Arbitrum and Optimism aim to enhance Ethereum’s efficiency, while Avalanche serves as an independent blockchain with Ethereum compatibility.

Written by: Anatol Antonovici | Updated August 5, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Arbitrum, Avalanche, and Optimism are three of the most efficient and affordable blockchain networks in existence. In this article, we’ll stack these DeFi giants side-by-side.

Table of Contents

🍒 tasty takeaways

Arbitrum and Optimism are layer 2 chains built on top of the Ethereum blockchain. Their goal is to streamline Ethereum transactions while reducing their costs. Avalanche is an independent layer 1 chain that competes with Ethereum.

Both Arbitrum and Optimism use the same technology called optimistic rollups, which bundle Ethereum transactions in batches to be settled off-chain. Optimistic rollups and ZK rollups are two methods used by layer 2 chains to scale Ethereum.

Arbitrum and Optimism differ in their fraud proof mechanism for transaction verification.

- Arbitrum, Avalanche, and Optimism play a major role in decentralized finance (DeFi) and Web3. Together, they account for over 9% of the DeFi space in terms of total value locked (TVL).

Creating Efficient Blockchains

The blockchain revolution began with bitcoin (BTC) over ten years ago. Aside from being resilient and censorship-resistant, however, this blockchain network doesn’t offer much else.

In 2015, Vitalik Buterin launched the Ethereum network. Unike Bitcoin, Ethereum is able to store and execute code via smart contracts. These contracts run decentralized applications, which are the platforms behind Web3.

Ethereum, however, is currently expensive and offers relatively low transaction throughput. Layer 2 solutions built on top of Ethereum, such as Arbitrum and Optimism, offer scaling solutions, while independent chains like Avalanche offer better performance on their own.

In this article, we discuss Arbitrum, Avalanche, and Optimism – three decentralized networks that bring efficiency to the blockchain ecosystem.

What is Arbitrum?

Arbitrum is a layer 2 (L2) chain designed to take the burden off Ethereum. Its so-called ‘optimistic rollups’ approach helps Ethereum scale by increasing transaction throughput and cutting gas fees. What Arbitrum does is essentially merge transactions into batches (rollups) that are verified off-Ethereum, helping it avoid congestion.

Arbitrum also enables fraud proof to achieve the highest possible level of security on its network. Users are able to dispute any invalid transactions.

ARB is the native coin of Arbitrum.

Arbitrum Architecture

The Arbitrum ecosystem includes two L2 chains:

- Arbitrum One is the mainnet that runs transactions on the Arbitrum Virtual Machine (AVM) extension, which is compatible with the Ethereum Virtual Machine (EVM).

- The Nitro upgrade improved its speed and compatibility with Ethereum while further reducing transaction fees.

- Arbitrum Nova came later. Nova is less dependent on Ethereum and thus less decentralized, but it does a great job at scaling, making it ideal for demanding Web3 apps for gaming and non-fungible token (NFT) projects.

Pros and Cons of Arbitrum

Arbitrum Pros

- Arbitrum increases the speed and reduces transaction costs on Ethereum. It can handle about 40,000 transactions per second (tps).

- Arbitrum achieves scalability while retaining the decentralization inherent to Ethereum.

- Its AVM is compatible with the EVM, supporting Ethereum dapps.

Arbitrum Cons

- Since the mainnet relies on a set of trusted validators, Arbitrum raises some centralization concerns, which are even more evident with the Nova chain.

- Users should be aware of time delays in transaction settlements and disputes, which is typical for rollups.

What is Avalanche?

Avalanche is a layer 1 (L1) blockchain with smart contract functionality. Its main goal is to solve the blockchain trilemma by achieving scalability and security without compromising the decentralization aspect.

Avalanche shares many similarities with Ethereum in terms of features and use cases. Like Ethereum, it also uses the Solidity language for smart contract programming, which opens the door to more interoperability between decentralized finance (DeFi) applications.

For example, Avalanche hosts DeFi projects like Aave, Compound, and Curve.

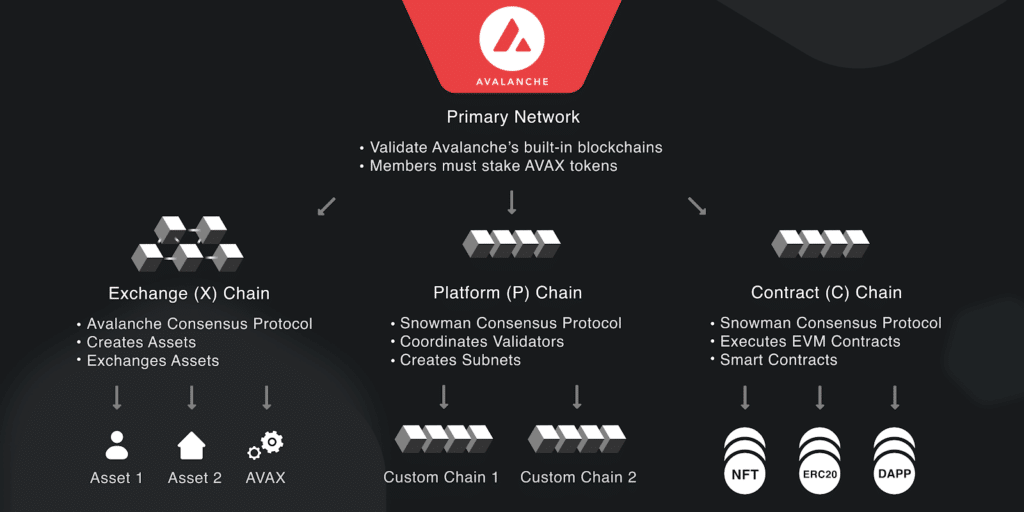

Avalanche Architecture

Avalanche relies on a Proof of Stake (PoS) version. AVAX is the native cryptocurrency of Avalanche, fueling its complex ecosystem that includes three proprietary chains:

- The Exchange Chain (X-Chain) is the official mainnet where crypto tokens can be created. AVAX is the native cryptocurrency of Avalanche.

- The Contract Chain (C-Chain) enables developers to create smart contracts. This chain is compatible with the EVM, achieving a high degree of cross-chain interoperability.

- The Platform Chain (P-Chain) is essential for Avalanche’s unique consensus mechanism. It is used to coordinate validators and enables the creation and management of subnets, which are similar to Polygon’s supernets (sidechains).

Source: Avalanche

Pros and cons of Avalanche

Avalanche Pros

- Avalanche is a fast and low-cost blockchain. Unlike Arbitrum and Optimism, it is a layer 1 chain built from scratch. It can achieve over 4,000 transactions per second (TPS).

- Despite being an independent layer 1, Avalanche demonstrates some compatibility with Ethereum.

- Avalanche enables the creation of specialized chains (subnets).

- Avalanche can be bridged to Ethereum.

Avalanche Cons

- The Avalanche consensus algorithm doesn’t punish malicious validators, which may lead to loopholes during the block creation process.

- Avalanche validators are required to stake at least 2,000 AVAX, which limits the entry of retail stakers.

- Avalanche lacks the high adaptability of Ethereum

What is Optimism?

Optimism is very much like Arbitrum – a layer 2 scaling solution for the Ethereum network that uses Optimistic rollups. Therefore, it also bundles Ethereum transactions in rollups to settle them off-chain and thus help Ethereum scale and become more usable for demanding apps.

Optimism introduced the Optimism Virtual Machine (OVM) extension, which is compatible with the EVM, ensuring interoperability with ETH’s mainnet. Unlike Arbitrum, which uses the Stylus feature to let developers build in popular languages like Rust, C, and C++, Optimism supports Solidity, which makes it more compatible with Ethereum apps.

Optimism, whose native token is OP, has a 7-day challenge window for verifiers to challenge the validity of pending transactions, although it uses single-round fraud proofs conducted on the Ethereum mainnet versus Arbitrum’s multi-round fraud proofs on its L2.

Pros and cons of Optimism

Optimism Pros

- Optimism is very much like Arbitrum, and it shares the same advantages for helping Ethereum with scaling.

Optimism Cons

- Since Ethereum has moved to proof-of-stake (PoS), it has made L2s like Optimism and Arbitrum less attractive, although these are still used by many blockchain developers for their low fee structures.

- Optimism faces strong competition from other L2 Ethereum scaling solutions, such as Arbitrum and Polygon.

Arbitrum vs. Avalanche vs. Optimism

Here is a quick comparison between the three:

| Criteria | Arbitrum | Avalanche | Optimism |

|---|---|---|---|

| Year of launch | 2021 | 2019 | 2021 |

| Type | Layer 2 | Layer 1 | Layer 2 |

| Technology | Optimistic rollups | PoS mainnet | Optimistic rollups |

| Consensus mechanism | The protocol of ETH | PoS | The protocol of ETH |

| Native token | ARB | AVAX | OP |

| Market cap | $1.1B | $3.5B | $1.04B |

| DeFi TVL | $2B | $1.2B | $680M |

| DeFi TVL Share | 4.6% | 2.9% | 1.6% |

| TPS capacity | 40,000 | 4,500 | 2,000 |

| Daily transactions (August avg) | 400,000 | 550,000 | 500,000 |

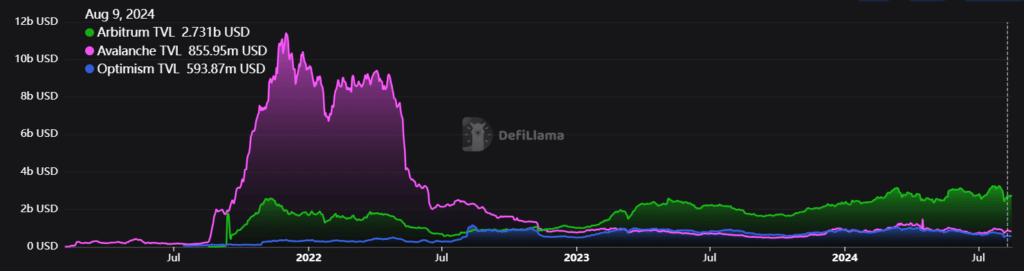

As we can see below, all three blockchains play a major role in DeFi, although Avalanche has lost ground.

Avalanche vs Optimsm vs Avalanche

Source: DefiLlama

AXAX vs ARB vs OP: Which is Best?

While Arbitrum, Avalanche, and Optimism each have their own unique characteristics, they are all incredibly efficient blockchain networks. Both Optimism and Arbitrum have the goal of enhancing Ethereum’s capabilities, whereas Avalanche operates as an Ethereum competitor.

One could argue that Avalanche is the better option because it’s a layer 1 chain and thus all transactions benefit from the security of the native chain. However, even though Optimism and Arbitrum are L2s, they benefit from the security of Ethereum itself.

While it’s hard to tell which is best, total-value locked (TVL) data from DeFiLlama shows that Arbitrum has a 33% market share among rollup solutions versus Optimism’s 7.5%. Judging by current metrics, we may conclude that Arbitrum is the best L2 chain while Avalanche is one of the best Ethereum alternatives together with Solana and Polkadot.

FAQs

While Arbitrum uses Optimistic rollups very much the same as Optimism, it is a different Ethereum layer 2 scaling solution and has some different approaches to verifying transactions off-chain.

Arbitrum and Optimism are L2 solutions built on top of Ethereum, and yes – their goal is to make Ethereum more efficient. However, Avalanche is an independent blockchain that challenges Ethereum, although it has some compatibility with it.

Anyone can buy these tokens on major crypto exchanges that support them (including Binance and Coinbase) or on decentralized exchanges (DEXs) like Uniswap.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences