Crypto swapping enables the instant exchange of one cryptocurrency for another without the necessity of converting to fiat currency first, streamlining the process of trading digital assets directly.

Written by: Anatol Antonovici | Updated March 1, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Table of Contents

🍒 tasty takeaways

Crypto swapping directly trades one cryptocurrency for another without intermediaries or fiat currency transactions.

Swapping is typically cheaper and more straightforward than trading on centralized exchanges.

tastycrypto’s swap feature offers a user-friendly method to swap crypto assets.

Summary

| Term | Description |

|---|---|

| Crypto Swapping | Instant exchange of one cryptocurrency for another without fiat conversions. |

| Swapping vs Trading | Swapping is direct and often cheaper than trading on centralized exchanges. |

| Platforms | Decentralized exchanges like Uniswap facilitate swapping without intermediaries. |

| Process | Exchanging one crypto for another directly between blockchain addresses. |

| Benefits | No KYC required, lower fees, and instant transactions. |

| DEX Swapping | Connect a wallet to a DEX and trade against a liquidity pool using smart contracts. |

| Wallet App Swapping | Use a self-custody wallet app like tastycrypto for convenient in-app swaps. |

| Atomic Swaps | Exchange crypto assets across different blockchains without third-party involvement. |

What Is Crypto Swapping?

Crypto swapping refers to the process of exchanging one crypto coin or token for another on-chain. The process eliminates the need to convert your current crypto asset into fiat currency before buying the desired token.

You can think of it as trading, exchanging, or purchasing crypto, but there are some nuances that make these processes differ.

Swapping is a common process in decentralized finance (DeFi), where decentralized exchanges (DEXs) and other protocols enable you to easily swap one crypto for another.

For example, Uniswap, the largest DEX by trading volume, derives its brand name from this very process.

🍒 Crypto for Beginners: What Is Crypto and How Does It Work?

Crypto Swapping vs Trading

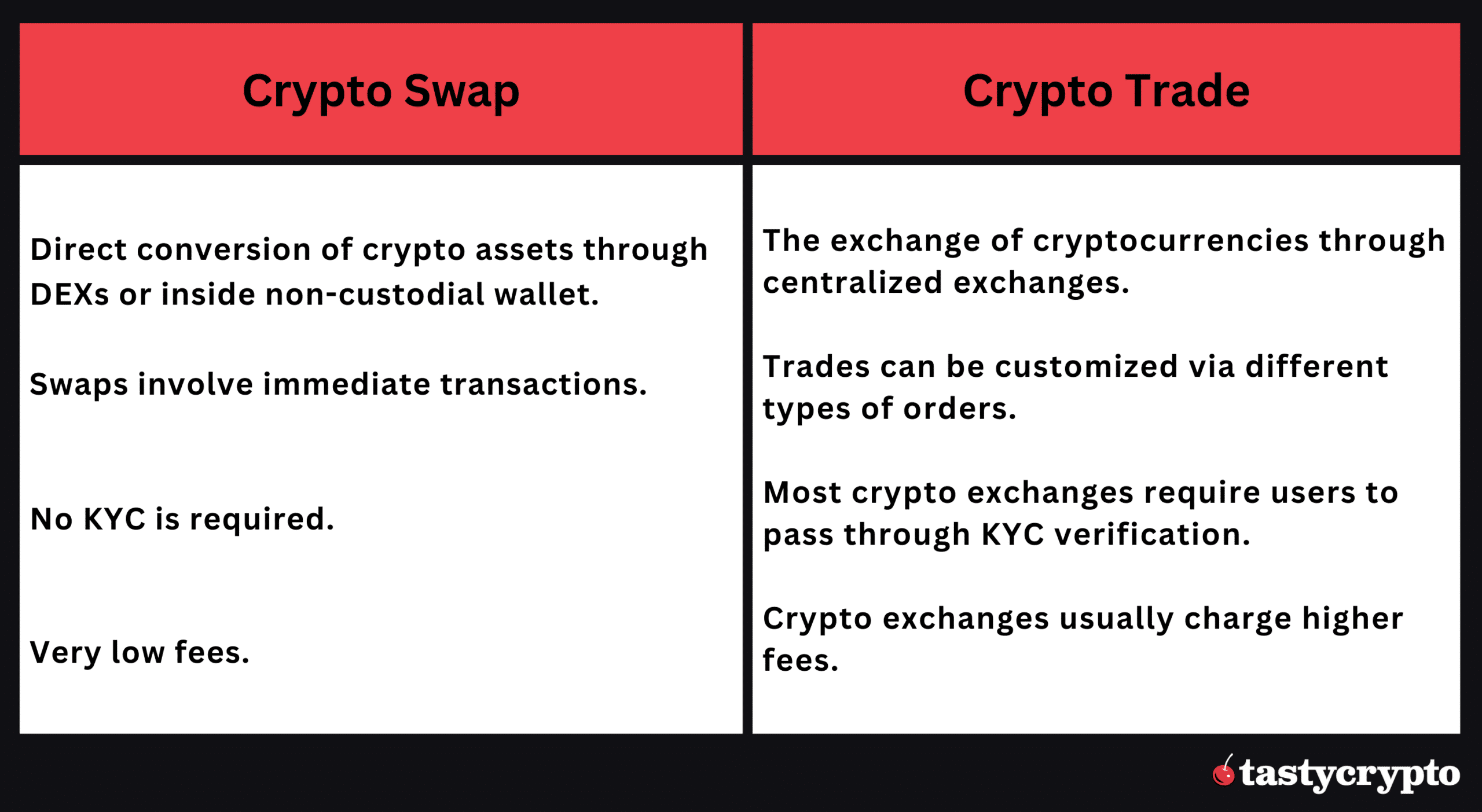

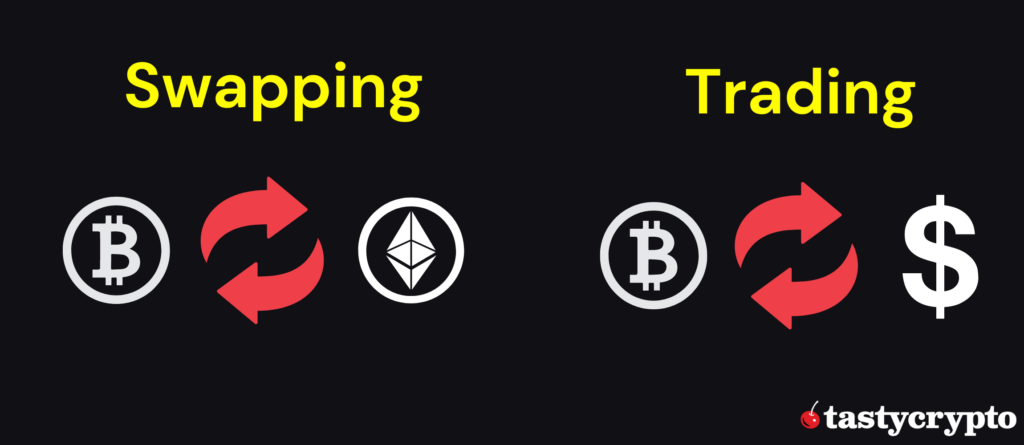

Crypto swapping and trading can be used interchangeably. However, for the sake of our crypto literacy, we’ll discuss what makes swapping stand out.

Some sources – a great deal of them – suggest that crypto swapping simply refers to the exchange of digital assets without using fiat currency, implying that this can be done both on DEXs and centralized exchanges (CEXs).

However, I believe the term ‘swapping’ should be used in the context of DeFi only. For centralized finance (CeFi), we simply use ‘crypto-to-crypto trading.’

Crypto swapping refers to the direct exchange of crypto assets from one address to another without the involvement of a custodian. Swapping is decentralized, cheaper, and more transparent than exchanging crypto coins and tokens on CEXs. Also, no KYC is required for crypto swapping.

🍒 CEX vs DEX: How Crypto Exchanges Differ

Exchanging or trading one crypto coin for another on a centralized platform involves sending orders to the order book, with balances updated centrally, exposing users to custody risks. Remember, when you hold your crypto on a centralized exchange, you don’t have access to your private keys.

While swapping occurs instantly, users of crypto exchanges enjoy additional benefits, such as the ability to place various types of trades, like limit orders, which are executed when a specific price target is met.

How Does Crypto Swapping Work?

Swapping is easy. There are two popular ways to swap tokens:

- Connecting your wallet to a DEX Web3 defi app.

- Swap in-app with a self-custody wallet. For example, tastycrypto is a self-custody wallet that allows users to easily convert one crypto asset to another.

Swapping Tokens on a DEX

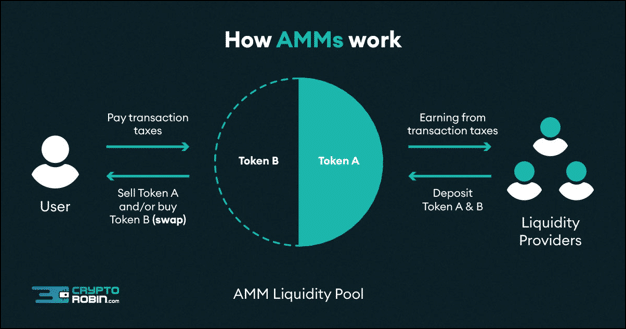

When you swap tokens through a DEX, you connect your crypto wallet to a DeFi protocol and trade against a liquidity pool.

Most DEXs act as automated market makers (AMMs) that run decentralized liquidity pools instead of typical order books. This means that the whole trading or swapping process is conducted by smart contracts alone based on pre-determined rules and algorithms.

Source: Shardeum

If you want to buy ether (ETH) and sell bitcoin (BTC), you would send BTC to the liquidity pool and receive ETH in return. The balance of ETH in the pool decreases, and the balance of BTC in the pool increases accordingly. The DEX will charge a low fee, such as 0.5%, which is used to pay liquidity providers who lock tokens in pools.

If you want to be a market maker in DeFi, you only have to contribute two cryptos to a pool. As users trade, you will receive a portion of the fees they pay. There are, however, some risks here, such as impermanent loss.

DEX aggregators offer the advantage of lower fees and more favorable fill prices.

Swapping Inside Wallet App

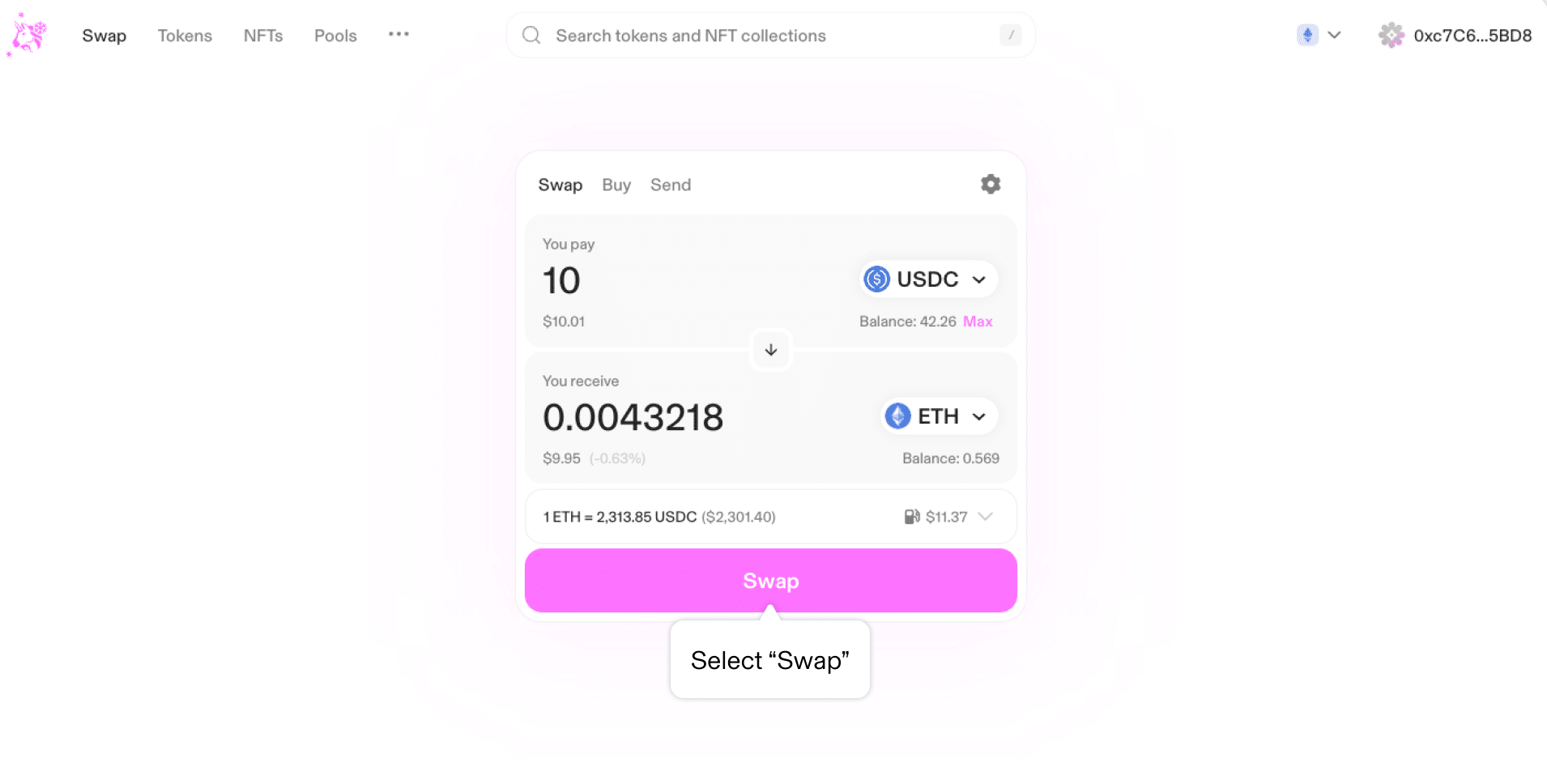

Alternatively, for more convenience and lower fees, you can use the in-app swapping feature of a self-custodial wallet like the tastycrypto DeFi wallet offers.

tastycrypto offers prices from multiple DEX aggregators, ensuring that users get the best deals and the lowest network fees. The feature enables users to easily convert one crypto to another without leaving the app.

Reasons to Swap

Crypto users can swap tokens for various reasons. For example, they may want to get quick exposure to a bullish crypto token.

While crypto swapping doesn’t involve fiat operations, token holders can easily exit volatile crypto assets by swapping to stablecoins such as USDT, USDC, or DAI.

Thanks to swapping, crypto investors can improve their risk management strategies and reduce volatility risks.

What Are Atomic Swaps?

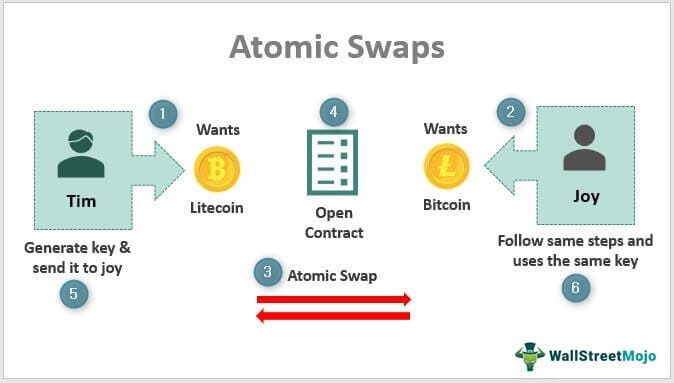

Atomic swaps allow two parties to exchange crypto assets across different blockchains, facilitating cross-chain trading. For example, one can swap Bitcoin (BTC) to Ethereum (ETH) without any third-party involvement.

While they resemble bridges, atomic swaps are more secure. They rely on smart contracts that encode all the conditions for the cross-chain swap. If one party fails to satisfy one of the conditions, the trade is not executed at all. Therefore, an atomic swap has only two outcomes: either it is successfully executed, or no action occurs.

Source: WallStreetMojo

How Do I Swap Crypto?

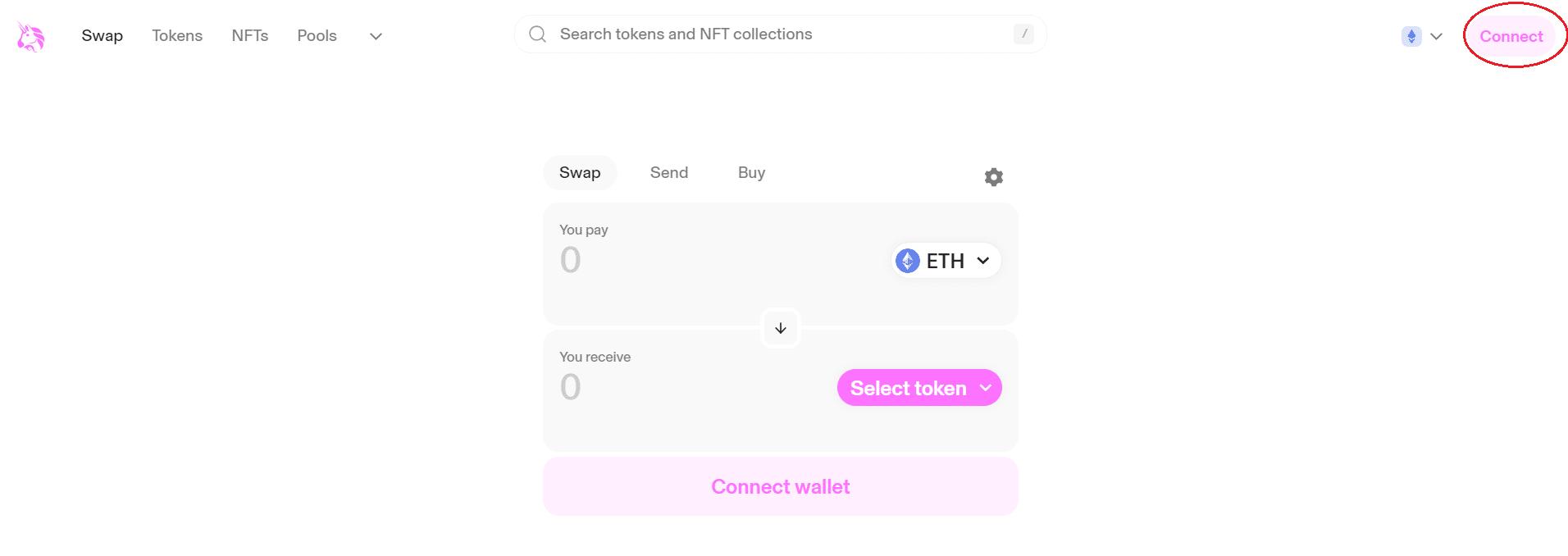

Beginners can start by swapping crypto through a DEX like Uniswap. Here is a quick tutorial:

- Open the Uniswap app and make sure you’re in the swap section.

- Click on “Connect” to connect to your non-custodial wallet.

- Select the tokens you want to exchange.

- Enter the amount you want to swap or receive, and then click on “Swap.”

- Approve the swap, and then go to your wallet to sign the message and approve the swap again.

Crypto Swapping Benefits

Here are some major benefits of crypto swapping:

- No intermediaries involved

- No KYC required

- Very low fees

- Almost instant execution

- User-friendly experience, especially on tastycrypto.

FAQs

Crypto swapping is the process of directly converting one cryptocurrency for another without using fiat currency. Swapping is done in a decentralized manner.

Crypto swapping refers to a direct exchange of tokens through a non-custodial wallet, unlike trading on centralized exchanges (CEXs), where orders are matched through an order book.

You can swap cryptocurrencies inside the tastycrypto app, which enables users to swap thousands of crypto assets.

Crypto swaps are direct, secure, instant, cheap, and require no KYC verification.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com