A blockchain oracle is a bridge enabling smart contracts to access external data and systems, including other blockchains and real-world events. This connectivity facilitates the execution of smart contracts and their integration into the Web3 ecosystem.

Written by: Anatol Antonovici | Updated March 4, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Oracles are services that connect blockchains like Ethereum to the outside world, enabling smart contracts to execute based on inputs and outputs from external sources. In this article, we’ll show you how they work!

Table of Contents

🍒 tasty takeaways

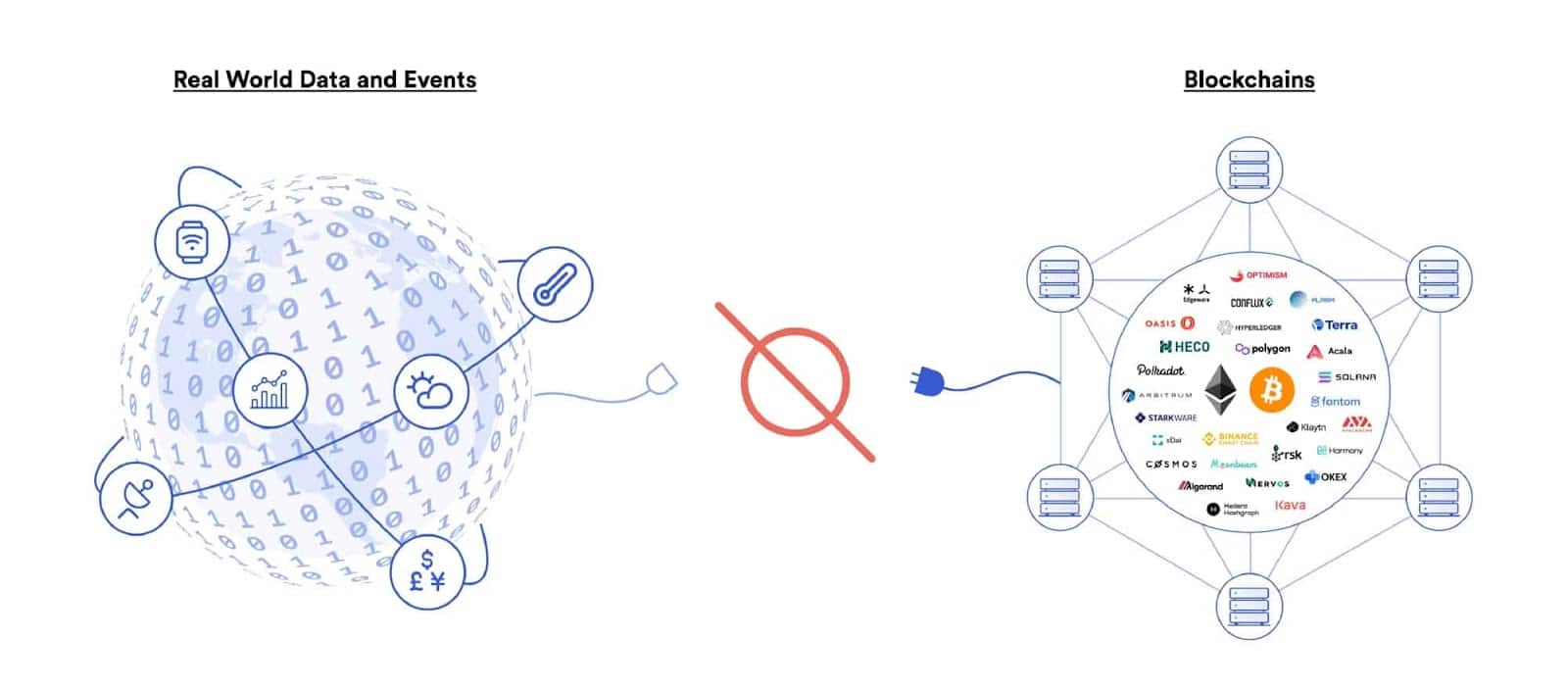

As per the Oracle Problem, blockchains are isolated networks that don’t have direct communication with the real world.

Oracles help a blockchain communicate with the external world and with other chains.

Decentralized oracles are more secure, eliminating the risk of malicious behavior.

Summary

| Topic | Details |

|---|---|

| Blockchain Oracles | Services connecting blockchains to external data, enabling smart contracts to access real-world information and other chains. |

| Oracle Problem | Challenges arising from blockchains' isolation and the risk of data source compromise; decentralized solutions are preferred. |

| Types of Oracles | Varies by data flow, source, and trust model, including inbound, outbound, cross-chain, software, hardware, and human oracles. |

| Oracle Functionality | Oracles query, verify, and authenticate external data for blockchain platforms, enabling smart contracts to execute automatically. |

| Use Cases | Enables DeFi, tokenization, insurance automation, dynamic NFTs, betting, supply chain management, and more. |

| Benefits and Risks | Oracles enhance functionality and accuracy of on-chain data but face security, accuracy, and regulatory challenges. |

What Is a Blockchain Oracle?

Source: ChainLink

Blockchain oracles are services that connect decentralized networks with real-world data. They can read and verify real-world data, enabling decentralized applications (dapps) to perform various functions.

Thanks to oracles, smart contracts can execute certain conditions, opening the door to multiple use cases.

🍒 Here’s How Smart Contracts Work

Oracles can also be designed to transmit data in a bridge-like fashion from a blockchain to the outside world and communicate with other chains, enabling cross-chain use cases.

Dapps leverage oracles to achieve greater scalability and interoperability.

Oracle Example

For example, imagine a blockchain-based predictions betting app (like Polymarket) where users can bet on sporting events. Oracles obtain and verify data from the outside world, such as match scores, and send it to the smart contract. In this way, the betting dapp can decide on winners and pay them accordingly.

Why Are Oracles Needed?

Many cryptocurrency users might not realize the essential role of oracles, yet they form a crucial part of the infrastructure.

Blockchains, by design, lack a direct link to the off-chain world. Oracles play a crucial role by providing this external data to smart contracts, which is essential for the functioning of many applications, including those in decentralized finance (DeFi), Web3, and other decentralized apps, as they depend on real-world information.

The Oracle Problem

To ensure mainstream adoption of dapps, the crypto industry has to address the so-called oracle problem, which refers to the isolation of decentralized networks and the risk of compromised data sources.

Centralized oracle systems increase the risk of a single point of failure, which is why decentralized oracle solutions are preferred.

Types of Oracles

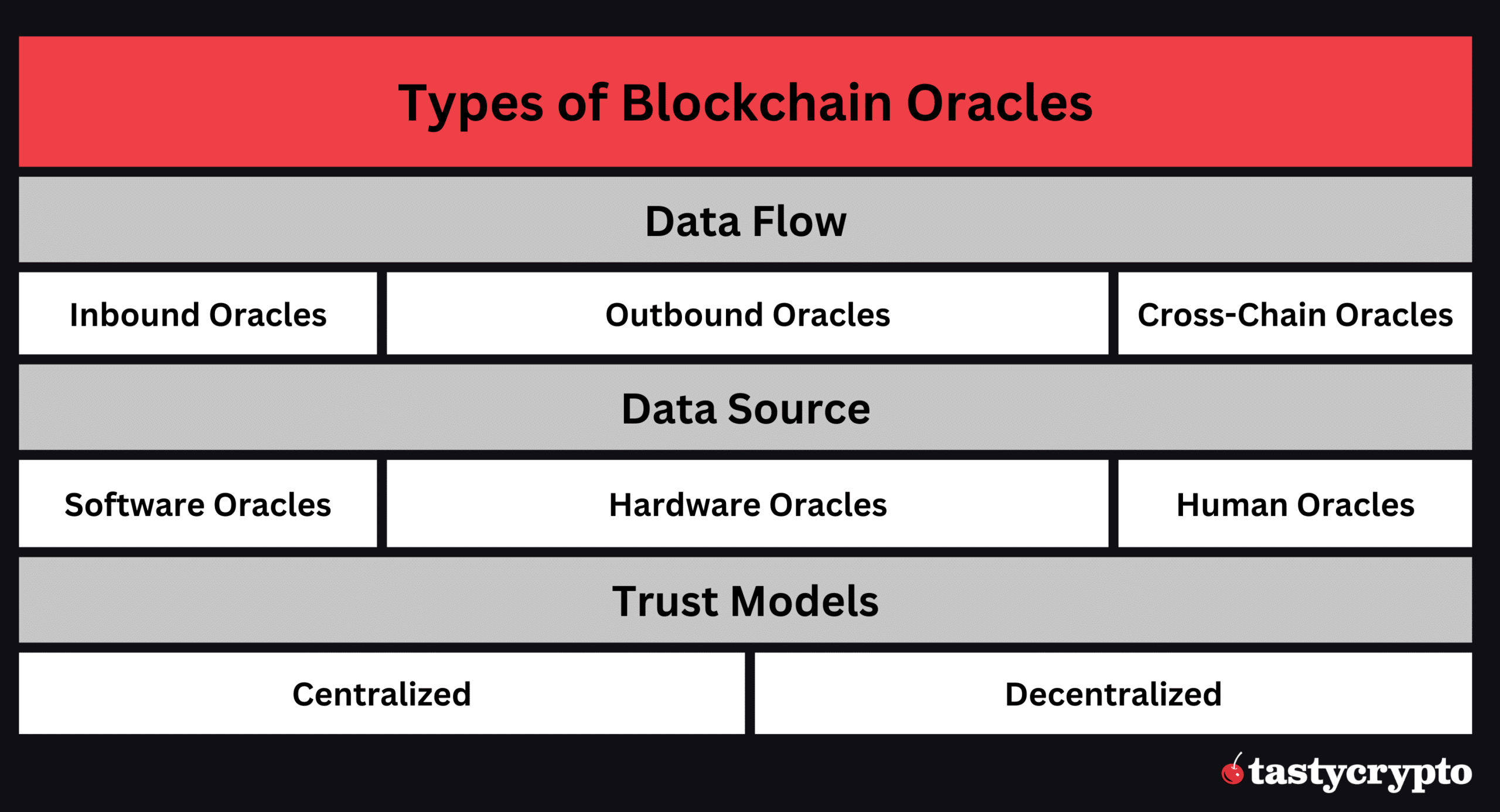

The most popular oracles in blockchain are decentralized inbound oracles accessing online sources, including price feeds and real-world events converted into digital data.

But there are several varietes of blockchain oracles, as seen below:

1. Data flow

- Inbound oracles fetch data from the external world and deliver it to blockchain.

- Outbound oracles can deliver blockchain data to off-chain systems to trigger certain actions.

- Cross-chain oracles can read and write data between different blockchain networks.

2. Data source

- Software oracles read data from online sources, such as websites, cloud servers, APIs, etc.

- Hardware oracles acquire external data from offline sources, such as sensors or QR scanners.

- Human oracles are experts or specialized individuals who can input data into a smart contract. For example, meteorologists can input weather data for blockchain prediction markets and other dapps.

3. Trust model

- Centralized oracles rely on trusted sources for their data feeds, such as companies, organizations, research teams, etc.

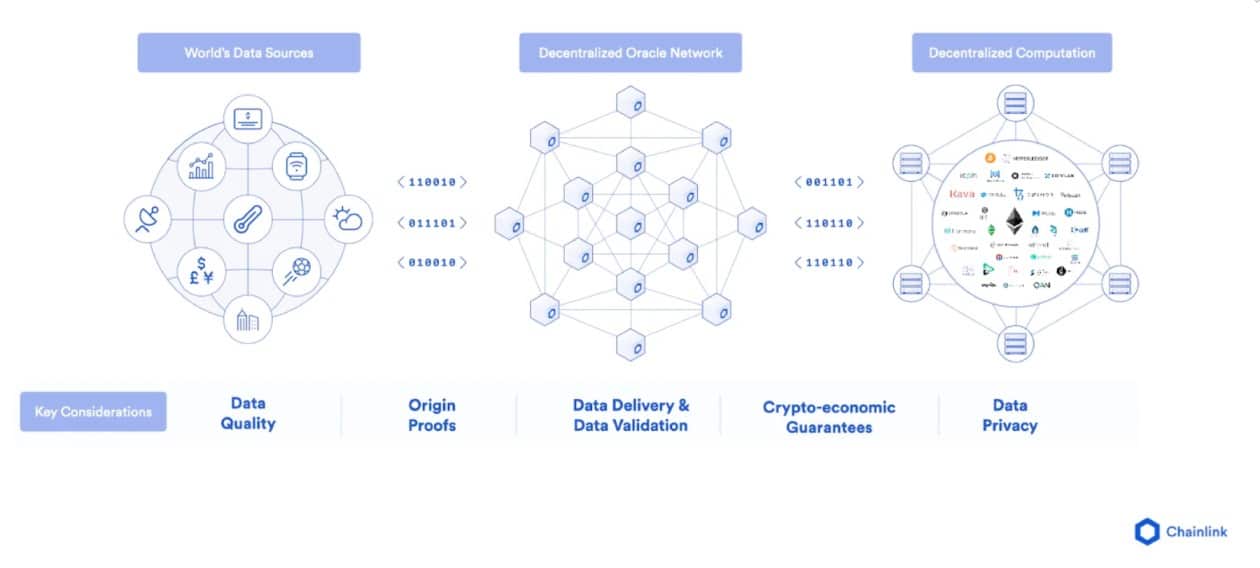

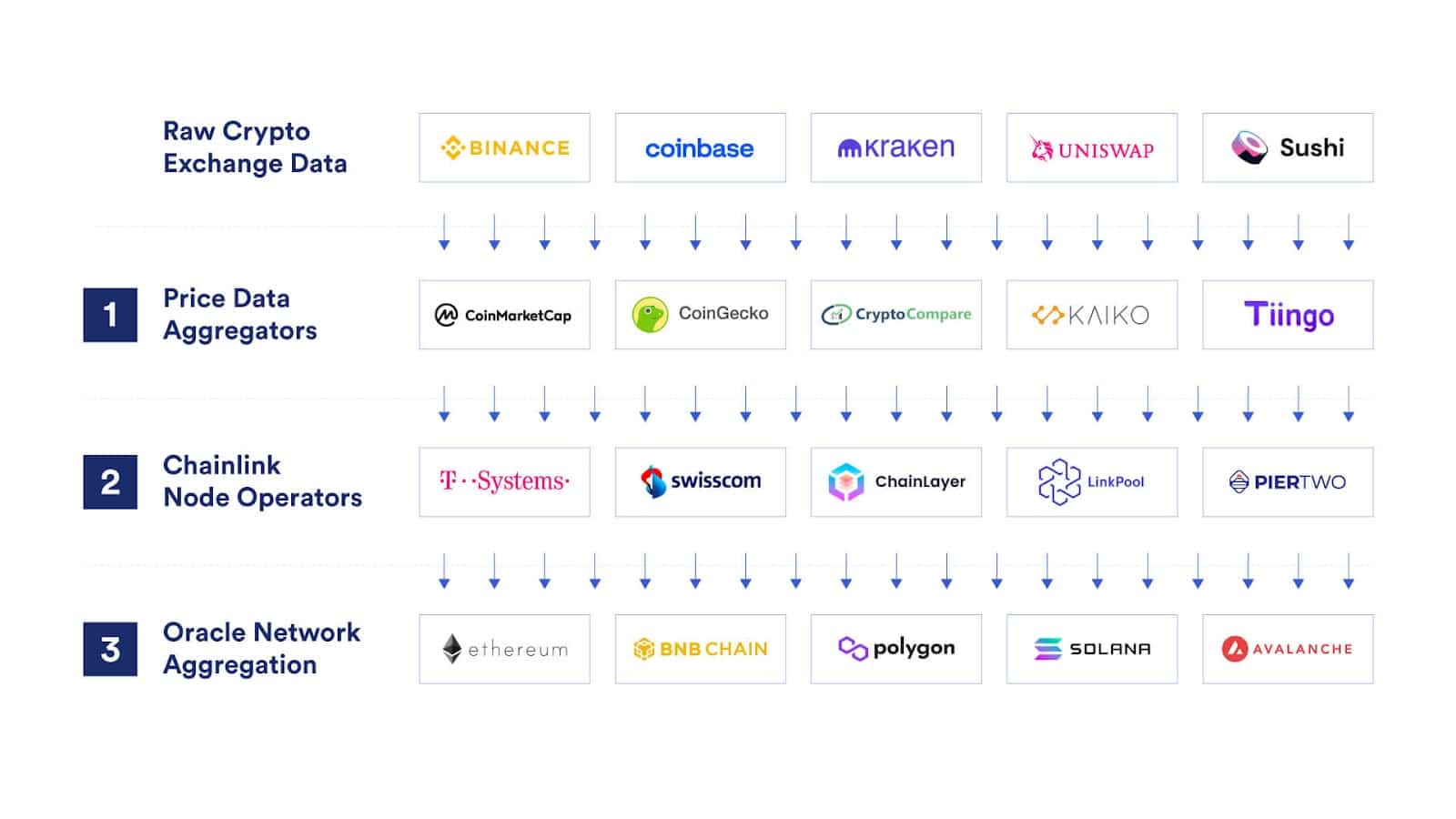

- Decentralized oracles build on the promise of decentralization by eliminating the risk of malicious behavior from third-party services. They represent specialized blockchains or a network of nodes connected to reliable data sources that are checked by multiple parties based on a consensus mechanism. This approach enables decentralized oracles to eliminate the single points of failure and reduce data inaccuracy and manipulation. Chainlink is the most relevant example of a decentralized oracle network.

How Do Blockchain Oracles Work?

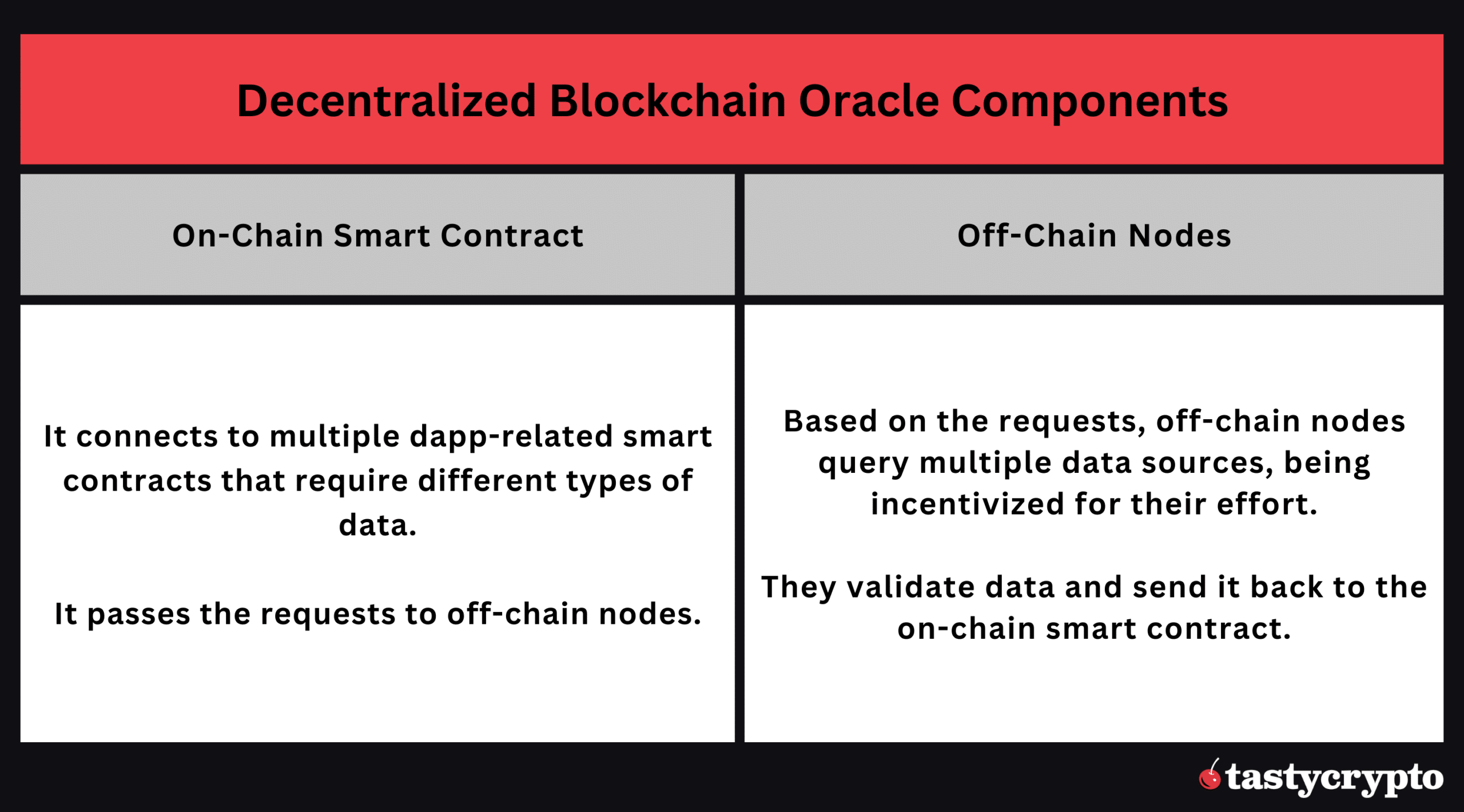

Oracle services’ goal is to query, verify, and authenticate data from external sources, such as API feeds, and then pass it to the blockchain platform. Therefore, they have two main components: the on-chain smart contracts and the off-chain nodes.

- The oracle’s smart contract takes requests from all connected smart contracts and passes these to the off-chain nodes.

- The off-chain nodes query relevant data sources, check data validity, and convert it into an on-chain format to be sent back to the smart contract.

After receiving the data, smart contracts connected to the oracle system can self-execute automatically.

An oracle ecosystem performs multiple processes, including:

- Data collection based on requests

- Data validation

- Data transmission to smart contracts

- Smart contract autonomous self-execution

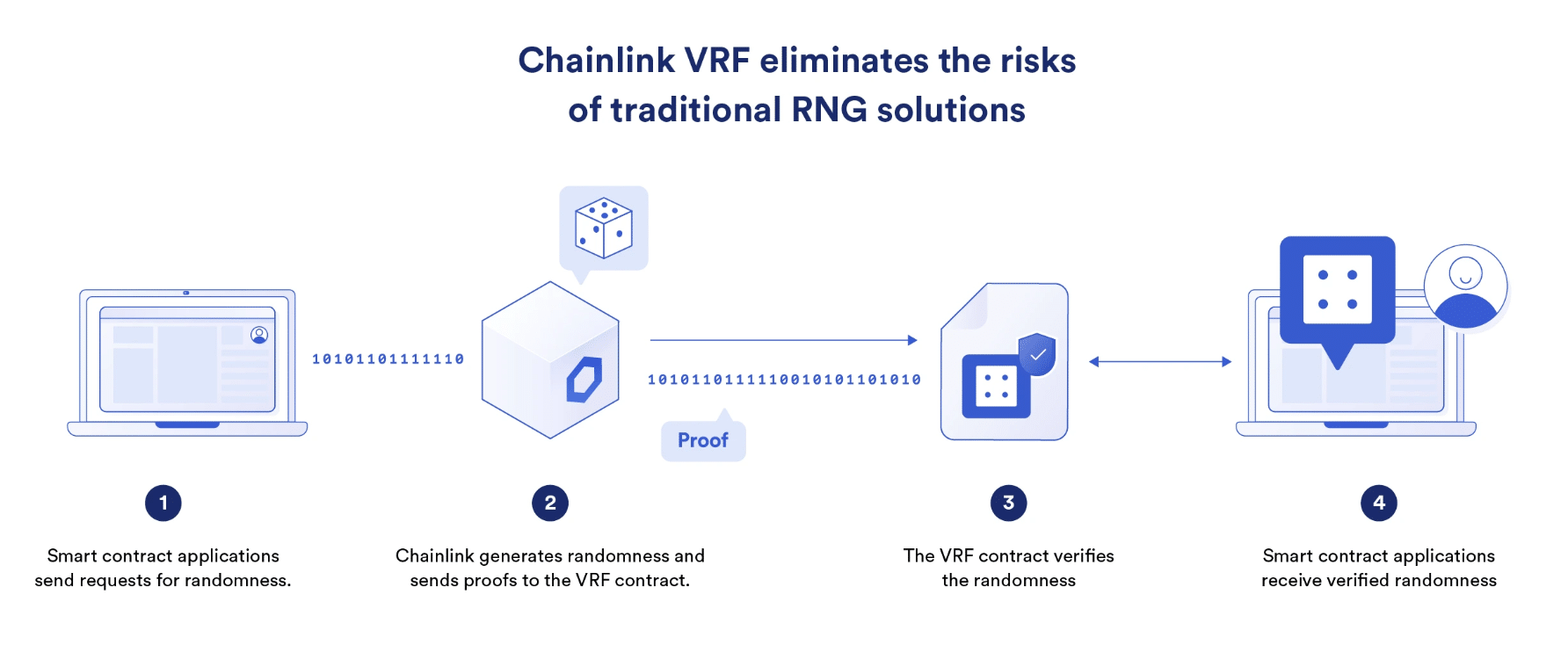

Generating Verifiable Randomness

Some oracles can perform off-chain computation and transfer the outcome on-chain. Since on-chain computation is expensive and slow, this is an important feature.

For instance, Chainlink’s Verifiable Random Function (VRF) conducts computations off-chain to produce genuinely random values, benefiting dapps such as lottery games or non-fungible tokens (NFTs).

Source: ChainLink

Examples of Decentralized Blockchain Oracles

Chainlink has been the leading blockchain oracle network for years, currently accounting for over 60% of the oracle sector, as per Coinmarketcap data.

This protocol represents a trustless network of data providers, offering multiple features to ensure data accuracy and incentivizing ecosystem participants through it’s native crypto LINK.

Source: ChainLink

Other decentralized oracle networks include Band Protocol, UMA, and Pyth. You can read more about the top oracle protocols in our dedicated article.

Blockchain Oracle Use Cases

Developers can leverage oracles for multiple use cases, including:

- DeFi – dapps like decentralized exchanges (DEXs) and lending protocols need real-time cryptocurrency price updates.

Source: ChainLink DeFi

- Tokenization – by tracking data of real-world assets, oracles can facilitate their tokenization and transformation into digital assets.

- Insurance – thanks to oracles, blockchain-based insurance apps can automate insurance claims.

- NFTs – artists can use oracles to generate random inputs. A special category of NFTs that benefit from oracles is dynamic NFTs, which can change their metadata based on certain triggers.

- Betting and prediction markets – oracles verify the outcomes of real-world events, such as scores, winners, etc.

- Supply chain – oracles can be used in blockchain-based supply chain management systems to track and verify products, enhancing transparency and accountability.

Benefits of Blockchain Oracles

- Connecting public blockchain networks to the outside world.

- Increased functionality for smart contracts and dapps.

- Improved accuracy of on-chain data.

- Cross-chain communication between decentralized networks.

- Scalability and automation of multiple on-chain processes.

- Income opportunity for data providers.

Risks and Challenges of Blockchain Oracles

- Security risks of centralized oracles.

- Difficulty in ensuring data accuracy from decentralized oracles.

- Regulatory risks.

- Complexity of integrating oracles into dapps.

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

FAQs

A blockchain oracle is a service that connects a blockchain network to the outside world. Oracles can read, verify, and send various data types to smart contracts.

Blockchains are closed and isolated networks that don’t communicate directly with the real world. Oracles help decentralized applications integrate off-chain data and events.

The function of an oracle is to query, validate, and transmit external data to smart contracts on the blockchain. They achieve this by relying on a network of nodes that data providers represent.

Oracle use cases include decentralized finance (DeFi) apps for real-time price updates, tokenization of real-world assets, automated insurance claims, dynamic NFTs, betting and prediction markets, and supply chain management, among others.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com