Bitcoin and Ethereum are the two largest cryptocurrencies by market cap, while Solana has been the fastest-growing chain since 2023. Let’s compare these three chains to determine which one is best.

Written by: Anatol Antonovici | Updated March 11, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

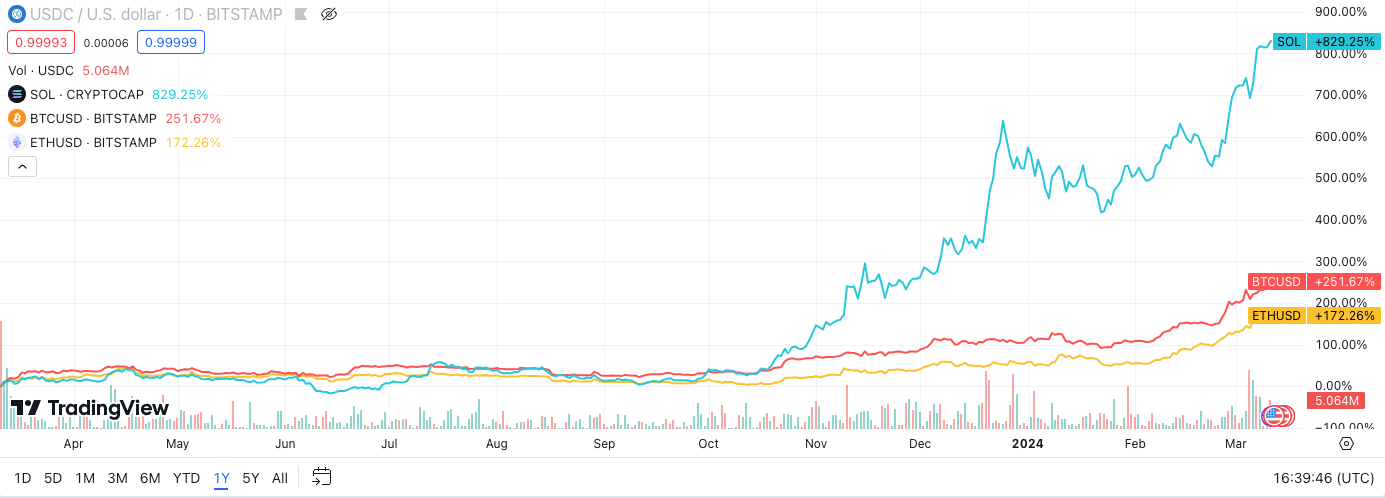

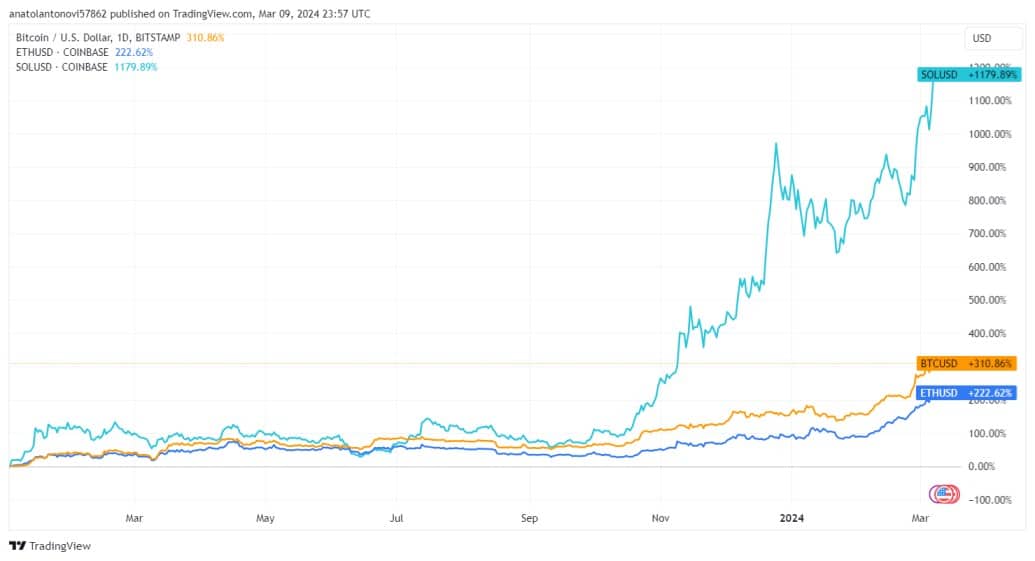

1-Year Performance; TradingView

Bitcoin rules in security, Ethereum leads in DeFi and NFTs, and Solana wins on speed and low costs. So which is best for you? Let’s find out! 🏃

Table of Contents

🍒 tasty takeaways

Bitcoin is the largest cryptocurrency by market cap, accounting for about half of the crypto market cap. It relies on a proof of work algorithm to validate transactions.

Ethereum and Solana both offer the smart contract feature, enabling developers to build decentralized applications and other tokens on top of them.

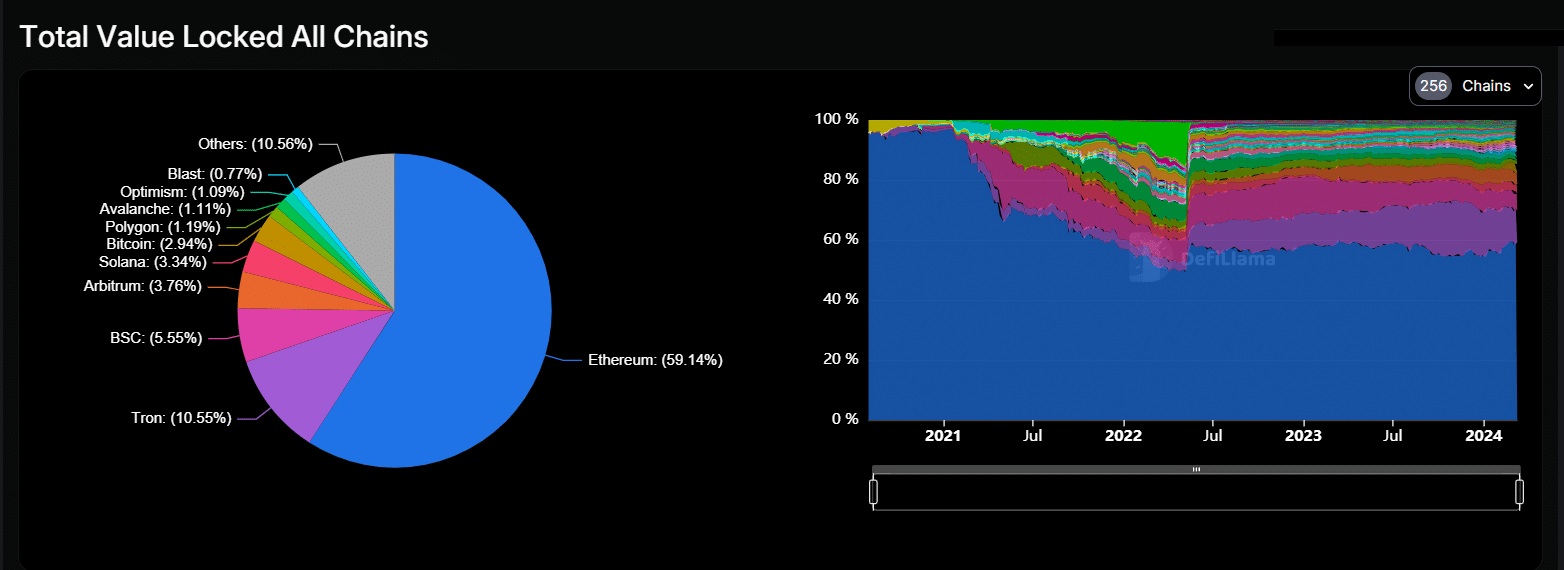

Ethereum accounts for almost 60% of the decentralized finance market, while Solana and Bitcoin have a 3% share.

Summary

| Feature | Bitcoin (BTC) | Ethereum (ETH) | Solana (SOL) |

|---|---|---|---|

| 1-Year Performance | +250% | +172% | +733% |

| Consensus Algorithm | Proof of Work (PoW) | Proof of Stake (PoS) | PoS + Proof of History (PoH) |

| Best For | Store of value | DeFi apps, NFTs | Enterprise use cases, gaming |

| Energy Consumption | High | Moderate | Low |

| Staking | No | Yes | Yes |

| Transaction Speed | ~7 tps | Up to 25 tps | ~65,000 tps |

| Transaction Cost | ~$7.6 | ~$23 | Up to $0.005 |

| Scalability | Layer 2 solutions | Layer 2 chains | Native scalability |

| Ecosystem | Limited | Large | Growing |

What Is Bitcoin (BTC)?

- Name: Bitcoin

- Ticker: BTC

- Consensus Algorithm: Proof of Work

- Best for: Store of value

Bitcoin is the oldest and most widely held cryptocurrency. Launched in 2009 after the publication of the now famous Bitcoin whitepaper, it represents the first use case of blockchain technology. Bitcoin triggered the emergence of a new industry and asset class: digital currencies.

Since its launch, Bitcoin has always been the largest cryptocurrency by market cap, accounting for over 50% of the crypto market as of this writing.

Bitcoin as Digital Gold

While Bitcoin was intended as a decentralized peer-to-peer money system, it became a store of value (SOV) asset, helping investors preserve wealth and hedge against inflation.

🍒 Bitcoin vs Gold: Which is Best?

However, Bitcoin has some downsides: the network is rigid and slow, not open to major upgrades, and doesn’t support applications. Think of it as digital gold.

Bitcoin Pros

- Thanks to an energy-intensive proof of work (PoW) algorithm and a large network of nodes dispersed worldwide, it is the most secure crypto infrastructure.

- High liquidity.

- Offers many related derivatives and investment vehicles, including futures, options, and exchange-traded funds (ETFs).

Bitcoin Cons

- Slow speed – about 7 transactions per second (tps).

- Doesn’t support applications on its mainnet.

- Coin production requires huge amounts of energy.

What Is Ethereum (ETH)?

- Name: Ethereum

- Ticker: ETH

- Consensus algorithm: proof of stake

- Best For: Web3

Ethereum has traditionally been the second-largest cryptocurrency by market cap and the largest one that offers the smart contract feature. Thanks to smart contracts, developers can create decentralized applications (dapps) and other tokens on top of its mainnet.

Over the last few years, the Ethereum network has gradually upgraded to switch from PoW to a proof of stake (PoS) algorithm (Ethereum 2.0). The new version, adopted in 2022, offers greater scalability and lower costs.

Ethereum’s Ecosystem

Ethereum has many token standards that support various types of assets, including utility tokens, non-fungible tokens (NFTs), stablecoins, and security tokens, among others.

The network dominates the decentralized finance (DeFi) sector, accounting for about 60% of total value locked (TVL) across DeFi Web3 apps.

Ethereum Pros

- Thanks to the smart contract feature, Ethereum supports the creation of dapps and tokens on top of it.

- Large ecosystem: Ethereum dominates the DeFi and Web3 space and has a large NFT presence.

- All dapps and erc20 tokens on Ethereum are interoperable

Ethereum Cons

- High gas fees.

- Scalability is lacking, especially given the high demand.

- Developers have to learn Solidity, a programming language created specifically for Ethereum.

What Is Solana (SOL)?

- Name: Solana

- Ticker: SOL

- Consensus algorithm: Delegated proof of stake

- Best for: Enterprise use cases, gaming apps, dapps

Solana is a fast-growing blockchain supporting the smart contract feature, which allows it to compete with Ethereum on the DeFi, NFT, and Web3 fronts. It’s widely regarded as the best ‘Ethereum killer’ candidate.

The network relies on a PoS version called Delegated Proof of Stake (DPoS), which enables it to achieve greater scalability than Ethereum.

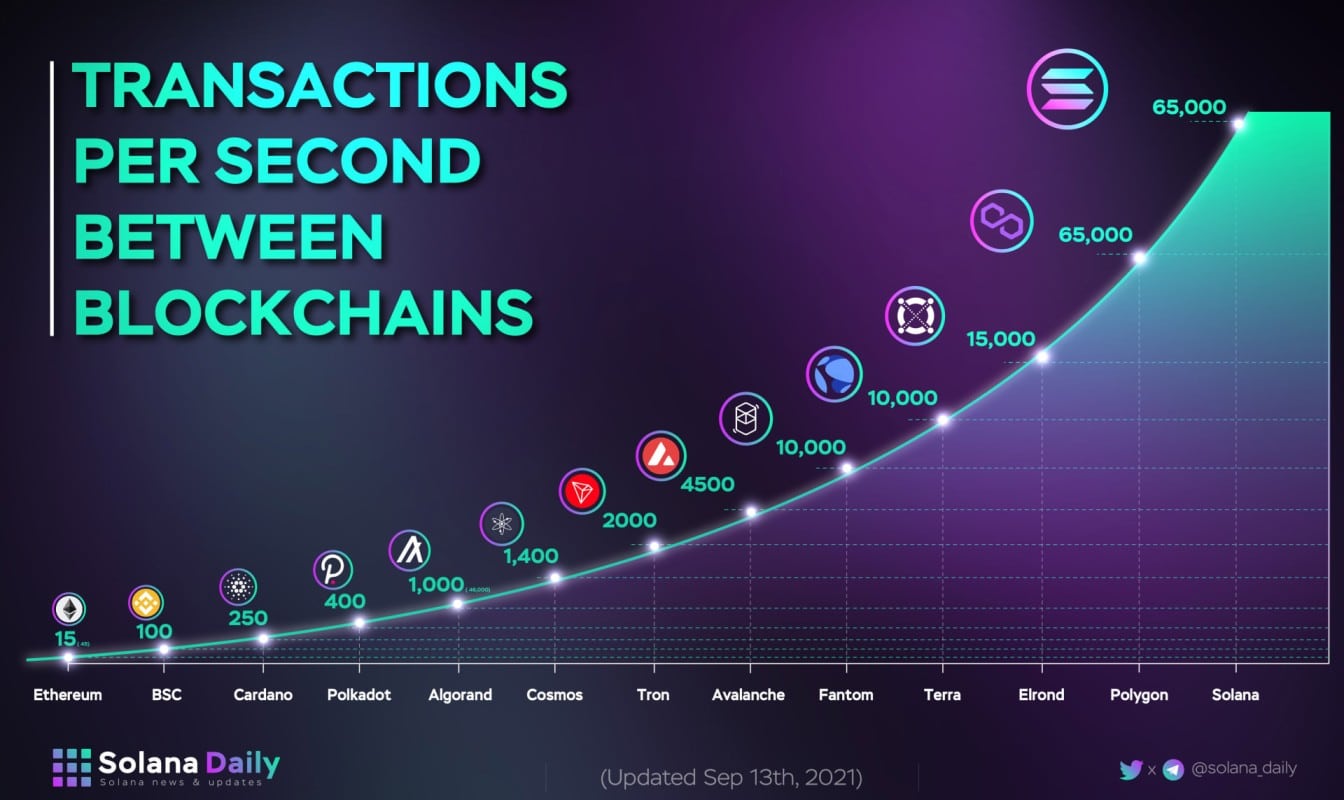

Solana is regarded as the fastest blockchain, with a transaction speed capacity of 65,000 tps. Solana transactions achieve instant finality thanks to its proof of history (PoH) feature integrated into its consensus mechanism.

SOL is the fifth-largest cryptocurrency by market cap.

Solana Pros

- High speed: about 65,000 tps capacity.

- Very low transaction fees.

- Supports multiple programming languages

Solana Cons

- Less decentralized and secure than Ethereum.

- Smaller ecosystem and limited adoption across developers.

- No compatibility with EVM chains.

Secure Your Crypto With Self-Custody

When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, wSOL and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Bitcoin vs Ethereum vs Solana: Comparison

Let’s explore how these three blockchains compare based on several factors:

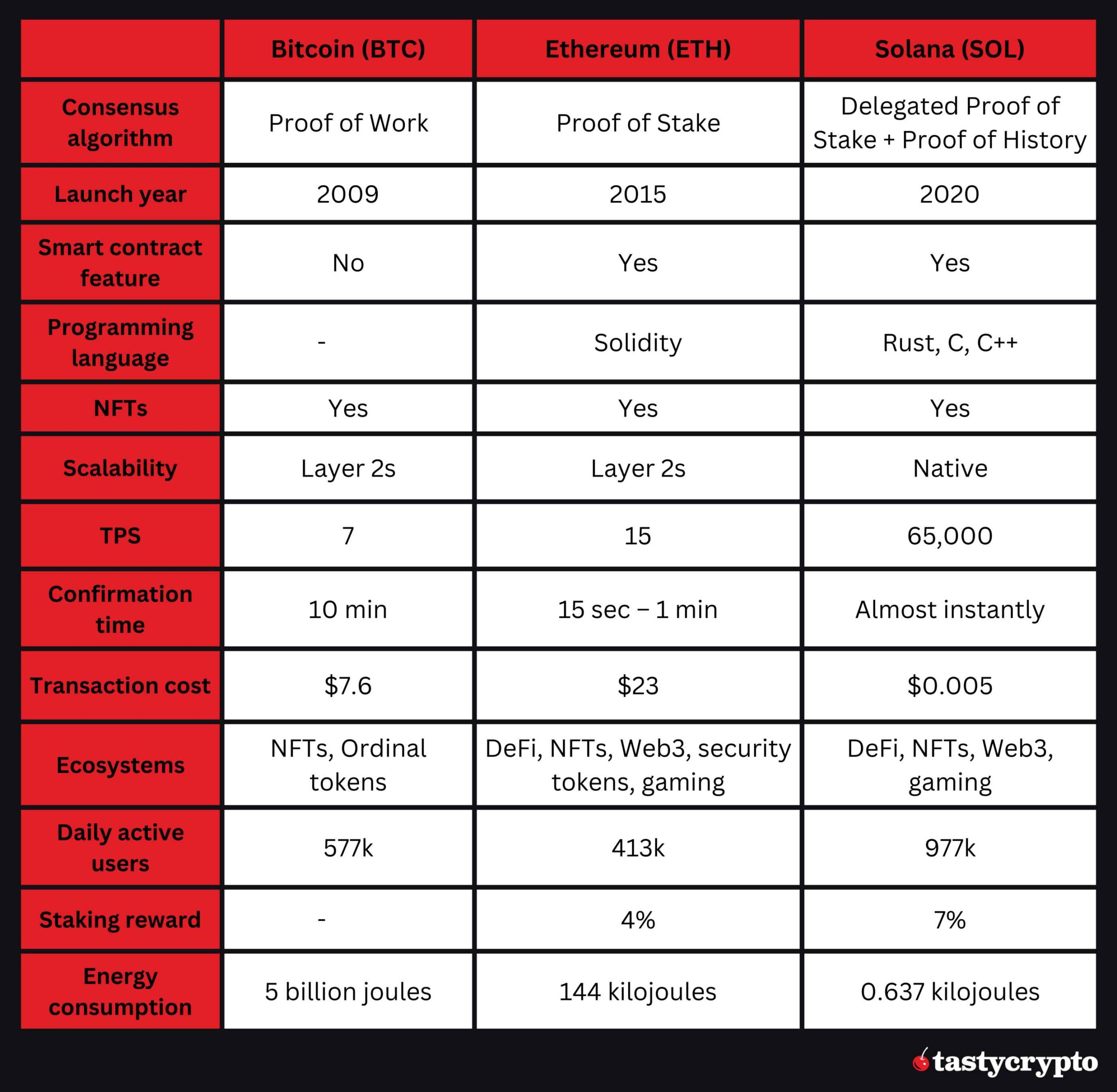

Consensus Algorithm

- Bitcoin: PoW

- Ethereum: PoS

- Solana: PoS+ PoH

Bitcoin uses a PoW algorithm that encourages competition among so-called miners, who use advanced computing devices to become the next block validator and get rewarded.

Ethereum and Solana use different PoS versions, with the latter also leveraging the PoH feature for greater scalability. In PoS, the system randomly selects block validators from a pool of participants who stake the native coin.

While Bitcoin’s PoW is slower and more rigid, it is the most secure chain thanks to a large network of nodes.

Staking

Bitcoin doesn’t allow for staking.

Ethereum and Solana enable users to stake the native coins and earn rewards. There are specialized staking pools that lower Ethereum’s entry barrier of 32 ETH minimum deposit.

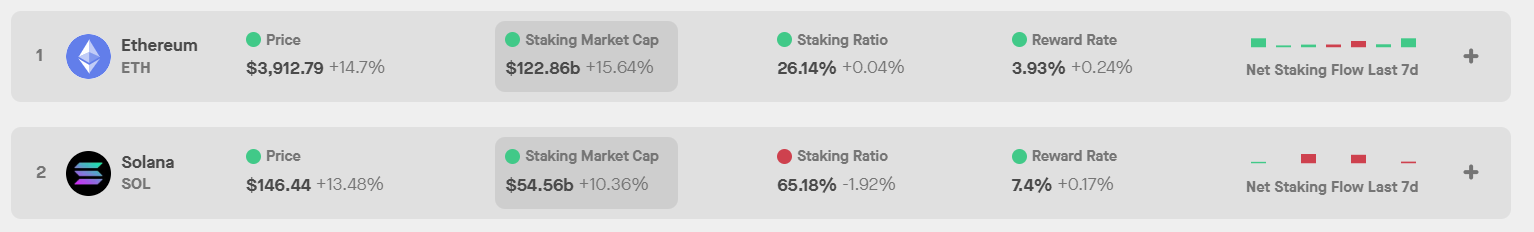

Solana doesn’t have a minimum threshold. Reward rates for Ethereum and Solana are about 4% and 7.4%, respectively.

Source: Staking Rewards

Features and Capabilities

Bitcoin is a PoW blockchain that hosts a native deflationary coin, BTC. Technically, it cannot support other dapps and tokens, but an ingenious protocol called Ordinals enables the creation of fungible assets and NFTs on its mainnet.

Ethereum and Solana support smart contracts, enabling the development of dapps and tokens, including NFTs.

Ethereum’s EVM (Ethereum Virtual Machine) can be adopted by other layer 1 and layer 2 chains for greater interoperability.

Solana offers several tools to support real-world use cases, including Solana Pay and GameShift.

Chain Performance

Bitcoin has a capacity of about 7 tps with an average confirmation time of 10 minutes.

Ethereum can reach up to 25 tps with confirmation times ranging from 15 seconds to 5 minutes.

The Solana network can process up to 65,000 tps with almost instant finality and has the highest throughput. But, again, Solana is not as widely adopted as our other coins.

Source: Twitter – Solana Daily

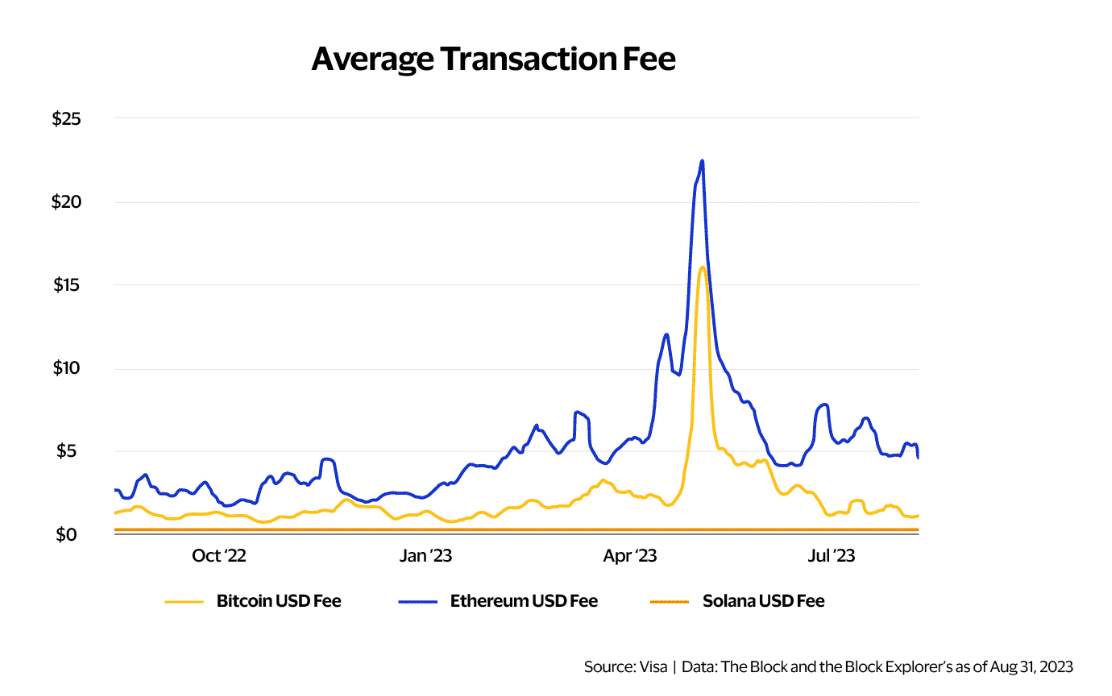

Transaction Costs

Transaction fees on Bitcoin and Ethereum fluctuate based on volume. As of this writing, the transaction costs on Bitcoin and Ethereum are $7.6 and $23, respectively.

Solana offers the smallest fees – up to $0.005 per transaction.

Source: Visa

Scalability

While Solana achieves native scalability, Bitcoin and Ethereum benefit from multiple layer 2 solutions that increase their performance and efficiency.

The most popular layer 2 solutions for Bitcoin are the Lightning Network, Liquid Network, and Stacks.

Ethereum benefits from multiple layer 2 chains, including Polygon, Arbitrum, and Optimism.

Ecosystem

Ethereum has the largest ecosystem of the three, while Solana competes with it on the Web3, DeFi, and NFTs fronts.

Interestingly, Bitcoin is also exploring these markets despite not supporting dapps. Thanks to Ordinals and layer 2s like Stacks, the world’s largest layer 1 can support NFTs, tokens, and even DeFi apps.

As of today, Ethereum accounts for almost 60% of TVL in DeFi protocols, with about $56 billion as of March 2024. Solana has surpassed the $3 billion mark, having a 3.3% share in DeFi. Even Bitcoin has a 3% market share in DeFi.

Source: DeFiLlama

Ethereum dominates the NFT sector, but Solana is doing well too. In December 2023, the monthly NFT sales volume on Solana beat Ethereum NFT sales for the first time, according to CryptoSlam data. As of this writing, Ethereum leads NFT monthly sales, with Bitcoin and Solana coming next.

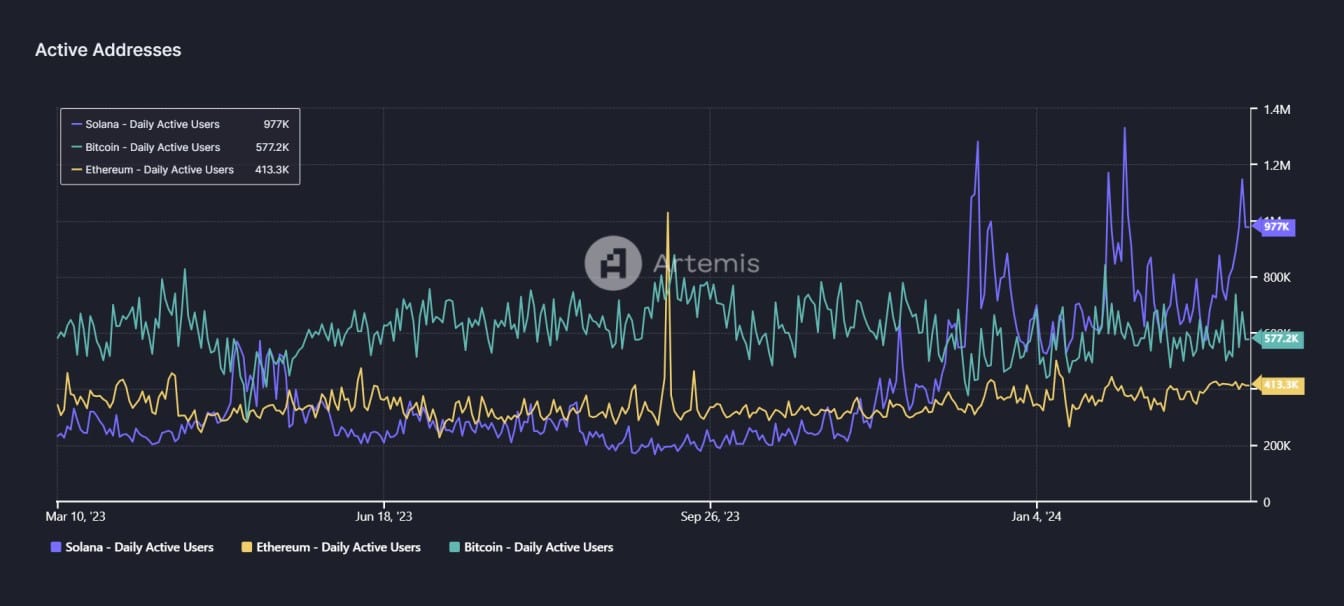

Adoption

The number of daily active users (DAUs) on Solana has increased rapidly in 2023 through 2024, overtaking both Bitcoin and Ethereum.

Source: Artemis

Coin Performance

SOL has been the fastest-growing coin among the three, gaining over 1,000% since the beginning of 2023.

Source: TradingView

Here is a head-to-head comparison between our three coins:

BTC vs ETH vs SOL: Which One Is Best?

These are the top blockchain networks as of today, but determining which one is best is an impossible task without context.

Bitcoin is in a league of its own, while Ethereum and Solana are direct competitors.

Bitcoin is a store of value, and it is the best cryptocurrency for preserving value and hedging against inflation.

Ethereum is best for DeFi applications thanks to its interoperable ecosystem, which leverages the EVM software. It’s also widely used for minting NFTs and security tokens.

Solana is the best chain for demanding apps, such as gaming and metaverse apps, as well as enterprise use cases focusing on speed and efficiency.

FAQs

Bitcoin, Ethereum, and Solana are layer 1 blockchain networks with native cryptocurrencies.

Bitcoin is often used as a store of value asset, while Ethereum and Solana are preferred for their smart contract functionality and their ability to host decentralized apps and tokens.

Solana has been the fastest-growing chain since 2023, but it can compete with Ethereum in several markets. However, Ethereum is also improving to increase efficiency.

You can buy BTC, ETH, and SOL on most cryptocurrency exchanges, including many decentralized exchanges (DEXs). Alternatively, you can get these coins inside the tastycrypto app, which offers the swap feature.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com