The best crypto decentralized exchanges (DEXs) in 2024 are Uniswap, Curve, PancakeSwap, Balancer, and SushiSwap.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Decentralized exchanges (DEXs) facilitate the trading of cryptocurrency and blockchain-based digital assets without the involvement of intermediaries. In this article, we make a list of the top decentralized crypto exchanges in 2024.

🍒 tasty takeaways

- The top 5 DEXs in 2024 are Uniswap, Curve, PancakeSwap, Balancer, and SushiSwap.

- DEXs facilitate the trading of tokens while offering passive income opportunities for liquidity providers.

- Uniswap is currently the largest DEX by trading volume and TVL.

- Most DEXs started on Ethereum but eventually have extended to multiple chains including Avalanche, Arbitrum, Optimism, and Polygon.

- Aerodrome, the main DEX behind BASE, is growing rapidly in 2024.

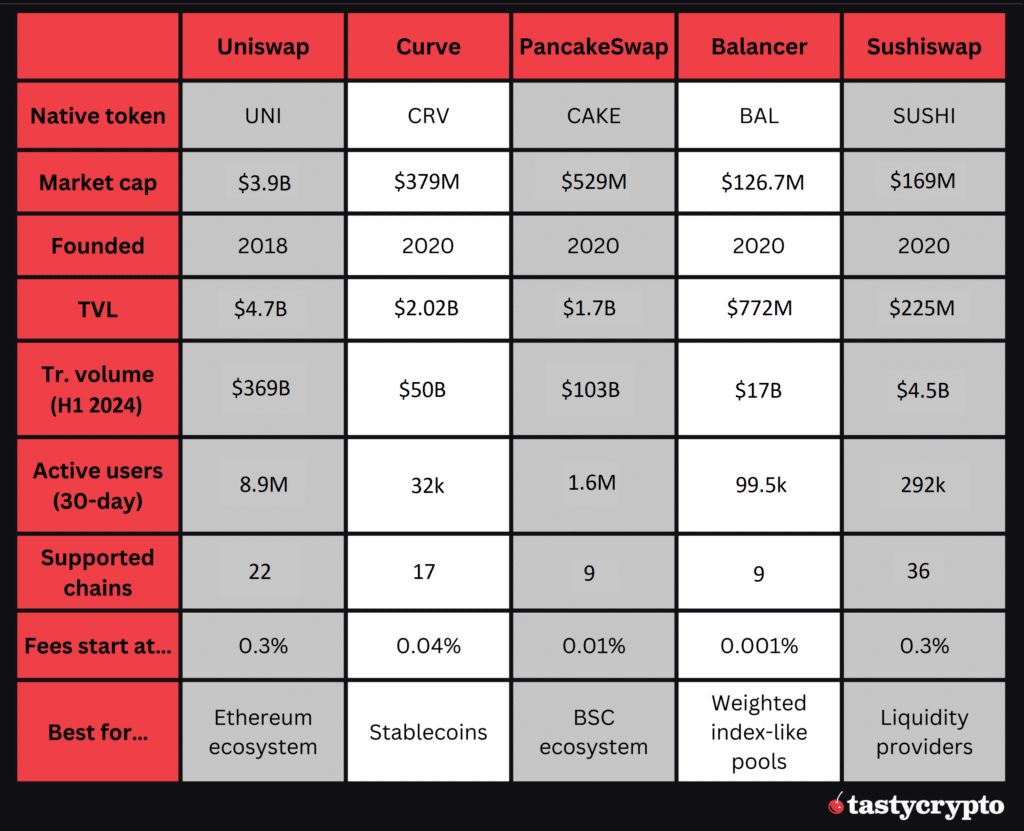

Comparing Top DEXs

| DEX Name | Launch Year | Supported Chains | TVL | Notes |

|---|---|---|---|---|

| Uniswap | 2018 | Ethereum, Arbitrum, Polygon, Avalanche, Optimism, Base, Celo, BNB Smart Chain | $5.53 billion | Largest by trading volume & TVL |

| Curve Finance | 2020 | Ethereum + 12 others | $2.23 billion | Primarily for stablecoins |

| PancakeSwap | 2020 | Binance BSC, Ethereum, Arbitrum, Base, Linea | $2.23 billion | Focused on BEP-20 tokens |

| Balancer | 2020 | Ethereum, Arbitrum, Avalanche, Polygon, Base, Gnosis | $1.05 billion | Can host up to eight tokens in a pool |

| SushiSwap | 2020 | 19 chains supported | $341 million | Most versatile in chain support |

| Aerodrone | 2023 | 1 chain supported | $699 million | Most popular BASE DEX |

What Are Decentralized Exchanges (DEXs)?

Decentralized exchanges (DEXs) represent one of the main use cases in decentralized finance (DeFi). These Web3 apps are blockchain-based platforms that facilitate the trading of a wide range of cryptocurrencies.

Unlike traditional CeFi cryptocurrency exchanges like Binance and Coinbase, DEXs are not operated by centralized entities. Instead, they leverage smart contracts and algorithms to handle token swaps without any intermediaries.

How DEXs Work

How can a decentralized exchange (DEX) operate without a centralized order book? The answer lies in a specialized mechanism known as an Automated Market Maker (AMM). Unlike traditional exchanges, DEXs use AMMs to facilitate trades. Here’s how they work:

- Smart Contract-Based Pools: Instead of matching buy and sell orders from an order book, AMMs use smart contracts to create liquidity pools of two or more tokens.

- Equal Weight in Trading Pairs: These pools generally maintain an equal balance of the two tokens. For instance, if there’s a trading pair of ETH and DAI, the pool aims to have an equal value of both.

- Token Swaps: When a trader wants to swap one token for another, they interact with this pool. They deposit one type of token and receive the other in return, incurring a small fee for the service from the platform.

- Role of Liquidity Providers (LPs): LPs are individuals or entities that supply tokens to these pools. They deposit an equal value of both tokens in the trading pair. In return for providing this liquidity, LPs earn rewards, which are primarily derived from the trading fees paid by traders.

Thanks to this model, DEXs like Uniswap, PancakeSwap and Curve have no central authority and are non-custodial, with token swaps occurring directly between a user wallet and the liquidity pool. This gives users full control over their funds and unmatched security compared to centralized cryptocurrency exchanges, which hold users’ private keys online.

Additionally, DEXs don’t require users to pass through KYC verification as they are censorship-resistant and fully decentralized apps.

5 Best Decentralized Exchanges in 2024

Here are the largest 5 DEXs by total value locked (TVL). Not included on the list is SUN, which is the DEX for the Tron ecosystem only.

#1 Uniswap

Uniswap is a multi-chain DEX launched in 2018. It is currently the largest DEX by trading volume, hosting hundreds of pairs, mostly made up of ERC-20 tokens. It is also the largest DEX by TVL, having over $4.7 billion in its pools as of mid-August 2024.

The first version of Uniswap started as a DEX for the Ethereum blockchain. The latest version, V3, has extended to other chains, including Arbitrum, Polygon, Avalanche, Optimism, Base, Celo, and Binance’s BNB Smart Chain (BSC) – previously known as Binance Smart Chain.

Uniswap V3 is also more flexible compared to the previous two versions, offering up to 4,000x capital efficiency, which translates into lower price slippage and higher returns for liquidity providers (LPs). Thanks to a range of features, Ethereum swaps are cheaper. Currently, the latest version accounts for over two-thirds of all activity on Uniswap.

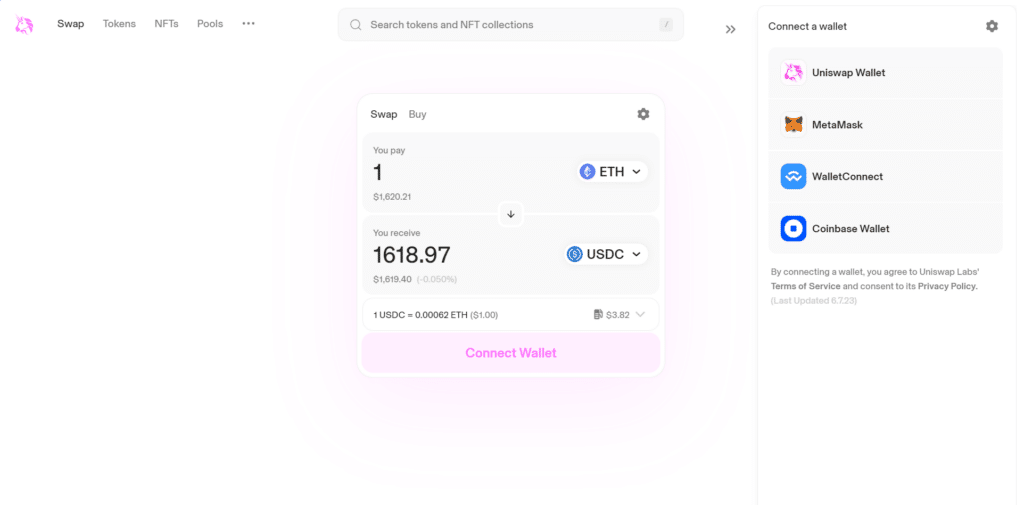

Uniswap is user-friendly and supports multiple self-custody wallets, including tastycrypto, MetaMask, Coinbase Wallet, as well as its proprietary wallet.

Source: UniSwap

The protocol’s native token, UNI, is used for rewards and fees as well as the governance process.

#2 Curve Finance

Curve Finance is a DEX that facilitates the trading of stablecoins, including DAI, USDC, USDT, TUSD, BUSD, and FRAX. It is currently the second-largest DEX in terms of trading volume and TVL, with over $1.8 billion locked in its pools.

Launched in early 2020, Curve also started on Ethereum. It has eventually extended to 13 chains, including many layer 2 networks.

Unlike Uniswap that facilitates pools consisting of paired tokens, Curve provides a diverse selection of pools that can contain two, three, or even four tokens. This versatility is more manageable because all the tokens in Curve’s pools are stablecoins.

While Curve initially focused exclusively on stablecoins, it has also added pools that include Ethereum (ETH) and wrapped tokens like Wrapped Bitcoin (WBTC).

Stablecoins play a major role in DeFi, as they eliminate volatility and enable the development of practical decentralized financial services like lending and insurance. Therefore, the focus on stablecoins is not a limitation for Curve. It enables users to carry out large trades with unnoticeable price slippage and low gas fees.

The Curve ecosystem is fueled by the native CRV token, which provides governance in CurveDAO.

#3 PancakeSwap

PancakeSwap, influenced by Uniswap and launched in 2020, is a DEX tailored for Binance’s BSC, catering to the exchange of BEP-20 tokens. Additionally, it accommodates several other chains like Ethereum, Arbitrum, Base, and Linea.

As of today, PancakeSwap has over $1.7 billion hosted in its pools.

Using PancakeSwap is similar to experiencing Uniswap, with a focus on the Binance ecosystem. The DEX accounts for about half of the TVL on BSC.

PancakeSwap offers a proprietary token known as CAKE, which can be used to participate in yield farming.

PancakeSwap also enables the trading and staking of non-fungible tokens (NFTs).

#4 Balancer

Balancer is a DeFi protocol that launched in 2020. It has been operating as a DEX on Ethereum, but is different from standard DEXs like Uniswap.

What sets Balancer apart are the extended token pools that it hosts, which function as index funds. Users can create Balancer pools consisting of multiple tokens. Sometimes, these pools can include as many as eight tokens!

LPs lock assets in these extended pools and earn rewards paid in BAL, the protocol’s native token.

Today, Balancer supports tokens on nine different chains. Besides Ethereum, it also supports Arbitrum, Avalanche, Polygon, Base, and Gnosis.

Today, over $770 million worth of crypto assets are locked in Balancer’s pools.

#5 Sushiswap

Sushiswap is a Uniswap-like DEX launched in 2020. Sushi developers copied the open-source code of Uniswap, so the two are pretty similar.

Sushi pledged to give its users more decision-making power, although Uniswap eventually introduced community governance as well.

SushiSwap facilitates the trading of tokens hosted on 36 chains, being the most versatile DEX in this sense. However, in August of 2024, it had less than $250 million TVL.

#5 Worthy Mention: Aerodrome

Aerodrone is the main DEX behind “Base”, the layer 2 network launched by Coinbase in 2023. In early 2024, memecoins on Base like “DEGEN” exploded, sending the TVL of Aerodrone to over $700 million.

Best DEXs: Comparison

Here is a table comparing the main aspects of the listed 5 DEXs:

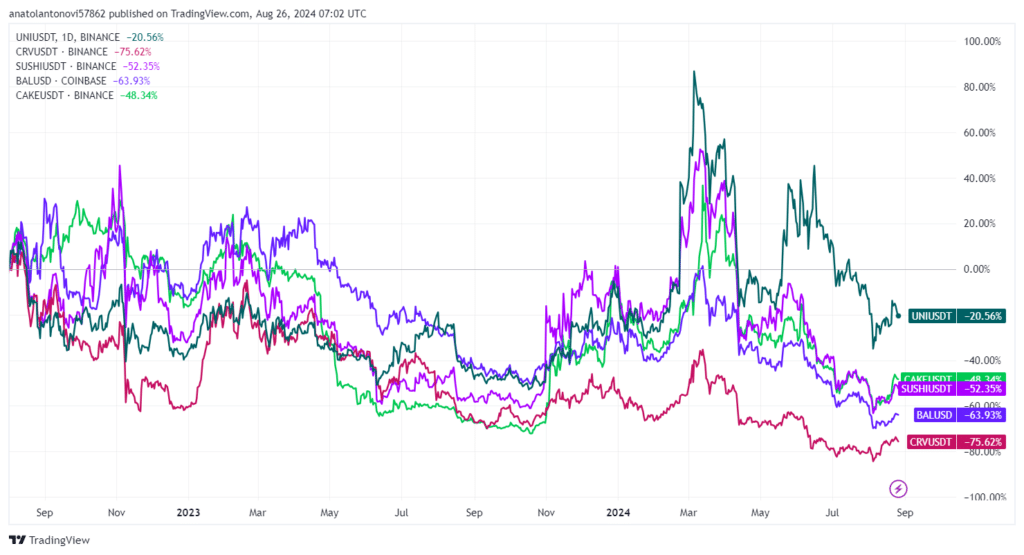

Judging by the market cap of their native tokens, Curve has been the worst performer during the last two years, while Uniswap continue to dominate the market.

Source: TradingView

So, which decentralized trading platform is best? As it stands, Uniswap is the best DEX overall, as it hosts many large pools, offers an intuitive user experience, and is compatible with multiple chains.

However, other DEXs may be more suitable for specific situations. For example, PancakeSwap is best for BEP-20 tokens, while Curve is best for stablecoins.

FAQs

DEXs have a completely different infrastructure compared to centralized crypto exchanges. They are fully decentralized and rely on smart contracts, facilitating non-custodial trading without KYC verification.

The best DEX in general is Uniswap. Some DEXs are best for specific markets. For example, Curve is best for stablecoins, while PancakeSwap is best for BEP-20 tokens. There are specialized DEXs for crypto perpetual futures and options, such as dYdX.

Yes, anyone can provide liquidity to DEXs and earn passive income. DEXs like Uniswap require LPs to deposit both tokens of a given pair with an equal value.

Crypto holders can also trade on DEX aggregators like 1inch, which automatically offers the lowest fees by browsing through multiple DEXs, including Uniswap.

No, you cannot trade BTC on DEXs since they’re suitable for blockchains that have the smart contract feature. Instead, you can exchange BTC for wBTC (an Ethereum-based token backed by Bitcoin based on a 1:1 ratio) and trade it on a DEX.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Written by: Anatol Antonovici | Updated August 26, 2024

Fact checked by: Ryan Grace