Bitcoin halving is an event during which the mining reward is reduced by 50%. It happens every 210,000 blocks mined, or about every four years.

Written by: Anatol Antonovici | Updated October 18, 2023

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

The next Bitcoin halving event will take place in April of 2024. In this guide, we’ll tell you how to prepare.

🍒 tasty takeaways

Bitcoin halving, also referred to as halvening, is encoded in the Bitcoin code and is in line with the cryptocurrency’s deflationary model.

The previous halving events occurred in 2012, 2016, and 2020, with the resulting Bitcoin block reward being reduced to 25 BTC, 12.5 BTC, and 6.25 BTC, respectively.

Bitcoin halving affects the supply of circulating BTC and therefore typically has an effect on the price.

Bitcoin Halving Summary

| Details | |

|---|---|

| What Happens During a Halving? | The number of Bitcoins generated per block is cut in half, decreasing the rate at which new Bitcoins are created, effectively controlling inflation. |

| Why Does Halving Occur? | Bitcoin halving occurs to reduce the rate at which new coins are created, emulating the scarcity of precious metals and acting as an anti-inflationary measure. |

| Next Anticipated Halving | 2024 (estimated to be around March or April, but this is subject to change based on the mining of blocks) |

| Effects on Bitcoin Price | Historically, halvings have preceded surges in Bitcoin's price, though causation is not definitively established. The reduction in supply and increased demand drive up the price, in theory. |

| Position in Market Cycle | The halving typically occurs before the "peak" of Bitcoin's market cycle, in the period known as the "bull market." |

What Is Bitcoin Halving?

Bitcoin Halving refers to a specific event during which the block reward of bitcoin miners is cut by 50%. Halving is automatic and encoded into Bitcoin’s blockchain.

Bitcoin (BTC) is a deflationary asset because Satoshi Nakamoto capped the crypto’s total supply at 21 million coins. Only a portion of the coins were put into circulation when the project launched in 2009. Today, there are over 19.5 million BTC in existence.

The rest of the coins gradually come into existence when miners hunt for the block reward in exchange for their effort to validate transactions and create new blocks. When Bitcoin reaches the 21 million cap, miners will only receive transaction fees for their work.

Why Mining Is Necessary

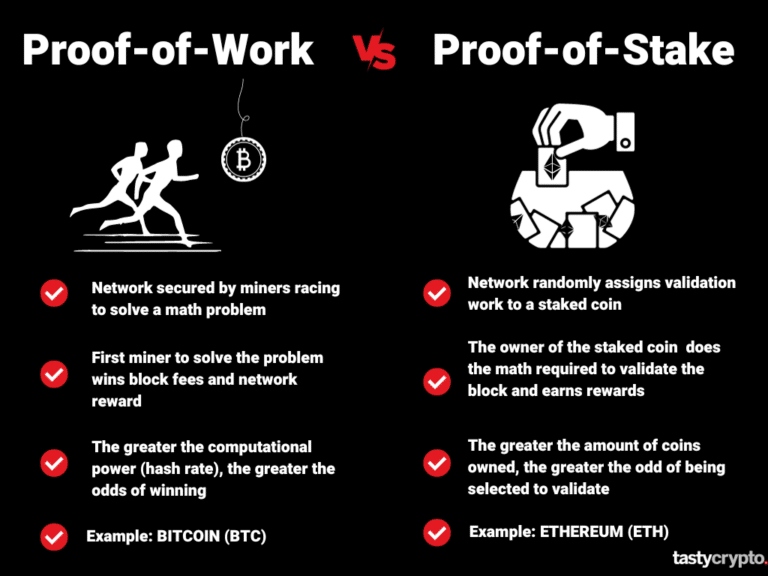

The concept of mining, supply, and reward figures was established by the person or group behind the Satoshi Nakamoto nickname. Mining is an essential aspect of Bitcoin’s Proof of Work (PoW) consensus mechanism, as it prevents the network from counterfeiting. This is in contrast to Ethereum as this blockchain uses Proof of Stake as its consensus mechanism.

For example, the process of mining is able to determine if a party has an adequate amount of crypto in their self-custody wallet to send to another party. This solves the ‘double-spending’ dilemma, a problem that plagued all blockchains before Bitcoin’s miners applied the proof-of-work consensus mechanism.

Miners use computing power to compete in finding the hash that fits the previous block, which is needed to validate transactions and create the next block in the ledger. The greater your computing power, the better your odds are of solving the math problem and winning the block reward.

How Block Reward Is Established

Whenever miners create a block, they are rewarded with Bitcoin minted just for them. Bitcoin’s blockchain is designed so that a new block is added about every 10 minutes.

Bitcoin halving occurs every 210,000 blocks. Given the average block time of 10 minutes, it takes about 2,100,000 minutes for 210,000 blocks to be mined. When converted to years, we can determine that a halving event happens approximately every 4 years.

What Was the Initial Block Reward?

When Bitcoin mining was first available in early 2009, the reward was set at 50 BTC per block. That’s about $1.5 million USD today! Anyone could be a Bitcoin miner back then as only a regular GPU processor was required. Competition among miners was nonexistent since the network was relatively unknown to the world.

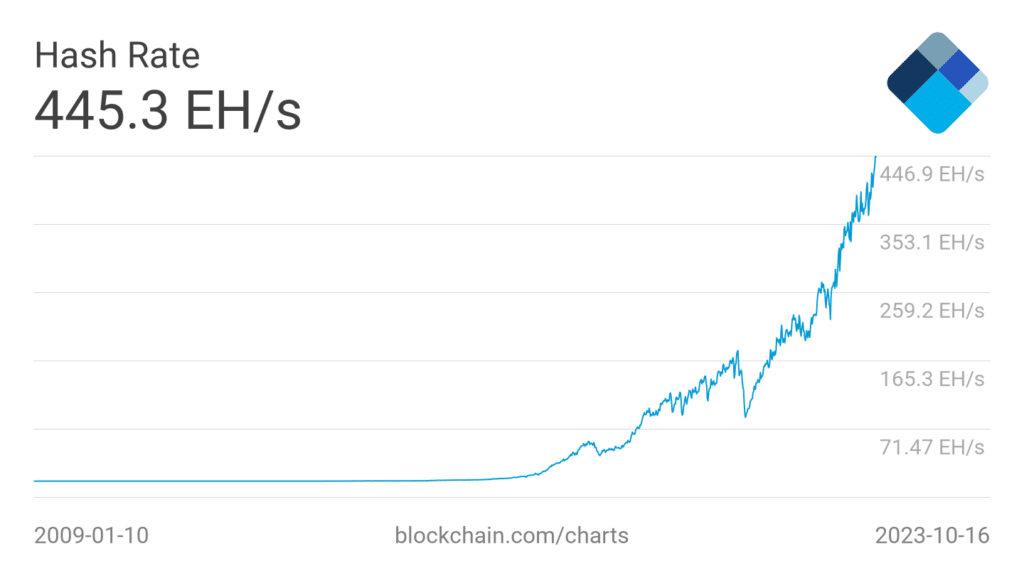

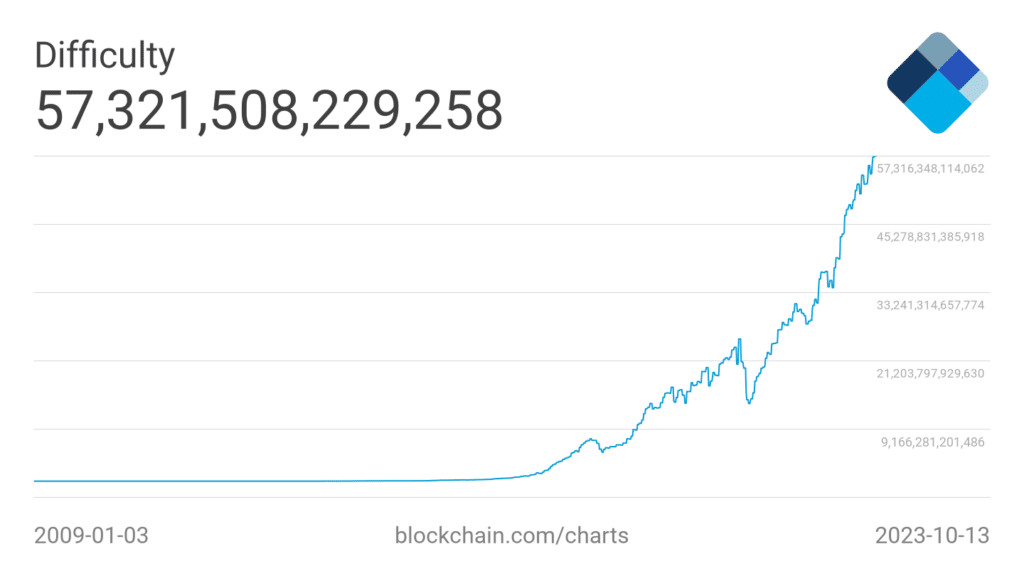

When compared to 2009, Bitcoin mining is 57 trillion times more difficult in 2023 because of increased competition.

Source: Blockchain.com

History of Previous Halving Events

Bitcoin was launched at the beginning of 2009 with the Genesis Block or Block 0. The first block was mined by Satoshi Nakamoto himself, who eventually accumulated over 1 million BTC in mining rewards.

Here is a brief history of previous Bitcoin halving events:

- First Halving – 2012: it occurred on November 28. The mining reward was cut from 50 BTC to 25 BTC. The inflation rate fell from 30% earlier that year to 12% after the halving.

The BTC price fluctuated between $3 and $12 in the months before the 2012 halving, and it exploded to over $900 one year after the event. However, that surge had more to do with price manipulation than the halving. - Second Halving – 2016: it occurred on July 9, with the reward being reduced from 25 BTC to 12.5 BTC. The inflation rate fell from 10% to 4% post-halving.

The BTC price was fluctuating near $600 during the halving, and it hit $3,000 one after, eventually skyrocketing to $20,000 by the end of 2017. - Third Halving – 2020: the last halving event took placeon May 11. This even reduced the block reward to 6.25 BTC. Inflation further dropped to 1.8%.

BTC was trading below $10,000 before halving and jumped to over $50,000 one year after that.

| Halving date | Block Nr | Block reward | Inflation rate after halving | BTC Price Before | BTC Price 1 Year Later |

|---|---|---|---|---|---|

| Nov 28, 2012 | 210k | 25 | 12% | $12 | $960 |

| July 9, 2016 | 420k | 12.5 | 4.2% | $660 | $2,800 |

| May 11, 2020 | 630k | 6.25 | 1.8% | $8,800 | $54,000 |

Impact of Halving on Bitcoin Price

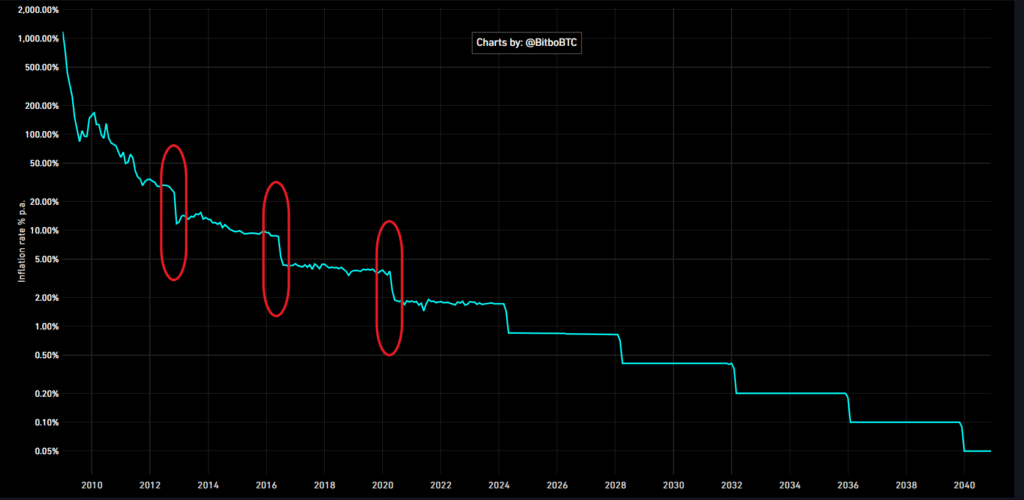

Historically, the price of bitcoin (BTC) has skyrocketed following a halving event with the inflation rate decreasing as displayed below.

Source: Bitbo

While the first halving may have gone unnoticed, subsequent events garnered much attention. As halving contributes to Bitcoin’s scarcity, many investors believe it significantly impacts its price.

Indeed, halving directly influences the supply/demand dynamic by affecting the supply. Historically, major peaks in Bitcoin’s price have occurred about a year after each halving.

Immediately following a halving, the price of bitcoin typically undergoes some correction.

Price charts related to halving events are similar and demonstrate the following behavior:

- An initial post-halving bullish run that lasts from 12 to 15 months.

- A major correction lasting for more than a year.

- A moderate run until the subsequent halving, lasting for over a year.

Source: Coinmarketcap.com

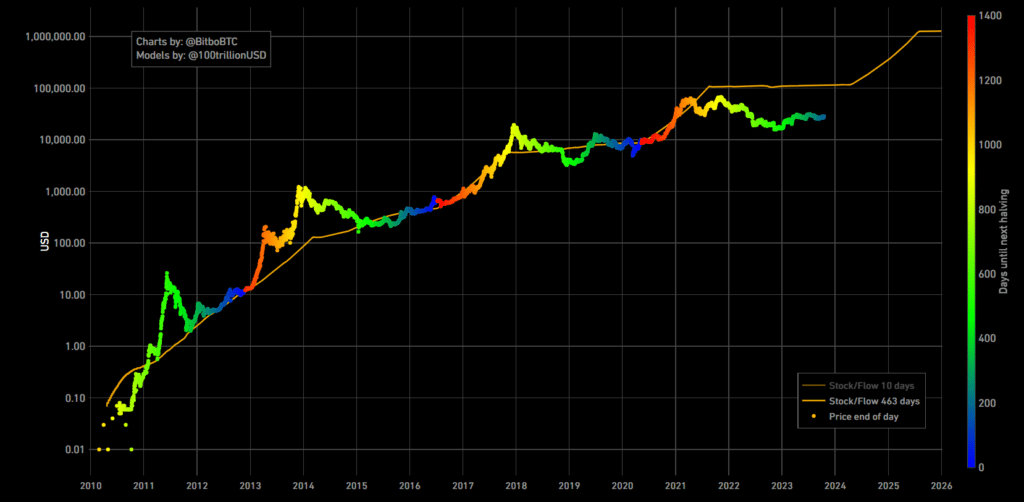

Stock-to-Flow Model & Bitcoin Price

Many investors prefer to use the so-called stock-to-flow (S2F) model to predict the price of Bitcoin, which was first proposed by Twitter user PlanB in a Medium post.

The S2F ratio reflects the relationship between a commodity’s existing supply and the amount produced in a specified period, such as monthly or annually. It shows the number of years required to achieve the current supply, considering the current output rate. The scarcer a commodity is, the higher the S2F ratio.

For example, gold has the highest S2F ratio among commodities.

PlanB argued that there is a direct relationship between the Bitcoin price and its S2F ratio, which increases gradually as the issuance rate slows due to of halving.

So far, this model has been incredibly accurate, but it has deviated since the ‘crypto winter’ in 2022.

Source: Bitbo

What Will Happen During the Next Halving?

The next Bitcoin halving is expected to occur at block 840,000, likely around April 2024. This event will likely create significant buzz, increasing BTC’s volatility and influencing its price. There’s even a countdown for the event! 👇

Despite the similarities between previous halving events, it’s difficult to guarantee halving will lead to a new all-time high for BTC, especially given its recent deviation from the S2F model.

In the past, Plan B argued that the bitcoin cryptocurrency should hit $288,000 after the 2024 halving, but that seems unrealistic given its price in late 2023.

Bitcoin Halving Impact on Miners

While predicting the price is a difficult task, we know for sure that halving will affect Bitcoin miners.

Reduced rewards and increased costs may force around 30% of all mining operations to shut down post-halving due to profitability concerns.

For miners, every halving event doubles the production costs per generated coin. Previously, this was offset by the massive bullish spikes that came after each halving event.

If the next bull market is delayed, a good chunk of mining operations will be gone for good. It remains to be seen what impact this will have on the Bitcoin protocol’s security.

The hash rate reflects the total processing power committed to mining, and it has constantly been increasing:

Source: blockchain.com

If small miners shut off their equipment en mass, the hash rate may drop by as much as 30% after the halving.

Buy Bitcoin with Self-Custody

You can buy bitcoin (BTC) with tastycrypto. When you store your crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Bitcoin Halving FAQs

Bitcoin halving refers to an event during which the mining reward is reduced by half. Historically, there has been significant volatility leading up to Bitcoin halving events.

As a rule, halving is associated with bullishness since it reduces the supply of BTC. However, while the Bitcoin protocol has scheduled 33 halving events until 2140, we can base our findings on only three events.

The next Bitcoin halving will likely occur in April or May of 2024 during the creation of block 840,000.

Bitcoin miners should be ready for increased volatility leading up to the next halving event in 2024. If you are a hodler, you can keep your coins untouched, at least until the next bull run.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences