Stablecoins are cryptocurrencies designed to maintain stable values, usually by being pegged to traditional assets like currencies or commodities or through algorithm-controlled supply.

Written by: Anatol Antonovici | Updated January 18, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Stablecoins play a key role in the crypto market, as they effectively eliminate volatility. In this guide, we discuss 7 of the best stablecoins out there.

🍒 tasty takeaways

Stablecoins are digital assets backed by fiat currencies, commodities, or other traditional assets. USD-backed tokens account for 99% of the stablecoin market.

The best-centralized stablecoins include USDC, USDT, TUSD, and USDP.

The best-decentralized stablecoins include DAI & USDD.

Summary

| Stablecoin | Description |

|---|---|

| USDC (USD Coin) | Centralized, fiat-collateralized stablecoin, widely used in the crypto market |

| USDT (Tether) | One of the first and most popular fiat-collateralized stablecoins |

| DAI | Decentralized, crypto-collateralized stablecoin popular in DeFi |

| TUSD (TrueUSD) | Fiat-collateralized stablecoin known for full transparency and regular audits |

| USDP (Pax Dollar) | USD-pegged stablecoin managed by Paxos with a focus on enterprise applications |

| EURC | Euro-backed stablecoin operated by Circle, available on multiple blockchains |

| USDD (Decentralized USD) | Algorithmic stablecoin of the Tron network, overcollateralized with crypto assets |

| Stablecoin | Type | Backing | Key Features |

|---|---|---|---|

| USDC (USD Coin) | Centralized | Fiat (USD) | Backed by CENTRE, available on multiple blockchains |

| USDT (Tether) | Centralized | Fiat (USD) | Multiple blockchain platforms |

| DAI | Decentralized | Crypto-collateralized | Over-collateralization model |

| TUSD (TrueUSD) | Centralized | Fiat (USD) | Full transparency, regular financial reports |

| USDP (Pax Dollar) | Centralized | Fiat (USD) | Regulated by NYDFS, offers stablecoin as a service |

| EURC | Centralized | Fiat (Euro) | Operated by Circle, available on multiple blockchains |

| USDD | Decentralized | Algorithmic/Crypto-collateralized | Issued by Tron DAO Reserve, legal tender in Dominica |

What Is a Stablecoin?

Stablecoins are blockchain-based digital assets pegged to traditional finance (TradeFi) fiat currencies or commodities. They mirror the price of their underlying asset by targeting a perfect parity.

Stablecoins implement different peg mechanisms to achieve price stability and reduce volatility to almost zero.

Thanks to stablecoins, crypto investors can easily exit their positions without leaving the crypto market. These tokens also play a leading role in decentralized finance (DeFi), accounting for a significant share in decentralized exchanges (DEXs), lending protocols, and yield farming apps.

How to Buy Stablecoins

Stablecoins are tokens. To have full access to the 1,000+ cryptocurrency tokens in existence, you’ll need a self-custody crypto wallet.

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

Best Fiat-Backed USD Stablecoins

Fiat-collateralized stablecoins are dominating the crypto market despite concerns about centralization. They account for over 90% of the stablecoins’ total market capitalization, currently at $132 billion.

These tokens are issued by financial service providers that maintain an equivalent fiat amount in bank accounts. Reserve funds must match the circulating stablecoin quantity, with issuers minting new tokens for demand and burning them upon user sales.

Here are the best fiat-backed stablecoins:

1. USDC

- Name: USD Coin

- Token: USDC

- Issuer: Circle

- Category: Centralized USD token

7

$60.90 B USD

$4.47 B USD

USD Coin (USDC) is a USD stablecoin de facto operated by fintech company Circle, although it’s officially supervised by the Centre Consortium comprised of Circle and crypto exchange Coinbase. Circle manages the price-pegging mechanism and offers various features and applications for its token.

USDC is suitable for both Web3 apps and traditional finance, covering use cases like payments, payouts, remittances, and more. USDC is baked 1×1 with USD.

The USDC stablecoin launched in 2018 as an Ethereum-based ERC-20 token standard, but it has gradually extended to a multi-chain infrastructure, supporting Solana, Avalanche, Polygon, Polkadot, Algorand, Arbitrum, NEAR, and other networks.

🍒 Stablecoins are actually tokens. Here’s how coins and tokens differ.

Source: Circle

In March 2023, USDC depegged for several hours by falling below $0.87 amid concerns about its exposure to Silicon Valley Bank, which went bankrupt at the time.

2. USDT

- Name: Tether

- Token: USDT

- Issuer: Tether Limited

- Category: Centralized USD token

3

$144.78 B USD

$32.32 B USD

USDT, also referred to as Tether, is a fiat-collateralized stablecoin issued by Tether Limited. It has been the largest stablecoin by market cap for many years. Today, it is the third-largest coin after Bitcoin and Ethereum, with over $93 billion worth of tokens in circulation.

USDT launched on Bitcoin via a software layer called Omni. Eventually, it moved to other chains, including Ethereum, Tron, and EOS.

Despite dominating its niche market, USDT has been surrounded by controversy for years, as investors and regulators have suspected that the token might not be fully backed by USD reserves.

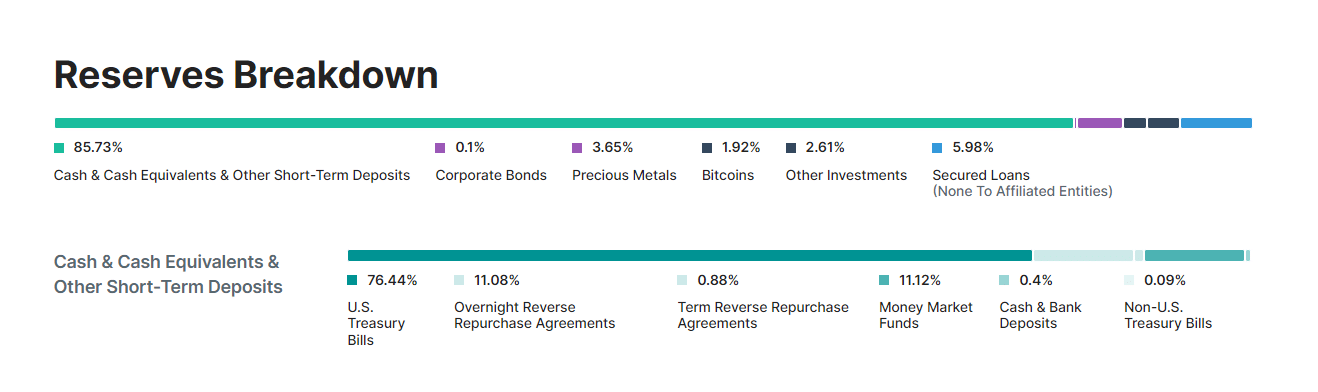

Shortly after its launch, the US Commodity Futures Trading Commission (CFTC) fined Tether Limited after discovering that it had less than 30% in USD reserves to back the token. Tether now displays its reserves and audits on its ‘Transparency’ page.

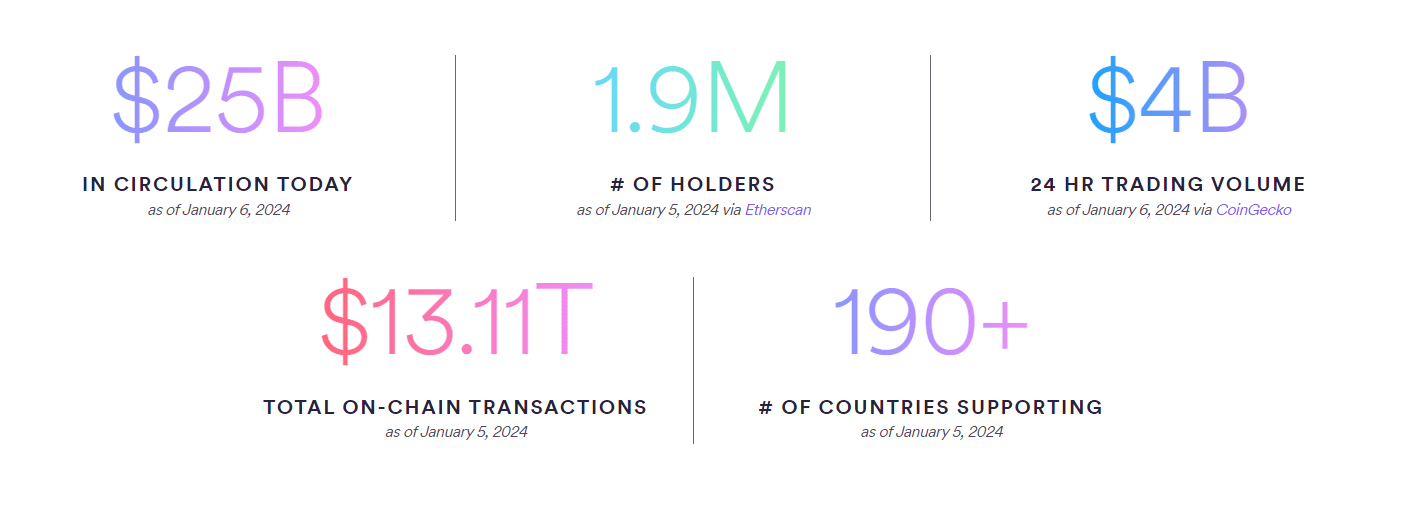

Source: Tether

3. True USD

- Name: True USD

- Token: TUSD

- Issuer: ArchBlock

- Category: Centralized USD token

105

$494.57 M USD

$52.34 M USD

True USD (TUSD) is a USD-backed stablecoin managed by ArchBlock, previously known as Trust Token. Launched in 2018, it has grown quickly by positioning itself as a fully regulated stablecoin. The USD funds are stored in segregated banking accounts and monitored regularly by third-party auditing firms.

TUSD is available on Binance’s BNB Chain, Ethereum, Avalanche, and Tron.

As of mid-January 2024, TUSD is a $2+ billion market, ranking among the top 50 largest cryptocurrencies.

4. Paxos USD

- Name: Pax Dollar

- Token: USDP

- Issuer: Paxos

- Category: Centralized USD token

373

$76.24 M USD

$1.46 M USD

Pax Dollar (USDP) is a USD-pegged stablecoin managed by US-based fintech firm Paxos, which ensures the backing of the token. The stablecoin is regulated by the New York State Department of Financial Services (NYDFS).

With a market cap of only $600 million, USDP is primarily utilized for enterprise applications.

The company had also minted Binance USD (BUSD), but it halted support for it in 2023 at the request of NYDFS. Binance itself is about to end support for its stablecoin in February 2024. BUSD’s supply has dropped from a peak of $20 billion to less than $1 billion.

Paxos is also responsible for minting PayPal USD (PYUSD), the stablecoin launched by payment operator PayPal.

🍒 You can fund your tastycrypto wallet with PYUSD and incur no transaction fees

Best Decentralized Stablecoins

Decentralized stablecoins are not managed by centralized entities, with all the rules being enforced by algorithms and smart contracts alone. They represent permissionless ecosystems that are fully transparent and non-custodial.

These tokens are backed by crypto collateral to maintain price stability. To avoid depegging, the total amount of the collateral exceeds the total stablecoin value.

1. DAI

- Name: DAI Stablecoin

- Token: DAI

- Issuer: MakerDAO

- Category: Decentralzied USD token

23

$5.37 B USD

$899.19 M USD

DAI is an Ethereum-based token that mirrors the price of the US dollar. It is the largest decentralized stablecoin by market cap, with a supply of over 5 billion tokens.

DAI is part of the Maker ecosystem, which acts as a central bank. The protocol, which is governed by the Maker decentralized autonomous organization (DAO), operates as a decentralized lending platform where users can deposit cryptocurrencies like Ethereum (ETH) to mint DAI.

2. USDD

- Name: Decentralized USD

- Token: USDD

- Issuer: Tron

- Category: Decentralzied USD token

127

$342.60 M USD

$4.01 M USD

Decentralized USD (USDD) is an algorithmic stablecoin launched by Justin Sun for the Tron ecosystem. It is issued by the Tron DAO Reserve. USDD is overcollateralized by a basket of crypto assets, including Tron (TRX), Bitcoin (BTC), and USDC.

Interestingly, the Commonwealth of Dominica recognizes USDD as legal tender, along with other Tron-based assets, including TRX.

Best Non-USD Stablecoins

1. EURC

- Name: EURC Stablecoin

- Token: EURC

- Issuer: Circle

- Category: Centralized EUR token

220

$218.81 M USD

$32.15 M USD

EURC is one of the largest stablecoins backed by the EURO. It is operated by Circle, the company behind USDC.

EURC is available on four chains: Ethereum, Avalanche, Solana, and Stellar.

The cash reserves are held in US banks, and the current circulating supply is about 55 million tokens.

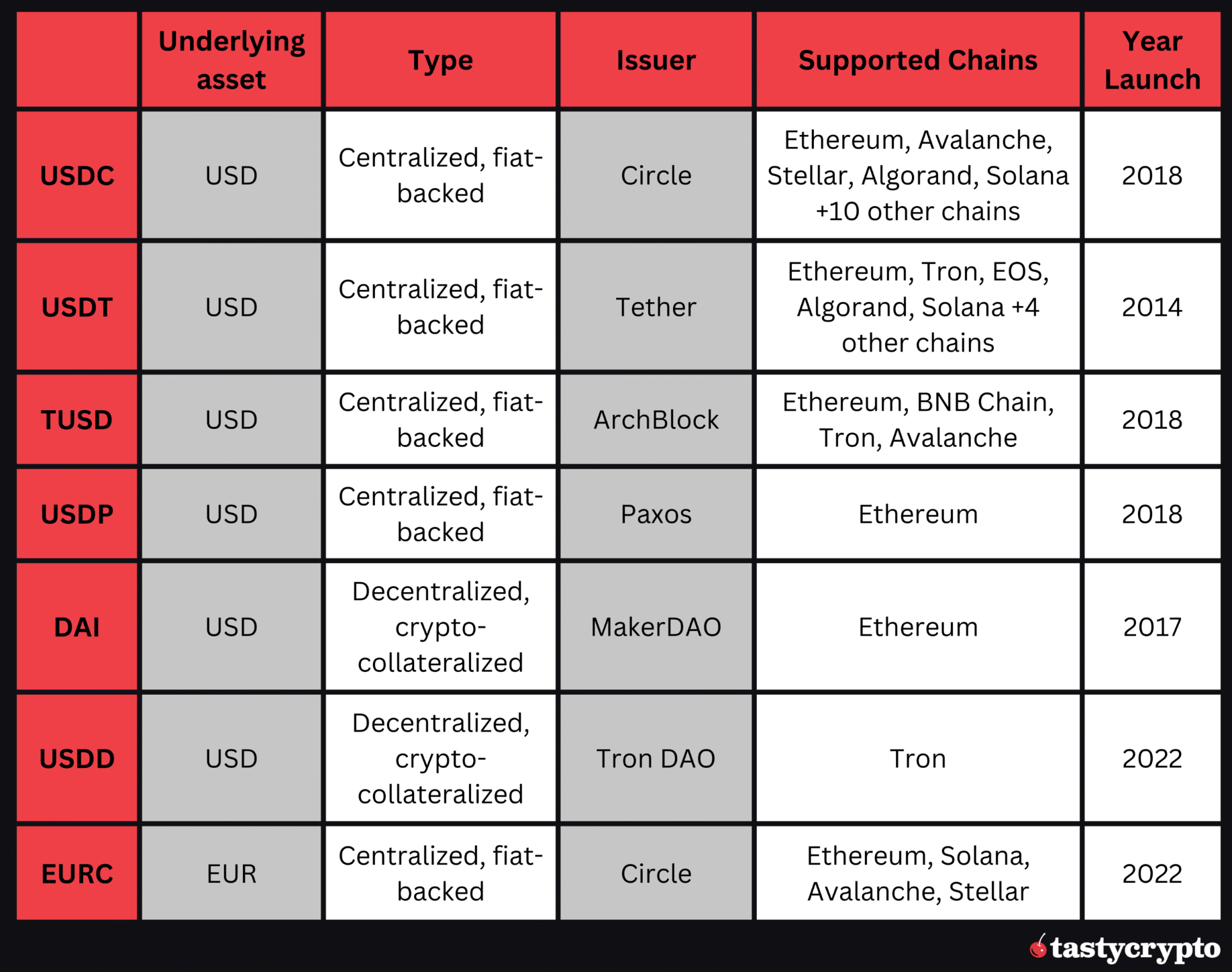

Best Stablecoins: Comparison

Here is a quick comparison of the best stablecoins:

FAQs

A stablecoin is a blockchain-based digital currency pegged to a real-world asset, predominantly a fiat currency like the US dollar. Stablecoins try to reduce volatility to zero.

This depends on your needs, preferences, and location, but USDC and USDT are among the most popular stablecoins both in decentralized finance (DeFi) and centralized finance (CeFi).

USDC is known for transparency and regulatory compliance, while USDT has a larger market cap, although it has faced controversies regarding its reserve backing. Still, USDC might be a better option due to the wide range of applications and APIs provided by Circle.

DAI is considered the best decentralized stablecoin due to its Ethereum-based, over-collateralized structure and governance by MakerDAO.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com