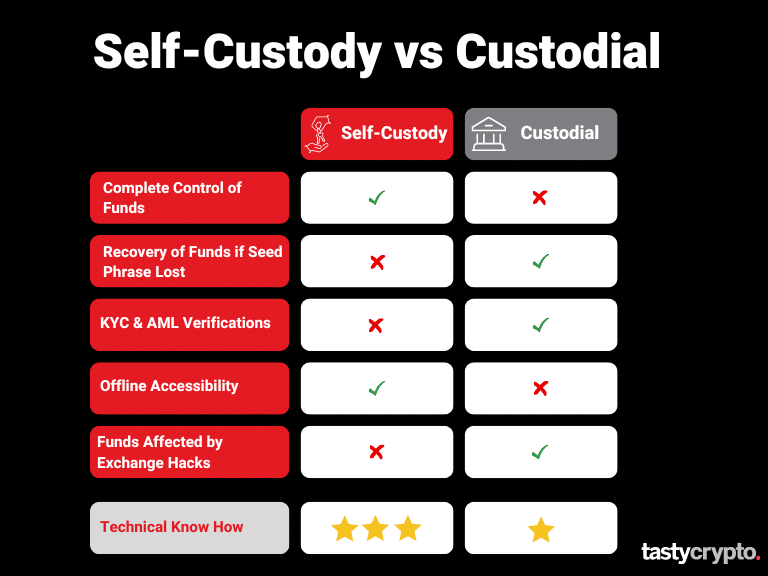

Pros and Cons of Custodial and Self-Custody Wallets

Types Of Custodial And Self-Custody Wallets

All custodial and self-custody wallets belong to one of two categories.

Hot wallets: Hot wallets are always connected to the internet.

This constant online connection makes hot wallets easy to use, which is very practical, particularly if you make a lot of transactions. The downside of hot wallets is that they are a common target for hackers. Good key management is therefore a must. Examples of hot wallets include:

Mobile wallets

Desktop wallets

Browser extension wallets such as Metamask and the tastycrypto wallet.

Cold wallets: Cold wallets are not connected to the internet or any network.

Interacting with cold wallets can be cumbersome and requires some technical understanding. For this reason, cold wallets are the preferred choice for crypto participants who do not plan on interacting with Web3 frequently. Examples of cold wallets include:

Paper wallets

Hardware wallets such as Ledger and Trezor.

Self-Custody Wallet Vs. Custodial Wallet: Pros And Cons

The below table lists the main advantages and disadvantages of custodial and self-custody wallets.

Reasons To Use A Self-Custody Wallet

The simple reason why you should use self-custody crypto wallets is that they are the safer choice to store your funds. “Not your keys, not your crypto” is a common saying in the crypto space.

And not without good reason!

Unfortunately, bankruptcies of crypto companies are quite common. In fact, just in the course of the 2022 crypto bear market, the 9 largest bankruptcies have caused losses of more than $18 billion. So far, users have only received a small part of their funds back.

Also, centralized crypto service providers are major targets for hackers. At least 47 exchanges have lost funds due to cybersecurity breaches since 2012, causing a total loss of more than $3.17 billion.

While users cannot prevent bankruptcies or hacks they can secure their funds by storing them in a self-custody wallet which ensures they have total control.

When To Use A Custodial Wallet

Custodial wallets are the best choice for beginners who don’t have a lot of experience with blockchain technology. They usually are user-friendly and act as a gateway for newbies when it comes to basic things such as crypto trading.

Check out the crypto offerings offered by the tastytrade custodial wallet here!

Another advantage is that custodial wallets on centralized platforms like Binance and Coinbase often give users easy access to advanced crypto functionalities such as leveraging and crypto staking.

Things To Consider When Choosing A Self-Custody Wallet

There are many self-custody crypto wallets available on the market. When it comes to choosing the right one, it is important to do your own research. Here are some important points to consider:

Self-Custody Wallet Features

How often will you use the wallet to send cryptos or perform other functions? As described above, some types of wallets make more sense depending on user behavior.

How many crypto assets does the wallet support? Will you be able to keep all your favorite coins/tokens/NFTs in it? Obviously, it’s a plus if you can keep all your assets in one place.

Does the self-custody wallet integrate with Web3 functions such as lending, staking, and borrowing to enable you to earn a passive income without using a centralized exchange?

Security

Do an in-depth check on the wallet’s history. Have there been hacks in the past or any other security-related issues?

How credible are the wallet’s developers? Do they have a good track record?

Is the code open-sourced or did the developers get a 3rd party to audit their code?

What do other users have to say about the self-custody wallet? Check out user reviews to learn more about their experience.

Things To Consider When Choosing A Custodial Wallet

The biggest advantage of custodial wallets is that they make many processes quick and convenient. There are also several things to consider when choosing custodial crypto wallets.

Pay attention to the following things:

Features

Easy access to the wallet and to its functions.

Many supported cryptocurrencies.

Many trading options and other functionalities.

Easy exchange of cryptocurrencies to Fiat currencies and easy cash-out process.

How high are fees for trading, exchanging, and withdrawals?

Security

Centralized services usually require thorough KYC (know your customer) and AML (anti-money laundering) processes before you can use them or before you can convert your cryptos into fiat currencies and cash them out. Depending on your location and the size of your funds, these processes can be very time-consuming and will require you to provide substantial personal information.

Research the service provider’s history. For example, have there been security issues in the past such as hacks or scams? In such cases, did users get reimbursed for lost funds?

If you are using an exchange, does it release information about its proof of reserves regularly? Is it audited by 3rd parties? Can users verify their balance in the exchange system? Does the exchange disclose its wallet addresses so that the balance can be checked by the public?

How does the custodial wallet provider secure users’ funds? What (certified) organizational processes and technological solutions are in place?

Regulations

Centralized crypto service providers such as exchanges face stricter regulations by the authorities. Make sure that the custodial wallet provider is properly registered with your local regulatory authority and that it has obtained relevant licenses to do business in your country.

Final Word

Custodial wallets are best for users who tend to forget or misplace important information. If you forget your password with an exchange-based wallet, the centralized party can reset it for you.

If you lose your seed phrase in a self-custody wallet, however, there is no 3rd party able to recover it for you – it is gone forever.

Self-custody wallets are best suited for tech-savvy people who are either reluctant to trust an exchange with their crypto or want to interact with Web3.

Siyu Ren Heinrich

5 years of experience in crypto research of writing practical blockchain and crypto analysis on Medium.

MSc in Computer Science, BSc in Smart Engineering, and BSc in Economics and Statistics.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences