Crypto portfolio trackers help you manage all of your cryptocurrency investments in a single place. This article reviews the best portfolio tools, including CoinMarketCap, CoinStats, Kubera, Delta, and CoinGecko.

Written by: Anatol Antonovici | Updated March 20, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Table of Contents

🍒 tasty takeaways

Coinstats is regarded as one of the best portfolio tracking tools thanks to its ability to connect to multiple platforms and support in-app token swaps.

Kubera and Delta also support traditional assets, including stocks.

Coinmarketcap and CoinGecko are the best crypto portfolio trackers that can be used for free.

Summary

| Tracker | Pros | Cons |

|---|---|---|

| CoinStats | Tracks over 20,000 assets, connects to 100 exchanges and 200 wallets, supports NFTs, advanced features. | Free plan limited to 1,000 transactions, fewer direct integrations. |

| CoinMarketCap | Free, tracks over 20,000 assets, robust market data. | Limited functionality, manual data entry, no direct API connections. |

| Kubera | Tracks digital and traditional assets, detailed portfolio analysis, nicely designed interface. | No free plan, $150/year, limited crypto support. |

| Delta | Modern design, supports over 10,000 coins, advanced Pro features. | Limited free version functionality, connects to only 2 exchanges. |

| CoinGecko | Free, tracks over 13,000 assets, real-time prices and advanced charting. | Manual transaction input, no direct exchange or wallet connections. |

What Is A Crypto Portfolio Tracker?

A crypto portfolio tracker is an application that enables you to manage all your crypto investments on a single platform. It presents real-time data on your holdings’ performance, covering aspects such as price, transaction history, and various key metrics.

Some portfolio apps can connect to cryptocurrency exchanges and digital wallets through APIs, allowing you to access all investments in real time.

Other crypto portfolio trackers offer advanced features, including technical and fundamental analysis, tax reporting, crypto news feeds, and risk analysis.

Why Use a Portfolio Tracker?

Cryptocurrencies are known for their extreme volatility, making diversification a crucial strategy for investors. This approach often requires seeking out the most favorable quotes and deals across various cryptocurrency platforms, as well as distributing the holdings among several crypto wallets for added security and risk management.

For example, you may use a hardware wallet for hodling, a non-custodial wallet to access decentralized finance (DeFi), and a hot wallet for active trading and transfers.

A crypto portfolio tracker helps you manage all crypto investments, which improves decision-making and efficiency.

That being said, here are the 5 best crypto portfolio trackers for 2024:

1. Coinstats

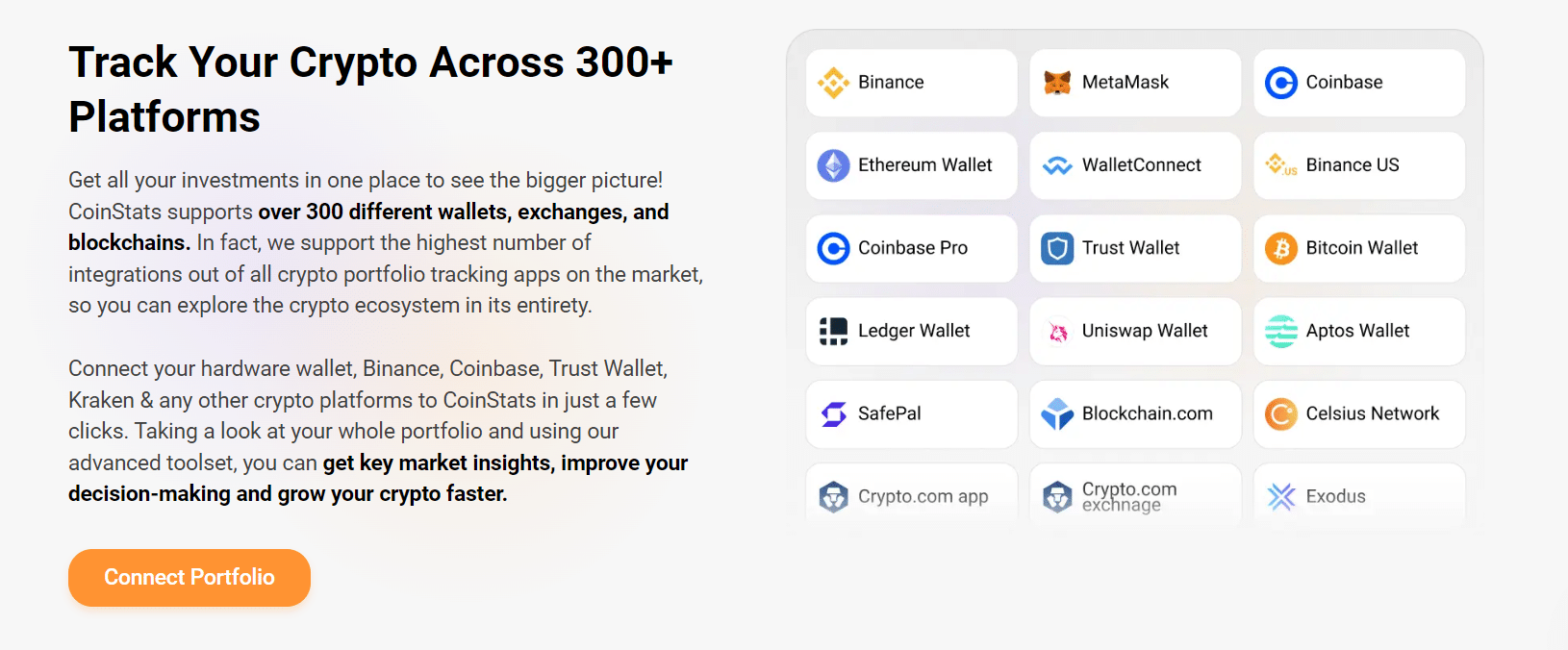

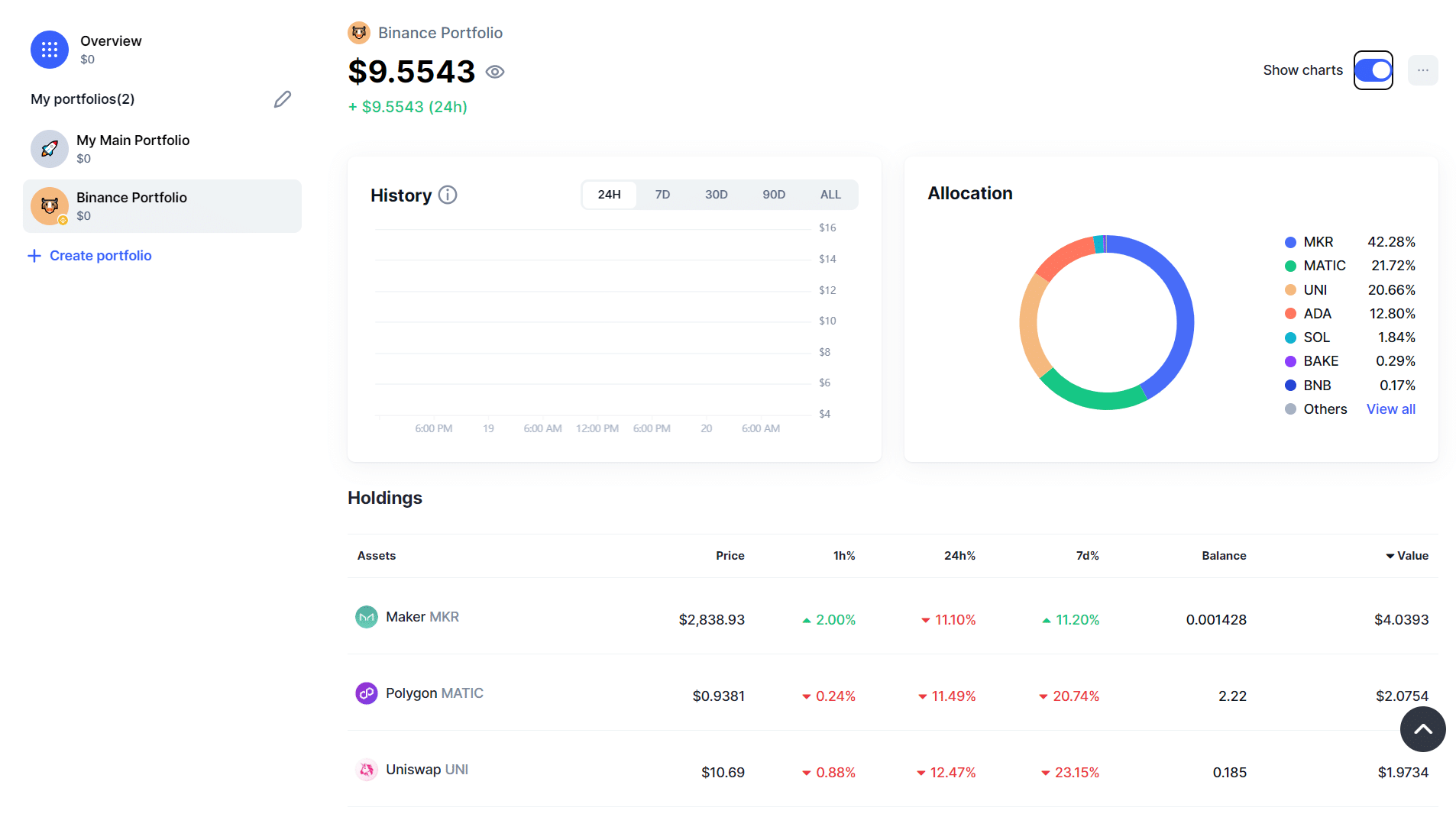

Coinstats offers one of the most comprehensive crypto portfolio trackers. It seamlessly connects with over 300 platforms, including crypto exchanges like Coinbase, Kraken, and Binance and wallets like MetaMask and Ledger. It can track all types of assets, including non-fungible tokens (NFTs).

Source: CoinStats

The free version allows you to create up to 10 portfolios and track 1,000 crypto transactions. The unlimited premium version costs $7.49 per month.

Pros

- Users can track over 20,000 crypto assets. It can connect to about 100 exchanges, 200 wallets, and over 1,000 DeFi protocols across multiple blockchains. NFTs are supported as well.

- Advanced features, including in-depth analytics, portfolio vs market tracker, most/least profitable coins, transaction/withdrawal history, tax reporting, and more.

- CoinStats also acts as a decentralized exchange (DEX) aggregator, enabling users to swap tokens without leaving the app.

Cons

- The free plan allows you to track only 1,000 transactions.

- Direct integration is possible with fewer apps.

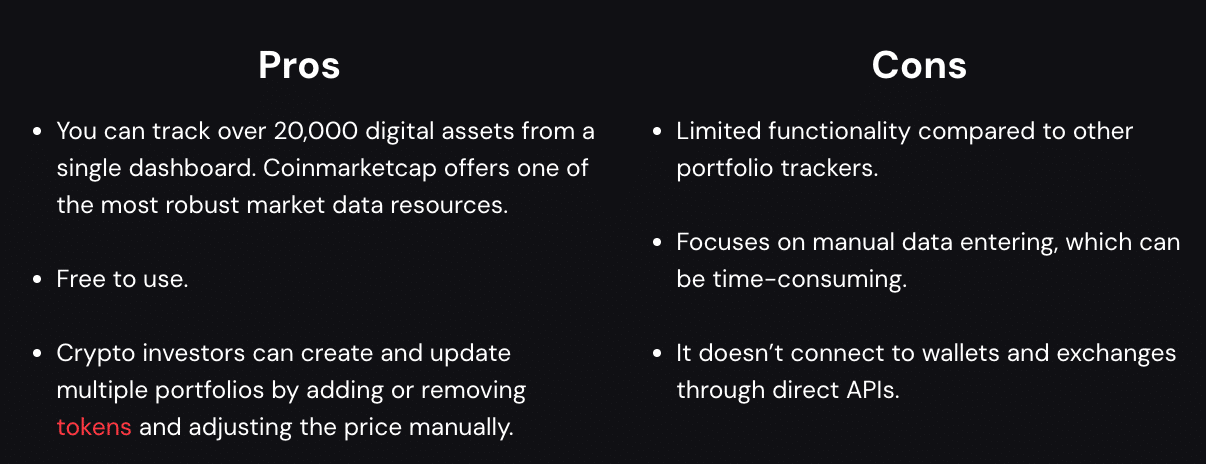

2. CoinMarketCap

CoinMarketCap is the most popular crypto price-tracker resource. It also offers free PC, iOS, and Android crypto portfolio tracking apps.

You can add your crypto holdings manually or import them from a wallet by inserting your address. The portfolio can also connect to various exchanges, including Binance (CoinMarketCap is owned by Binance).

Source: CoinMarketCap

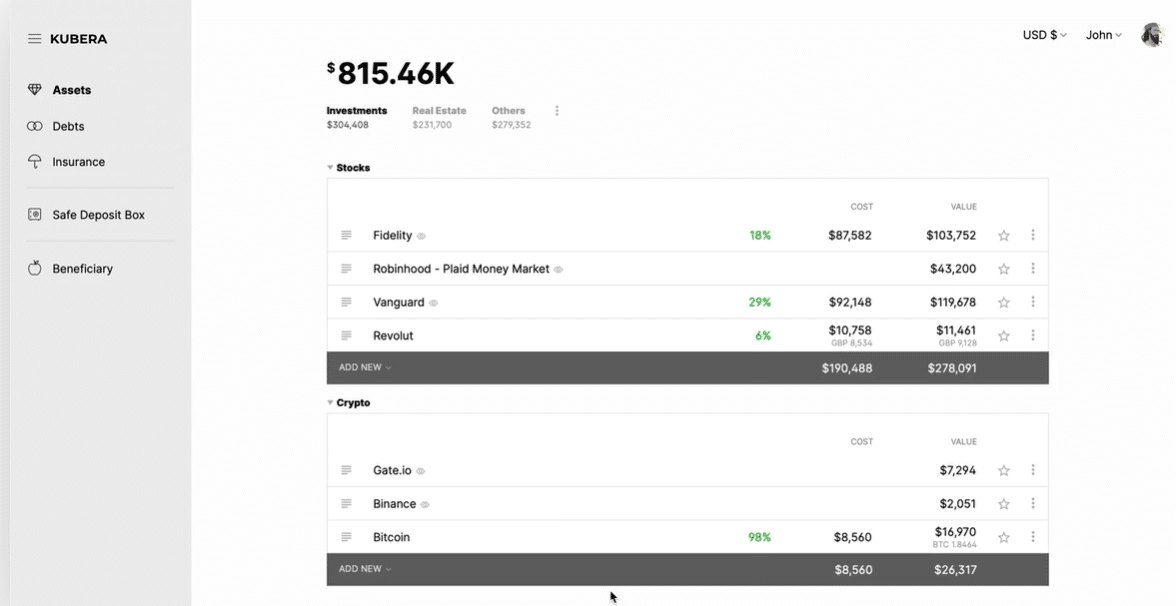

Source: Kubera

Kubera focuses on offering a user-friendly and premium experience, although using it costs $150 per year.

The platform can connect with multiple traditional banks, brokerage firms, and a few crypto wallets, including Ledger and Metamask.

Pros

- Track digital and traditional assets, such as stocks and real estate, from a single platform.

- Detailed analysis of portfolio performance and its assets.

- Nicely designed interface.

Cons

- No free plan and a higher than the average cost of $150 per year.

- Limited support for crypto exchanges and wallets.

4. Delta

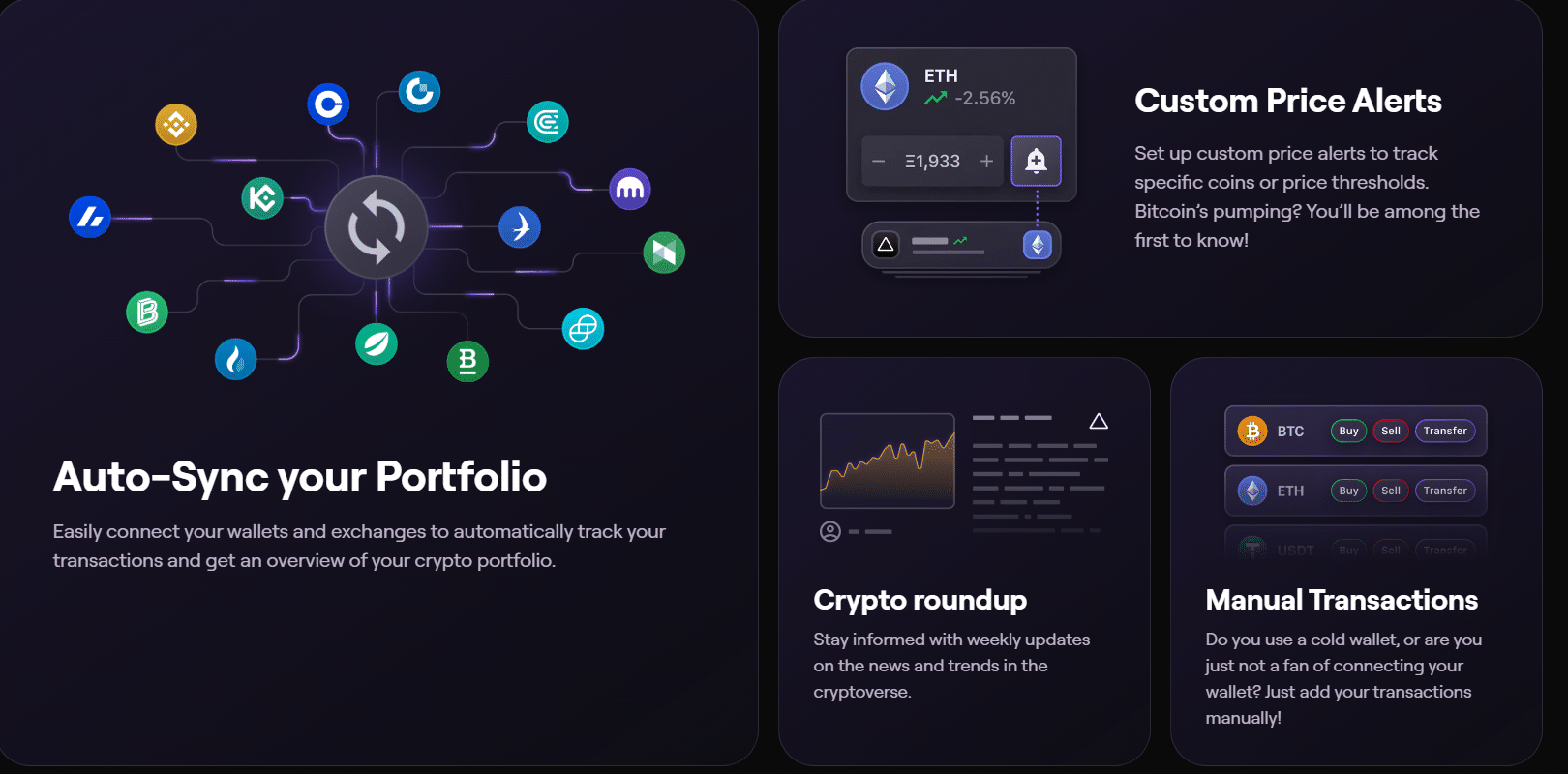

Delta Investment Tracker is another portfolio-tracking app that supports cryptocurrencies and traditional assets, including stocks, exchange-traded funds (ETFs), fiat currencies, and bonds. A product of brokerage service eToro, Delta offers powerful tools and charts to visualize your investments.

The pro version costs $99 per year and offers access to advanced metrics, fundamental analysis tools, and up to 5 synced devices.

Source: Delta

Pros

- Track crypto and traditional assets from a single dashboard with a modern design and multiple features.

- Delta supports over 10,000 coins and can connect to multiple crypto exchanges and digital wallets.

- Multiple features with the Pro version, including an overview of asset allocation, risk analysis, gas fees, custom price alerts, customizable widgets for iOS devices, news feed, and more.

Cons

- Limited functionality for the free version. For example, it connects to only 2 exchanges.

- No auto-refreshing prices with the free version.

5. CoinGecko

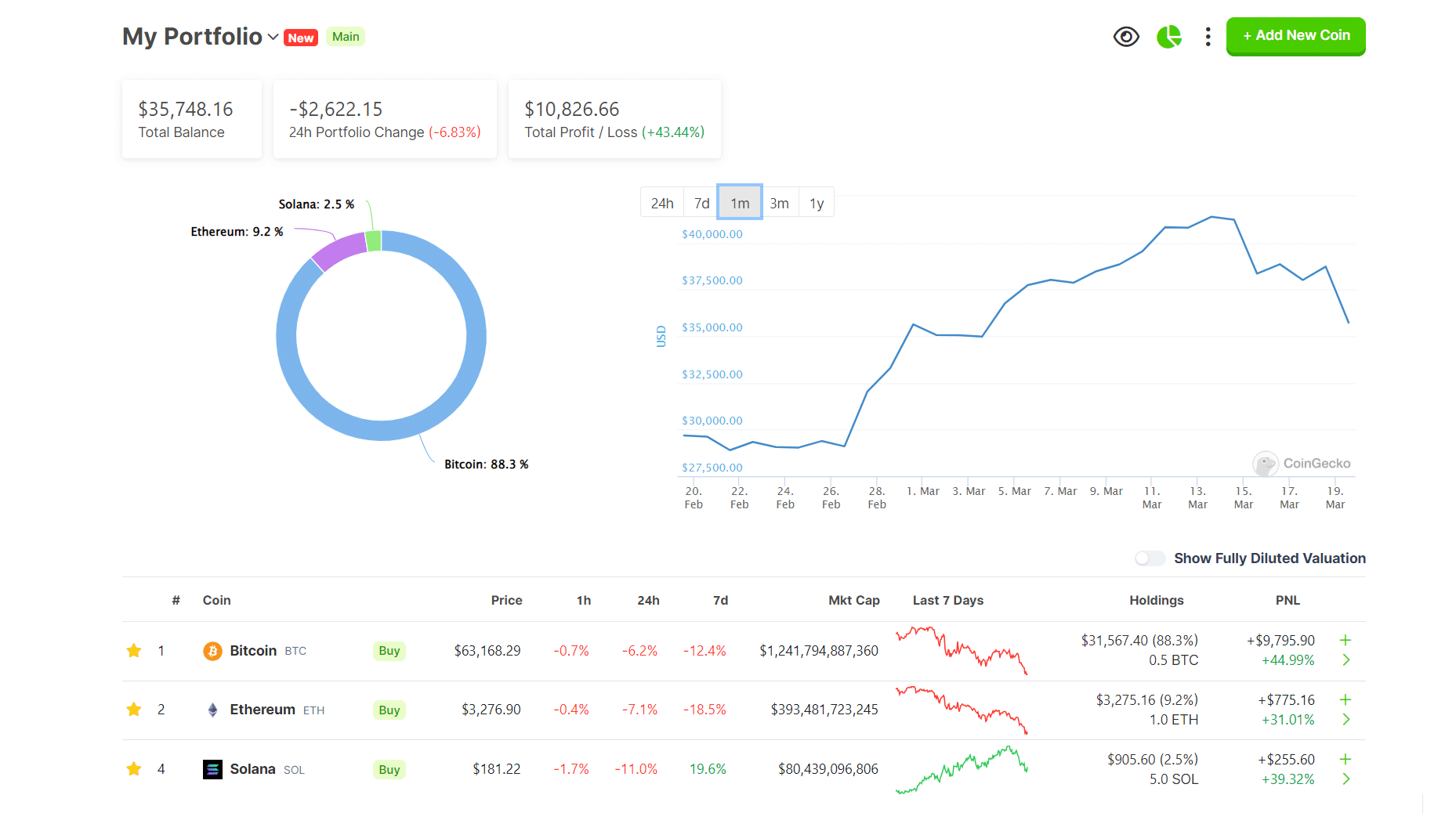

CoinGecko is a Coinmarketcap-like crypto ranking and tracking platform. It offers a powerful crypto portfolio tracking tool with many free-to-use features.

The portfolio tracker supports over 13,000 crypto assets, offering accurate real-time prices and advanced charting for each asset.

However, it lacks an API-based connection to crypto exchanges and wallets, requiring manual input of transaction details.

Source: CoinGecko

Pros

- Track over 13,000 digital assets with access to real-time prices and advanced charting.

- Free to use.

- Beginner-friendly interface with multiple features.

Cons

- Users have to manually input transaction details.

- It cannot connect to crypto exchanges and Web3 wallets.

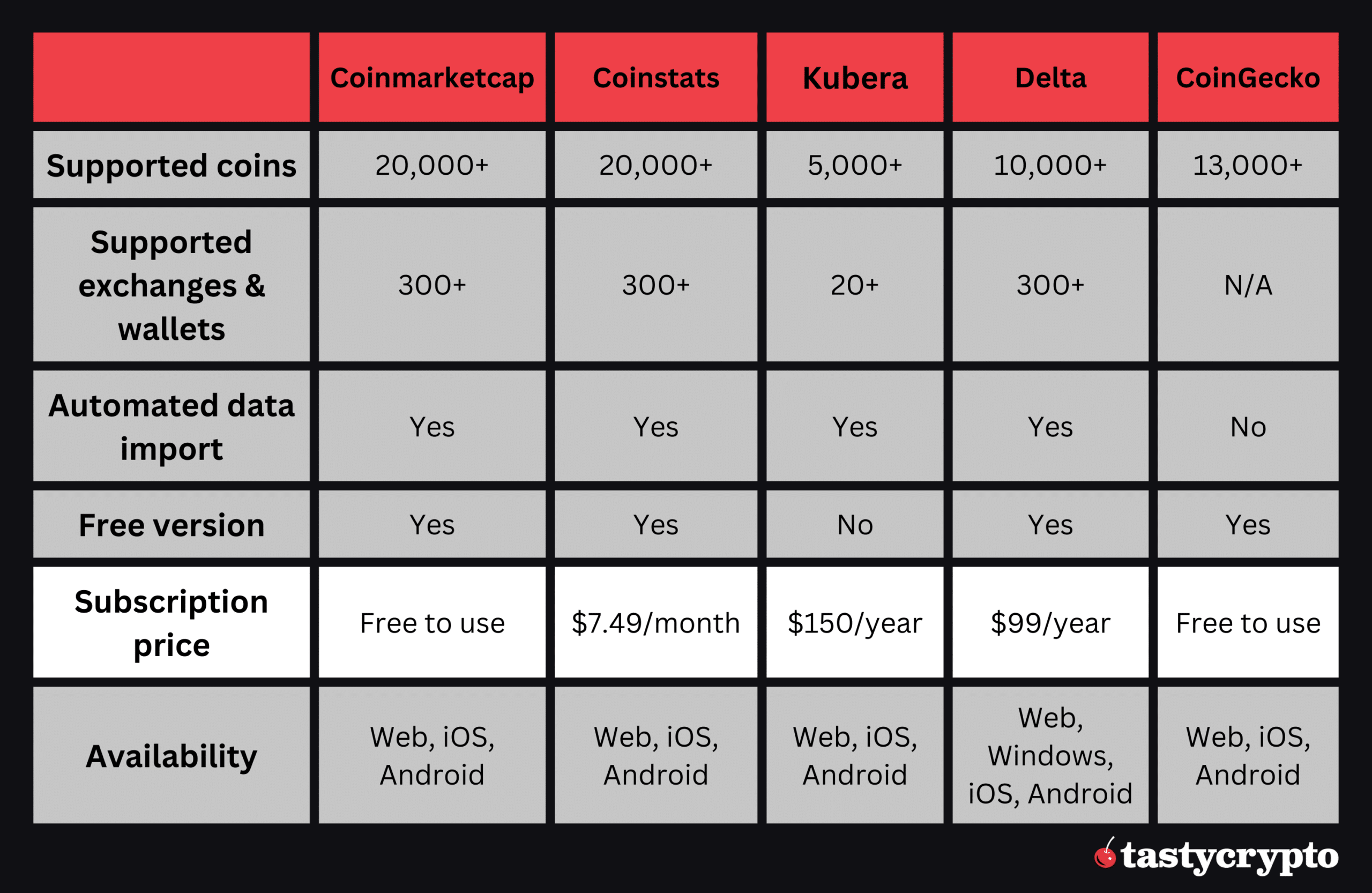

Crypto Portfolio Trackers: Comparison

Notable Mentions

Some of the following crypto portfolio trackers that didn’t make our list may also be worthy of consideration:

- CryptoCompare is a powerful crypto analysis tool offering detailed price information, market trends, and trading volumes.

- Koinly is a crypto tax software app offering a comprehensive portfolio tracker tool. It can connect with hundreds of exchanges and wallets, supporting Bitcoin (BTC), altcoins, and NFTs.

- CoinTracker – another crypto tax service offering portfolio tracking.

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

FAQs

A crypto portfolio tracker is a tool that helps crypto traders manage all their crypto investments in one place. It offers additional features to visualize real-time prices and perform in-depth analysis.

There are many portfolio trackers, and picking the best depends on your needs. CoinStats is preferred for its comprehensive features and broad platform integration.

Coinmarketcap and CoinGecko offer extensive asset-tracking capabilities among the best free crypto portfolio trackers.

Yes, Kubera and Delta Investment Tracker support digital currencies and traditional assets, including stocks, real estate, and forex pairs.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com