For beginners, the ideal cryptocurrencies are characterized by low volatility, substantial market caps, and, where relevant, a high total value locked. A few of these coins include: bitcoin (BTC), ethereum (ETH) and litecoin (LTC).

Written by: Anatol Antonovici | Updated June 10, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Table of Contents

🍒 tasty takeaways

For beginners, the best cryptocurrency investments are those with substantial market capitalizations, high trading volumes, and robust liquidity.

Bitcoin accounts for about 50% of the entire crypto space, while Ethereum accounts for 50% of decentralized finance (DeFi) – making these two the most popular cryptocurrencies for a beginner’s portfolio.

Highly volatile and less utility-driven memecoins, such as Dogecoin, are excluded due to their unpredictability and lack of real-world applications.

- Great cryptos for beginners include: BTC, ETH, LTC, LINK, ADA, BNB, MATIC, AVAX, SOL

🍒 To invest in some of the coins on our list, you’ll need a self-custody crypto wallet. tastycrypto offers self-custody wallets in the form of mobile apps and a browser extension

Summary

| Name (Symbol) | Market Cap | TVL | Staking |

|---|---|---|---|

| Bitcoin (BTC) | $1.4 trillion | $1.2 billion | No |

| Ethereum (ETH) | $443.3 billion | $64.5 billion | Yes |

| Solana (SOL) | $74.6 billion | $4.6 billion | Yes |

| Litecoin (LTC) | $6 billion | $4.9 million | No |

| Chainlink (LINK) | $9.4 billion | $25.6 billion | No |

| Cardano (ADA) | $15.8 billion | $248 million | Yes |

| BNB Coin (BNB) | $95.6 billion | $6 billion | Yes |

| Polygon (MATIC) | $6.5 billion | $934.7 million | Yes |

| Avalanche (AVAX) | $12.9 billion | $835.2 billion | Yes |

| XRP (XRP) | $27.8 billion | - | No |

| Uniswap (UNI) | $6.2 billion | $6.1 billion | Yes |

What Are Cryptocurrencies?

Cryptocurrencies, which are digital assets, use blockchain technology as their foundational structure. This technology is characterized by a decentralized network that is maintained through a peer-to-peer consensus algorithm. This allows network participants to independently validate and record transactions without the need for a central authority.

The absence of a centralized governing body and the lack of intermediaries in the operation of cryptocurrencies differentiates them from traditional financial assets (TradFi) like fiat currencies, stocks, or commodities.

Some blockchain networks, such as Ethereum (ETH), are equipped with the smart contract feature. This enables developers to create applications that are entirely governed by code. These are referred to as decentralized applications or dapps. These applications operate independently of a central control.

Crypto Coins for Beginners

Cryptocurrencies can be complex and volatile, making them challenging for crypto beginners in investing or trading. However, this shouldn’t discourage you from exploring the crypto world. Blockchain technology is becoming increasingly important, and starting early can give you an edge.

For those new to this space, it’s best to begin with more stable and well-established digital assets, characterized by large market capitalizations, high trading volumes, and, when applicable, high total value locked. These criteria generally indicate a safer entry point into cryptocurrencies.

The cryptocurrency market now offers user-friendly applications and services, with platforms like tastytrade and tastycrypto being ideal for beginners to purchase and store crypto. These tools provide an accessible way to start your journey into crypto assets.

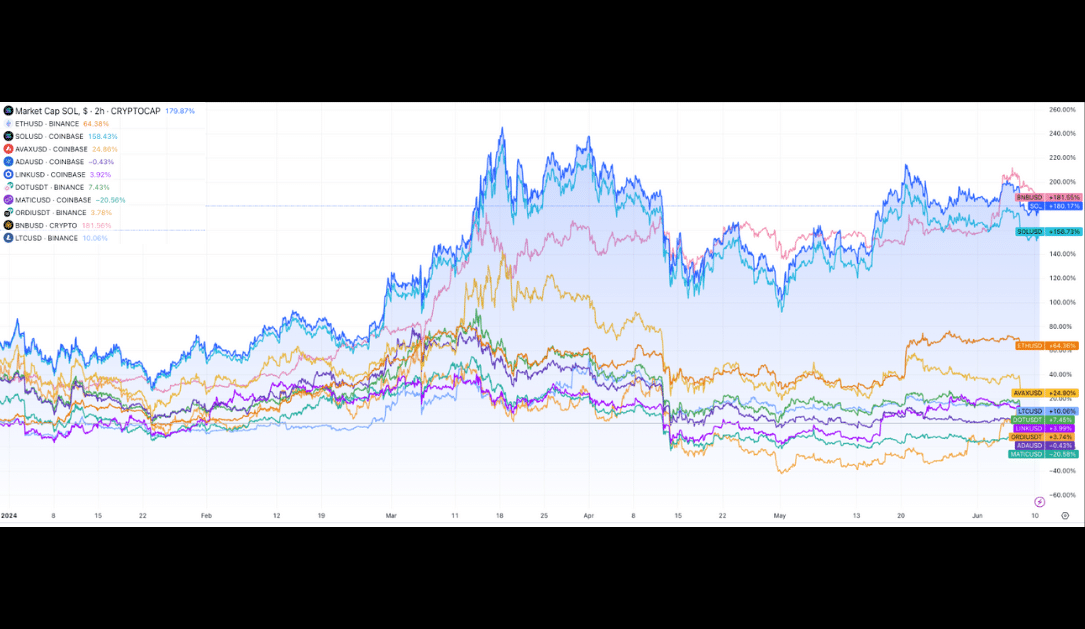

Let’s now look at a chart comparing our 9 cryptos for beginners and then dive into the individual coins. Remember, crypto is very volatile, so start small.

Crypto Coins Performance: 6-Months

Source: TradingView

Secure Your Crypto With Self-Custody

When you store you crypto in a self-custody wallet, you don’t have to trust that an exchange is acting in your best interest. This is because you are the only party privy to your private key, or seed phrase.

Here are some additional benefits you get when you choose to self-custody your digital assets with tastycrypto:

- In-App Swap: Trade BTC, ETH, and 1,000+ tokens

- Generate Yield in DeFi: Stake, lend, and become your own market maker

- NFTs: Buy, sell, and view NFTs in-app

tastycrypto offers both iOS and Android self-custody wallets – download yours today! 👇

1. Bitcoin (BTC)

- Symbol: BTC

- Market Cap Rank: #1

- TVL: $1.2b

- Staking: No

Bitcoin is the oldest and the largest cryptocurrency by market cap, with its valuation exceeding $1 trillion as of mid-February 2024, according to Coinmarketcap data. This crypto coin represents the first use case of blockchain, and it is responsible for the emergence of the crypto industry that we know today.

As a beginner, you should know that the entire crypto market follows BTC – when it gains bullish momentum, altcoins (all coins that aren’t bitcoin) tend to increase as well, and vice versa.

While Bitcoin is highly volatile, it tends to be more balanced than the rest of the coins. Worth noting is the upcoming 2024 bitcoin halving event, which many believe will be bullish for BTC.

2. Ethereum (ETH)

- Symbol: ETH

- Market Cap Rank: #2

- TVL: $64.5 billion

- Staking: Yes

Ethereum (ETH) is the second-largest cryptocurrency by market cap and the largest blockchain network offering the smart contract feature. It enables developers to build dapps and other tokens on top of it.

The demand for Ethereum, technically called ether, is driven by its popularity across the DeFi ecosystem. Many DeFi apps use Ethereum as their underlying infrastructure.

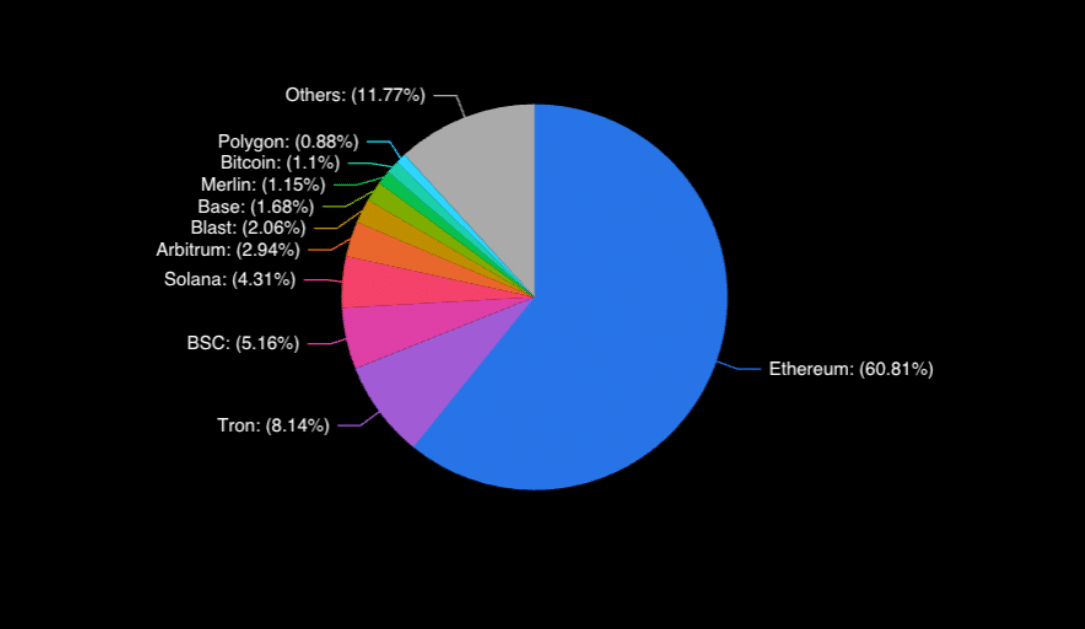

The image below illustrates the total value locked (TVL) across different networks, which represents the amount of cryptocurrency tied up in various blockchains and protocols. The higher the TVL, the more people use that platform/network. It’s noteworthy that Ethereum accounts for the largest portion of this value, highlighting its dominant role in the sector.

Source: DeFiLlama

Ethereum is also the most popular blockchain building Web3 and minting NFTs (non-fungible tokens). Additionally, you can stake your ETH to earn extra income on your investment.

Like Ethereum, Solana uses a Proof of Stake (PoS) algorithm and allows participants to earn rewards by staking their tokens. This approach offers greater scalability compared to Bitcoin’s Proof of Work consensus mechanism. Solana’s unique PoS system also enables it to be more rapid and flexible than Ethereum.

SOL is the fifth-largest cryptocurrency by market cap, with a total valuation of over $74 billion.

Many developers choose to build on Solana due to its scalability, although it still accounts for only 2% of the DeFi sector.

4. Litecoin (LTC)

- Symbol: LTC

- Market Cap Rank: #20

- TVL: $4.9b

- Staking: No

Litecoin (LTC) is one of the oldest cryptocurrencies out there, and it has been inspired by Bitcoin. It shares a similar codebase with Bitcoin but is more miner-friendly. Up until recently, you could mine LTC with a CPU or GPU. This is still possible in theory, but realistically, it’s not profitable anymore.

Like Bitcoin, Litecoin doesn’t support smart contracts and other additional features.

Still, it consistently ranks among the top 20 largest coins by market cap, and it’s not as volatile as other altcoins, making it a great pick for beginners.

🍒 Litecoin vs Bitcoin vs Bitcoin Cash vs Ethereum: Which Wins?

5. Chainlink (LINK)

- Symbol: LINK

- Market Cap Rank: #14

- TVL: $25.6 billion

- Staking: No

Chainlink is the leading decentralized oracle network. Its role is to help blockchains communicate with the real world. By having access to accurate and vetted off-chain information, dapps can avoid errors and work smoothly.

On top of that, Chainlink helps different chains communicate with each other, helping the industry achieve a greater level of interoperability.

Thanks to its unique position in the crypto industry, LINK is expected to experience high demand in the years to come.

Unlike most of the digital assets on our list, LINK is a token, not a coin.

6. Cardano (ADA)

- Symbol: ADA

- Market Cap Rank: #10

- TVL: $248 million

- Staking: Yes

Cardano was launched in 2017 as an alternative to Ethereum, as the latter was often struggling with congestion and spiking gas fees. Often dubbed the Ethereum killer, especially during the first years, Cardano has yet to fully convince neutral observers of its potential.

However, beginners prefer to invest in ADA due to its solid infrastructure and popularity. ADA is the tenth-largest cryptocurrency with a market cap of $15+ billion.

Additionally, Cardano can be staked to earn extra income from your investment.

7. BNB Coin (BNB)

- Symbol: BNB

- Market Cap Rank: #4

- TVL: $6 billion

- Staking: Yes

BNB is the cryptocurrency that fuels the BNB Chain ecosystem. While it was launched by Binance – the world’s largest centralized crypto exchange by trading volume – it operates independently as a decentralized network.

BNB Chain offers the same features as Ethereum and even has some compatibility with it. However, some blockchain experts claim that it’s not as decentralized as promoted.

Still, BNB is currently the fourth-largest cryptocurrency, and it leverages Binance’s popularity and BNB Chain’s growing role in DeFi.

8. Polygon (MATIC)

- Symbol: MATIC

- Market Cap Rank: #18

- TVL: $934.7 million

- Staking: Yes

Decentralized networks like Solana and Cardano have emerged as solutions to Ethereum’s scalability challenges. However, there are also projects that take a supportive approach. Polygon is a prime example of this, functioning as a layer 2 chain designed to enhance Ethereum’s scalability. It achieves this by handling transactions off the main network, thereby lowering congestion and reducing fees.

Polygon’s MATIC token is an ERC-20 token, utilizing Ethereum as its base chain. This feature makes MATIC popular among beginners, especially for its potential to demonstrate rapid growth during bullish trends in the broader cryptocurrency market.

9. Avalanche (AVAX)

- Symbol: AVAX

- Market Cap Rank: #12

- TVL: $835.2 billion

- Staking: Yes

Avalanche is another Ethereum-like blockchain that focuses on speed and scalability. It has become an important player in DeFi and is seeking to achieve the blockchain trilemma by achieving scalability without compromising the two other fundamental aspects – decentralization and security.

AVAX is currently an $12 billion market, and it’s a great crypto investment for beginners due to its solid fundamentals.

10. XRP (XRP)

- Symbol: XRP

- Market Cap Rank: #7

- Staking: No

Ripple Labs aimed to develop a faster and more energy-efficient blockchain than Bitcoin. Unlike most blockchains, Ripple bypasses traditional mining or validating mechanisms and validates transactions between network participants. This approach significantly reduces energy consumption compared to Bitcoin.

11. Uniswap (UNI)

- Symbol: UNI

- Market Cap Rank: #19

- TVL: $6.1b

- Staking: No

Uniswap is the largest decentralized exchange (DEX). DEXs allow crypto participants to trade only using their private keys and do not involve centralized intermediaries like Coinbase or Binance.

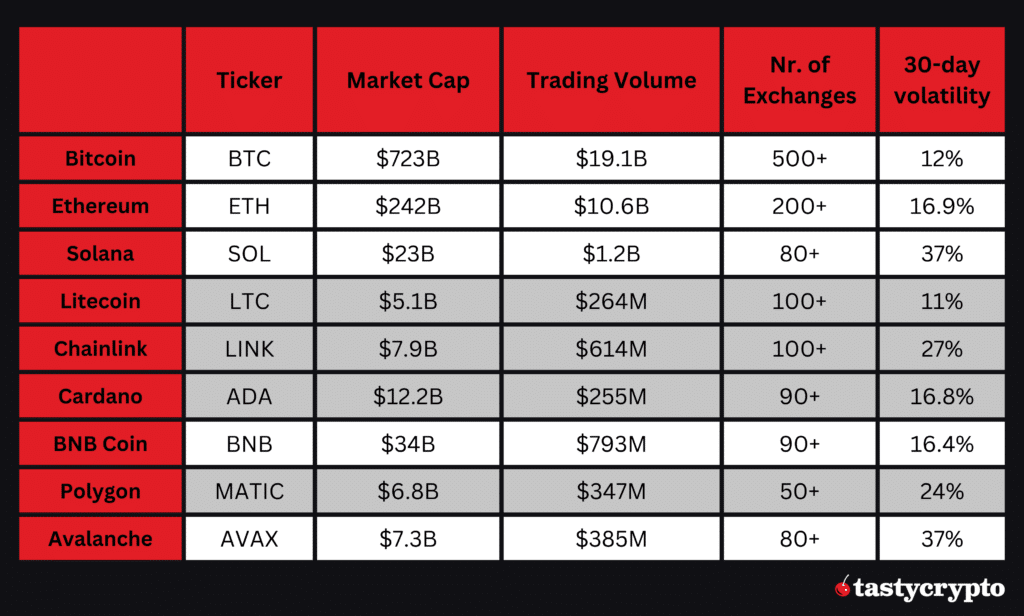

Crypto Coins for Beginners: Comparison

Here is a brief comparison of our 9 selected cryptos:

Read next: 17 Best Cryptos to Invest In

FAQs

Yes, beginners should get at least some exposure to cryptocurrencies as it is a great way to diversify an investment portfolio. Crypto also helps contribute to a more democratic financial ecosystem.

Beginners should start by investing in cryptocurrencies with large market capitalization and great demand, e.g., Bitcoin and Ethereum.

The golden rule for beginners is to invest only an amount they are comfortable losing, as crypto is a highly volatile and risky market. It’s wise to start with a small, manageable sum that won’t affect you overall financial stability.

You can buy digital currencies on decentralized exchanges like Uniswap with a self-custody wallet (tastycrypto) and on centralized cryptocurrency exchanges like tastytrade.

For beginners not yet invested in cryptocurrencies, bearish markets can be seen as prime opportunities to enter the market. Those who already hold crypto shouldn’t panic during market downturns but focus on holding their investments as long as they can afford to do so.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com