In cryptocurrency, a “CEX,” short for centralized exchange, is a crypto platform where the exchange holds its users’ private keys. On the other hand, a “DEX,” which stands for decentralized exchange, is a fully automated exchange that operates without holding the private keys of its users.

Users of self-custody crypto wallets only interact with a DEX when they wish to swap crypto.

Written by: Mike Martin | Updated January 13 2023

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Table of Contents

🍒 tasty takeaways

CEXs are centralized, custodial, and user-friendly, ideal for mainstream coins. DEXs are decentralized, non-custodial, and best for diverse, direct crypto trading.

CEXs require KYC and are regulatory compliant, focusing on liquidity and ease of fiat transactions. DEXs prioritize transparency, security, and offer a broader range of cryptos with varying fees.

Centralized Exchanges (CEXs) are vulnerable to attacks but offer lower fees, while Decentralized Exchanges (DEXs) arguably have higher security and transparency but may charge higher fees when considering gas fees.

Centralized Exchanges (CEXs) are typically run by companies or groups of individuals. They function as intermediaries, serving as both brokers and custodians for cryptocurrency transactions.

CEXs hold the private keys (seed phrases) of their users, which limits their customer’s ability to interact with DeFi and Web3 applications. This means you have to trust that your exchange is acting in your best interest as you can’t track your digital assets 1×1 on a blockchain.

CEXs provide liquidity by operating an order book, much like the order books used in stock exchanges.

CEXs are popular for crypto market investors holding just a few large market cap coins, such as Ethereum (ETH) and Bitcoin (BTC). Popular DEXs include Coinbase, Kraken and Binance.

Generally, CEXs offer a greater experience than DEXs.

CEX Regulations

Similar to traditional finance (TradFi) stock exchanges, CEXs are usually subject to government regulations and licensing requirements. To open an account with a CEX, users are required to undergo KYC (Know Your Customer) and AML (anti-money laundering) procedures.

CEXs Role in Cryptocurrency

CEXs play a key role in funding and facilitating withdrawals for self-custody wallet users as fiat currency is not part of the crypto ecosystem. To turn your crypto into fiat currency, you will need to send it to a CEX, which in turn converts it to cash and sends it to your bank or financial service of choice.

What is a Decentralized Crypto Exchange (DEX)?

🍒 Decentralized Crypto Exchange Definition: A decentralized crypto exchange (DEX) is a digital, decentralized peer-to-peer marketplace available for anyone to buy and sell cryptocurrencies.

Decentralized Crypto Exchanges (DEXs) differ significantly from centralized exchanges (CEXs). DEXs are Web3 protocols built on proof-of-stake blockchains like the Ethereum network. These smart contract-driven exchanges are run by peer-to-peer platforms allowing users to trade cryptocurrencies directly without intermediaries or middlemen.

DEXs are the most popular category of DeFi, or decentralized finance.

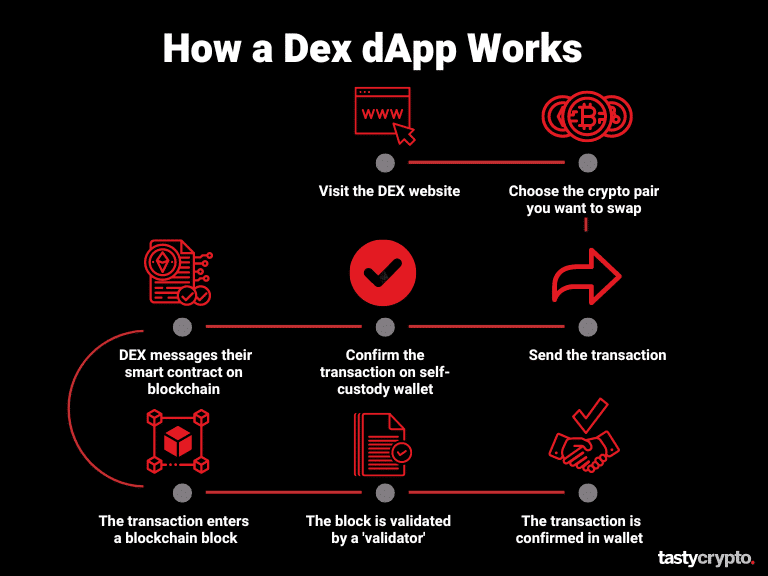

To connect to a DEX and get on-chain, simply connect your self-custody wallet (like tastycrypto) to the website hosting the DEX and then proceed to swap.

DEXs operate efficiently, but users should be aware of protocol and gas fees involved in trading.

Some top DEXs include Curve, Uniswap, PancakeSwap, and Balancer, while DEX aggregators like the 1inch Network enhance trading efficiency by providing access to multiple DEX liquidity pools.

How DEXs Work

DEXs are fully automated exchanges. Liquidity is provided by automated market maker technology or AMMs.

On DEXs, anybody can become a liquidity provider by contributing two cryptocurrencies to a liquidity pool. As users trade from your pool, you earn fees!

🍒 5 Best Crypto Decentralized Exchanges (DEXs)

DEXs offer transparent and secure trading options but come with risks that users must manage carefully.

CEX vs DEX: Security Features

| Security Features | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Asset Custody | Custodial, CEXs hold assets | Non-custodial, users control assets |

| Transparency | Limited transparency | High transparency |

| Security Risks | Vulnerable to attacks | Lower risk due to control |

| Government Censorship | Potential for fund freezing | Less susceptible to censorship |

| Operational Downtime | Possible during technical issues | Less prone to downtime |

CEX vs DEX: Fees

| Fee Type | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Maker Fees | Range: -0.05% to 0.1% | Some with 0% fees |

| Taker Fees | Range: 0.1% to 0.75% | Average: 0.187% |

| Deposit & Withdrawal Fees | Varies, some with cash out fee | May include network gas fees |

| Lowest Fees (Maker/Taker) | tastytrade, Currency.com, Liquid | Curve, Balancer, Canto, Sushiswap |

CEX vs DEX: Regulation

| Regulatory Aspect | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| KYC Procedures | Required | None |

| AML Regulations | Compliant | None |

| Government Oversight | Often regulated | No direct oversight |

| License Requirements | Often required to operate | Not required |

CEX vs DEX: Crypto Offerings

| Crypto Offerings | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Number of Cryptos | Limited selection (typically 12 or less) | Thousands of tokens |

| Variety of Choices | Curated, mainstream coins | Wide variety - all memecoins and new tokens |

| Accessibility of New Coins | Delayed listing of new coins | Immediate access upon release |

Trade thousands of tokens with the tastycrypto self-custody wallet! 👇

CEX vs DEX: User Friendly

| Feature | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

|---|---|---|

| Interface | Intuitive, user-friendly | Varies, some less intuitive |

| Customer Support | Available, often 24/7 | Limited or community-driven |

| Fiat Transactions | Direct fiat to crypto transactions | Typically not available |

| Technical Knowledge | Less required | More required |

FAQs

CEXs are generally best suited for beginner investors getting started. DEXs off more security and flexibility.

CEXs are generally less secure than DEXs. This is because, on a CEX, you don’t have access to your private key, which proves ownership of cryptocurrency. DEXs, however, come with risks as well, such as hacking risk.

Coinbase operates as a centralized cryptocurrency exchange (CEX).

No, you can not trade fiat currency on a DEX. However, you can trade stablecoins, which are backed by and mirror the price of certain fiat currencies.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.