In 2025, Bitcoin is projected to potentially surpass $100,000, with predictions indicating a rise to $1.5 million by 2030 and extending into multi-million dollar valuations by 2040 and 2050.

Written by: Anatol Antonovici | Updated April 1, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In this speculative article, we have a little fun by trying to predict the price of Bitcoin (BTC) from next year through 2050. Let’s go! 🏃♀️

Table of Contents

🍒 tasty takeaways

2025: Bitcoin may break above $100,000, influenced by factors such as approving Bitcoin ETFs and following historical trends showing significant price increases post-halving events.

2030: Predictions suggest Bitcoin could reach $1.5 million, driven by increased adoption, scarcity as highlighted by the stock-to-flow model, and possibly macroeconomic factors affecting fiat currencies.

2040: Long-term predictions are highly speculative; however, prices could reach millions given Bitcoin’s decreasing inflation rate and increasing scarcity.

2050: Predictions extend into multi-million dollar valuations, largely speculative, with potential influences from global economic shifts and the intrinsic properties of Bitcoin’s supply and demand dynamics.

Summary

| Year | Predicted Price | Factors |

|---|---|---|

| 2025 | $100,000+ | Bitcoin ETF approval, historical post-halving price trends |

| 2030 | $1.5 million | Increased adoption, scarcity (Stock-to-Flow model), macroeconomic factors |

| 2040 | Multi-million dollars | Decreasing inflation rate, increasing scarcity |

| 2050 | Multi-million dollars | Global economic shifts, Bitcoin's supply and demand dynamics |

What Affects Bitcoin Price in the Long Term?

When trying to predict the price of Bitcoin (BTC), the most important thing to know is that it uses a deflationary model. Its supply side is slowly but steadily narrowing, while the demand side has significant room for growth since Bitcoin adoption is far from saturated.

Since its launch in 2009, Bitcoin’s inflation rate has been regularly slashed every three or four years during a special halving event. According to the rules encoded into Bitcoin, the mining reward is reduced by 50% during this event.

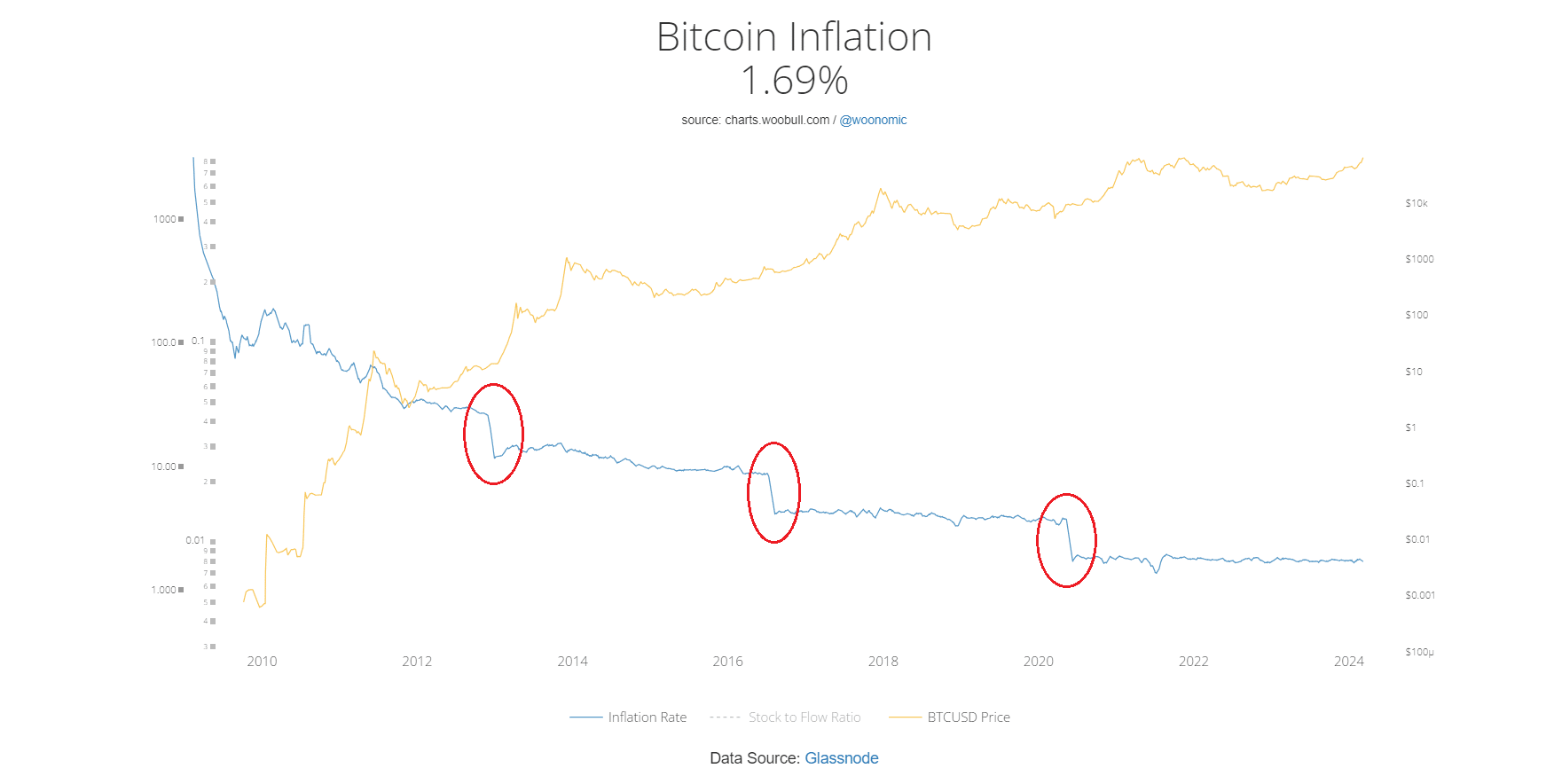

Check out this chart to see how each inflation cut following the scheduled halving event leads to a new all-time high (ATH), usually after a few months or about a year.

Source: WooBull

Today, Bitcoin’s inflation rate is about 0.84%, suggesting that its circulating supply is increasing by 0.8% yearly. This rate will decrease to about 0.41% after the next halving event, expected to occur in 2028.

Feel free to check our dedicated post on Bitcoin halving, which touches upon previous halvings.

Bitcoin Price Predictions: The tastycrypto Show

Watch our episode on Bitcoin (BTC) price predictions for a more in-depth review!

Bitcoin Stock-to-Flow Model

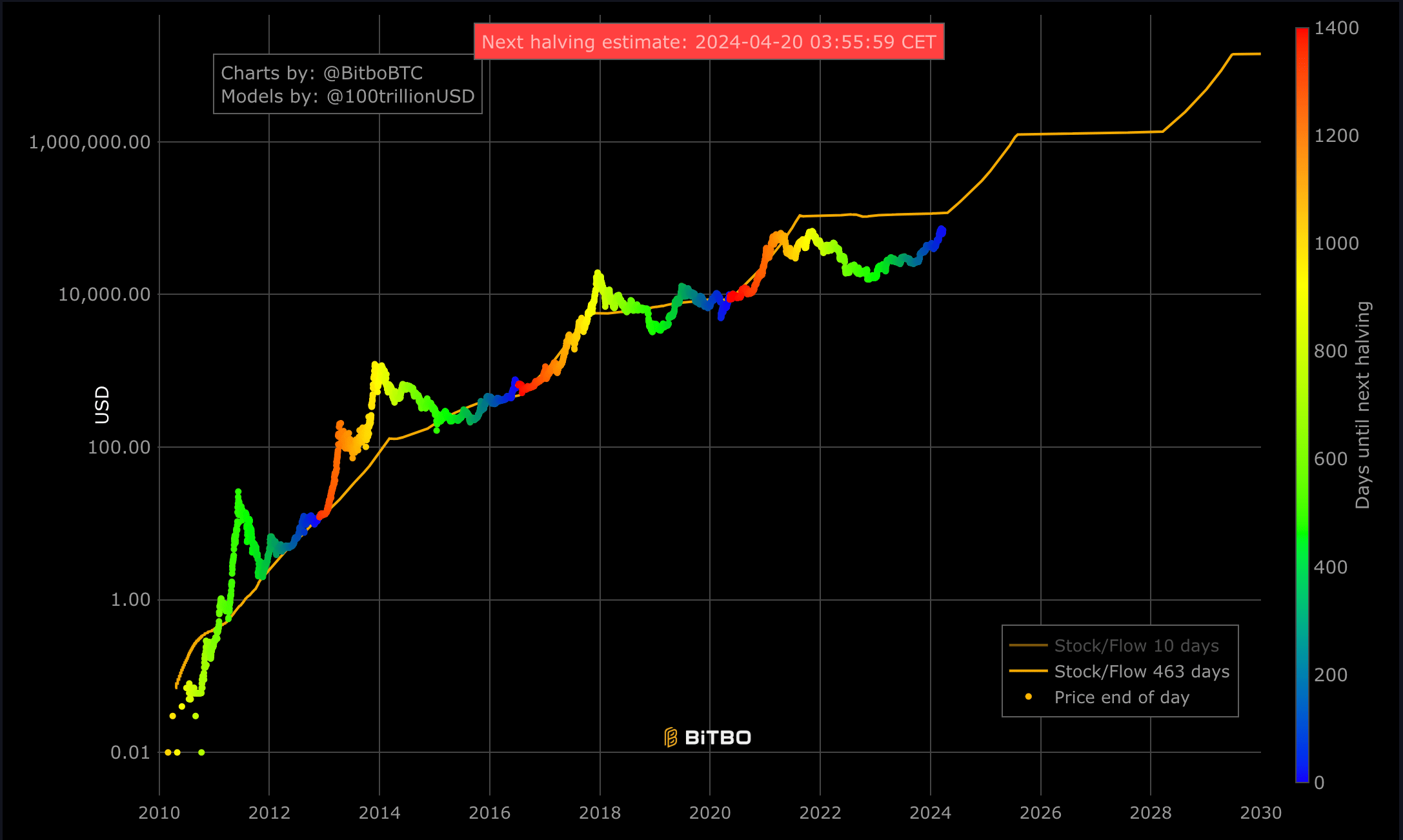

So far, the most accurate model for predicting Bitcoin’s long-term price has been the stock-to-flow (S2F) model, first proposed by Twitter user PlanB in a Medium post.

The S2F is a ratio that shows the relationship between a commodity’s current supply and the amount produced in a certain period, like monthly or annually. It shows how scarce a commodity is, i.e., how much time it needs to achieve the current supply given the current output rate.

With Bitcoin, the S2F rate increases after each halving event, as does its price.

This model has been incredibly accurate, except for the ‘crypto winter’ in 2022, when it deviated to the bearish side. The cryptocurrency market lost tens of billions at the time, and many digital assets followed in BTC‘s footsteps.

Source: Bitbo

USD Inflation and Bitcoins Future Value

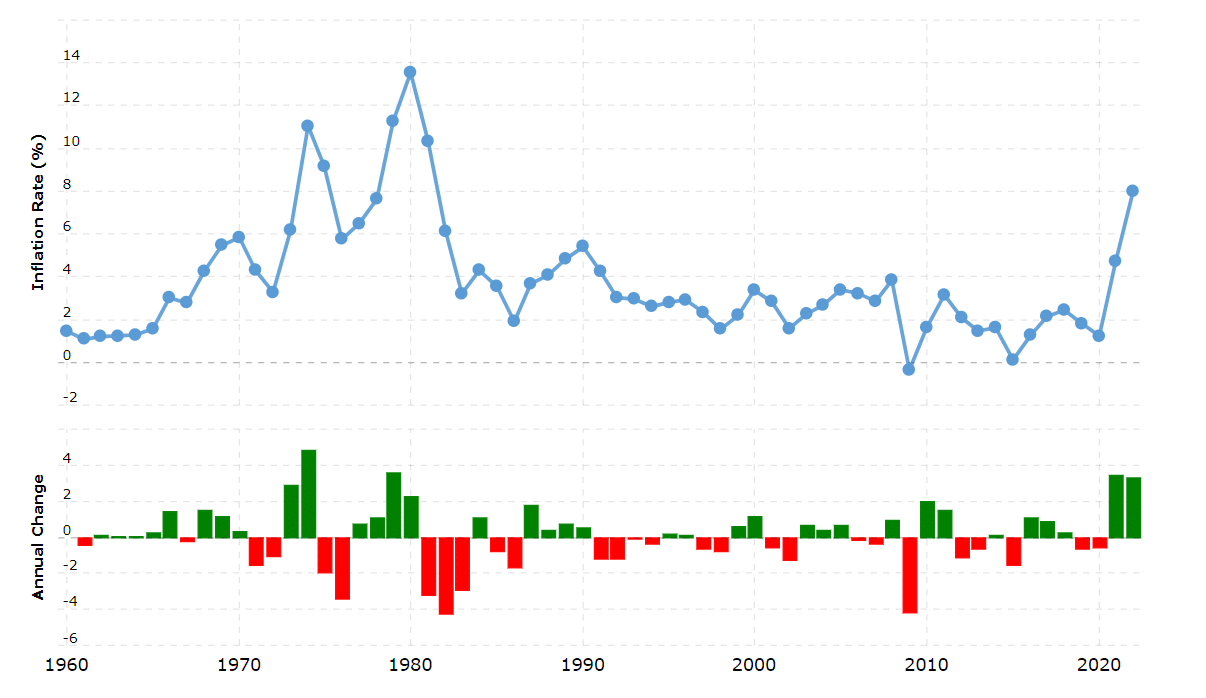

When giving a price outlook in terms of decades, many analysts focus on BTC while ignoring that the US dollar also has an inflation rate. This is significant since a weakening US dollar can result in a much higher price for an asset without considering its supply/demand dynamics.

Unlike Bitcoin, the US dollar is an inflationary asset, with the US Federal Reserve’s inflation target of 2%. However, we’re not robots, and achieving full control over the economy is challenging. The central bank often prints significantly more money by lowering interest rates to stimulate economic growth during difficult times, like the pandemic.

This is how we got surging inflation, with annual rates hitting 8%, the highest in about 40 years.

Source: Macrotrends

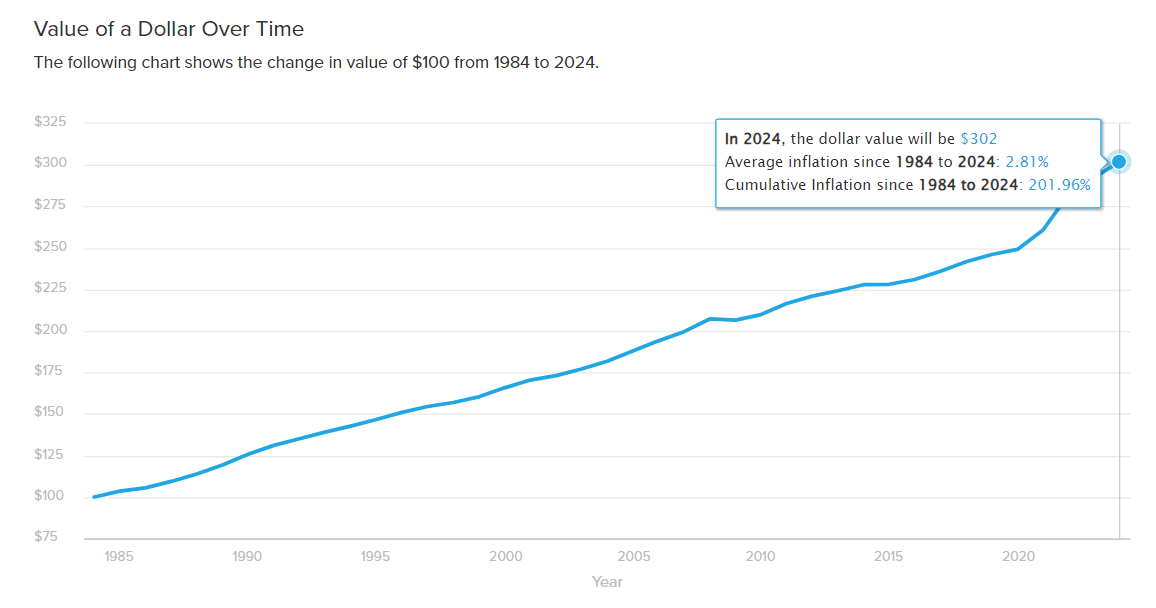

Due to increasing inflation, the purchasing power of the US dollar is weakening. In fact, it has declined by 96% since the Fed was created in 1913. For instance, $100 in 1984 is worth over $300 today.

Source: SmartAsset

Due to this factor alone, Bitcoin’s current price of $69,400 can turn into about $200,000 by 2050 without considering additional fundamentals.

In fact, if the US dollar is dethroned from its position as a world reserve currency, which may happen due to the current tectonic geopolitical shifts, it can lead to hyperinflation (although highly unlikely), pricing bitcoin at astronomical levels.

Bitcoin Prediction: Near and Distant

Predicting the price of Bitcoin or Ethereum (ETH) or any other crypto asset takes work. Unexpected events can often defy fundamental and technical analysis logic. Consider the collapse of LUNA and FTX.

Still, Bitcoin’s past performance has demonstrated that it has always recovered, even after the most dramatic bubble bursts.

At the beginning of 2024, the US Securities and Exchange Commission (SEC) approved the first BTC exchange-traded funds (ETFs), supporting a strong bullish sentiment that propelled it to a new ATH above the $70,000 mark.

Bitcoin (BTC) Prediction for 2025

The recent ETF approval may boost inflows from institutional investors, which is a bullish signal for Bitcoin’s price action in 2025.

History has shown that BTC’s new highs come about one year after each halving event, and the next one happens in April 2024.

2025 may be the year when Bitcoin catches up with the S2F model and finally breaks above the $100,000 mark.

Analysts at Standard Chartered expect Bitcoin to surge to $250,000 by 2025, mainly driven by inflows to BTC ETFs.

PlanB, the creator of the S2F model for Bitcoin, reiterated his 2025 outlook in June 2024, suggesting that the price of BTC would touch $500,000 by then.

Bitcoin (BTC) Prediction for 2030

Long-term predictions become even vaguer. For example, we couldn’t anticipate the pandemic with its devastating events. What about a third world war or a major shift in geopolitics? If we ignore unexpected major events that can shake the world, Bitcoin may hit the $1 million mark by 2030.

For example, ARK Invest CEO Cathie Wood expects Bitcoin to grow to $1.5 million by 2030. The S2F model predicts a $10 million BTC by that time.

Former Twitter CEO Jack Dorsey also believes that the oldest crypto would break the $1 million mark by the end of 2030.

Bitcoin (BTC) Prediction for 2040 and 2050

In 2040 and 2050, Bitcoin’s sky is the limit, as anything may happen when we speak in terms of decades. The question is not how much Bitcoin will grow but how much purchasing power the US dollar will lose by then.

Bitcoin’s inflation rate will be only 0.05% in 2040, which means that the price will be dictated by its adoption levels and USD inflation (if there is still a US dollar).

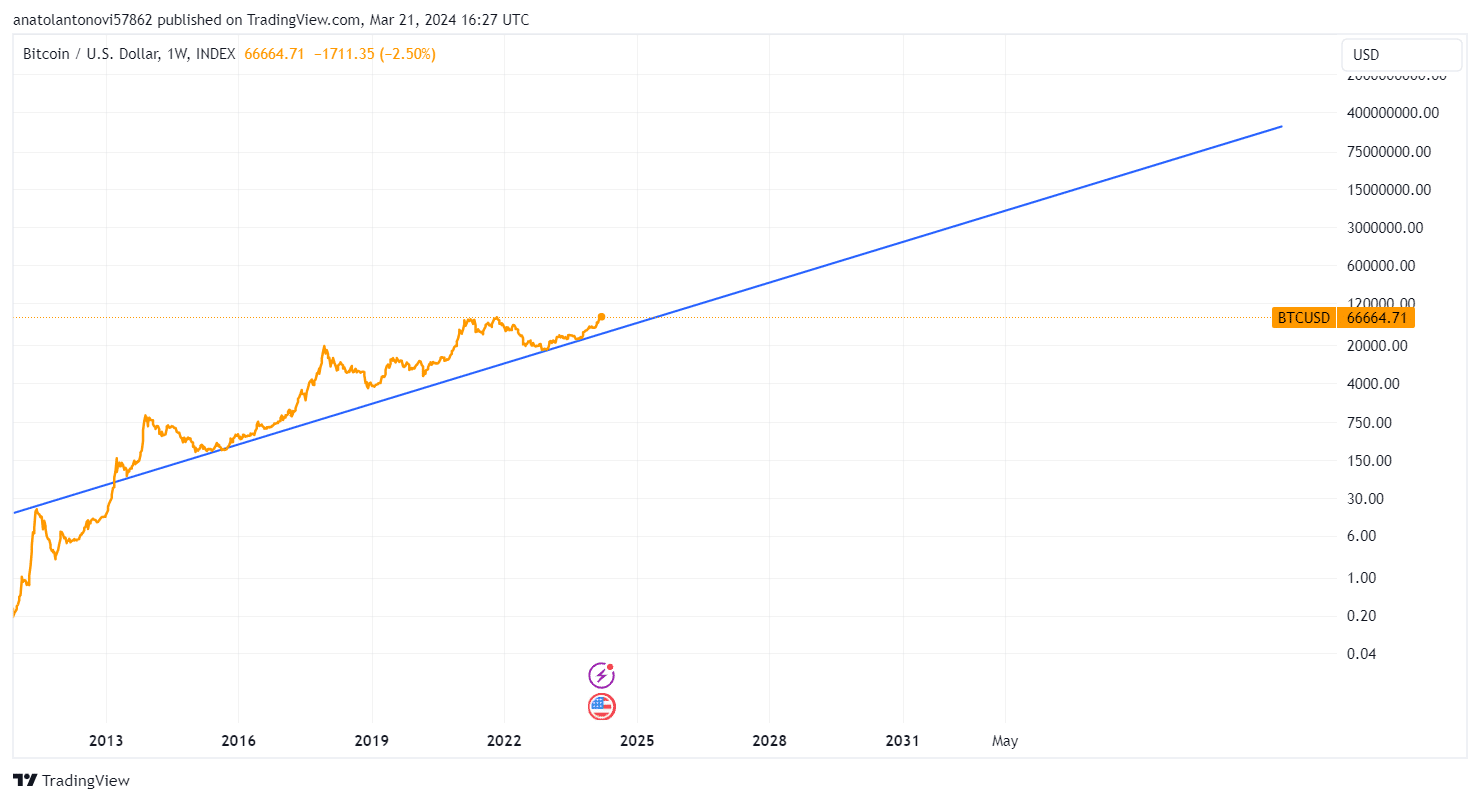

If we draw a line connecting Bitcoin’s historical lows, we get a prediction of $1.3 million by 2030 and a staggering $200+ million by 2040 and 2050, which would put its market cap at an unreasonable $4 quadrillion. By this time, this asset class will likely be matured.

Source: TradingView

Is such a scenario possible? With a hyperinflated dollar (highly unlikely), yes. However, a more plausible scenario is that Bitcoin’s growth pace may decline with time due to a saturated market.

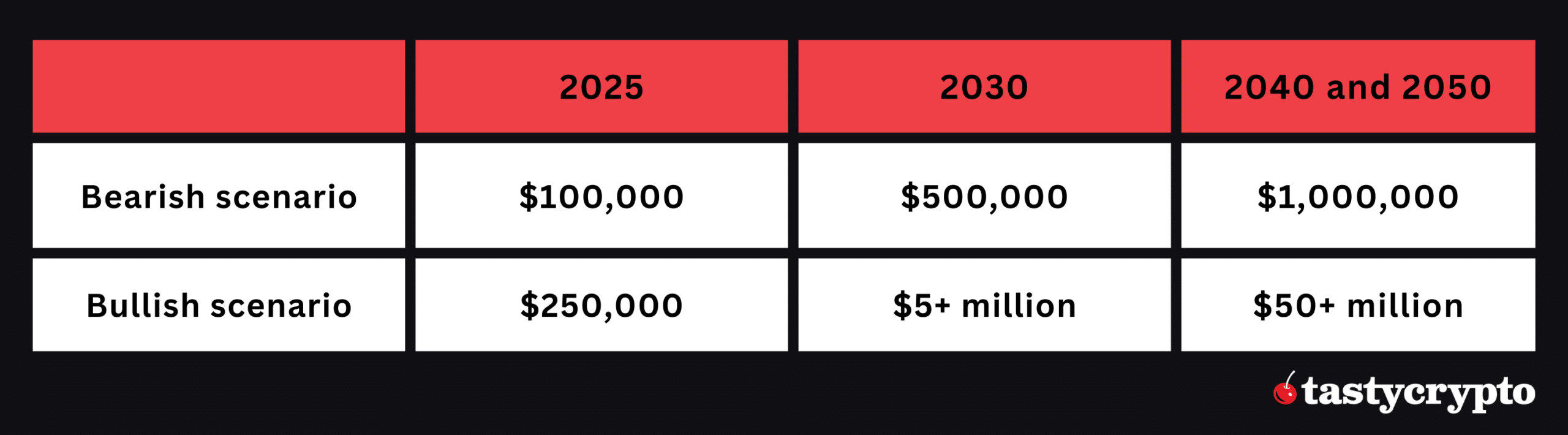

Here is Bitcoin’s price prediction for various time periods based on the S2F model and expert analyst opinions:

FAQs

Is it possible to accurately predict Bitcoin’s future price?

Predicting the price of Bitcoin, Ethereum (ETH), or any other altcoin is very uncertain due to the high volatility of the crypto market and unexpected price movements. Various factors can influence the price of BTC, including adoption levels, regulatory environment, tech advancements, and macroeconomic trends.

How much will 1 Bitcoin be worth in 2025?

Many analysts expect Bitcoin’s price to break above the $100,000 mark and may even hit $250,000 by 2025.

How much will 1 Bitcoin be worth in 2030?

ARK Invest CEO Cathie Wood anticipates that Bitcoin will cost about $1.5 million by 2030.

How much will 1 Bitcoin be worth in 2040 and 2050?

Long-term predictions are highly speculative. Bitcoin itself has been around for a little more than a decade. Some extreme Bitcoin price predictions point to multi-million dollar valuations for BTC by 2040 and 2050.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com