Layer-2 solutions, like the Lightning Network, enhance Bitcoin by enabling fast, low-fee transactions through off-chain channels, providing essential scalability and reduced costs.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Bitcoin Layer-2s refer to all networks that are built atop Bitcoin’s base layer. Layer 2s reduce fees and increase transaction throughput. In this guide, we’ll explain Bitcoin layer 2s and show you why they are vital for wider Bitcoin adoption.

🍒 tasty takeaways

The Bitcoin network sacrifices scalability for security and decentralization, managing around seven transactions per second (TPS).

Layer 2s are protocols on Bitcoin’s mainnet that offer enhanced transaction speeds and lower fees by processing transactions off-chain and later settling them on the mainnet.

Lightning Network is an example of a layer 2 and allows fast off-chain transactions, perfect for micropayments.

Rollups bundle multiple transactions into one transaction which are later recorded on the mainnet.

Sidechains, like Rootstock, extend Bitcoin’s capabilities by enabling the smart contract feature.

Bitcoin’s Scalability Issues

The Bitcoin Network prioritizes decentralization and security, but often at the expense of scalability. Addressing this ‘blockchain trilemma‘ is a challenge for most cryptocurrency ecosystems and decentralized applications.

The Bitcoin blockchain can handle about seven transactions per second (TPS), which pales in comparison to other blockchains that leverage the Proof of Stake (PoS) consensus algorithm instead of Bitcoin’s energy-intensive Proof of Work (PoW). For example, Solana can process over 500,000 tps, while the upgraded Ethereum network aims for 100,000 tps.

The Segwit and Taproot upgrades increased Bitcoin’s block size limit to 4MB, which allowed for Ordinals and added some scalability features. These changes, however, matter little in the context of wider adoption.

Bitcoin core developers and the community wouldn’t dare modify the core protocol, and layer 2 networks are the only solutions for scalability. Additionally, Layer 2s open the door to decentralized finance (DeFi) use cases, even though Bitcoin doesn’t natively support smart contracts.

What Are Layer 2 Solutions?

Layer 2s are protocols built on top of the Bitcoin chain, which is referred to as the mainnet or the base layer. Layer 2s bring scalability by processing Bitcoin transactions off-chain and then settling them on-chain. They can also add other features that cannot be embedded in Bitcoin’s rigid network.

🍒 Off-Chain vs On Chain: Here’s How They Differ

Other mainnets, such as Ethereum, also have layer 2 protocols. Examples of Layer 2s for the Ethereum blockchain include Arbitrum (ARB), Optimism (OP), and Polygon (MATIC).

Layer 2 solutions improve the overall performance of the mainnet while leveraging its inherent security and decentralization, all without modifying the primary chain.

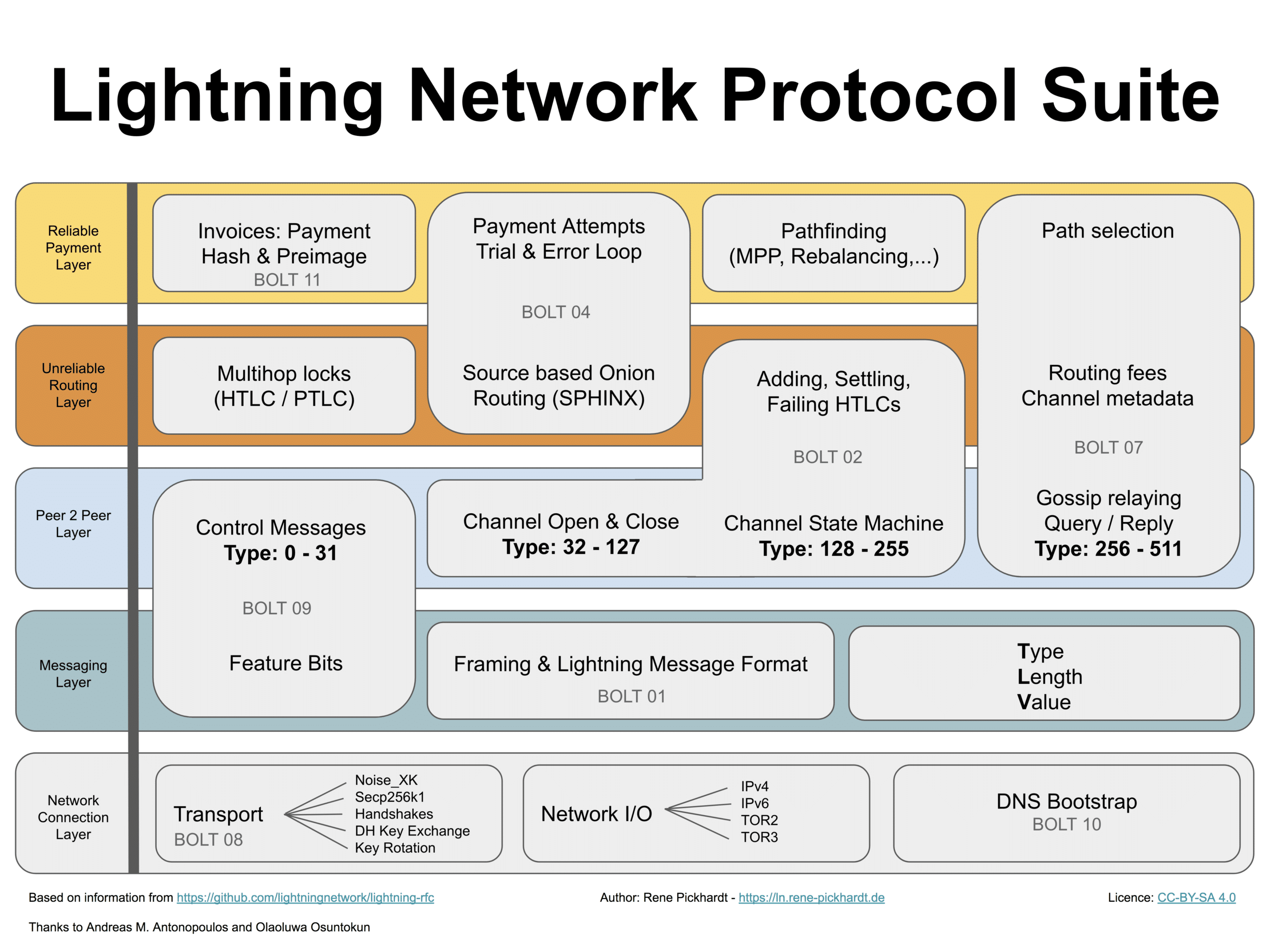

Bitcoin Lightning Network

The Lightning Network is the first and most popular layer 2 application for Bitcoin. It enables two parties to transfer coins through an off-chain channel, bypassing the main blockchain. In this way, multiple transactions can be settled more rapidly at an extremely low cost.

For example, the Lightning Network is 1,000x cheaper than Visa!

Layer 1s vs Layer 2s

Layer 2 solutions are not standalone protocols; they rely on the underlying main chain. Without layer 1, there is no layer 2. Layer 2 solutions lack their own distinct security protocols, drawing instead from the decentralization and security foundational to the mainnet.

Additionally, it’s vital to note that layer 2s can be centralized, sometimes managed by a single entity, such as a company. These chains defeat the purpose of decentralization.

Types of Layer 2s on Bitcoin

In general, layer 2s offer greater performance by processing Bitcoin transactions off-chain, but they achieve this in different ways. Here are the main types of layer 2s:

1. State channels

State channels are private off-chain channels between two or more parties that enable rapid and low-cost transactions. They are mainly used for micropayments.

Channels are set up by noting a starting balance on the blockchain. Once established, users within that channel can make multiple transactions off-chain. Only the final balance gets recorded on-chain when the channel closes. This approach ensures instantaneous, low-cost transactions suitable for repetitive payments.

The Lightning Network is the most relevant example of a channel layer 2.

2. Rollups

These layer 2s bundle multiple off-chain transactions into one transaction which gets recorded on the main chain. There are two main types of rollups:

Optimistic rollups – transactions are considered valid unless challenged by a fraud-proof. If a transaction is proven fraudulent, it’s reversed, and penalties are applied.

Zero-knowledge (ZK) rollups – they use cryptographic proofs (validity proofs) to validate transaction legitimacy without revealing details. Thanks to this method, ZK-rollups enhance security and privacy compared to optimistic counterparts. RIF Rollup is a good example of a Bitcoin layer 2.

3. Sidechains

Sidechains are separate blockchain networks that work together with the mainnet. The assets move between the main chain and the sidechain through a two-way peg or bridge. These layer 2s enable the smart contract feature for Bitcoin, allowing developers to build decentralized applications (dapps). Rootstock is the most popular sidechain for Bitcoin.

Examples of Bitcoin Layer 2s

The most popular layer 2s for Bitcoin are:

- Lightning Network – this layer 2 was launched in 2016 and is the most popular network built on top of Bitcoin. It works by enabling two Lightning nodes to create a channel and send transactions back and forth off-chain through a smart contract. Only the final state of the contract reaches the mainnet after the channel’s closure. This network is utilized for small payments, sending money across distances, and Web3 gaming, among other uses.

- Liquid Network – Liquid was developed by Blockstream, a company founded by Adam Back – one of the Satoshi Nakamoto candidates. It functions as a separate blockchain and offers better performance. The Liquid Network has a native coin pegged to Bitcoin.

- Stacks – this is another layer 2 that operates as an independent protocol with a native token. It uses Bitcoin as its settlement layer and hosts smart contracts and Web3 apps on its network, making Bitcoin compatible with DeFi and non-fungible tokens (NFTs).

- Rootstock – like Stacks, Rootstock enables the execution of smart contracts, improving Bitcoin’s functionality and opening the door to DeFi applications. Rootstock operates as an Ethereum Virtual Machine (EVM) sidechain, which means it is compatible with all Ethereum-based assets.

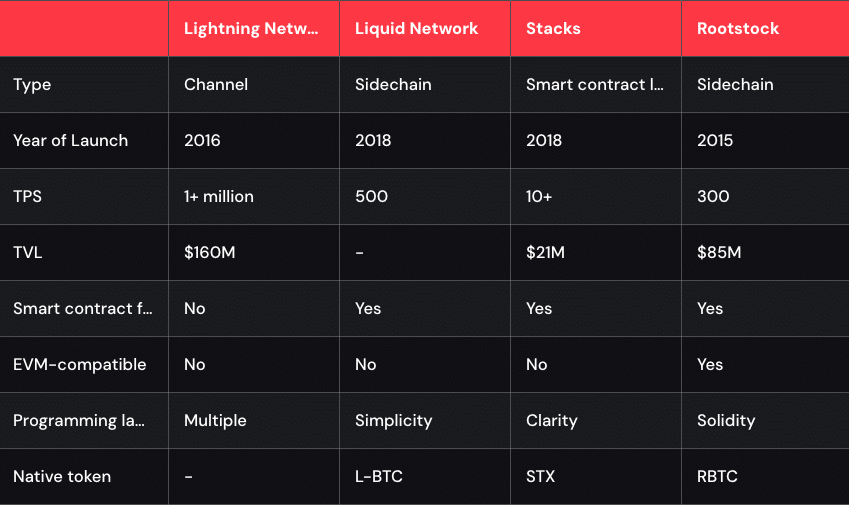

Bitcoin Layer 2 Comparison Table

| Lightning Network | Liquid Network | Stacks | Rootstock | |

|---|---|---|---|---|

| Type | Channel | Sidechain | Smart contract layer | Sidechain |

| Year of Launch | 2016 | 2018 | 2018 | 2015 |

| TPS | 1+ million | 500 | 10+ | 300 |

| TVL | $160M | - | $21M | $85M |

| Smart contract feature | No | Yes | Yes | Yes |

| EVM-compatible | No | No | No | Yes |

| Programming language | Multiple | Simplicity | Clarity | Solidity |

| Native token | - | L-BTC | STX | RBTC |

Benefits of Layer 2s

Top benefits of Bitcoin layer 2s include:

- Layer 2 brings scalability to the mainnet, helping it handle hundreds and thousands of transactions per second, which is essential for reaching a mainstream audience.

- These solutions reduce the cost of Bitcoin transactions, enabling micropayments.

- Some Bitcoin layer 2s support the smart contract feature, unlocking DeFi use cases.

- Some layers 2s, like ZKproofs, enhance privacy on Bitcoin, enabling confidential interactions.

- Layer 2s allow Bitcoin to scale while maintaining the decentralization and security of the overall network.

Challenges of Layer 2s

Despite their game-changing potential, Bitcoin layer 2s have to address some challenges:

- Some layer 2s, such as the Liquid Network, can be considered centralized. While Bitcoin has thousands of nodes and miners distributed worldwide, Liquid runs within a closed system where 15 functionaries sign transactions and maintain the network. Most layer 2s have a small number of validators in comparison to Bitcoin.

- While some layer 2s can offer the smart contract feature, it comes with very limited possibilities, and they don’t have any direct connection with the Bitcoin mainnet.

- Layer 2s are considered the most suitable solutions to drive Bitcoin adoption, but in reality, they are too complex for non-tech-savvy Bitcoin users. Frequently, Bitcoin holders have to use risky bridges to access layer 2s.

Buy Bitcoin with Self-Custody

You can buy bitcoin with tastycrypto. When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Bitcoin Layer 2s FAQs

Bitcoin layer 2s are decentralized or centralized protocols built on top of the Bitcoin blockchain to improve its performance and add new features.

Different layer 2 solutions cater to specific requirements. Currently, the Lightning Network is the most well-known layer 2, but it doesn’t handle smart contracts. For smart contracts, sidechains such as Rootstock or Stacks are popular.

Popular Bitcoin layer 2s are somewhat safe, but they cannot reach the security level provided by the mainnet. Centralized layer 2s are even less safe.

Layer 2 solutions offer advantages like fast and affordable transactions, making them suitable for a range of applications such as micropayments, app marketplaces, gaming, money transfers, and decentralized finance (DeFi).

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences