In this guide, we explore Aerodrome, the leading DEX on Base. Learn how to trade, provide liquidity, and earn rewards in 2024.

Written by: Anatol Antonovici | Updated July 9, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Aerodrome is the go-to decentralized exchange platform for the Base ecosystem. Read on to discover how you can use it in 2024.

Table of Contents

🍒 tasty takeaways

Aerodrome is the main DEX on Base. It borrows from the vote-lock governance model on OP Mainnet’s Velodrome.

The ecosystem uses a utility token, AERO, and a non-fungible token, veAERO, which offers voting power.

Aerodrome accounts for over 35% of the total value locked (TVL) across Base DeFi apps.

Summary

| Protocol | Details |

|---|---|

| Aerodrome Finance | Leading DEX on Base ecosystem. Facilitates token swaps using AMM model without intermediaries. |

| AERO Token | Utility token used for rewards and governance. Distributed to liquidity providers. |

| veAERO Token | Non-fungible token offering voting power. Distributed to AERO stakers. |

| Trading on Aerodrome | Connect a wallet, select tokens to swap, agree to conditions, and execute the trade. |

| Providing Liquidity | Deposit tokens in pools to earn rewards from trading fees and AERO emissions. |

| Staking AERO | Lock AERO to receive veAERO NFT and participate in voting for emissions distribution. |

| Aerodrome and Velodrome | Aerodrome borrows its model from Velodrome, incentivizing liquidity in the ecosystem. |

| Performance | AERO price is $0.71 with a market cap of $371 million. Significant growth in 2024. |

What Is Aerodrome Finance?

Aerodrome Finance is a decentralized exchange (DEX) that facilitates the exchange of tokens built on the Base blockchain.

The DEX operates as an automated market maker (AMM), which means it doesn’t have a centralized order book and doesn’t rely on intermediaries to settle token swaps.

An AMM has two main players:

- Traders swap their tokens against liquidity pools hosted by the platform, paying a small fee for each swap.

- Liquidity providers deposit tokens in the pools, which usually represent token pairs. They receive rewards from trading fees.

Aerodrome Tokens

The Aerodrome ecosystem utilizes two native tokens:

- AERO is a fungible utility token distributed to liquidity providers.

- veAERO is a non-fungible token (NFT) distributed to AERO stakers. The token offers voting rights.

Aerodrome and Velodrome

Aerodrome launched at the end of August 2023 to become the liquidity hub on Base, a layer 2 scaling solution for Ethereum developed by the popular crypto exchange Coinbase.

Its design is inspired by Velodrome, the main DEX and liquidity platform of OP Mainnet (formerly known as Optimism), a leading Ethereum layer 2.

Aerodrome borrows Velodrome v2’s model of incentivizing liquidity in the ecosystem.

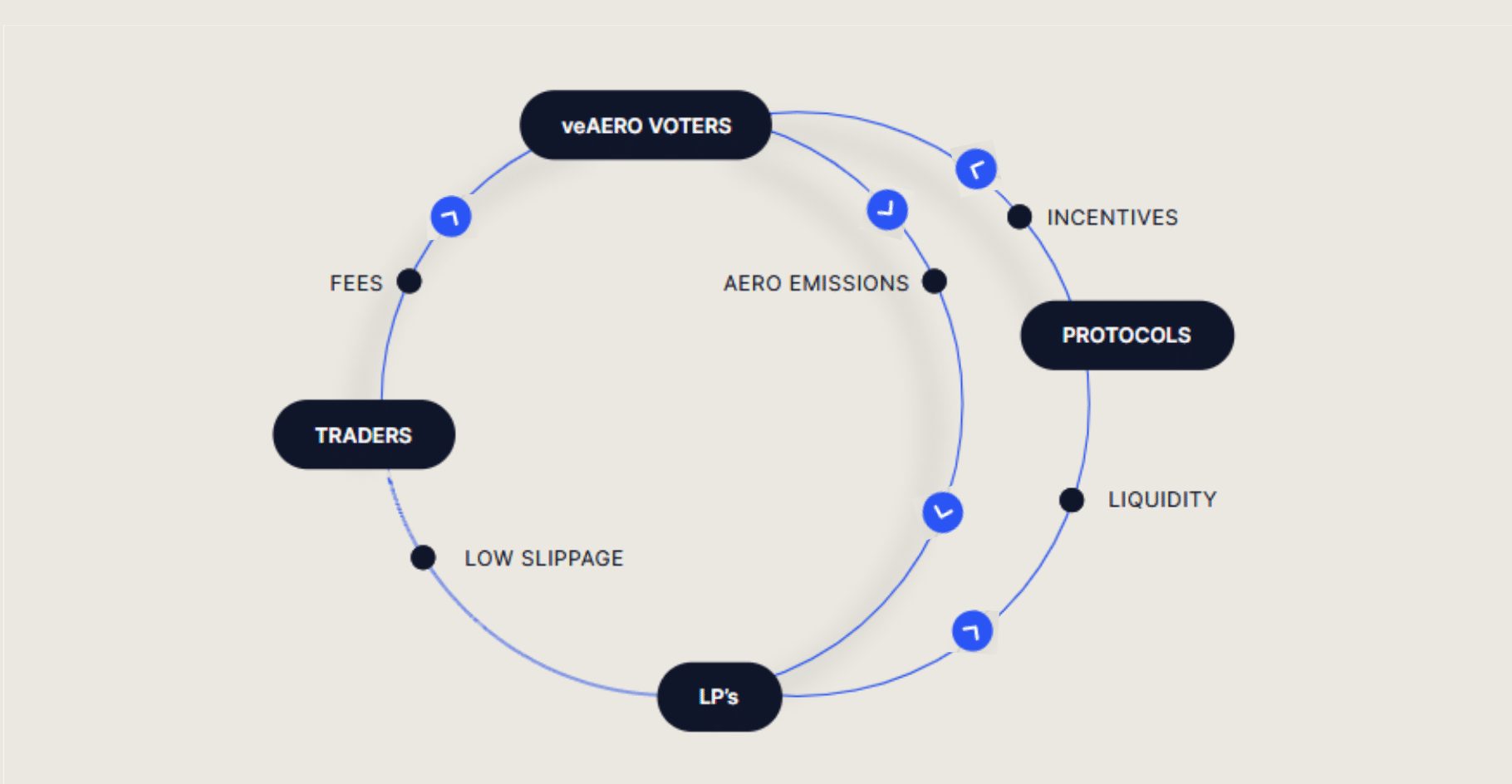

How Does Aerodrome Work?

The Aerodrome DEX operates through four key processes:

- Trade – users can swap tokens against liquidity pools, paying small fees.

- Emissions – Liquidity providers receive AERO emissions, the distribution of which is dictated by the votes a given liquidity pool receives. Emissions are distributed in epochs, each representing a week.

- Vote – AERO holders can lock their coin to get veAERO, which gives them the right to vote on the emissions for each liquidity pool for the subsequent epoch.

- Rewards – veAERO holders receive various rewards, with the main incentives deriving from the fees generated by the pools they have voted for.

Another reward source is the so-called bribe paid by external protocols to incentivize specific pools, e.g., new protocols listing their tokens and seeking liquidity.

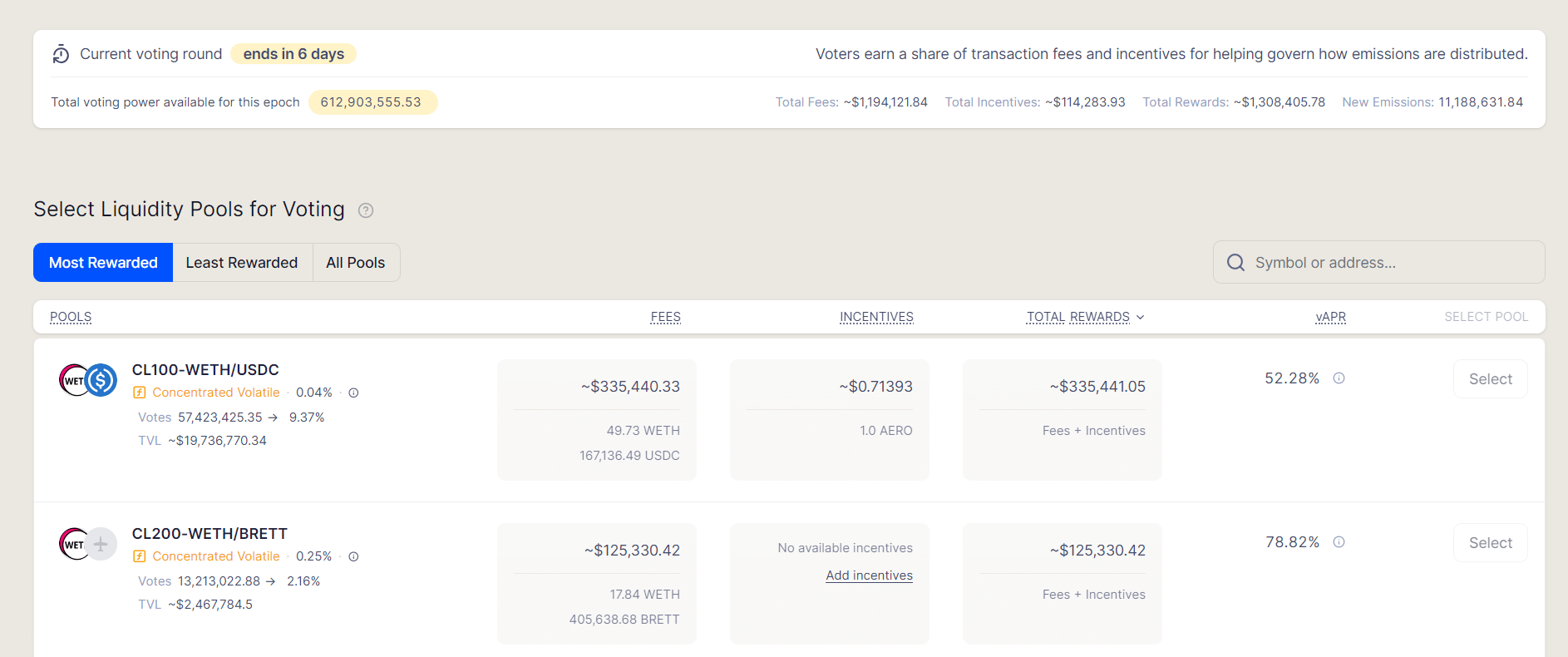

Source: aerodrome

By voting on rewards (AERO emissions) per pool, veAERO holders can strategically boost liquidity in selected pools. Greater liquidity attracts more traders, generating more fees and rewards.

The protocol uses anti-dilution rebates to prevent the dilution of voting power resulting from regular AERO emissions, providing veAERO with proportional weekly rebase payments.

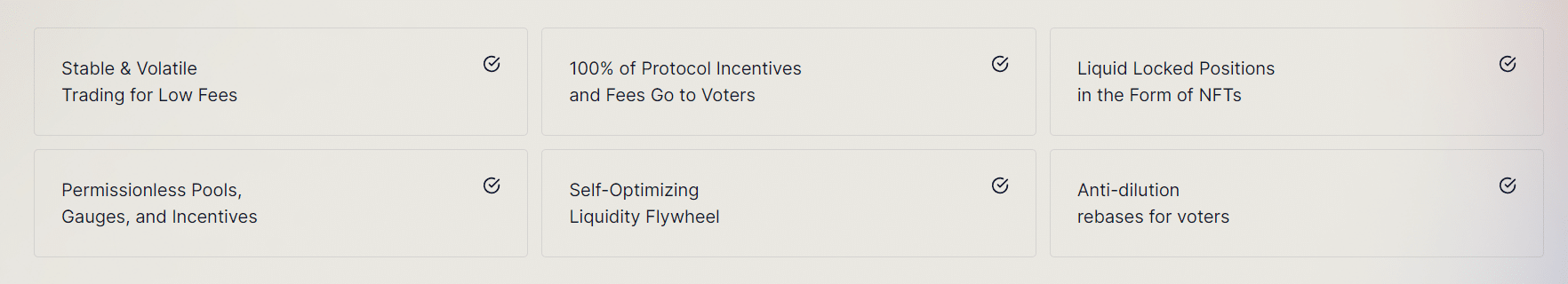

Aerodrome Features

Here are the main features and benefits of Aerodrome:

- Low costs token swaps and low slippage.

- High annual percentage yield (APY) figures for liquidity providers.

- Community-governed ecosystem where AERO holders can influence the liquidity of the pools.

Source: Aerodrome

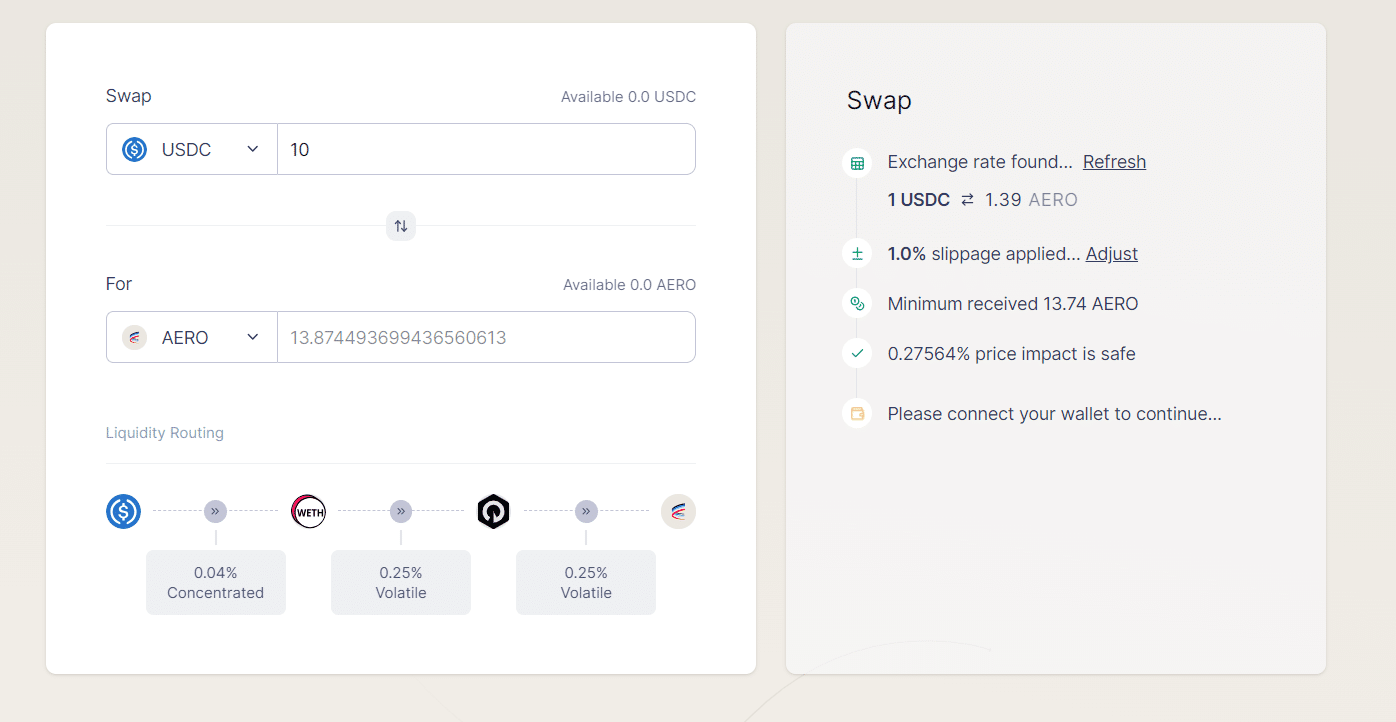

How to Trade on Aerodrome

Trading on Aerodrome is easy. Here are the 3 main steps to perform token swaps:

- Go to Aerodrome Finance and connect your self-custody wallet. You can choose from Browser Wallets (like MetaMask), WalletConnect (tastycrypto), CoinbaseWallet, or Safe.

- Select the token to swap from over 180 supported assets, as well as the amount you want to exchange.

- After introducing the amount, you can see the exchange rate, the percentage of slippage applied, and the estimated price impact preliminarily. If you agree with the conditions, hit the swap button to conclude the token exchange. 👇

Source: Aerodrome

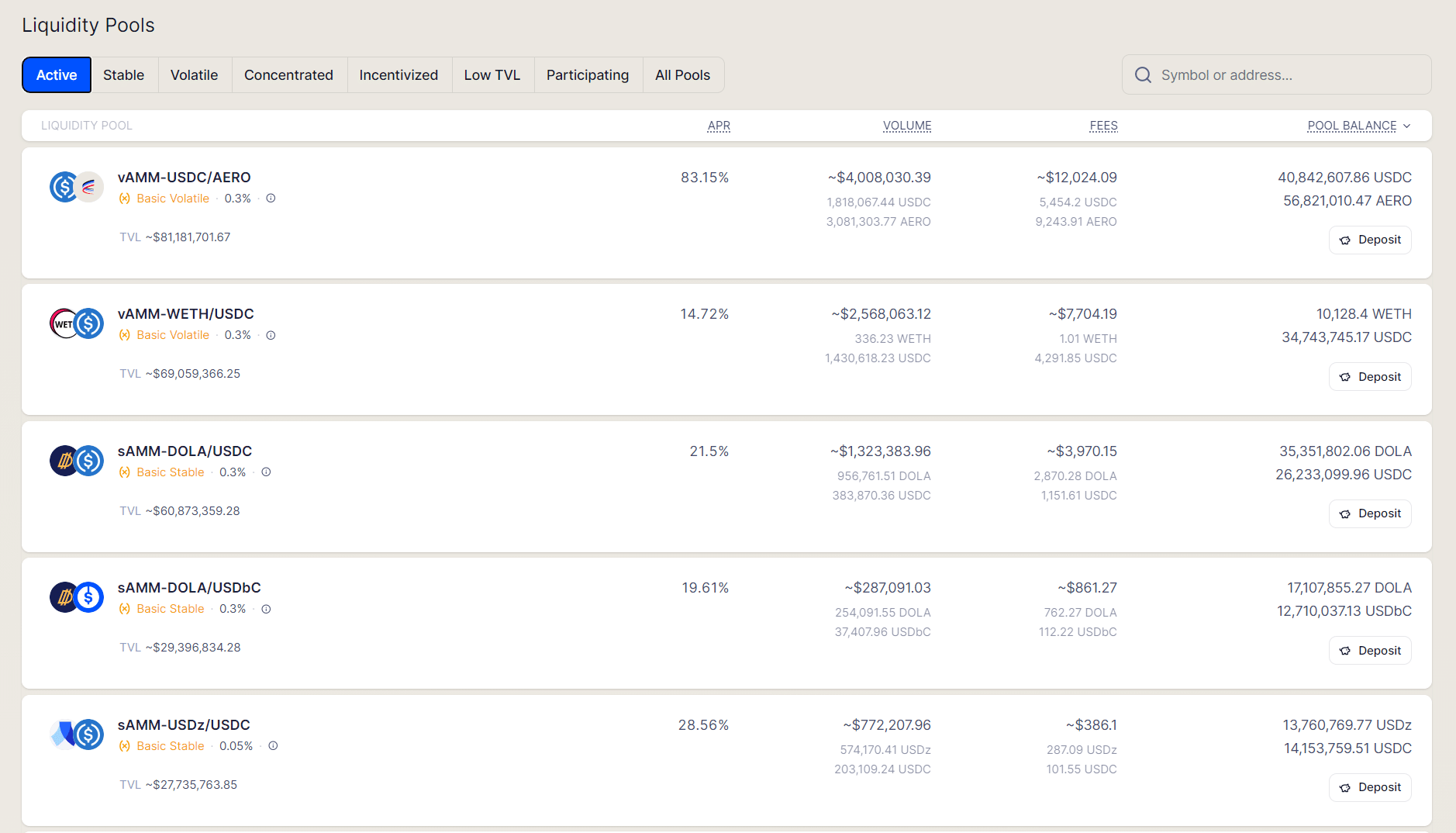

Aerodrome Liquidity Provision

You can also provide liquidity across Aerodrome pools to earn rewards. To do this, click on the ‘Liquidity’ tab and select from a wide range of investments.

Liquidity pools are categorized by status and risk level, such as active, stable, volatile, incentivized, and low TVL. You can pick the option that suits your risk profile.

Source: Aerodrome

As of this writing, there are 399 pools on Aerodrome, with APRs ranging from 4% to over 500%.

After depositing crypto funds to a pool, you will become eligible for rewards from weekly AERO emissions.

Staking AERO

If you hold AERO, you can vote-escrow it for up to four years to receive a veAERO NFT representing your staking position. The voting power depends on the amount locked and the duration. For example, if you lock 1,000 AERO for four years, you will get four times the voting power compared to locking the same amount for one year.

veAERO holders also receive weekly rebase payments to avoid the dilution of their voting power.

Holding veAERO allows you to participate in weekly voting to determine which pools should receive AERO emissions. The protocol then distributes AERO based on community votes, and votes receive 100% of all trading fees of the pools they voted on.

Source: Aerodrome

AERO Token

AERO is the erc-20 utility token of Aerodrome.

AERO Tokenomics

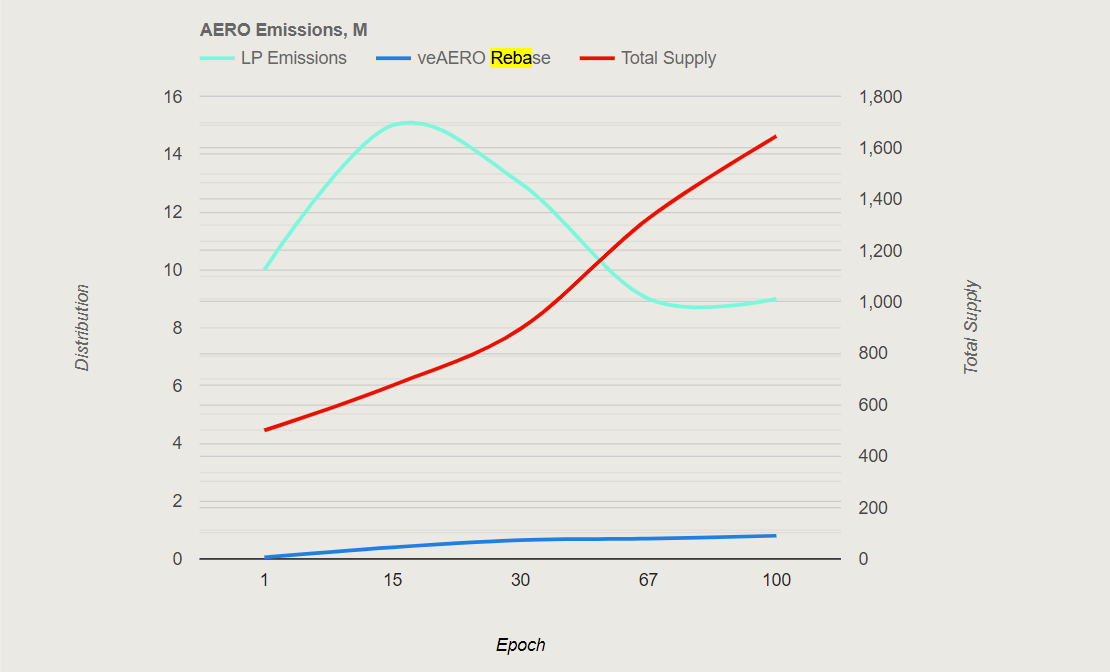

Let’s get into the tokenomics now! The token started with an initial circulating supply of 500 million, which is increasing due to emissions.

The emission rate started at 3% per week during the initial phase, and it has been reduced by about 1% per week. After emissions are reduced to about 9 million AERO per epoch, the emission rate will be determined by veAERO holders, which can collectively choose from a minimum rate of 0.01% per week (0.52% annualized) to 1% per week (52% annualized).

Source: Aerodrome

AERO Performance

As of this writing, the AERO price is $0.71. It reached an all-time high of $2.33 in April.

The token has a market cap of $371 million, ranking 211th on Coinmarketcap.

The token outperformed major cryptocurrency assets like Bitcoin (BTC) and Ethereum (ETH) in 2024.

Source: TradingView

Aerodrome Stats

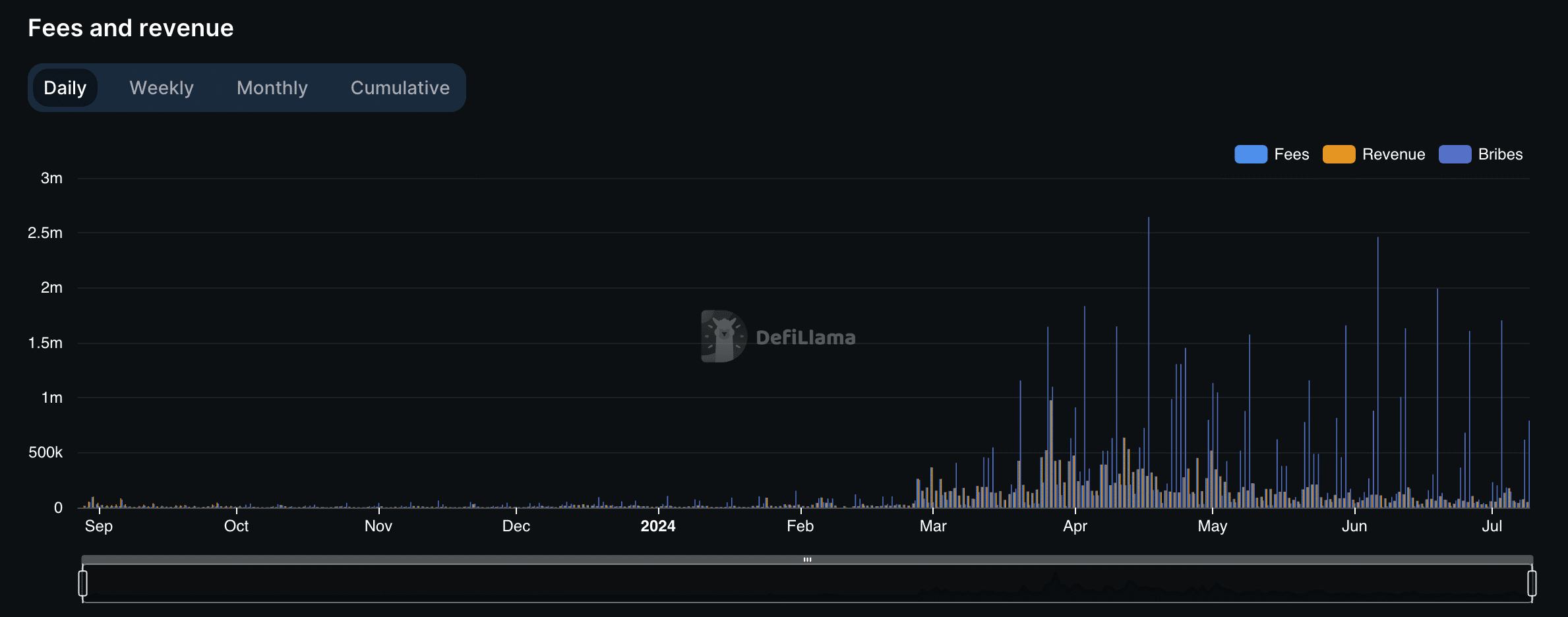

Aerodrome’s success reflects Base’s leading position in decentralized finance (DeFi).

As of the end of June 2024, Base is the sixth-largest chain by total value locked (TVL), with over $1.5 billion locked across 270 DeFi apps. Aerodrome accounts for over 35% of Base TVL, almost $600 million.

Source: DeFiLlama

The largest pools by TVL are:

- USDC–AERO with $81 million TVL, offering 82% APY.

- WETH-USDC with $69 million TVL, offering 14.4% APY.

- DOLA-USDC with $61 million TVL, offering 21% APY.

Weekly fees across all pools have declined, although bribe volume remains high.

Source: DeFiLlama

FAQs

What is Aerodrome Finance?

Aerodrome Finance is a decentralized exchange (DEX) on the Base network. It facilitates token exchanges without intermediaries and rewards liquidity providers in the process.

What is Base?

Base is a layer 2 scaling solution for Ethereum developed by Coinbase. It uses Optimistic rollups to boost Ethereum‘s efficiency and scalability.

How can I trade on Aerodrome?

To trade on Aerodrome, connect a compatible self-custody wallet to the app, select the token you wish to swap from over 180 supported assets, and execute the trade after agreeing to the terms.

How can I get AERO?

You can obtain AERO tokens by providing liquidity in various pools on the Aerodrome platform, which rewards participants with weekly AERO emissions. You can also buy Aerodrome Finance on cryptocurrency exchanges that support it, such as Coinbase or Aerodrome itself.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com