In 2024, a few of the most liquid and promising crypto coins include Bitcoin (BTC), Ethereum (ETH), Solana (SOL), BNB Chain (BNB), and Cardano (ADA).

Written by: Anatol Antonovici | Updated April,. 22 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In this article, we put 11 of the hottest cryptos of 2024 under the microscope. Let’s go! 🏃

Table of Contents

🍒 tasty takeaways

Diversifying your crypto investments across both large-cap and smaller-cap coins can be an effective strategy

Successful investors often allocate a significant portion of their portfolio to Bitcoin, the most liquid and popular cryptocurrency.

The best cryptocurrencies for investing have a significant market cap, high liquidity, robust security, and real utility.

Summary

| Name | Description |

|---|---|

| Bitcoin (BTC) | The most liquid and popular cryptocurrency, significant in long-term portfolios. |

| Ethereum (ETH) | Dominates DeFi and NFTs sectors with extensive smart contract capabilities. |

| Solana (SOL) | Known for fast transactions and low fees, a potential 'Ethereum killer.' |

| BNB Chain (BNB) | Backbone of Binance’s ecosystem, key in DeFi with robust community support. |

| Cardano (ADA) | Focuses on peer-reviewed research with goals of security and sustainability for dapps. |

| Avalanche (AVAX) | Competes with major chains by focusing on speed and compatibility with Ethereum. |

| Chainlink (LINK) | Connects blockchains with real-world data through its decentralized oracle network. |

| Near Protocol (NEAR) | A scalable smart contract platform aiming to power decentralized applications. |

| Mantle (MNT) | A layer 2 solution enhancing Ethereum's scalability and performance for Web3 applications. |

| Fetch.ai (FET) | AI-driven blockchain for autonomous machine operations, merging with other AI projects. |

| Stacks (STX) | Integrates dapps and NFTs to Bitcoin, expanding its use beyond just a currency. |

Choosing the Best Cryptocurrencies

Crypto assets can provide great investment opportunities, but they’re highly volatile. When choosing the best digital currency to invest in, it’s imperative to consider three key aspects:

- Individual goals

- Risk profile

- Investing timeline

The best approach is to build a diversified crypto portfolio with defined goals and rebalance it every few months, depending on performance.

How Do I Pick the Best Crypto Coins?

When building your portfolio, you can evaluate each crypto asset based on several key factors, including:

- Market capitalization – large-cap coins may not generate meteoric returns but are more reliable.

- Liquidity – selecting crypto assets listed on many centralized and decentralized cryptocurrency exchanges that are easily traded is recommended.

- Trading volume – high trading volumes point to a healthy market.

- Use case – get exposure to crypto projects that solve real problems and have unique use cases.

- Security – pick cryptocurrencies with open-source code audited by reputable third parties.

In this article, we picked some of the best crypto assets based on the listed criteria, although we avoided meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB). While meme coins may be the best-performing crypto assets today, they have no utility and are highly volatile.

Stablecoins like USDT are omitted, as they don’t generate returns and mirror the USD price.

Now let’s go straight to unboxing the top cryptocurrencies to hold this year!

1. Bitcoin (BTC)

- Name: Bitcoin

- Ticker: BTC

- Type: Layer 1

- Q1 Performance: +68.7%

Bitcoin is the largest digital currency by market cap. In mid-March, it reached a new all-time high at over $73,000, but it has the potential to go even higher after the completion of the halving event on April 19.

Why Invest in BTC?

Allocating the lion’s share to Bitcoin helps to build a reliable portfolio. Thanks to its Proof of Work (PoW) algorithm and high adoption, Bitcoin is the most secure blockchain network.

After the US Securities and Exchange Commission (SEC) finally approved Bitcoin ETFs in mid-January, many financial institutions gained exposure due to its status as a robust store of value (SOV)

2. Ethereum (ETH)

- Name: Ethereum

- Ticker: ETH

- Type: Smart contract chain

- Q1 Performance: +59.8%

Ethereum is the largest blockchain network that supports smart contracts, enabling developers to build tokens and decentralized applications (dapps) on top of it.

Why Invest in ETH?

The Ethereum network still dominates key crypto sectors, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and real-world assets (RWAs).

The layer 1 network is also popular for the staking ecosystem built around it. It includes many liquid staking and restaking platforms, such as EigenLayer, that act as validators on behalf of users.

3. Solana (SOL)

- Name: Solana

- Ticker: SOL

- Type: Smart contract chain

- Q1 Performance: +99.3%

Solana is a fast-growing layer 1 chain offering smart contract functionality. Over the past year, its price has increased over 600%

Why Invest in SOL?

The crypto community regards Solana as the only ‘Ethereum killer’ candidate due to its fast speed and low transaction fees. The upcoming Firedancer upgrade is expected to bring significant improvements.

4. BNB Chain (BNB)

- Name: BNB Chain

- Ticker: BNB

- Type: Smart contract chain

- Q1 Performance: +94.4%

BNB Chain is a decentralized network developed by Binance, the world’s largest crypto exchange.

Why Invest in BNB?

Binance Coin’s underlying chain accounts for 7% of the DeFi market and has a robust ecosystem and community. However, the SEC filed suit against Binance last year, so investors should keep a close eye on these developments.

5. Cardano (ADA)

- Name: Cardano

- Ticker: ADA

- Type: Smart contract chain

- Q1 Performance: +9.56%

Cardano is a blockchain network that has been developed based on peer-reviewed research. It was designed to improve the flaws of Ethereum. Its goal is to build a global democratic economy to empower the unbanked population.

Why Invest in ADA?

Although Cardano hasn’t managed to build a sizeable dapp ecosystem like Solana and Avalanche, it boasts a secure network and an ambitious vision.

6. Avalanche (AVAX)

- Name: Avalanche

- Ticker: AVAX

- Type: Smart contract chain

- Q1 Performance: +40.2%

Avalanche is a smart contract layer 1 chain focusing on efficiency and scalability.

Why Invest in AVAX?

Despite losing competition to Solana and layer 2 networks, Avalanche still has a strong presence across DeFi, NFTs, and meme coins. It is also compatible with the Ethereum Virtual Machine (EVM).

7. Chainlink (LINK)

- Name: Chainlink

- Ticker: LINK

- Type: Oracle network

- Q1 Performance: +28.2%

Chainlink is the largest decentralized oracle platform.

Why Invest in LINK?

Chainlink is unique due to its specific use case. This platform helps blockchains communicate with the real world and between themselves, offering a secure and transparent solution for data exchange.

8. Near (NEAR)

- Name: Near Protocol

- Ticker: NEAR

- Type: smart contract chain

- Q1 Performance: +99.7%

Near is a fast-growing layer 1 network focused on decentralzied applications capable of scaling to billions of users.

Why Invest in NEAR?

Near has been an AI play and is increasing its presence in DeFi.

9. Mantle (MNT)

- Name: Mantle

- Ticker: MNT

- Type: Ethereum layer 2

- Q1 Performance: +98.4%

Mantle is a layer 2 chain designed to bring super-scalability to Ethereum.

Why Invest in MNT?

Layer 2 platforms have surged this year, with Mantle, Linea, and Coinbase’s Base experiencing a surge in activity. This is because developers need scalable blockchain technology for Web3 apps.

10. Fetch.ai (FET)

- Name: Fetch.ai

- Ticker: FET

- Type: AI coin

- Q1 Performance: +353.5%

Fetch.ai is a blockchain-based platform that offers artificial intelligence (AI) solutions.

Why Invest in FET?

Fetch AI is one of the best-performing AI coins. Investors are excited about FET because it will merge with SingularityNET’s AGIX and Ocean Protocol’s OCEAN to form the Superintelligence Alliance under the ticker ‘ASI’. ASI is expected to be among the top 20 largest cryptocurrencies by market cap from day one.

11. Stacks (STX)

- Name: Stacks

- Ticker: STX

- Type: Bitcoin layer 2

- Q1 Performance: +143.7%

Stacks is a new and unique crypto project that allows smart contracts and dapps to operate under the Bitcoin blockchain network.

Why Invest in STX?

Stacks is the only major decentralized network that turns Bitcoin into a smart contract infrastructure layer.

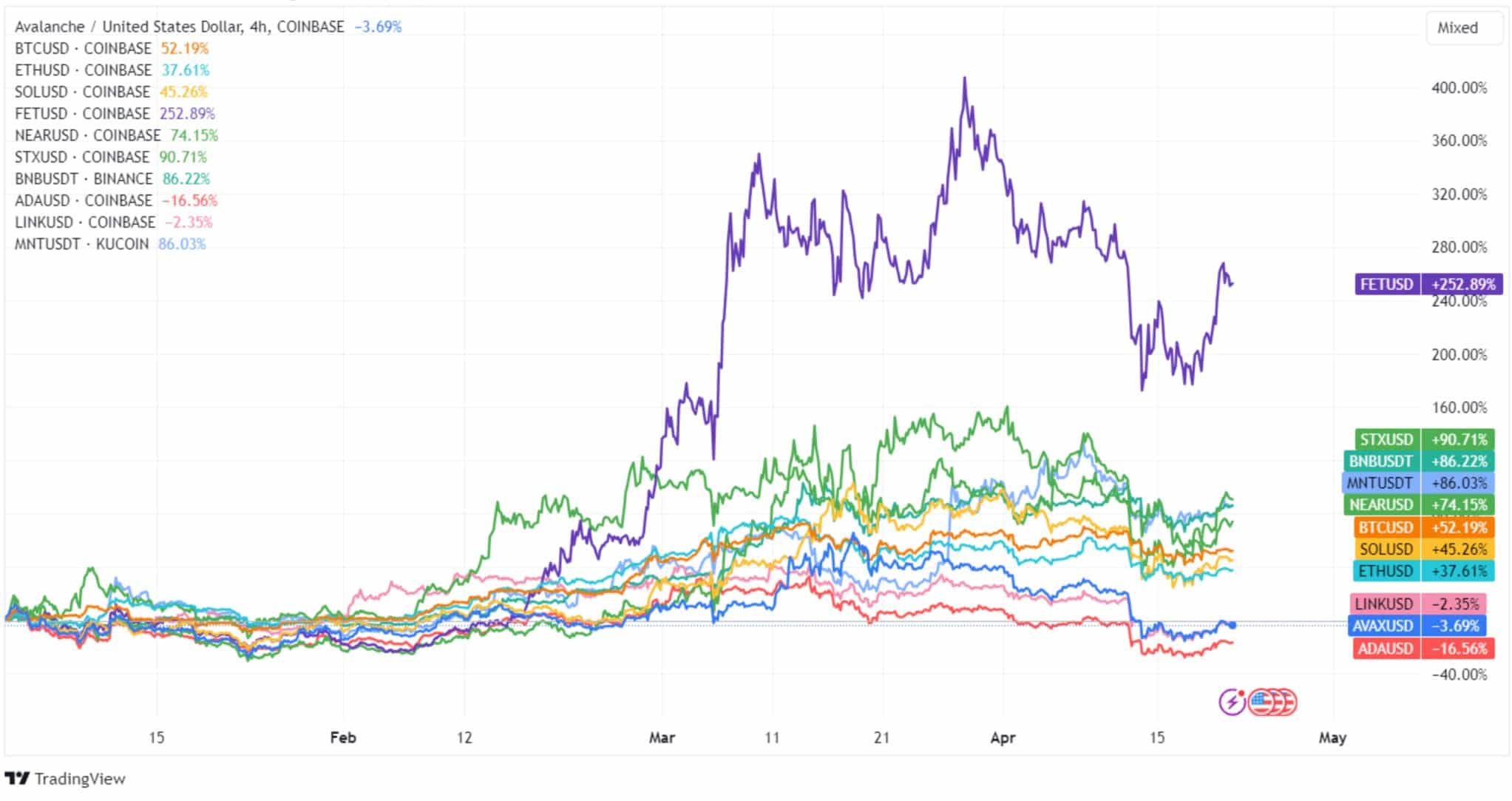

Comparing the Best Cryptos of 2024

Here is the year-to-date performance of our listed coins:

FAQs

What are the best cryptocurrencies to invest in right now?

Some of the best crypto coins to invest in in 2024 include Bitcoin, Ethereum, Solana, BNB Chain, Cardano, Avalanche, Chainlink, Near, Mantle, Fetch.ai, and Stacks.

How to choose cryptocurrencies to invest in?

Define your individual goals, risk profile, and investing timeline. Next, evaluate each coin based on several criteria, including market capitalization, liquidity, trading volume, use case, and security features.

What is the safest cryptocurrency to invest in for long-term growth?

Bitcoin is considered the safest cryptocurrency for long-term investment due to its crypto market dominance, deflationary model (halving), high adoption, and robust security.

How can I build a crypto portfolio?

You can build a diversified crypto portfolio by selecting a mix of large-cap and promising smaller-cap coins based on market trends, personal investment goals, and risk tolerance.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com